Saudi Arabia's ABS Market: Growth Opportunities After Regulatory Reform

Table of Contents

H2: Regulatory Reforms and Their Impact on the ABS Market

The recent regulatory overhaul in Saudi Arabia's ABS market has been instrumental in unlocking its growth potential. These reforms have focused on simplifying processes, enhancing transparency, and expanding the range of eligible assets, leading to a more robust and attractive investment landscape.

H3: Streamlined Issuance Process

The issuance process for ABS has been significantly streamlined, reducing bureaucratic hurdles and accelerating approvals. This translates to lower costs and faster time-to-market for issuers.

- Reduced Paperwork: The implementation of digital platforms and simplified documentation requirements has drastically cut down on administrative burden.

- Faster Approvals: Regulatory authorities have expedited the approval process, leading to quicker issuance of ABS.

- Clearer Guidelines: The introduction of clearer and more comprehensive guidelines has provided greater certainty for issuers, reducing ambiguity and delays.

These improvements directly reduce transaction costs and allow issuers to bring new ABS products to the market more efficiently, ultimately stimulating market growth.

H3: Increased Transparency and Investor Confidence

Improved transparency measures are building trust and attracting both domestic and international investors to Saudi Arabia's ABS market.

- Standardized Disclosures: The implementation of standardized disclosure requirements ensures consistent and comparable information for investors, enhancing their ability to make informed decisions.

- Enhanced Credit Rating Requirements: Stricter credit rating requirements help to maintain high standards of creditworthiness, mitigating risk and attracting higher-quality investors.

This increased transparency fosters confidence among investors, leading to greater participation and liquidity within the market. The result is a more robust and resilient ABS market capable of supporting significant growth.

H3: Expansion of Eligible Underlying Assets

The range of assets eligible for securitization has broadened considerably, creating diversification opportunities for investors and stimulating market growth.

- Auto Loans: The growing automotive sector provides a substantial pool of assets for securitization.

- Mortgages: The expanding real estate market offers significant potential for mortgage-backed securities.

- Receivables: Securitization of trade receivables opens up new avenues for financing businesses.

This expansion of eligible assets allows for a more diverse and resilient ABS market, reducing reliance on any single asset class and attracting a wider range of investors with varied risk appetites.

H2: Growth Opportunities in Specific Sectors

Saudi Arabia's ambitious Vision 2030 plan is driving significant investment across various sectors, creating numerous growth opportunities within the ABS market.

H3: Real Estate ABS

The real estate sector is a key focus of Vision 2030, with numerous large-scale projects underway. This creates substantial demand for real estate ABS.

- NEOM: The development of NEOM and other megaprojects will drive significant investment in real estate, creating a substantial pipeline of assets for securitization.

- Red Sea Project: Similar opportunities exist in other large-scale developments like the Red Sea Project.

However, careful consideration of potential risks, such as market fluctuations and construction delays, is crucial for successful real estate ABS issuance.

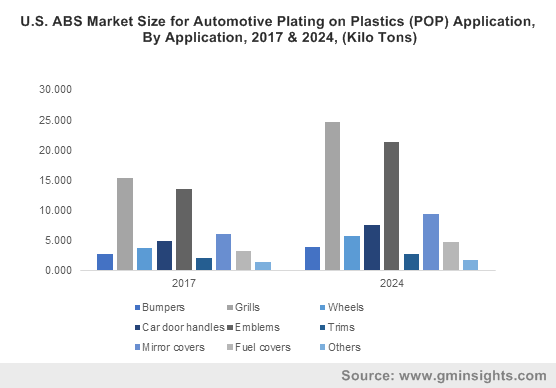

H3: Auto Loan ABS

With increasing car ownership in Saudi Arabia, the automotive finance market presents a significant growth opportunity for auto loan ABS.

- Rising Car Ownership: Statistics show a consistent increase in car ownership, leading to higher demand for auto financing.

- High Loan Penetration: The relatively high loan penetration rate in the automotive sector provides a large pool of assets for securitization.

However, credit risk management is crucial due to factors such as potential fluctuations in the used car market.

H3: SME Financing through ABS

ABS can play a vital role in facilitating access to funding for Small and Medium-sized Enterprises (SMEs), a key driver of economic growth.

- Alternative Financing: ABS offers an alternative financing mechanism for SMEs, particularly those with limited access to traditional bank lending.

- Government Support: Government initiatives aimed at supporting SME growth could include incentives for SME ABS issuance.

This offers considerable potential for expanding the reach and impact of the ABS market within the Saudi Arabian economy.

H2: Challenges and Mitigation Strategies

Despite the significant growth opportunities, some challenges must be addressed to ensure the sustainable development of Saudi Arabia's ABS market.

H3: Credit Risk Management

Effective credit risk management is crucial for the success of the ABS market.

- Credit Scoring: Robust credit scoring models are necessary for accurate risk assessment.

- Diversification: Diversifying the underlying assets across various sectors and borrowers can mitigate risk.

Credit rating agencies play a key role in providing independent assessments of credit risk, enhancing investor confidence.

H3: Liquidity Concerns

Developing a robust secondary market is vital to enhance market liquidity.

- Market Makers: Encouraging the participation of market makers can improve liquidity.

- Regulatory Incentives: Government incentives can also promote the development of a liquid secondary market.

Addressing liquidity concerns will ensure that investors can easily buy and sell ABS, enhancing the attractiveness of the market.

H3: Competition and Market Development

The market must compete effectively with other financing options.

- Market Depth: Strategies to increase market depth and breadth, such as promoting investor education and awareness, are needed.

- Government Initiatives: Government initiatives to support the development of the ABS market, such as tax incentives or guarantees, can also boost growth.

Sustained efforts towards market development are key to realizing the full potential of Saudi Arabia's ABS market.

3. Conclusion

Regulatory reforms have significantly transformed Saudi Arabia's ABS market, opening up exciting growth opportunities across various sectors. The streamlined issuance process, increased transparency, and expansion of eligible assets have created a more attractive environment for investors. Opportunities abound in real estate, auto loans, and SME financing, but addressing challenges like credit risk management and liquidity is crucial. Invest in the future of Saudi Arabia's ABS market; capitalize on the growth opportunities presented by this dynamic and evolving landscape. The potential for significant returns makes this a compelling investment opportunity. For further information on investment opportunities, please refer to [link to relevant resources, if available].

Featured Posts

-

Watch England Vs Spain Tv Channel Kick Off Time And Live Streaming Info

May 02, 2025

Watch England Vs Spain Tv Channel Kick Off Time And Live Streaming Info

May 02, 2025 -

Nigel Farages Whats Apps A Crisis Of Integrity For The Reform Party

May 02, 2025

Nigel Farages Whats Apps A Crisis Of Integrity For The Reform Party

May 02, 2025 -

A Century Of Acting Priscilla Pointer Dies At 100

May 02, 2025

A Century Of Acting Priscilla Pointer Dies At 100

May 02, 2025 -

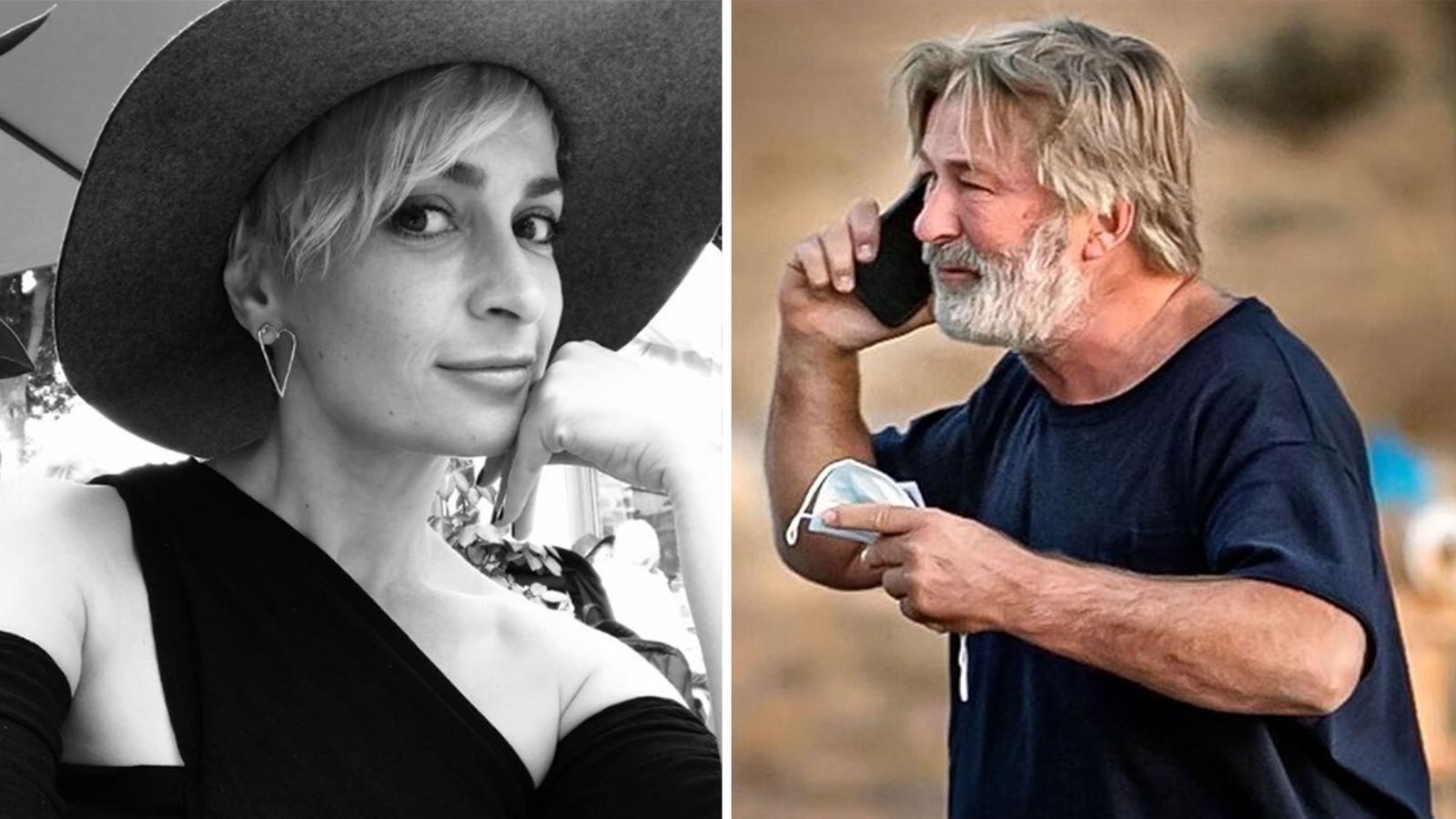

Rust Film Review Production Challenges And Cinematic Merit

May 02, 2025

Rust Film Review Production Challenges And Cinematic Merit

May 02, 2025 -

Ripple Lawsuit Update Sec Considers Xrp Commodity Classification In Settlement Negotiations

May 02, 2025

Ripple Lawsuit Update Sec Considers Xrp Commodity Classification In Settlement Negotiations

May 02, 2025