Saudi Arabia's ABS Market: Significant Rule Change And Its Global Impact

Table of Contents

The New Regulations: A Detailed Analysis

The recent amendments to the regulations governing Saudi Arabia's ABS market represent a considerable overhaul of the existing framework. These changes aim to enhance transparency, protect investors, and stimulate further growth within the sector. Key aspects of the new rules include:

- Changes to Securitization Criteria: The new regulations have tightened the criteria for eligible assets used in securitization, focusing on higher quality and more predictable cash flows. This aims to reduce risk for investors.

- Impact on Eligible Assets: A more defined and stringent list of eligible assets has been introduced, potentially limiting the range of assets that can be securitized but enhancing the overall quality of the ABS market.

- New Requirements for Originators and Sponsors: Originators and sponsors now face stricter requirements regarding due diligence, risk management, and disclosure, promoting greater accountability and transparency.

- Updated Due Diligence Procedures: More rigorous due diligence procedures are now mandated, encompassing a more comprehensive assessment of the underlying assets and the risks involved.

- Changes to Investor Protection Measures: The new regulations strengthen investor protection mechanisms, providing greater safeguards against potential losses and fostering greater confidence in the market.

The rationale behind these changes is to foster a more robust, transparent, and internationally competitive Saudi Arabia's ABS market. This is achieved by aligning the regulatory framework with international best practices and enhancing investor confidence. [Link to official government source on new regulations].

Impact on Domestic Players in Saudi Arabia's ABS Market

The new regulations will undoubtedly have a significant impact on Saudi Arabian banks and financial institutions involved in the ABS market. While some challenges are anticipated, there are also considerable opportunities.

- Increased Transparency and Efficiency: The enhanced regulatory framework should streamline processes and improve efficiency in the issuance and trading of ABS.

- Enhanced Investor Confidence: Stronger investor protection measures will boost confidence, potentially attracting greater participation from both domestic and international investors.

- Potential for Greater Capital Inflows: A more mature and transparent market can attract significant foreign investment, supporting economic growth and development within Saudi Arabia.

- Increased Compliance Costs: Adapting to the new regulations will require investments in technology, training, and internal processes, potentially increasing compliance costs for financial institutions.

- Need for Adaptation to New Procedures: Banks and financial institutions will need to adapt their operational processes and internal controls to meet the requirements of the new regulations.

These changes will influence lending practices and credit availability, potentially leading to a more sophisticated and risk-averse lending environment.

Global Implications of the Saudi Arabia ABS Market Shift

The transformation of Saudi Arabia's ABS market has global implications, particularly for the Middle East and North Africa (MENA) region and the broader Islamic finance sector.

- Increased Competition in the Global ABS Market: A more developed Saudi ABS market will likely increase competition in the global market, potentially impacting pricing and investment strategies.

- Potential for Increased Investment in Saudi Arabia's Infrastructure Projects: The improved regulatory environment could attract greater investment in large-scale infrastructure projects in Saudi Arabia, driving economic growth.

- Implications for Global Islamic Finance: The changes in Saudi Arabia, a significant player in Islamic finance, will influence the development and regulation of Islamic ABS globally.

- Potential Impact on Global Regulatory Frameworks: The successful implementation of the new regulations in Saudi Arabia could serve as a model or benchmark for other countries seeking to develop or improve their own ABS markets.

The global ABS landscape will be influenced by the developments in Saudi Arabia’s evolving market, as investors and issuers alike adjust to this significant shift.

Conclusion: Navigating the Future of Saudi Arabia's ABS Market

The transformative changes in Saudi Arabia's ABS sector are far-reaching. The new regulations, while presenting some initial challenges, ultimately aim to create a more robust, transparent, and internationally competitive market. The impact on both domestic players and the global ABS landscape will be considerable. Saudi Arabia's evolving ABS market presents both opportunities and challenges. Understanding these shifts is crucial for navigating the future of this dynamic sector. Further research into the specific regulations and their implications is recommended. Contact experts in Saudi Arabian financial regulation for more detailed information on navigating the new regulatory environment of Saudi Arabia's ABS market.

Featured Posts

-

Increased Chinese Naval Activity Off Sydney What Does It Mean For Australia

May 03, 2025

Increased Chinese Naval Activity Off Sydney What Does It Mean For Australia

May 03, 2025 -

Farages Nat West Debanking Case Resolved Settlement Reached

May 03, 2025

Farages Nat West Debanking Case Resolved Settlement Reached

May 03, 2025 -

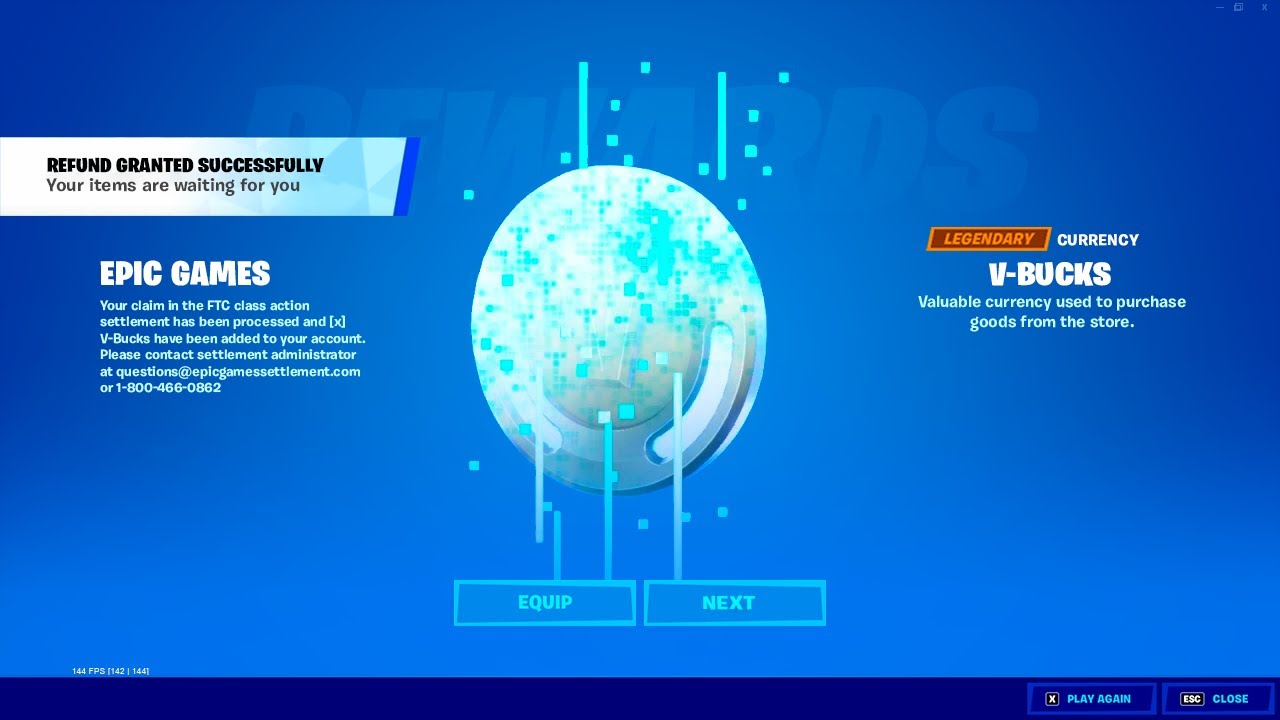

Understanding Fortnites Refunds And Upcoming Cosmetic Changes

May 03, 2025

Understanding Fortnites Refunds And Upcoming Cosmetic Changes

May 03, 2025 -

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

May 03, 2025

Hollywood Shutdown Writers And Actors Strike Impacts Film And Television

May 03, 2025 -

Condemnation Of Russian Aggression Swiss Presidents Call For Peace In Ukraine

May 03, 2025

Condemnation Of Russian Aggression Swiss Presidents Call For Peace In Ukraine

May 03, 2025