Saudi Arabia's New ABS Regulations: A Market Transformation

Table of Contents

Enhanced Transparency and Disclosure Requirements

The new Saudi Arabia ABS regulations prioritize transparency and robust disclosure, leading to several crucial improvements.

Improved Investor Protection

The regulations mandate more detailed disclosures about the underlying assets in ABS transactions. This significantly enhances investor protection by providing a clearer understanding of the associated risks. This increased transparency aims to build trust and confidence in the market.

- Stricter requirements for due diligence and asset valuation: Independent valuations and rigorous due diligence processes are now mandatory, ensuring the accuracy and reliability of information provided to investors.

- Mandatory disclosure of all relevant information pertaining to the underlying assets: This includes comprehensive details on the quality, performance, and risk profile of the underlying assets, leaving no room for ambiguity.

- Increased scrutiny of originators and servicers of ABS: The regulations impose stricter standards on the entities originating and servicing the ABS, enhancing accountability and reducing potential conflicts of interest.

Strengthened Regulatory Oversight

The Saudi Arabian Monetary Authority (SAMA) has significantly increased its oversight of the ABS market to guarantee compliance with the new regulations. This includes regular audits, inspections, and strengthened enforcement mechanisms.

- Increased penalties for non-compliance: Substantial penalties are in place to deter non-compliance and ensure adherence to the new standards, promoting a culture of compliance within the market.

- Enhanced reporting requirements for issuers: Issuers are now required to provide more frequent and detailed reports to SAMA, enabling proactive monitoring and early identification of potential issues.

- More robust framework for dispute resolution: A more efficient and transparent dispute resolution mechanism is in place to address any disagreements or conflicts that may arise, ensuring fairness and protecting the rights of all stakeholders.

Impact on the Saudi Arabian Capital Markets

The Saudi Arabia ABS regulations are expected to have a profound impact on the Kingdom's capital markets, stimulating growth and attracting significant investment.

Increased Liquidity and Investment

The increased transparency and investor confidence resulting from the new regulations are expected to attract substantial domestic and international investment into the Saudi ABS market. This influx of capital will benefit various sectors of the Saudi economy.

- Greater diversification of funding sources for Saudi businesses: ABS provide businesses with alternative financing options, reducing reliance on traditional bank lending and expanding their access to capital.

- Increased availability of credit for various sectors of the Saudi economy: The wider use of ABS is projected to facilitate lending and credit expansion across multiple sectors, driving economic growth and development.

- Potential for growth in the Islamic finance sector through Sharia-compliant ABS: The regulations are designed to accommodate Sharia-compliant ABS, opening new opportunities for growth within the thriving Islamic finance sector in Saudi Arabia.

Development of a Deeper and More Liquid Market

The aim of the new rules is to cultivate a more sophisticated and liquid ABS market in Saudi Arabia. This will offer investors a broader range of opportunities and enhance the overall efficiency of the financial system.

- Stimulation of innovation in structured finance products: The regulatory framework encourages innovation in the design and structuring of ABS products, catering to diverse investor needs and market demands.

- Attracting international expertise and investment into the Saudi market: The improved regulatory environment is expected to attract significant foreign investment and expertise, further enhancing the development of the Saudi ABS market.

- Contribution towards the development of a robust financial ecosystem: The enhanced ABS market contributes to the broader goal of developing a robust and well-regulated financial ecosystem in Saudi Arabia, supporting sustainable economic growth.

Challenges and Opportunities Presented by the New Regulations

The implementation of the new Saudi Arabia ABS regulations presents both challenges and significant opportunities for growth.

Implementation Challenges

The successful implementation of the new regulations requires collaboration between regulators, issuers, and investors. Adapting to the new framework and navigating its complexities may present certain hurdles.

- Need for comprehensive training and education for market participants: A comprehensive training program is needed to ensure all stakeholders understand and comply with the new rules.

- Potential for initial delays and adjustments as the market adapts: It is expected that some initial adjustments and delays will occur as the market adapts to the new regulations.

- Importance of clear and consistent communication from regulatory bodies: Consistent and clear communication from SAMA is crucial to ensure a smooth transition and minimize confusion among market participants.

Opportunities for Growth

Despite the challenges, the new Saudi Arabia ABS regulations present significant opportunities for growth within the Saudi financial market. This includes innovation in product development and improved access to capital.

- Development of specialized ABS products tailored to specific market needs: The regulations provide an environment for the development of innovative ABS products that address specific market needs.

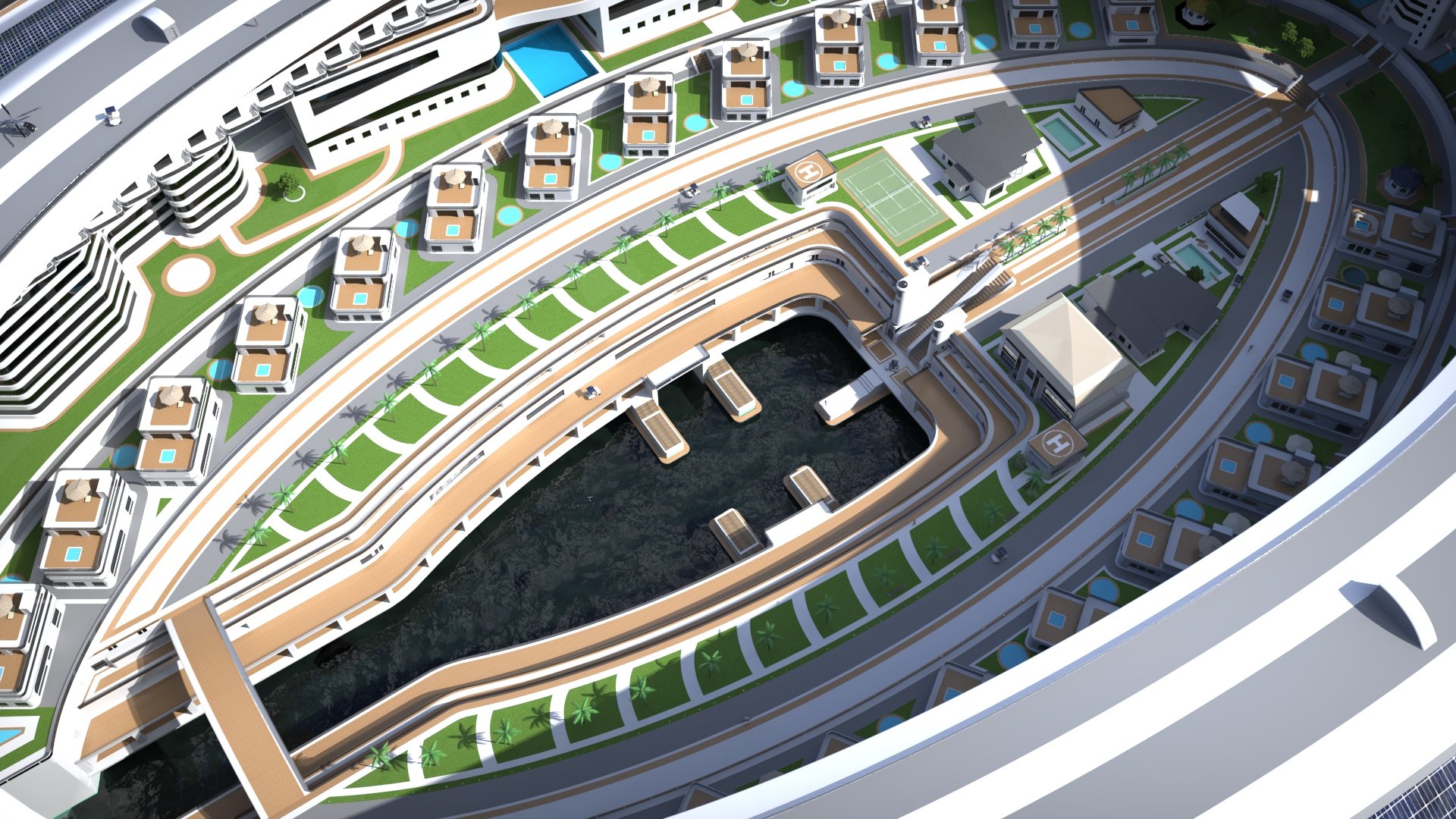

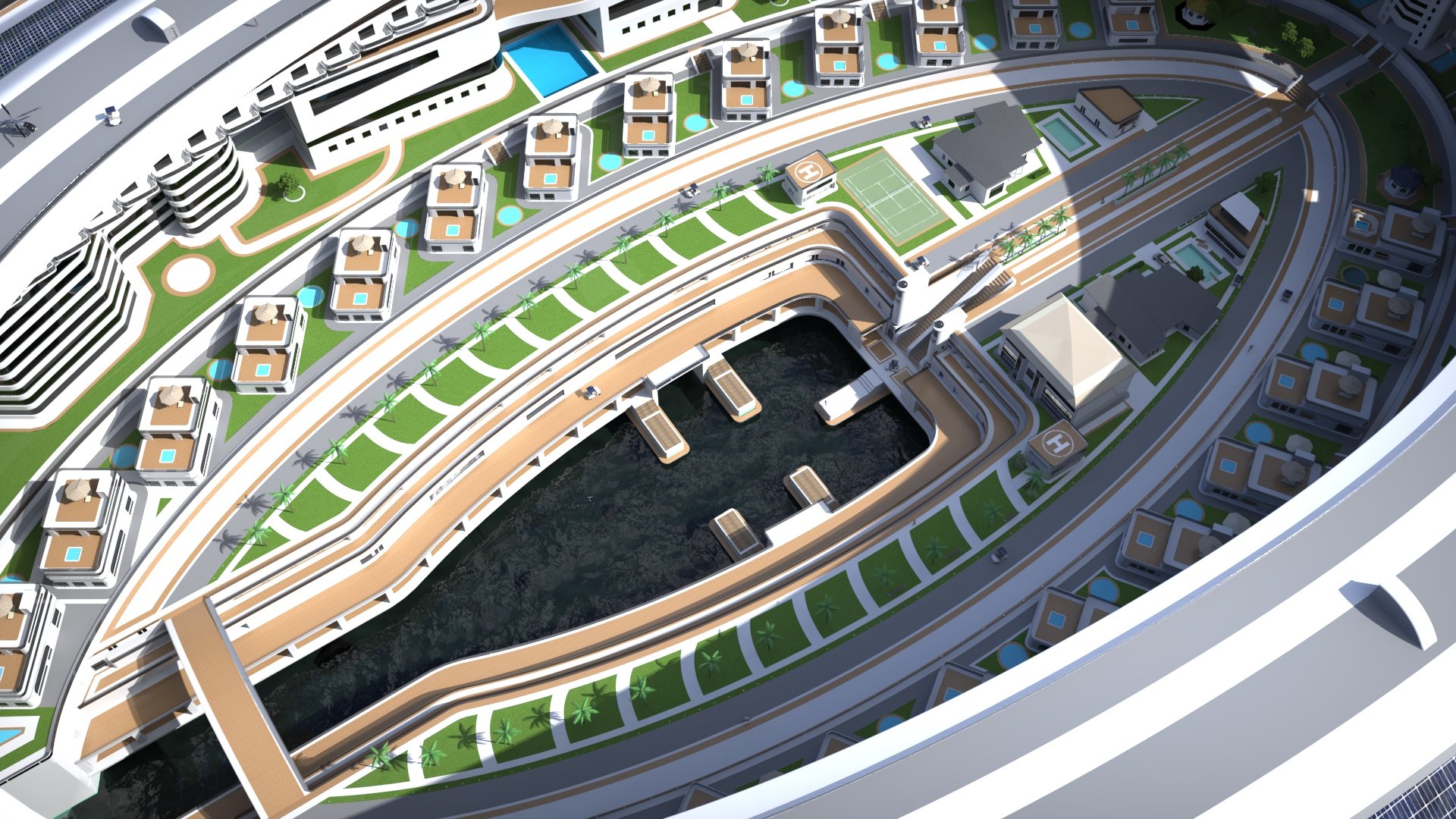

- Attracting foreign investment in Saudi infrastructure projects: The improved regulatory environment will likely attract substantial foreign investment in infrastructure projects within Saudi Arabia.

- Boosting economic diversification through increased capital market activity: A thriving ABS market contributes significantly to economic diversification by increasing capital market activity and facilitating investment in various sectors.

Conclusion

The introduction of new Saudi Arabia ABS regulations marks a pivotal moment for the Kingdom's financial sector. By enhancing transparency, improving investor protection, and fostering market development, these regulations are laying the groundwork for a more robust and sophisticated ABS market. While challenges remain in implementation, the potential benefits—increased liquidity, greater investment, and economic diversification—are substantial. Understanding and adapting to these new Saudi Arabia ABS regulations is crucial for all stakeholders seeking to navigate this transformed landscape and capitalize on the significant opportunities presented. Stay informed about the latest developments in Saudi Arabia ABS regulations to ensure your business thrives in this evolving market.

Featured Posts

-

Rugby World Cup Dupont Leads France To Victory Against Italy

May 02, 2025

Rugby World Cup Dupont Leads France To Victory Against Italy

May 02, 2025 -

Fortnite Server Status How Long Will Chapter 6 Season 2 Maintenance Last

May 02, 2025

Fortnite Server Status How Long Will Chapter 6 Season 2 Maintenance Last

May 02, 2025 -

Elektriciteitsstoring Breda Oorzaken En Gevolgen Van De Grote Uitval

May 02, 2025

Elektriciteitsstoring Breda Oorzaken En Gevolgen Van De Grote Uitval

May 02, 2025 -

Priscilla Pointer 1923 2023 Celebrated Actress And Workshop Co Founder Passes Away

May 02, 2025

Priscilla Pointer 1923 2023 Celebrated Actress And Workshop Co Founder Passes Away

May 02, 2025 -

France Crushes Italy Ireland On High Alert For Six Nations Showdown

May 02, 2025

France Crushes Italy Ireland On High Alert For Six Nations Showdown

May 02, 2025