Saudi Arabia's Revised ABS Regulations: A Market-Shifting Development

Table of Contents

Key Changes in the Revised Regulations

The revised Saudi Arabia ABS Regulations introduce several key changes designed to modernize and enhance the Kingdom's ABS market. These changes aim to increase efficiency, transparency, and ultimately, attract greater investment. The reforms represent a significant shift towards a more internationally aligned and investor-friendly regulatory framework.

-

Simplification of the application process for ABS issuance: The previous, more complex application process has been streamlined, reducing bureaucratic hurdles and accelerating the time to market for new ABS offerings. This simplification should encourage greater participation from issuers.

-

Broadened eligible underlying assets for securitization: The revised regulations expand the range of eligible assets that can be securitized, opening up new avenues for funding and investment. This includes a wider variety of receivables and assets, enhancing the market's depth and liquidity.

-

Enhanced disclosure requirements for greater investor confidence: Increased transparency is a cornerstone of the revised regulations. More detailed and comprehensive disclosure requirements aim to foster greater trust and confidence among investors, both domestic and international. This improved transparency is crucial for attracting foreign capital.

-

Clarification on regulatory oversight and compliance procedures: The new regulations provide clearer guidance on regulatory oversight and compliance procedures, reducing ambiguity and fostering a more predictable regulatory environment. This clarity minimizes risks for both issuers and investors.

-

Introduction of new frameworks for risk management and mitigation: The revised regulations introduce robust frameworks for managing and mitigating risks associated with ABS issuance and trading. This includes enhanced credit risk assessment and capital adequacy requirements, promoting market stability.

Impact on the Saudi Arabian Financial Market

The impact of the revised Saudi Arabia ABS Regulations on the Kingdom's financial market is anticipated to be substantial and multifaceted. The changes are poised to stimulate growth across various sectors and improve the overall efficiency of the financial system.

-

Increased liquidity in the Saudi capital markets: The streamlined issuance process and broader eligible assets will significantly increase liquidity in the Saudi capital markets, facilitating smoother trading and price discovery.

-

Stimulated growth of the SME sector through improved access to finance: SMEs, often facing challenges in accessing traditional financing, will benefit significantly from the increased availability of ABS-based funding. This improved access to capital will fuel SME growth and contribute to job creation.

-

Attraction of foreign investment into Saudi Arabia’s financial sector: The improved regulatory framework, increased transparency, and enhanced investor protections are expected to attract significant foreign investment into Saudi Arabia's financial sector, boosting economic diversification.

-

Development of a more robust and sophisticated ABS market: The reforms are laying the foundation for a more robust and sophisticated ABS market in Saudi Arabia, comparable to those in established international markets.

-

Potential for diversification of funding sources for Saudi businesses: The revised regulations provide Saudi businesses with a greater diversity of funding sources, reducing their reliance on traditional bank lending and fostering a more resilient financial ecosystem.

Opportunities for Investors and Businesses

The revised Saudi Arabia ABS Regulations present significant opportunities for both investors and businesses. The changes create a more efficient, transparent, and attractive market for ABS transactions.

-

Higher potential returns for investors due to increased market efficiency: A more efficient market leads to better price discovery and potentially higher returns for investors in ABS.

-

Lower borrowing costs for businesses seeking alternative funding options: Increased competition and efficiency in the ABS market can translate into lower borrowing costs for businesses.

-

Access to a wider range of investment products: The expansion of eligible assets for securitization creates a more diverse range of investment products available to investors.

-

Increased transparency and reduced risk for investors: The enhanced disclosure requirements and robust risk management frameworks reduce the risks associated with investing in ABS.

-

Opportunities for international investors to participate in the Saudi market: The revised regulations make the Saudi ABS market more attractive to international investors, fostering greater cross-border capital flows.

Addressing Potential Challenges

While the revised Saudi Arabia ABS Regulations offer significant advantages, some potential challenges need to be addressed for successful implementation.

-

Need for enhanced market education to promote awareness of ABS products: Educating market participants about the benefits and risks of ABS is crucial for widespread adoption.

-

Potential challenges in managing credit risk associated with new asset classes: As the range of securitizable assets broadens, robust credit risk management frameworks are essential.

-

Ensuring effective implementation and enforcement of the regulations: Effective implementation and enforcement are key to maintaining the integrity and efficiency of the new regulatory framework.

-

Potential need for further regulatory clarifications in certain areas: Ongoing dialogue and clarification may be needed to address any ambiguities or unforeseen challenges that may arise during implementation.

Conclusion

The revised Saudi Arabia ABS regulations represent a transformative step for the Kingdom's financial sector. The changes are designed to foster growth, attract investment, and provide more accessible funding options for businesses, ultimately contributing to broader economic development. The streamlined processes, increased transparency, and broadened eligible assets promise to unlock significant opportunities. Understanding these new Saudi Arabia ABS Regulations is crucial for navigating the dynamic financial market and capitalizing on the emerging opportunities. Explore the implications of these changes for your investment strategy and business operations.

Featured Posts

-

When Will Sabrina Carpenter Arrive In Fortnite

May 03, 2025

When Will Sabrina Carpenter Arrive In Fortnite

May 03, 2025 -

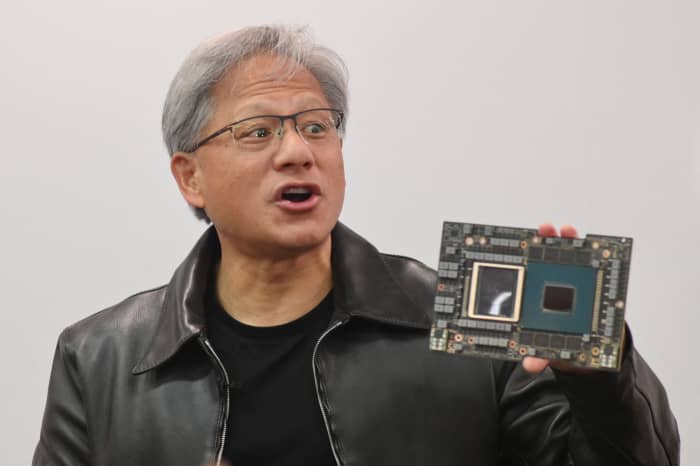

Nvidias Ceo Urges Trump Administration To Revise Ai Chip Export Regulations

May 03, 2025

Nvidias Ceo Urges Trump Administration To Revise Ai Chip Export Regulations

May 03, 2025 -

Five Threats To Reform Uks Political Future

May 03, 2025

Five Threats To Reform Uks Political Future

May 03, 2025 -

Graeme Souness On Declan Rice Final Third Needs Refinement

May 03, 2025

Graeme Souness On Declan Rice Final Third Needs Refinement

May 03, 2025 -

Aljyl Aljdyd Mn Blaystyshn Nzrt Mtemqt Ela Blay Styshn 6

May 03, 2025

Aljyl Aljdyd Mn Blaystyshn Nzrt Mtemqt Ela Blay Styshn 6

May 03, 2025