Saudi Arabia's Revised ABS Rules: Implications And Opportunities

Table of Contents

Key Changes in the Revised Saudi Arabia ABS Rules

The revised Saudi Arabia ABS rules introduce several key changes designed to enhance transparency, strengthen risk mitigation, and streamline the approval process. These changes aim to bolster investor confidence and promote the growth of the Saudi capital markets.

Enhanced Transparency and Disclosure Requirements

The new regulations significantly increase transparency and disclosure requirements for ABS issuances. This includes:

- Increased scrutiny of originator due diligence: Issuers must now provide significantly more detail about the origination and underwriting processes of the underlying assets. This rigorous due diligence aims to minimize risk and improve the quality of the underlying assets.

- Stricter requirements for the disclosure of underlying assets and risks: Comprehensive disclosure of the characteristics of the underlying assets, including their risk profiles and potential vulnerabilities, is now mandatory. This detailed information aims to ensure investors are fully informed before making investment decisions.

- Implementation of robust reporting mechanisms to ensure ongoing transparency: Regular reporting requirements are now in place to ensure ongoing transparency throughout the life of the ABS transaction. This includes reporting on the performance of the underlying assets and any potential risks.

These enhanced transparency measures, while increasing the cost and complexity of ABS issuance for issuers, ultimately benefit investors by reducing information asymmetry and promoting more informed investment decisions. The increased transparency associated with the updated Saudi Arabia ABS rules makes the market more attractive to international investors.

Strengthened Credit Enhancement Mechanisms

The revised rules place a stronger emphasis on credit enhancement mechanisms to mitigate potential risks associated with ABS transactions. Key changes include:

- New requirements for credit enhancement levels based on asset risk profiles: The level of credit enhancement required will now depend on the risk profile of the underlying assets. Higher-risk assets will require higher levels of credit enhancement.

- Increased emphasis on robust collateral management practices: Stricter rules governing the management and monitoring of collateral are now in place. This ensures the collateral remains adequate throughout the life of the transaction.

- The role of government-backed guarantees and insurance in mitigating risk: The government's potential role in providing guarantees or insurance to enhance creditworthiness is being explored to further support the development of the ABS market.

These strengthened credit enhancement mechanisms aim to enhance investor protection and reduce the likelihood of defaults. However, these stricter requirements may impact the feasibility of certain types of ABS transactions and influence the availability of credit enhancement providers.

Streamlined Approval Processes

Despite the increased scrutiny, the revised Saudi Arabia ABS rules also aim to streamline the approval process for ABS issuances. This includes:

- Simplified application procedures for ABS issuances: The application process has been simplified to reduce administrative burden and processing time.

- Reduced processing time for regulatory approvals: The goal is to expedite the approval process, encouraging a higher volume of ABS transactions.

This streamlining is intended to incentivize greater participation in the Saudi capital market. However, striking a balance between efficient processing and maintaining rigorous oversight remains a challenge. The efficacy of these streamlined processes will be a key factor in the success of the revised Saudi Arabia ABS rules.

Implications for Issuers

The revised Saudi Arabia ABS rules have significant implications for issuers, presenting both challenges and opportunities.

Increased Costs and Compliance Burden

Issuers will face increased costs and a heavier compliance burden due to the new regulations. This includes:

- Need for enhanced internal controls and compliance functions: Issuers will need to invest in robust internal controls and compliance functions to meet the new requirements.

- Investment in technology and expertise to meet new regulatory requirements: Significant investment in technology and specialized expertise will be necessary to ensure compliance.

These increased costs could impact the profitability of ABS issuances. However, issuers can mitigate these impacts by proactively implementing efficient compliance strategies and leveraging technology to streamline processes.

Opportunities for Diversification and Growth

Despite the increased costs, the revised regulations also offer significant opportunities for diversification and growth for issuers. This includes:

- Access to a wider range of investors due to increased transparency: The enhanced transparency attracts a broader range of investors, both domestic and international.

- Potential for lower borrowing costs through efficient ABS issuances: Efficient ABS issuances can potentially lead to lower borrowing costs compared to traditional financing methods.

- Enhanced ability to securitize various asset classes: The revised rules may open up opportunities to securitize a wider range of asset classes, increasing diversification possibilities.

By strategically adapting to the new regulations and leveraging the opportunities they provide, issuers can enhance their competitiveness and expand their business.

Opportunities for Investors

The revised Saudi Arabia ABS rules also present significant opportunities for investors, particularly in terms of enhanced protection and access to new investment avenues.

Enhanced Investor Protection

The strengthened transparency and credit enhancement mechanisms significantly enhance investor protection:

- Improved transparency and disclosure leading to more informed investment decisions: Investors can make more informed decisions based on the comprehensive information provided.

- Strengthened credit enhancement mechanisms reducing investment risks: The enhanced credit enhancement significantly mitigates investment risks.

- Increased confidence in the integrity of the Saudi ABS market: The revised rules build confidence in the Saudi ABS market, attracting more investment.

Access to New Investment Opportunities

The regulatory reforms are expected to foster growth in the Saudi ABS market, leading to new investment opportunities:

- Growth potential in the Saudi ABS market due to regulatory reforms: The changes are expected to stimulate growth in the market, creating new avenues for investment.

- Diversification opportunities across various asset classes: Investors can diversify their portfolios by investing in various asset classes through ABS.

- Potential for higher returns relative to traditional investment instruments: ABS may offer higher returns compared to traditional investment options, although this depends on the underlying asset performance and market conditions.

Conclusion

The revised Saudi Arabia ABS rules present both challenges and opportunities for all stakeholders. While increased regulatory scrutiny and compliance requirements necessitate adjustments for issuers, these changes ultimately contribute to a more transparent and robust ABS market, benefiting investors and fostering sustainable growth in the Saudi capital markets. Understanding these implications is crucial for successfully navigating the new landscape. To stay informed about the latest developments and strategies for leveraging the opportunities presented by the revised Saudi Arabia ABS rules, continue to research and engage with relevant industry experts. By staying abreast of the evolving Saudi Arabia ABS rules, you can effectively navigate this dynamic market and capitalize on emerging opportunities.

Featured Posts

-

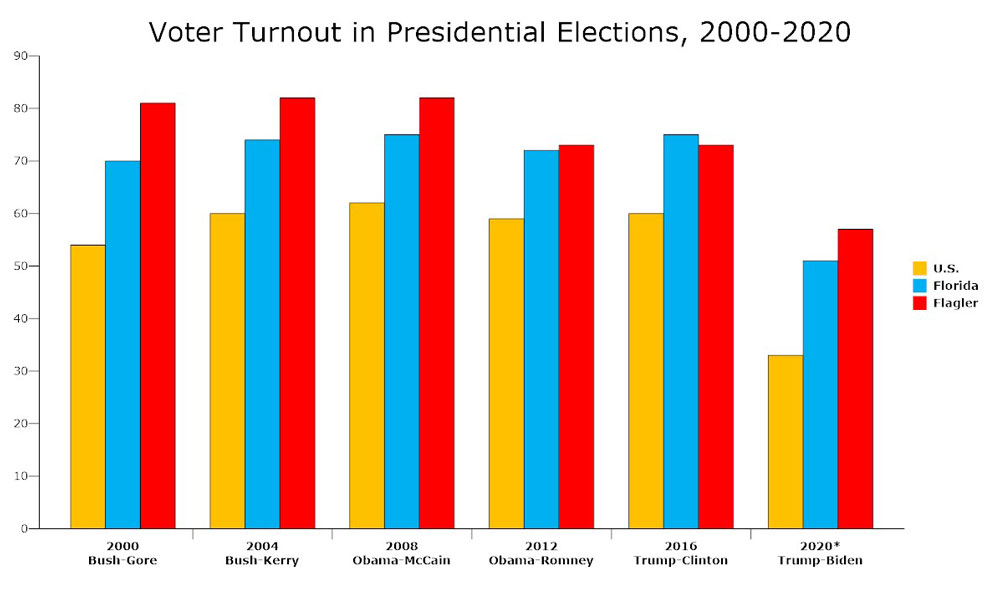

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 02, 2025

What The Florida And Wisconsin Election Turnout Reveals About The Political Climate

May 02, 2025 -

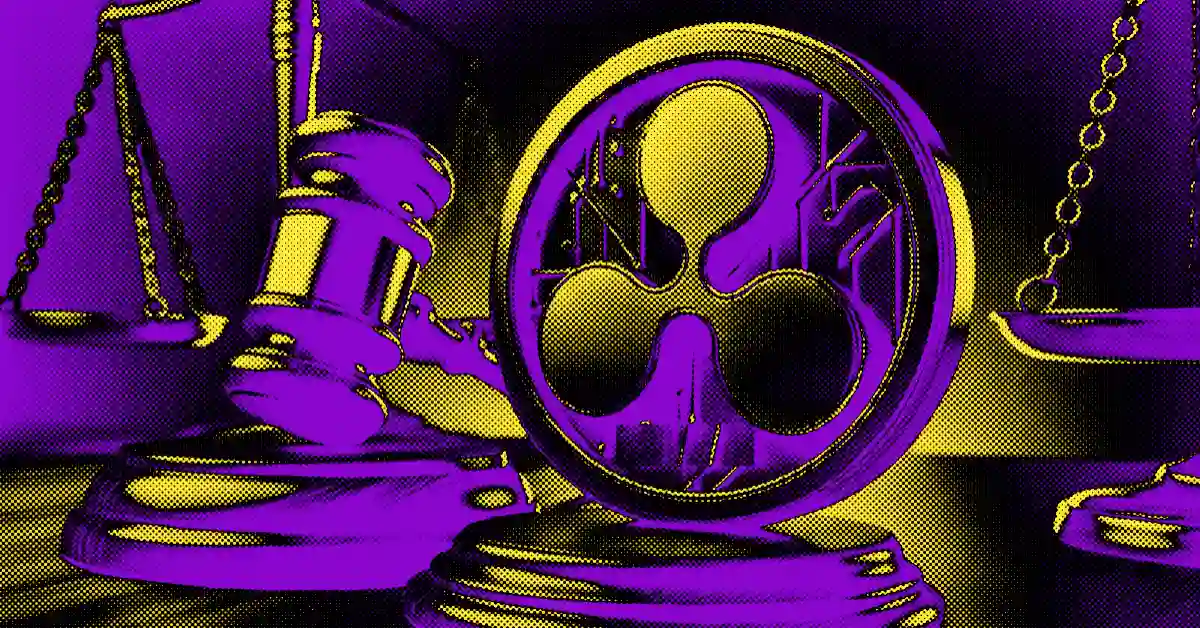

50 M Settlement Reached The Ripple And Sec Case Concludes Xrp Implications

May 02, 2025

50 M Settlement Reached The Ripple And Sec Case Concludes Xrp Implications

May 02, 2025 -

Where To Watch Newsround Bbc Two Hd Channel Guide

May 02, 2025

Where To Watch Newsround Bbc Two Hd Channel Guide

May 02, 2025 -

Slim Opladen Met Enexis In Noord Nederland Buiten Piektijden

May 02, 2025

Slim Opladen Met Enexis In Noord Nederland Buiten Piektijden

May 02, 2025 -

Avrupa Ile Daha Gueclue Bir Ortaklik Icin Yeni Stratejiler

May 02, 2025

Avrupa Ile Daha Gueclue Bir Ortaklik Icin Yeni Stratejiler

May 02, 2025