SBI Holdings' XRP Shareholder Reward: A Deep Dive Into The Ripple News

Table of Contents

SBI Holdings' Investment in Ripple and XRP

SBI Holdings' involvement with Ripple and XRP is significant, shaping its position within the cryptocurrency landscape. Understanding this relationship is crucial to assessing the potential "SBI Holdings' XRP shareholder reward."

The History of SBI Holdings' XRP Investment

SBI Holdings has been a strong supporter of Ripple and XRP for several years. Their involvement demonstrates a strategic long-term vision within the cryptocurrency market.

- 2018: SBI Holdings invested in Ripple, acquiring a significant stake in the company. The exact amount remains undisclosed.

- 2019-2023: SBI Holdings continued to support Ripple's initiatives, integrating XRP into its various financial services, showcasing their confidence in the long-term potential of XRP and Ripple's technology.

- Ongoing: SBI Holdings continues to actively participate in the XRP ecosystem, demonstrating continued belief in the long-term value proposition of XRP.

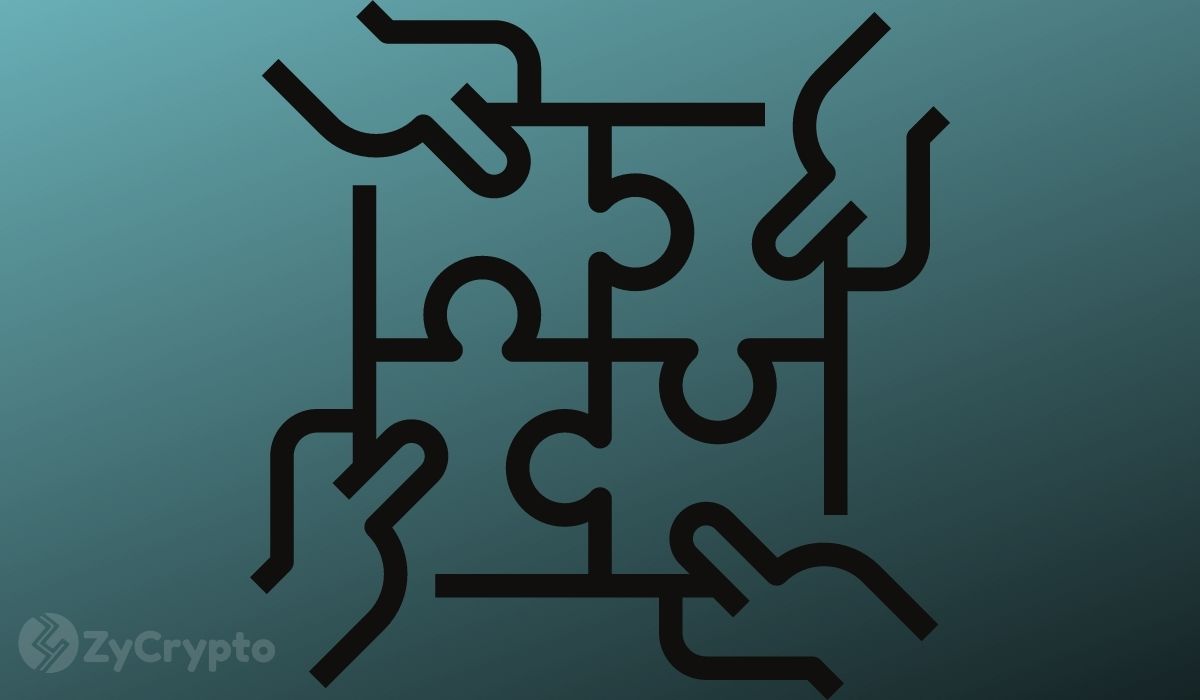

These strategic partnerships and investments highlight SBI Holdings' commitment to the Ripple project and the potential of XRP as a payment solution. The "SBI Holdings XRP investment" represents a substantial portion of their cryptocurrency portfolio.

The Significance of SBI Holdings' Stake in Ripple

The size of SBI Holdings' stake in Ripple is substantial, making them a key player within the Ripple ecosystem. Determining the exact percentage of XRP held by SBI remains difficult due to the lack of public disclosures. However, their influence is undeniable.

- Market Influence: As a major XRP holder, SBI Holdings' actions and statements carry significant weight in the XRP market. Their influence extends beyond simple market capitalization, affecting investor sentiment and potentially influencing Ripple's strategic direction.

- Potential Voting Rights: While the specifics aren't publicly known, SBI Holdings' significant XRP holdings likely grant them certain voting rights within Ripple's governance structure, albeit the extent is uncertain.

Understanding the "SBI Holdings Ripple stake" is critical to predicting the potential impact of the Ripple lawsuit on the company.

Impact of the Ripple Lawsuit on SBI Holdings' XRP Holdings

The ongoing Ripple SEC lawsuit presents significant uncertainty for SBI Holdings' XRP investment, potentially affecting their "SBI Holdings' XRP shareholder reward" significantly.

Analyzing the Ripple SEC Lawsuit

The core of the Ripple SEC lawsuit centers on whether XRP is a security. The SEC argues that Ripple's sale of XRP constituted an unregistered securities offering, while Ripple contends that XRP is a digital currency and not subject to securities laws.

- SEC Arguments: The SEC's main arguments hinge on Ripple's distribution and sales practices, claiming they violated securities laws.

- Ripple's Arguments: Ripple argues that XRP is a decentralized digital asset functioning as a currency, not a security.

- Potential Outcomes: The lawsuit's outcome could range from a complete victory for the SEC to a dismissal of the case or a negotiated settlement. This uncertainty is a major factor influencing the "SBI Holdings XRP losses" or potential "SBI Holdings XRP gains."

Direct and Indirect Effects on SBI Holdings

A favorable or unfavorable ruling in the Ripple lawsuit will have profound consequences for SBI Holdings.

- Favorable Ruling: A win for Ripple could trigger a significant surge in XRP's price, resulting in substantial gains for SBI Holdings. Their "SBI Holdings XRP shareholder reward" would be considerable.

- Unfavorable Ruling: Conversely, an SEC victory could significantly decrease XRP's value, leading to substantial losses for SBI Holdings and negatively impacting their financial standing. This could involve significant "SBI Holdings XRP losses."

- Reputational Impact: Regardless of the outcome, the lawsuit's protracted nature has already caused reputational damage to Ripple and could impact SBI Holdings' reputation and future investment decisions.

The "SBI Holdings XRP gains" or "SBI Holdings XRP losses" directly correlate with the Ripple lawsuit's outcome.

Potential Shareholder Rewards and Future Outlook for SBI Holdings and XRP

The future of SBI Holdings' XRP investment and its potential "SBI Holdings' XRP shareholder reward" depend heavily on the Ripple lawsuit's resolution and subsequent market reactions.

Scenarios following the Ripple Lawsuit

Several scenarios could unfold following the conclusion of the Ripple lawsuit:

- Positive Outcome (Ripple Wins): An XRP price surge is highly likely, directly impacting SBI Holdings' portfolio value positively. This scenario offers the most significant "SBI Holdings' XRP shareholder reward."

- Negative Outcome (Ripple Loses): XRP's price could plummet, resulting in substantial losses for SBI Holdings, impacting their investment significantly.

- Neutral Outcome (Settlement): A settlement could lead to a mixed market reaction, with price fluctuations depending on the terms of the settlement. This offers a less clear "SBI Holdings' XRP shareholder reward" scenario.

These scenarios highlight the "XRP price prediction" uncertainty surrounding SBI Holdings' investment.

Long-Term Implications for SBI Holdings' Crypto Strategy

This situation will significantly influence SBI Holdings' future cryptocurrency investment strategy.

- Diversification: SBI Holdings may diversify their portfolio to mitigate risks associated with a single cryptocurrency.

- Reduced XRP Investment: A negative outcome might lead to SBI Holdings reducing their XRP holdings.

- Increased Investment in Other Cryptos: They may shift their focus to other cryptocurrencies deemed less risky or with more regulatory clarity.

The "SBI Holdings crypto strategy" will likely adapt based on the final outcome of the Ripple lawsuit and the resulting "XRP investment updates."

Conclusion: Understanding the SBI Holdings' XRP Shareholder Reward Implications

The Ripple lawsuit's outcome remains highly uncertain, significantly affecting SBI Holdings' XRP investment and the potential "SBI Holdings' XRP shareholder reward." The various scenarios presented highlight the inherent risks and rewards associated with cryptocurrency investments. While a positive outcome could bring significant gains, a negative one could lead to substantial losses. The long-term impact on SBI Holdings' crypto strategy is equally uncertain, potentially leading to diversification or a shift in investment focus.

Stay tuned for updates on the SBI Holdings' XRP shareholder reward situation as the Ripple news unfolds. Continue to follow our analysis for in-depth coverage of this evolving story, focusing on "SBI Holdings XRP," "Ripple XRP news," and "XRP investment updates."

Featured Posts

-

Is Age Just A Number Challenging Ageist Stereotypes And Assumptions

May 01, 2025

Is Age Just A Number Challenging Ageist Stereotypes And Assumptions

May 01, 2025 -

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

May 01, 2025

Japanese Financial Giant Sbi Holdings Distributes Xrp To Shareholders

May 01, 2025 -

Bet Mgm Bonus Code Rotobg 150 150 Bonus On Warriors Vs Rockets Nba Playoffs

May 01, 2025

Bet Mgm Bonus Code Rotobg 150 150 Bonus On Warriors Vs Rockets Nba Playoffs

May 01, 2025 -

Indigenous Arts Festival Faces Funding Crisis Due To Economic Downturn

May 01, 2025

Indigenous Arts Festival Faces Funding Crisis Due To Economic Downturn

May 01, 2025 -

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

May 01, 2025

Rekord Grettski N Kh L Obnovila Prognoz Dlya Ovechkina

May 01, 2025