Scholar Rock Stock's Monday Dip: Causes And Consequences

Table of Contents

Scholar Rock Holding Corporation (SRRK), a prominent player in the biotech industry, experienced a significant stock price dip on Monday. This unexpected downturn has left many investors questioning the causes and potential consequences. This article delves into the potential reasons behind this Scholar Rock stock price drop, analyzing its implications for both investors and the company itself, offering insights into navigating the volatility inherent in biotech stock investments.

Potential Causes of the Scholar Rock Stock Dip

Several factors could have contributed to the Monday dip in Scholar Rock stock. Understanding these potential causes is crucial for making informed investment decisions.

Negative News or Announcements

Negative news, whether directly related to Scholar Rock or affecting the broader biotech landscape, can significantly impact investor confidence and lead to stock price declines. Several possibilities warrant consideration:

- Clinical trial setbacks: Any delays, negative results, or safety concerns arising from ongoing clinical trials for Scholar Rock's pipeline products could trigger a sell-off. Investors closely monitor the progress of clinical trials, and any setbacks can drastically alter perceptions of the company's future prospects.

- Regulatory concerns: Potential issues with the FDA or other regulatory bodies regarding drug approvals or manufacturing processes could also contribute to a drop in SRRK stock. Regulatory hurdles are a common risk in the biotech industry, and any negative news in this area can quickly impact investor sentiment.

- Financial performance issues: Disappointing financial reports, missed earnings expectations, or concerns about the company's financial stability could lead to investor apprehension and a subsequent stock price decline. Investors carefully scrutinize a company's financial health, and any negative news in this area can impact the stock price negatively.

- Competitor advancements: Significant advancements by competitors in the same therapeutic area could put pressure on Scholar Rock's stock price. Competitive pressure is a constant in the biotech industry, and any major breakthrough by a competitor can shift investor focus and negatively influence SRRK stock.

The importance of staying informed about company-specific news and announcements cannot be overstated. Reliable news sources and official company communications are essential for making sound investment decisions regarding Scholar Rock stock.

Broader Market Trends

The overall performance of the stock market and the biotech sector itself significantly influences individual stock prices, even those of fundamentally strong companies like Scholar Rock.

- General market downturn: A broader market sell-off, often triggered by macroeconomic factors like inflation or interest rate hikes, can impact even the most robust stocks. During periods of general market uncertainty, investors often move towards safer investments, leading to sell-offs in riskier sectors like biotech.

- Sector-specific sell-offs: Negative sentiment or regulatory changes specifically affecting the biotech industry can lead to sector-wide sell-offs, impacting Scholar Rock stock regardless of its individual performance. This highlights the interconnectedness of the biotech market and the influence of broader sector trends.

- Macroeconomic factors influencing investor risk appetite: Global economic conditions, geopolitical events, and inflation rates all play a role in investor sentiment and risk tolerance. Negative macroeconomic news can prompt investors to reduce their exposure to riskier investments, such as biotech stocks.

Understanding these broader market trends is essential for contextualizing the Scholar Rock stock dip and for making informed investment decisions in a volatile market.

Analyst Ratings and Price Target Adjustments

Analyst opinions and recommendations can significantly influence investor behavior and stock price movements.

- Downgrades: Negative revisions to analyst ratings, indicating a less optimistic outlook for Scholar Rock's future performance, can trigger selling pressure. Analyst ratings are closely watched by investors, and downgrades can lead to significant stock price declines.

- Reduced price targets: Lowering of price targets by analysts reflects a diminished expectation of future stock price appreciation. This can discourage investors and contribute to a stock price decline.

- Shifts in investment recommendations: Changes in analyst recommendations, from "buy" to "hold" or "sell," can influence investor behavior and create selling pressure, negatively affecting the stock price.

It's important to remember that while analyst opinions can be helpful, they shouldn't be the sole basis for investment decisions. Independent research and a thorough understanding of the company's fundamentals remain crucial.

Consequences of the Scholar Rock Stock Dip

The Monday dip in Scholar Rock stock has several potential short-term and long-term consequences.

Impact on Investor Sentiment and Confidence

A sudden stock price drop can significantly impact investor sentiment and confidence.

- Increased volatility: The dip can increase the volatility of Scholar Rock stock, making it more susceptible to further price swings. This volatility can make it challenging for investors to predict future price movements.

- Potential sell-offs: The price drop can trigger further sell-offs as investors react to the negative news or uncertainty. This can create a downward spiral, exacerbating the initial drop.

- Impact on future fundraising: A depressed stock price can make it more challenging for Scholar Rock to raise capital through future equity offerings, hindering its ability to fund research and development efforts.

Maintaining a long-term perspective and carefully managing risk are crucial strategies for navigating such volatility.

Short-Term and Long-Term Implications for the Company

The consequences of the stock price drop extend to Scholar Rock's operational and financial capabilities.

- Impact on valuation: The lower stock price directly impacts the company's overall market valuation, potentially affecting its ability to attract partnerships or make acquisitions. A lower valuation can limit the company’s strategic options.

- Access to capital: As mentioned above, a depressed stock price can hinder access to capital through future equity offerings. This can limit the company's ability to invest in research, development and expansion.

- Ability to pursue research and development: Reduced access to capital can directly impact the company's ability to pursue its research and development pipeline, potentially delaying or jeopardizing the development of promising products.

The duration and severity of the dip will determine the extent of the company's short-term and long-term implications.

Opportunities for Investors

While the dip presents challenges, it might also offer opportunities for investors with a long-term perspective.

- Buy-the-dip strategy: Some investors might see the dip as a buying opportunity, believing the stock price has fallen below its intrinsic value. This is a risky strategy, but it can potentially yield high rewards if the stock price rebounds.

- Potential for future growth: Despite the short-term setback, Scholar Rock's long-term prospects may remain strong. The dip could present an opportunity to invest at a lower price point, potentially benefiting from future growth.

- Analysis of risk-reward ratio: Investors should carefully assess the risk-reward ratio before making any investment decisions. The potential for future gains must be weighed against the risks associated with continued volatility or further price declines.

Caution is advised: investing based solely on short-term market fluctuations is risky. Thorough due diligence is crucial.

Conclusion

This analysis explored the potential causes and consequences of Scholar Rock stock's Monday dip, highlighting the interplay between company-specific news, broader market trends, and investor sentiment. Understanding these factors is crucial for navigating the volatility inherent in biotech investments. While the Scholar Rock stock's Monday dip presents challenges, it also highlights the importance of staying informed and conducting thorough due diligence before investing in the biotech sector. Continue monitoring Scholar Rock Stock (SRRK) and other biotech investments closely to make informed decisions. Thorough research and a long-term perspective are key to successful investing in volatile markets like that of Scholar Rock stock.

Featured Posts

-

Uber Ditches Commission Model Subscription Plan Details For Drivers

May 08, 2025

Uber Ditches Commission Model Subscription Plan Details For Drivers

May 08, 2025 -

Nba Playoffs Triple Doubles Leader Quiz Test Your Basketball Knowledge

May 08, 2025

Nba Playoffs Triple Doubles Leader Quiz Test Your Basketball Knowledge

May 08, 2025 -

Okc Thunders Sharp Words For National Media Outlets

May 08, 2025

Okc Thunders Sharp Words For National Media Outlets

May 08, 2025 -

Japanese Trading House Stocks Rise Following Berkshire Hathaways Investment

May 08, 2025

Japanese Trading House Stocks Rise Following Berkshire Hathaways Investment

May 08, 2025 -

Dyrynh Dshmny Gjranwalh Myn Fayrng Se 5 Afrad Jan Bhq Mlzm Grftar

May 08, 2025

Dyrynh Dshmny Gjranwalh Myn Fayrng Se 5 Afrad Jan Bhq Mlzm Grftar

May 08, 2025

Latest Posts

-

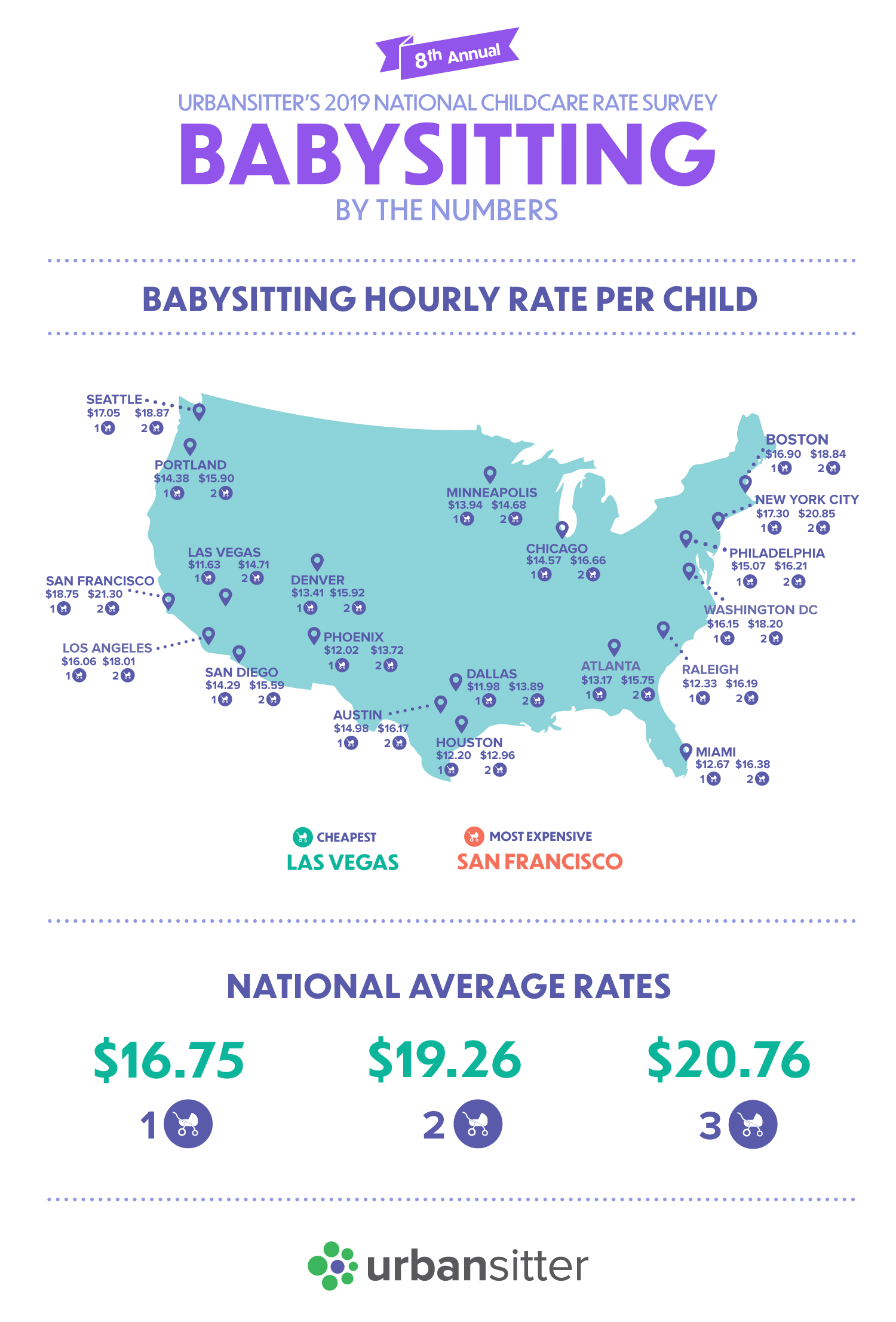

3 000 Babysitter To 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025

3 000 Babysitter To 3 600 Daycare One Mans Expensive Childcare Struggle

May 09, 2025 -

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025 -

Expensive Babysitting Costs Lead To Even Higher Daycare Expenses A Cautionary Tale

May 09, 2025

Expensive Babysitting Costs Lead To Even Higher Daycare Expenses A Cautionary Tale

May 09, 2025 -

Brekelmans En India Een Analyse Van De Relatie En Toekomstige Samenwerking

May 09, 2025

Brekelmans En India Een Analyse Van De Relatie En Toekomstige Samenwerking

May 09, 2025 -

Ba Me Tien Giang To Cao Bao Mau Bao Hanh Con Can Siet Chat Quan Ly Giu Tre

May 09, 2025

Ba Me Tien Giang To Cao Bao Mau Bao Hanh Con Can Siet Chat Quan Ly Giu Tre

May 09, 2025