SEC Review Of Grayscale ETF Application Impacts XRP Price

Table of Contents

The ongoing SEC review of Grayscale's application for a Bitcoin spot ETF is a major event in the cryptocurrency world, impacting not only Bitcoin but also other digital assets like XRP. This article explores the complex relationship between the SEC's decision and the potential fluctuations in the XRP price, examining the interconnectedness of the crypto market and regulatory uncertainty. The SEC's decision on this Bitcoin ETF application could have far-reaching consequences for the entire crypto landscape.

The Grayscale Bitcoin ETF Application and its Implications

Grayscale Investments' application to convert its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin exchange-traded fund (ETF) is a pivotal moment for Bitcoin's mainstream adoption. Approval would represent a significant endorsement of Bitcoin by the SEC, potentially unlocking massive institutional investment.

- Increased Bitcoin Adoption: ETF approval would likely lead to a surge in Bitcoin adoption among institutional investors who currently have limited access to regulated Bitcoin investment vehicles. This increased institutional participation could boost Bitcoin's price and overall market capitalization.

- Institutional Investment in Bitcoin: Currently, many large institutional investors are hesitant to invest directly in Bitcoin due to regulatory uncertainties and operational complexities. A Bitcoin ETF would provide a regulated and accessible pathway for these investors, potentially pouring billions into the Bitcoin market.

- SEC Arguments For and Against Approval: The SEC's arguments against previous Bitcoin ETF applications have centered on concerns about market manipulation and price volatility. However, Grayscale has argued that its application addresses these concerns, and the recent surge in institutional interest and maturation of the Bitcoin market may sway the SEC's perspective.

The Interconnectedness of the Crypto Market: Bitcoin and XRP

While Bitcoin and XRP are distinct cryptocurrencies with different functionalities, they are not entirely independent of each other. The crypto market exhibits a degree of interconnectedness, with movements in Bitcoin often influencing the prices of altcoins like XRP.

- Market Sentiment and Regulatory Pressures: Market sentiment plays a significant role in driving the correlation between Bitcoin and XRP. Positive news for Bitcoin, such as the approval of a Bitcoin ETF, tends to boost overall market sentiment, potentially benefiting XRP. Conversely, regulatory crackdowns impacting Bitcoin could negatively affect XRP.

- Historical Price Data Analysis: Analyzing historical price data reveals a positive correlation between Bitcoin and XRP price movements, although the strength of this correlation can fluctuate. Periods of significant Bitcoin price increases often coincide with XRP price increases, indicating a shared sensitivity to overall market trends.

- Positive Sentiment and XRP: If the SEC approves the Grayscale Bitcoin ETF, the resulting positive sentiment could spill over into the broader crypto market, potentially leading to increased demand and price appreciation for XRP. Increased investor confidence in the crypto space generally benefits altcoins.

How Regulatory Uncertainty Affects XRP Price

Regulatory clarity is crucial for investor confidence in the cryptocurrency market. The SEC's decisions on cryptocurrencies, particularly prominent ones like Bitcoin, have a significant impact on investor sentiment and market stability.

- Regulatory Clarity and XRP Trading Volume: Uncertainty surrounding SEC regulations can lead to reduced trading volume and increased price volatility for XRP. Clear regulatory frameworks increase investor confidence, encouraging greater participation and stabilizing prices.

- Investor Risk Aversion and SEC Rejection: If the SEC rejects Grayscale's application, it could trigger a wave of risk aversion across the crypto market. Investors may withdraw from less established assets like XRP, potentially leading to a price decline.

- Potential XRP Price Scenarios: The SEC's ruling could result in several scenarios for XRP: a significant price increase if the ETF is approved, a moderate to significant price decline if rejected, or sustained uncertainty and volatility if the decision is delayed.

Alternative Scenarios and Their Impact on XRP

The outcome of the SEC's decision on the Grayscale Bitcoin ETF application will have varying impacts on XRP, depending on the specific decision.

- Scenario 1: ETF Approval: Approval would likely lead to a surge in Bitcoin's price and a positive ripple effect across the crypto market, potentially boosting XRP's price due to improved investor sentiment and increased market liquidity.

- Scenario 2: ETF Rejection: Rejection could trigger a sell-off in Bitcoin and a negative impact on the broader crypto market, potentially leading to a decline in XRP's price due to decreased investor confidence and risk aversion.

- Scenario 3: Delayed Decision: A delayed decision would prolong market uncertainty, potentially leading to increased volatility and unpredictable price movements for XRP as investors grapple with prolonged uncertainty.

Conclusion

The SEC's review of Grayscale's Bitcoin ETF application carries significant weight for the entire cryptocurrency market. While not directly impacting XRP, the decision influences market sentiment and investor confidence, leading to potential indirect effects on XRP's price. The interconnected nature of the crypto market means that events surrounding Bitcoin heavily influence other cryptocurrencies like XRP.

Call to Action: Stay informed about the SEC's decision on the Grayscale Bitcoin ETF application and its potential impact on the XRP price. Follow our updates for the latest news and analysis on the SEC review of Grayscale ETF application and its impact on XRP. Continue to monitor the developments in the crypto market to make informed investment decisions regarding XRP and other crypto assets.

Featured Posts

-

Review Of Official Play Station Podcast Episode 512 Featuring True Blue

May 08, 2025

Review Of Official Play Station Podcast Episode 512 Featuring True Blue

May 08, 2025 -

Raising Productivity Dodges Call To Action For Carneys Agenda

May 08, 2025

Raising Productivity Dodges Call To Action For Carneys Agenda

May 08, 2025 -

Shkelje Te Rregullave Te Uefa S Hetimi Ndaj Arsenalit Pas Ndeshjes Me Psg

May 08, 2025

Shkelje Te Rregullave Te Uefa S Hetimi Ndaj Arsenalit Pas Ndeshjes Me Psg

May 08, 2025 -

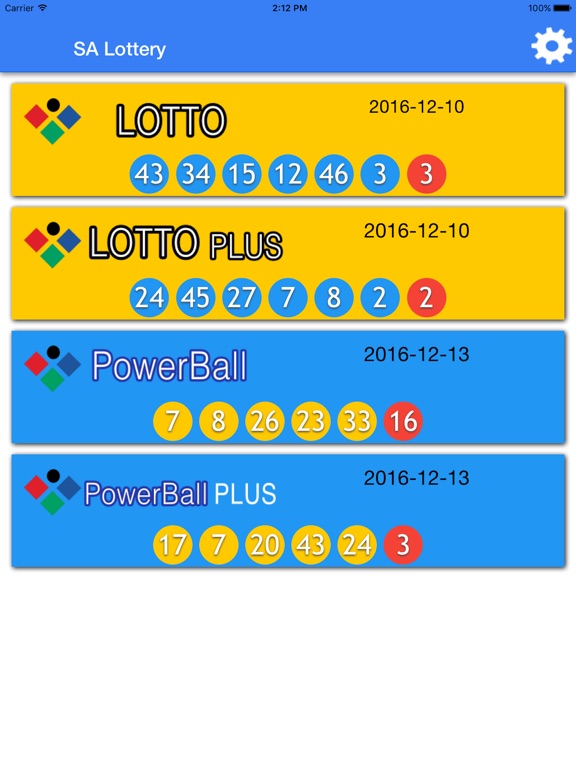

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 08, 2025 -

Cornilles Vs Babouins Qui Possede Les Meilleures Competences Geometriques

May 08, 2025

Cornilles Vs Babouins Qui Possede Les Meilleures Competences Geometriques

May 08, 2025

Latest Posts

-

Check Your Bank Account Dwp Warning On 12 Benefit Payments

May 08, 2025

Check Your Bank Account Dwp Warning On 12 Benefit Payments

May 08, 2025 -

Four Word Letter From Dwp What Uk Households Need To Know About Benefit Stoppages

May 08, 2025

Four Word Letter From Dwp What Uk Households Need To Know About Benefit Stoppages

May 08, 2025 -

Dwp Bank Account Verification Protect Your 12 Benefits

May 08, 2025

Dwp Bank Account Verification Protect Your 12 Benefits

May 08, 2025 -

Dwp Issues Warning Letters Uk Benefits Could Be Stopped

May 08, 2025

Dwp Issues Warning Letters Uk Benefits Could Be Stopped

May 08, 2025 -

Urgent Dwp Sending Letters Benefits At Risk For Uk Households

May 08, 2025

Urgent Dwp Sending Letters Benefits At Risk For Uk Households

May 08, 2025