SEC Review Of Grayscale's XRP ETF: What It Means For XRP Price

Table of Contents

Grayscale's Application and its Implications

Grayscale, a prominent digital currency asset manager, has filed an application with the SEC for an XRP exchange-traded fund (ETF). This move is incredibly significant because Grayscale manages billions of dollars in digital assets, and their endorsement of XRP through an ETF would bring a level of legitimacy and institutional interest currently lacking in the XRP market. The implications of a successful application are far-reaching:

-

Increased institutional investment potential: An approved XRP ETF would open the doors for institutional investors, such as hedge funds and pension funds, to easily gain exposure to XRP, potentially driving significant price appreciation. This contrasts sharply with the current situation where direct XRP investment often requires navigating complex exchanges and wallets.

-

Enhanced legitimacy and mainstream adoption of XRP: The SEC approval process itself implies a degree of validation, signaling to the wider financial community that XRP meets certain regulatory standards. This could significantly boost mainstream adoption and acceptance of XRP as a legitimate asset. This is a major step beyond simply being listed on various cryptocurrency exchanges.

-

Potential impact on XRP trading volume and liquidity: An ETF would undoubtedly increase XRP trading volume and liquidity. Greater liquidity means less price volatility and easier buying and selling for all investors. This increased accessibility is a key factor for driving broader market participation.

-

Comparison to other approved or rejected ETF applications: The SEC's decision on the Grayscale XRP ETF will be compared to its previous rulings on Bitcoin ETFs and other cryptocurrency-related investment vehicles. Analyzing these precedents will give investors valuable insight into the likely outcome of this application. The approval or rejection of similar applications in the past provides a historical context to predict the future of this XRP ETF application.

The SEC's Scrutiny and Potential Outcomes

The SEC's scrutiny of the XRP ETF application will be intense. The regulatory body has expressed significant concerns about the cryptocurrency market in general, and XRP in particular, due to its history and association with Ripple Labs, which faced a lawsuit alleging the sale of unregistered securities. There are three main potential outcomes:

-

Potential reasons for SEC approval: The SEC might approve the ETF if Grayscale can demonstrate robust investor protection measures, stringent market surveillance mechanisms, and a clear path to compliance with existing securities laws. A well-structured ETF application that minimizes risk for investors will improve the chances of SEC approval.

-

Potential reasons for SEC rejection: Rejection could stem from concerns about potential market manipulation, the ongoing legal uncertainty surrounding XRP's classification as a security or a commodity, or inadequate investor protections. Failure to address these concerns could lead to the rejection of the XRP ETF application.

-

Impact of a delayed decision on XRP price volatility: A prolonged review process could cause significant price volatility in XRP. Uncertainty breeds volatility, so a drawn-out decision will keep XRP price fluctuations high until a conclusion is reached. This inherent risk of a prolonged review process should be factored into any investment strategy.

-

Analysis of past SEC decisions regarding similar applications: Examining how the SEC has handled past ETF applications, particularly those involving cryptocurrencies, provides valuable insight. Understanding past decisions offers a template for predicting the potential outcome of the Grayscale XRP ETF application.

Market Sentiment and Price Prediction

Current market sentiment surrounding XRP is cautiously optimistic, with many investors viewing the Grayscale application as a potential catalyst for significant price increases. However, the outcome is far from certain.

-

Short-term price predictions (bullish vs. bearish): A positive SEC decision could lead to a significant short-term price surge, while rejection could result in a substantial drop. The short-term impact depends heavily on market reaction to the SEC's announcement.

-

Long-term implications for XRP price if the ETF is approved: Long-term, ETF approval would likely lead to sustained price growth, driven by increased institutional adoption and mainstream awareness. Long-term implications are far more positive than short-term risks.

-

Factors affecting price movements beyond the SEC decision: Other factors, such as overall market conditions, technological advancements within the XRP ecosystem, and broader regulatory developments, will also affect XRP's price. These factors are not mutually exclusive of the XRP ETF application outcome.

-

Risk assessment for investors based on various scenarios: Investors should carefully assess the risks associated with various scenarios, including the possibility of both significant gains and losses. Thorough risk assessment is critical before investing in any cryptocurrency.

Investing in XRP: Risks and Opportunities

Investing in XRP offers both significant potential rewards and considerable risks. A balanced approach is crucial.

-

Risk factors associated with XRP investments: XRP remains a volatile asset, subject to significant price swings. Regulatory uncertainty also poses a considerable risk, as future legal decisions could significantly impact its value. Volatility and regulatory uncertainty are significant risks inherent to cryptocurrency investment.

-

Potential benefits of XRP investment: The long-term growth potential of XRP, particularly if it gains wider adoption as a payment solution within the Ripple ecosystem, is a compelling factor for investors. Long-term growth potential is a key driver for XRP investment.

-

Strategies for mitigating risk: Investors can mitigate risk through strategies like dollar-cost averaging (investing smaller amounts regularly) and diversification (spreading investments across different assets). Diversification is critical in managing risks associated with volatile cryptocurrency assets.

-

Importance of due diligence before investing in cryptocurrencies: Thorough research and due diligence are essential before investing in any cryptocurrency, including XRP. Understanding the underlying technology, market dynamics, and potential risks is crucial for informed investment decisions.

Conclusion

The SEC's decision on Grayscale's XRP ETF application will be a pivotal moment for XRP. Approval could trigger a significant price increase and boost institutional investment, while rejection would likely result in a price drop. The Grayscale XRP ETF application holds immense significance for the future of XRP. Stay informed about the SEC's review and its implications for XRP's future price. Understand the risks and opportunities before investing in XRP and other cryptocurrencies. Research the latest developments surrounding the XRP ETF to make informed investment decisions. The potential impact of the XRP ETF is significant, requiring careful consideration before making investment choices.

Featured Posts

-

Bmw Porsche And The Complexities Of The Chinese Automotive Market

May 08, 2025

Bmw Porsche And The Complexities Of The Chinese Automotive Market

May 08, 2025 -

Nevilles Arsenal Vs Psg Prediction A Tense Matchup

May 08, 2025

Nevilles Arsenal Vs Psg Prediction A Tense Matchup

May 08, 2025 -

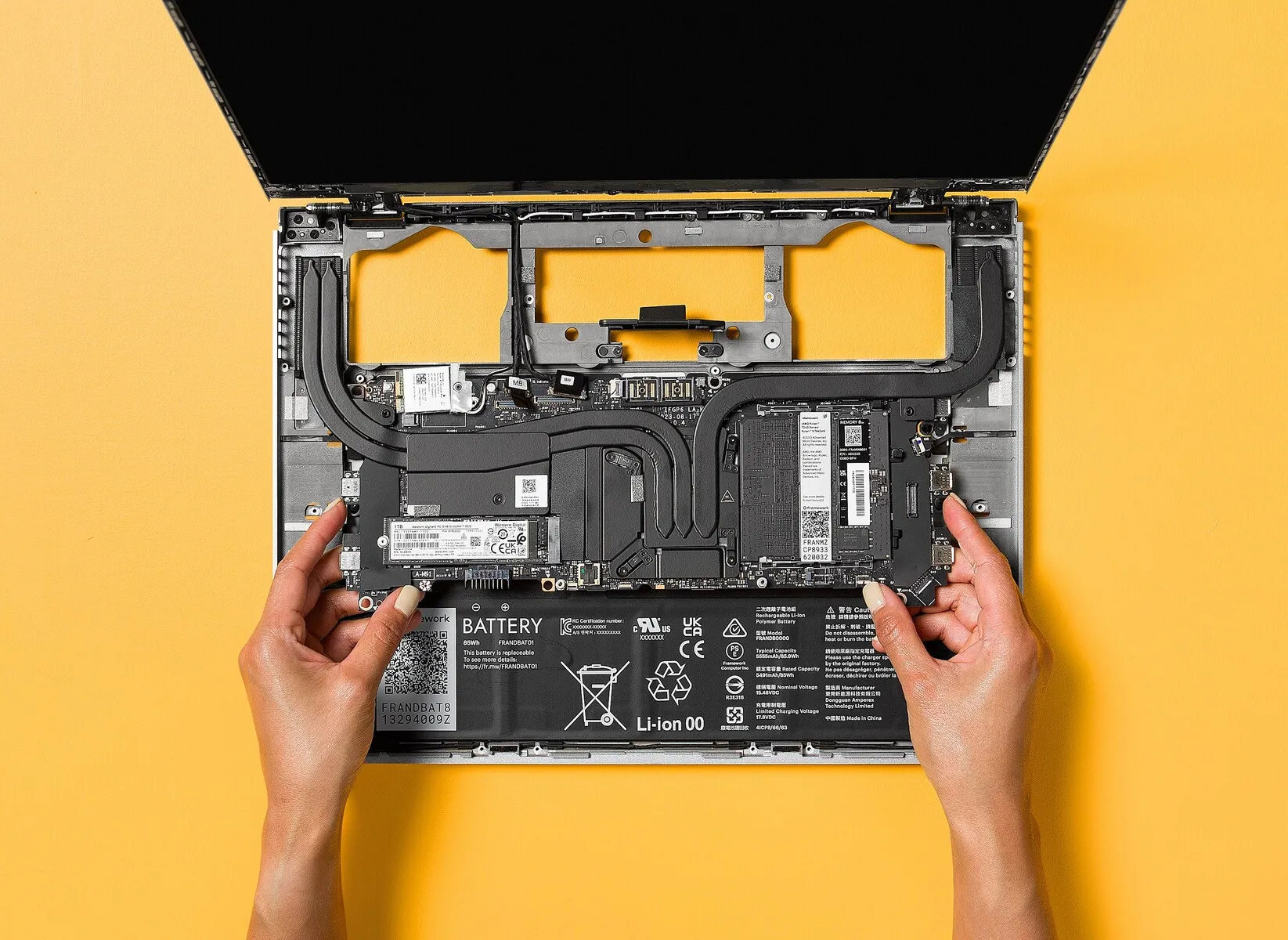

Sony Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling System Via Teardown

May 08, 2025

Sony Ps 5 Pro A Deep Dive Into Its Liquid Metal Cooling System Via Teardown

May 08, 2025 -

X Mens Rogue A Costume Retrospective Focusing On More Than Just The Outfit

May 08, 2025

X Mens Rogue A Costume Retrospective Focusing On More Than Just The Outfit

May 08, 2025 -

0 4

May 08, 2025

0 4

May 08, 2025

Latest Posts

-

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025

Dwp Benefit Claim Update Important Information For April 5th

May 08, 2025 -

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025

Dwps New Approach To Universal Credit Claim Verification

May 08, 2025 -

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025

Jayson Tatum And Ella Mai Commercial Hints At New Baby

May 08, 2025 -

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025

Dwp Cuts Benefits Letter Notifications And Next Steps For Claimants

May 08, 2025 -

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025

Universal Credit Overhaul Dwp Alters Claim Verification Process

May 08, 2025