Securing A Personal Loan With Bad Credit: A Guide To Direct Lenders

Table of Contents

Understanding Direct Lenders and Their Advantages

Direct lenders are financial institutions that provide loans directly to borrowers, without the involvement of a third-party broker. This contrasts with brokers who act as intermediaries, connecting borrowers with multiple lenders. Using a direct lender for a bad credit loan offers several key advantages:

- Faster processing times: Direct lenders often have streamlined application processes, leading to quicker approvals and funding compared to brokers who need to shop your application around.

- Increased transparency and fewer hidden fees: Direct lenders typically have clearer fee structures and fewer hidden charges than some brokers. You know exactly what you're paying upfront.

- Direct communication with the lender: Dealing directly with the lender simplifies communication, making it easier to address questions and concerns throughout the loan process.

- Potentially better interest rates than some brokers: While not always the case, direct lenders may offer more competitive interest rates in certain situations, as they don't have to share profits with a broker.

Direct lenders also assess risk differently. While your credit score is still a significant factor, they often consider other factors like your income, employment history, and debt-to-income ratio. They understand that a low credit score doesn't always reflect your ability to repay a loan responsibly. Responsible borrowing and a consistent repayment history, even on smaller loans, can demonstrate your commitment to repaying your debt.

Improving Your Chances of Approval: Steps to Take Before Applying

Before applying for a personal loan with bad credit, taking steps to improve your creditworthiness is crucial. Credit repair isn't magic, but it can make a significant difference.

- Check your credit report for errors and dispute them: Errors on your credit report can significantly lower your score. Review your reports from all three major credit bureaus (Equifax, Experian, and TransUnion) and dispute any inaccuracies.

- Pay down existing debts to lower your credit utilization ratio: Aim to keep your credit utilization ratio (the percentage of available credit you're using) below 30%. Paying down existing debts can significantly improve your score.

- Consider a secured loan or credit builder loan: These loans require collateral (like a savings account) or involve regular payments that are reported to credit bureaus, helping you build a positive credit history.

- Gather all necessary financial documents: This includes proof of income (pay stubs, tax returns), employment verification, and bank statements. Being prepared saves time and increases the efficiency of your application.

Budgeting effectively is also crucial. Demonstrating responsible financial management through a well-structured budget shows lenders your ability to handle repayments. Several online resources and financial advisors can help you create and stick to a realistic budget, leading to improved credit scores and a stronger application.

Finding Reputable Direct Lenders for Bad Credit Loans

The online lending landscape includes both reputable lenders and predatory ones. Thorough research is essential to protect yourself. Avoid lenders who promise guaranteed approval or have exceptionally high fees and interest rates.

- Check online reviews and ratings from trusted sources: Look for reviews on sites like the Better Business Bureau (BBB) and independent financial review websites.

- Verify licensing and registration with relevant authorities: Ensure the lender is legally operating and licensed in your state.

- Look for transparent fee structures and terms: Avoid lenders with hidden fees or unclear terms and conditions. Read the fine print carefully!

- Compare interest rates and loan terms from multiple lenders: Don't settle for the first offer you receive. Compare rates, fees, and repayment terms from several lenders before deciding.

Using online comparison tools can simplify the process of comparing lenders. These tools allow you to input your financial information and receive customized loan offers from multiple lenders, making it easier to find the best option for your needs. Remember, reading the loan agreement thoroughly before signing is paramount to understanding your obligations.

The Application Process: What to Expect and How to Prepare

The application process typically involves completing an online application form, providing necessary documentation, and undergoing a credit check. Be prepared to provide information about your income, employment history, and existing debts.

- Be accurate and honest in your application: Providing false information can severely damage your chances of approval and potentially have legal repercussions.

- Provide all requested documentation promptly: Delays in providing documentation can slow down the approval process.

- Be prepared to answer questions about your financial situation: Lenders will want to understand your financial circumstances to assess your ability to repay the loan.

Maintain open communication with the lender throughout the process. Ask questions and address any concerns promptly. A proactive approach can significantly improve the outcome.

Negotiating Loan Terms

In some cases, you might be able to negotiate loan terms, such as interest rates or repayment periods. Having a strong financial situation, demonstrating responsible debt management, and a steady income can strengthen your negotiating position.

Conclusion

Securing a personal loan with bad credit can be challenging, but by understanding the advantages of direct lenders and taking proactive steps to improve your financial situation, you significantly increase your chances of approval. Remember to research thoroughly, compare lenders, and carefully review the loan terms before committing. Don't let bad credit define your financial future. Take control and start your journey towards securing the personal loan you need through a reputable direct lender today!

Featured Posts

-

The Grass Isnt Always Greener A German Expats Perspective On California

May 28, 2025

The Grass Isnt Always Greener A German Expats Perspective On California

May 28, 2025 -

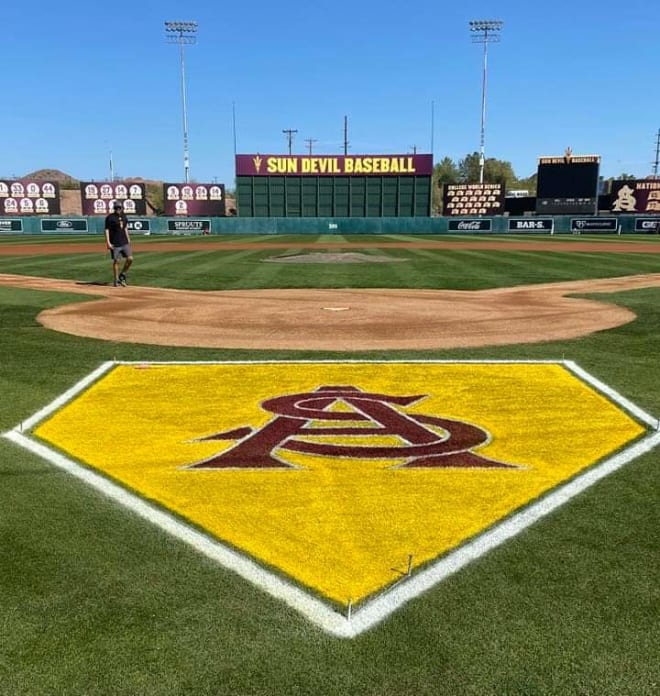

Diamondbacks Vs Dodgers Predicting Las Performance

May 28, 2025

Diamondbacks Vs Dodgers Predicting Las Performance

May 28, 2025 -

Is Jacob Wilsons Breakout A Reality Results Of Our Poll

May 28, 2025

Is Jacob Wilsons Breakout A Reality Results Of Our Poll

May 28, 2025 -

Nicolas Anelka All The Latest News Pictures And Videos

May 28, 2025

Nicolas Anelka All The Latest News Pictures And Videos

May 28, 2025 -

Pirates Lose To Braves Triolos Contributions And Consistent Bullpen Performance

May 28, 2025

Pirates Lose To Braves Triolos Contributions And Consistent Bullpen Performance

May 28, 2025