Securing A Place In The Sun: Tips For Overseas Property Investment

Table of Contents

Thorough Market Research: Unveiling the Perfect Overseas Property

Before diving into the exciting world of international real estate, thorough market research is paramount. This involves more than just browsing online listings; it requires a deep understanding of the market and your personal investment goals.

Identifying your ideal location: Consider climate, lifestyle, and potential rental income.

Choosing the right location is the cornerstone of successful overseas property investment. Several factors influence this crucial decision:

- Climate: Do you prefer warm, sunny weather year-round or a more temperate climate?

- Lifestyle: Are you seeking a bustling city environment or a tranquil rural retreat?

- Proximity to Amenities: Consider access to healthcare, schools, transportation, and entertainment.

- Tourism Potential: If you plan on renting out your property, high tourist traffic can significantly boost rental income.

- Local Regulations: Understanding building codes, planning permissions, and property ownership laws is crucial.

For example, researching specific areas within a country like Spain – comparing coastal regions with their high tourist potential and associated higher property prices to quieter inland areas offering potentially better value – is vital. Understanding the nuances of the international property market is essential for making an informed decision.

Analyzing property values and market trends: Understand current prices and predict future growth.

Analyzing property values and predicting future growth is crucial for a sound investment. This requires a multifaceted approach:

- Utilize Online Resources: Websites specializing in global real estate offer valuable data on property prices and market trends.

- Consult Local Real Estate Agents: Local expertise offers invaluable insights into market dynamics and potential pitfalls.

- Study Historical Property Data: Analyzing past trends can help you predict future growth potential.

Comparing property prices in different locations and analyzing rental yields – the return on investment from rental income – is crucial. Understanding the intricacies of property market analysis and real estate investment trends in your chosen overseas property markets is vital for making a smart investment.

Navigating the Legal Landscape: Protecting Your Overseas Property Investment

Investing in overseas property presents unique legal complexities. Understanding and navigating these complexities is essential to protect your investment.

Understanding local laws and regulations: Property ownership rights, taxes, and building codes.

Navigating international property law requires a proactive approach:

- Seek Legal Counsel: A lawyer specializing in international property law is invaluable for understanding the intricacies of local regulations.

- Research Specific Laws: Thoroughly research property ownership rights, building codes, and environmental regulations in your target country.

- Understand Taxation Implications: Be aware of property tax, capital gains tax, and inheritance tax implications.

For example, the process of obtaining a property title deed varies significantly across countries. Understanding these differences and ensuring clear ownership is paramount. This due diligence helps mitigate the risks inherent in foreign property ownership.

Due diligence and property verification: Ensuring the property's legitimacy and avoiding scams.

Protecting your investment from scams requires meticulous due diligence:

- Conduct Thorough Title Searches: Verify the property's ownership and ensure there are no outstanding liens or claims.

- Verify Property Documents: Check the authenticity of all property documents and ensure they are legally sound.

- Use Reputable Agents and Lawyers: Working with trusted professionals significantly reduces the risk of fraud.

Verifying the authenticity of property documents is a crucial step in avoiding overseas property scams. By following best practices, you can significantly reduce the risks associated with buying property abroad safely.

Financing Your Overseas Property Dream: Securing the Right Mortgage

Securing the right financing is a critical step in your overseas property investment journey.

Exploring financing options: Mortgages, cash purchases, and other funding sources.

Several financing options are available:

- Mortgages: International mortgage lenders offer various mortgage products for overseas properties. Compare interest rates and repayment terms carefully.

- Cash Purchases: Buying with cash eliminates mortgage complexities but requires significant upfront capital.

- Other Funding Sources: Explore other financing options like private loans or lines of credit.

Understanding mortgage requirements in different countries is vital. The process of obtaining a mortgage for an overseas property can vary significantly, requiring meticulous preparation.

Managing currency exchange risks: Protecting your investment from fluctuations.

Fluctuations in currency exchange rates can significantly impact your investment:

- Understand Exchange Rates: Monitor exchange rate movements and their potential impact on your investment.

- Use Currency Hedging Strategies: Consider strategies to mitigate currency risks, such as forward contracts or currency options.

- Consult Financial Advisors: Seek advice from financial professionals specializing in international finance.

The impact of currency fluctuations on overseas property investments can be substantial. Understanding and managing these risks is crucial for protecting your investment.

Conclusion

Successful overseas property investment hinges on three key pillars: thorough market research, a comprehensive understanding of the legal landscape, and sound financial planning. By carefully researching potential locations, navigating the legal complexities, and securing appropriate financing, you can significantly increase your chances of securing a profitable and enjoyable investment. The potential rewards – both financial gains and lifestyle enhancements – are significant. Start your research today and take the first step towards securing your place in the sun through well-informed overseas property investment. [Link to relevant resources]

Featured Posts

-

Lee Andersons Attack On Rupert Lowe A Major Blow To Conservative Party Reform

May 03, 2025

Lee Andersons Attack On Rupert Lowe A Major Blow To Conservative Party Reform

May 03, 2025 -

Register For The Sony Play Station Beta Program Full Requirements Guide

May 03, 2025

Register For The Sony Play Station Beta Program Full Requirements Guide

May 03, 2025 -

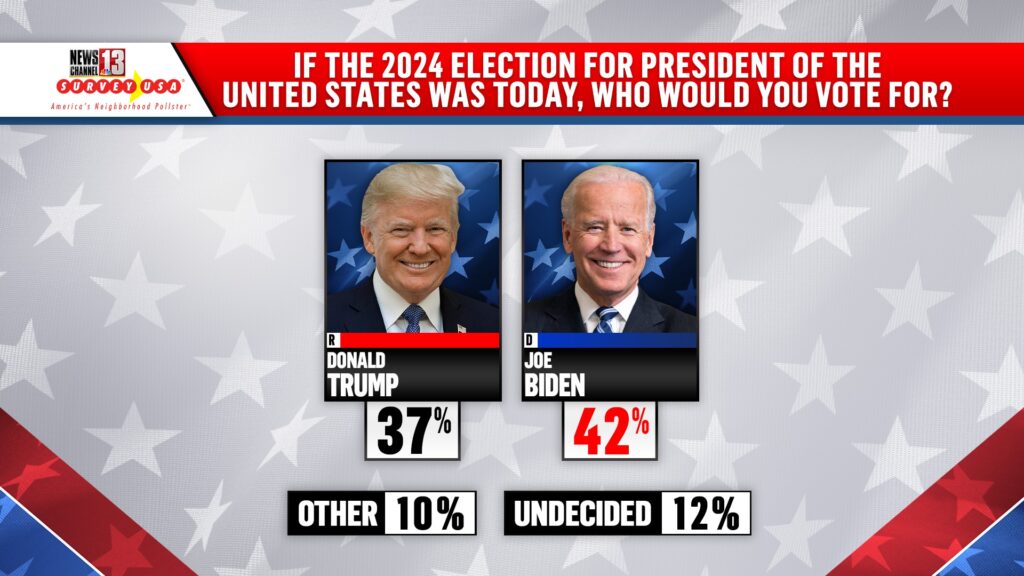

Securing Election Results The Robustness Of The New Poll Data System

May 03, 2025

Securing Election Results The Robustness Of The New Poll Data System

May 03, 2025 -

Winter Weather Delays Trash Collection And Friday School Schedule Updates

May 03, 2025

Winter Weather Delays Trash Collection And Friday School Schedule Updates

May 03, 2025 -

1 T 50

May 03, 2025

1 T 50

May 03, 2025