Securing Your Place In The Sun: Smart Strategies For International Property Investment

Table of Contents

Researching Your Ideal International Property Market

Before diving into the exhilarating world of international property investment, thorough research is paramount. This crucial step lays the foundation for a successful and profitable venture.

Due Diligence and Market Analysis

Investing in overseas property requires meticulous due diligence and a comprehensive market analysis. Don't rush into a decision; take your time to thoroughly investigate the market conditions in your chosen location.

- Analyze Market Trends: Study historical property price data, identify current trends, and project future growth potential. Consider factors influencing the market, such as economic stability, population growth, and infrastructure development.

- Assess Economic Stability: A stable economy is crucial. Research the country's GDP growth, inflation rates, and political climate. A volatile economy can significantly impact property values.

- Understand Local Regulations: Familiarize yourself with local laws, building codes, and property ownership regulations. These vary considerably between countries and can impact your investment.

- Consider Taxes and Currency Exchange: Factor in local property taxes, potential capital gains taxes, and the impact of currency exchange rate fluctuations. These can influence your overall return on investment.

- Consult Local Experts: Engage reputable real estate agents, lawyers, and financial advisors with local expertise. Their insights are invaluable in navigating the complexities of the international property market. Utilize property market analysis tools and reports from trusted sources to inform your decision-making.

Identifying Promising Locations for International Property Investment

With your research complete, identifying promising locations for international property investment is the next crucial step. Focus on areas with potential for strong rental yields or high capital appreciation.

- High-Yield Properties: Look for locations with a strong rental market, providing consistent income streams alongside capital appreciation. Consider factors like tourism, student populations, and proximity to employment centers.

- Emerging Markets: Explore emerging markets with high growth potential. While riskier, these can offer substantial returns if you conduct thorough due diligence.

- Established Investment Hotspots: Established markets offer stability and lower risk, but competition is generally higher. Research locations with proven track records of property value growth.

- Lifestyle Considerations: Consider your lifestyle preferences. Do you prefer a bustling city or a peaceful coastal retreat? Choose a location that aligns with your vision. Factors like infrastructure, climate, and proximity to amenities are also important.

- Examples of Popular Destinations: Portugal's Golden Visa program, Spain's coastal properties, and various Southeast Asian cities are popular international property investment destinations, but always conduct your own thorough research before making a decision.

Financing Your International Property Purchase

Securing the necessary financing is a vital step in your international property investment journey. Explore various options, understand the associated risks, and plan carefully.

Securing International Mortgages and Financing Options

Several options exist for financing your overseas property purchase. Each comes with unique requirements and considerations.

- International Mortgages: Many international banks and lenders offer mortgages for overseas property purchases. However, securing an international mortgage may be more challenging than obtaining a domestic loan and typically requires a larger down payment.

- Private Loans: Consider private loans from family, friends, or private lenders as a supplementary financing source.

- Cash Purchases: A cash purchase eliminates the complexities of securing a mortgage, offering greater control and potentially a stronger negotiating position.

- Financial Advice: Seek advice from financial advisors specializing in international investments. They can help you navigate the complexities of international finance and develop a tailored financing strategy.

Managing Currency Exchange Risks

Currency exchange rate fluctuations can significantly impact your investment. Develop a strategy to mitigate these risks.

- Hedging Strategies: Explore hedging strategies, such as forward contracts or options, to protect against losses due to currency fluctuations.

- Currency Exchange Specialists: Consult currency exchange specialists to understand the market and implement effective risk management strategies. They can help you secure favorable exchange rates and minimize transaction costs.

Navigating the Legal and Tax Implications of International Property Ownership

Understanding the legal and tax implications is critical for a successful international property investment. Seek professional advice to ensure compliance and optimize your investment.

Understanding International Property Laws and Regulations

Navigating the legal landscape of international property ownership requires expertise and careful planning.

- Legal Representation: Engage a reputable lawyer specializing in international property law in both your home country and the country of investment. This is essential to ensure legal compliance and protect your interests.

- Local Property Laws: Thoroughly understand local property laws, regulations, and ownership structures. These vary considerably across countries.

- Due Diligence on Title: Conduct thorough due diligence to verify clear title to the property and avoid potential legal disputes.

Tax Implications of International Property Investment

International property ownership involves complex tax implications that require careful consideration.

- Capital Gains Tax: Understand the capital gains tax implications in both your home country and the country of investment. Tax rates and regulations vary significantly.

- Property Tax: Factor in local property taxes, which can vary considerably depending on location and property value.

- Tax Optimization: Utilize tax optimization strategies, such as tax treaties or deductions, to minimize your tax liabilities. Consult with tax advisors specializing in international taxation.

Securing Your Place in the Sun: Final Thoughts on International Property Investment

Successfully navigating the world of international property investment requires thorough research, secure financing, and a clear understanding of the legal and tax implications. However, the potential rewards are substantial, offering significant financial growth, lifestyle enhancements, and portfolio diversification. Remember that expert advice from lawyers, financial advisors, and tax specialists is invaluable throughout this process.

Ready to secure your place in the sun? Start your research into international property investment today! Find the perfect overseas property that aligns with your goals and budget. Don't hesitate to reach out to professionals to guide you through this exciting journey into global real estate.

Featured Posts

-

Examining Voter Participation A Comparative Analysis Of Florida And Wisconsin

May 03, 2025

Examining Voter Participation A Comparative Analysis Of Florida And Wisconsin

May 03, 2025 -

Reform Uk Faces Bullying Scandal Investigation Into Rupert Lowe

May 03, 2025

Reform Uk Faces Bullying Scandal Investigation Into Rupert Lowe

May 03, 2025 -

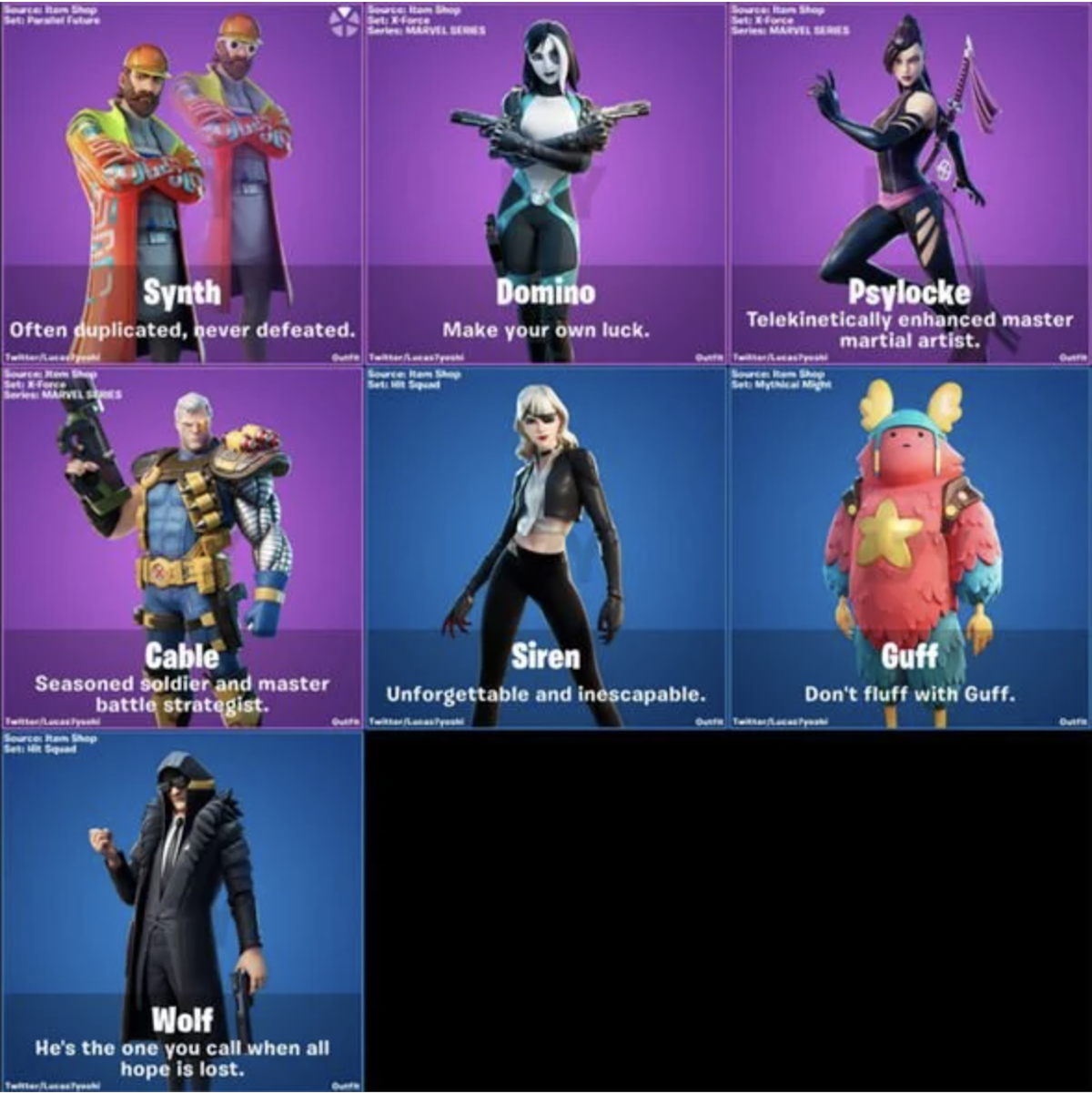

Fortnites Item Shop Gets A Helpful Update For Players

May 03, 2025

Fortnites Item Shop Gets A Helpful Update For Players

May 03, 2025 -

Epl Flop Souness Critical Of Havertzs Arsenal Performance

May 03, 2025

Epl Flop Souness Critical Of Havertzs Arsenal Performance

May 03, 2025 -

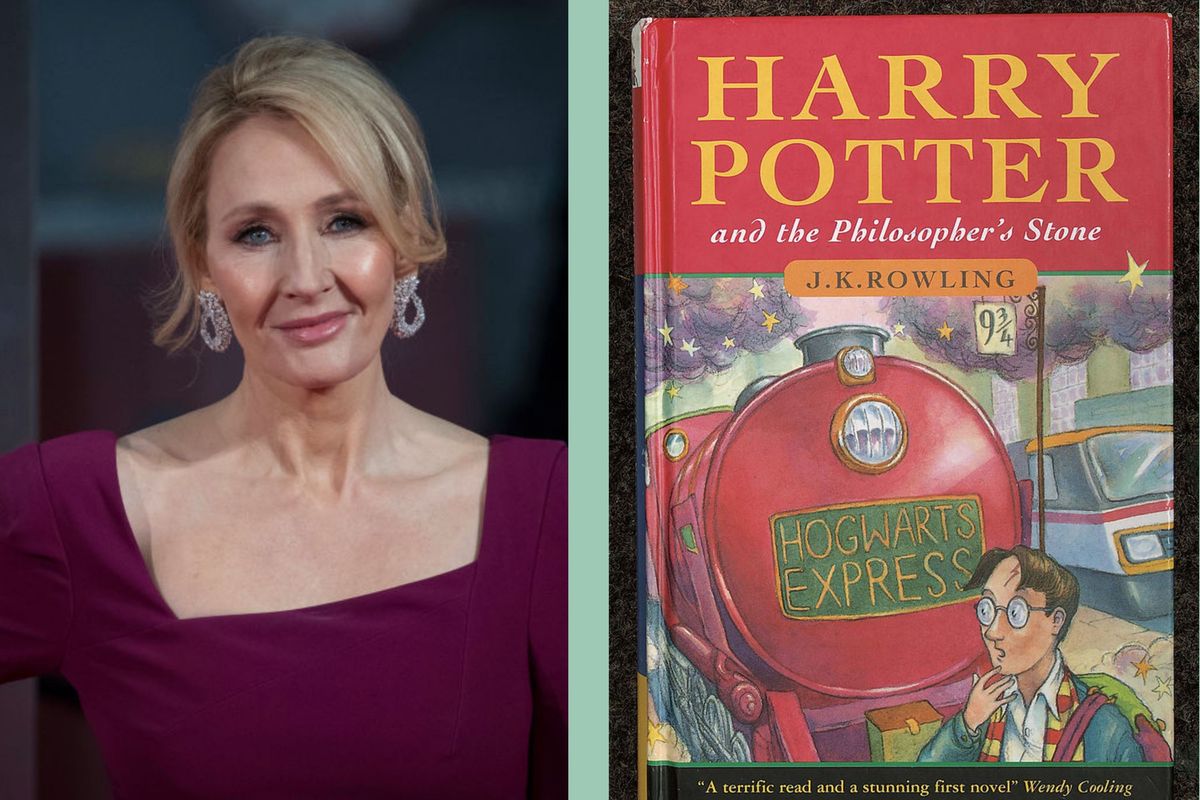

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025