Securities Lawsuit Targets BigBear.ai Holdings, Inc.

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

The Allegations

The lawsuit against BigBear.ai alleges various instances of misrepresentation and omission of material facts, constituting securities fraud. Specifically, the plaintiffs claim that:

- BigBear.ai misled investors about the company's financial performance and prospects.

- The company omitted crucial information regarding its contracts and revenue streams.

- Statements made by company executives and in official filings were materially false and misleading.

The plaintiff(s), [insert name(s) of plaintiff(s) and their legal representation if known], allege that these actions violated federal securities laws, causing significant financial losses to investors. [Insert link to official court documents if available].

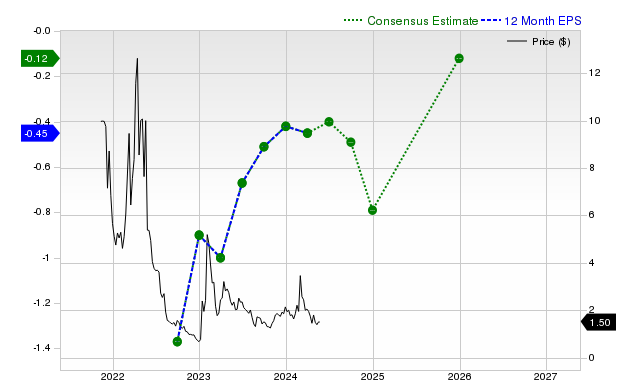

Potential Impact on BigBear.ai's Stock Price

The filing of the securities lawsuit immediately impacted BigBear.ai's stock price. [Insert graph or chart showing stock performance before and after the lawsuit]. The immediate reaction was a [Insert percentage] drop in share value. The long-term effects remain uncertain, but potential scenarios include:

- Further decline in stock price as the lawsuit progresses.

- Settlement negotiations leading to a partial recovery in stock price.

- A court ruling that could significantly impact the company's valuation and future prospects.

Analyst comments vary, with some predicting a sustained decline while others believe the impact will be short-lived. [Insert any analyst quotes or predictions].

The Company's Response

BigBear.ai has [Insert BigBear.ai's official statement or response to the lawsuit]. [Insert quotes from the statement if available]. The tone of their response is [describe the tone – e.g., defensive, conciliatory, etc.], and their strategy appears to be [describe their strategy – e.g., to vigorously defend against the allegations, to negotiate a settlement, etc.]. The company has [mention any actions BigBear.ai has taken or plans to take – e.g., launched an internal investigation, hired legal counsel, etc.].

Implications for BigBear.ai Investors

Understanding Investor Rights

Investors involved in securities class action lawsuits have several legal rights. These include:

- The right to participate in the lawsuit, potentially recovering financial losses.

- The right to join a class action lawsuit, sharing legal costs and potentially benefiting from a larger settlement.

- The right to seek independent legal counsel to understand their options and protect their interests.

Assessing the Risk

Investors holding BigBear.ai stock face considerable financial risks due to the lawsuit. These risks include:

- Further decline in stock value.

- Potential loss of the entire investment if the lawsuit is successful.

- Ongoing legal costs and uncertainties associated with the case.

The potential loss of investment value is directly correlated to the outcome of the lawsuit and the court's decision regarding the allegations.

Next Steps for Investors

Investors should take the following steps:

- Consult with a securities attorney experienced in class action lawsuits.

- Carefully monitor news and updates regarding the legal proceedings.

- Consider diversifying their investment portfolio to mitigate risk.

[Insert links to resources for legal assistance or financial advice.]

Securities Law and Legal Precedents

Relevant Securities Laws

The lawsuit against BigBear.ai likely involves violations of several federal securities laws, including:

- The Securities Act of 1933, which governs the initial offering of securities.

- The Securities Exchange Act of 1934, which regulates the trading of securities on exchanges.

These laws aim to protect investors from fraud and ensure transparency in the securities market. A violation of these laws can lead to significant legal consequences for the company and its officers.

Similar Cases and Precedents

The outcome of the BigBear.ai case will depend partly on similar securities lawsuits and legal precedents. Analyzing these cases can provide insights into potential outcomes: [Discuss similar cases and precedents, highlighting their relevance to the BigBear.ai case and potential outcomes based on previous rulings and legal history.].

Conclusion

The securities lawsuit against BigBear.ai Holdings, Inc. presents significant challenges for the company and its investors. The allegations of misrepresentation and omission of material facts, coupled with the potential impact on the stock price and investor confidence, highlight the risks associated with investing in publicly traded companies. The legal complexities and the potential for significant financial losses underscore the need for investors to understand their rights and seek professional advice.

Call to Action: Investors affected by the BigBear.ai lawsuit should carefully monitor the situation, seek professional legal counsel if necessary, and stay informed about further developments in the case. Understanding the complexities of this BigBear.ai securities lawsuit is crucial for protecting your investment. Stay updated on any further announcements and legal proceedings related to BigBear.ai.

Featured Posts

-

Hmrc Letter Thousands Of Uk Households Earning Over 23 000 Affected

May 20, 2025

Hmrc Letter Thousands Of Uk Households Earning Over 23 000 Affected

May 20, 2025 -

Suki Waterhouses Tik Tok The Twink Controversy And Its Online Impact

May 20, 2025

Suki Waterhouses Tik Tok The Twink Controversy And Its Online Impact

May 20, 2025 -

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Wayne Gretzky Trump Tariffs And Canadian Patriotism A Heated Debate

May 20, 2025

Wayne Gretzky Trump Tariffs And Canadian Patriotism A Heated Debate

May 20, 2025 -

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 20, 2025

Wlos Hosts Good Morning Americas Ginger Zee For Asheville Rising Helene Preview

May 20, 2025