Self-Defense Shooting: Do You Need Insurance Coverage?

Table of Contents

Understanding the Legal Ramifications of Self-Defense Shooting

Even when acting in self-defense, the legal and financial consequences can be severe. Understanding these potential ramifications is crucial for responsible gun owners.

Civil Lawsuits and Their Costs

Being sued after a self-defense shooting is a very real possibility, even if you were entirely justified in your actions. Civil lawsuits can arise from various scenarios, resulting in substantial financial burdens.

- Examples of scenarios leading to lawsuits:

- Accidental injury to bystanders, even if the shooter acted in self-defense.

- Claims of excessive force, even if the threat was significant.

- Disputes over the interpretation of the "stand your ground" or "castle doctrine" laws (depending on your jurisdiction).

The financial burden of defending yourself in court can be crippling. Costs include:

- High legal fees for experienced attorneys specializing in self-defense cases.

- Medical expenses for injured parties, regardless of fault.

- Potential judgments against you, potentially reaching hundreds of thousands or even millions of dollars.

Criminal Charges and Their Consequences

Even in justified self-defense cases, you could face criminal charges. This is especially true if details of the event are contested or if there are discrepancies in your account.

- Costs associated with criminal charges:

- High legal fees for a criminal defense attorney, often exceeding those of civil cases.

- Potential fines, which can be substantial.

- Imprisonment, even if charges are eventually dropped or you are acquitted. The time spent in pre-trial detention alone can be devastating.

The impact on your reputation, employment prospects, and future opportunities can also be significant, regardless of the legal outcome.

Types of Insurance Coverage for Self-Defense Shooting

Several types of insurance can help mitigate the financial and legal risks associated with self-defense shooting. Choosing the right coverage is paramount.

Liability Insurance

Liability insurance protects you against claims of negligence or injury resulting from your actions. While general liability insurance might offer some coverage, it's crucial to consider specialized firearm liability insurance.

- Coverage provided by liability insurance:

- Coverage for medical expenses of those injured.

- Coverage for legal fees incurred in defending against lawsuits.

- Coverage for settlements or judgments awarded against you.

Firearm liability insurance specifically addresses incidents involving firearms, providing more comprehensive protection than general liability policies.

Self-Defense Legal Defense Insurance

This specialized insurance is designed to cover the legal costs associated with self-defense incidents, regardless of the outcome.

- Specific benefits of self-defense legal defense insurance:

- Coverage for attorney fees, ensuring you have access to skilled legal representation.

- Coverage for expert witness fees, which are often necessary in self-defense cases.

- Coverage for court costs and other associated expenses.

Having legal representation specializing in self-defense cases is critical for navigating the complex legal landscape.

Concealed Carry Insurance

For concealed carry permit holders, specific insurance options are available to address the unique risks associated with carrying a firearm in public.

- Key features of concealed carry insurance:

- Coverage for incidents involving your concealed weapon, even if you acted in self-defense.

- Potential inclusion of training requirements or restrictions, incentivizing responsible gun ownership.

- Often includes legal defense coverage specifically tailored to concealed carry situations.

Choosing the Right Insurance Policy for Your Needs

Selecting the right insurance policy depends on several key factors.

Factors to Consider

- Type of firearm: The type of firearm you own can influence premium costs and coverage options.

- Frequency of use: How often you use your firearm for practice or carry it affects your risk profile.

- Location: Home defense situations differ significantly from concealed carry in public. Your insurance needs will reflect this difference.

- Personal risk tolerance: Assess your comfort level with potential financial exposure and choose coverage accordingly.

Comparing Policies and Premiums

Comparing policies and premiums is vital to finding the best fit for your needs and budget.

- Key factors to compare:

- Coverage limits: Understand the maximum amount the insurance will pay out.

- Exclusions: Carefully review what the policy doesn't cover.

- Reputation of the insurance provider: Choose a reputable company with a history of strong claims service.

Take the time to contact several insurance providers to compare quotes and coverage details. Don't hesitate to ask questions and clarify any uncertainties.

Conclusion

Protecting yourself isn't just about firearm proficiency; it's about comprehensive risk management. The potential legal and financial risks associated with self-defense shooting are substantial. We've examined the various types of insurance available—liability insurance, self-defense legal defense insurance, and concealed carry insurance—each offering crucial protection in different scenarios. Choosing a policy that meets your individual needs is vital. Don't leave your future to chance. Research and secure appropriate self-defense shooting insurance today. Explore your options and find the coverage that best safeguards your interests. Don't hesitate to contact several insurance providers to compare quotes and coverage.

Featured Posts

-

A Fathers Strength A Message From Hostage To Son

May 13, 2025

A Fathers Strength A Message From Hostage To Son

May 13, 2025 -

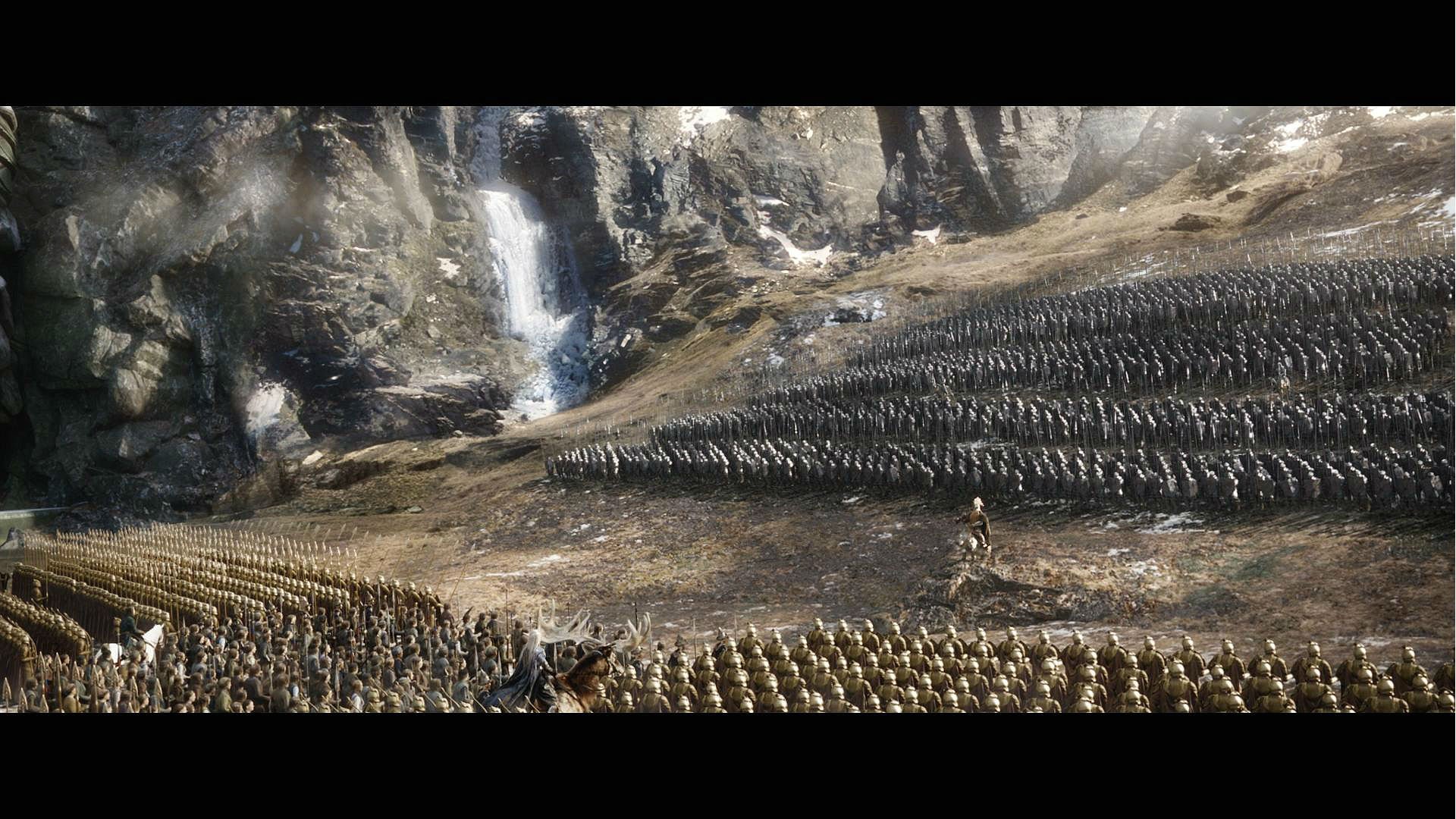

Exploring The Epic Confrontation The Hobbit The Battle Of The Five Armies

May 13, 2025

Exploring The Epic Confrontation The Hobbit The Battle Of The Five Armies

May 13, 2025 -

Southern California Heatwave Record Temperatures In La And Orange Counties

May 13, 2025

Southern California Heatwave Record Temperatures In La And Orange Counties

May 13, 2025 -

Metas Antitrust Battle Examining The Ftcs Case Against Whats App And Instagram

May 13, 2025

Metas Antitrust Battle Examining The Ftcs Case Against Whats App And Instagram

May 13, 2025 -

Lara Croft Tomb Raider The Cradle Of Life Gameplay And Challenges

May 13, 2025

Lara Croft Tomb Raider The Cradle Of Life Gameplay And Challenges

May 13, 2025