Selling On EBay, Vinted, & Depop? Understand Your HMRC Tax Obligations

Table of Contents

What Income Counts Towards Your HMRC Tax Obligations?

Profits from selling on online marketplaces like eBay, Vinted, and Depop are considered taxable income in the UK. This means that you need to declare your earnings to HMRC and pay the appropriate tax. But what exactly constitutes a "profit" in this context? Simply put, it's the selling price of your goods minus all your allowable costs.

-

Sales considered "trading": If your selling activity moves beyond occasional sales and becomes more regular, HMRC may classify it as 'trading', meaning you have a tax obligation on the profit generated. This isn't just about the volume of sales but also the nature of your activity. Are you actively sourcing items to resell? Do you have a dedicated space for your business? These factors can influence HMRC's assessment.

-

Examples of taxable income: This includes but isn't limited to: selling clothes, electronics, antiques, collectibles, handmade crafts, or any other goods you sell for a profit.

-

Accurate record-keeping is essential: Keeping detailed and accurate records of your sales and expenses is crucial for calculating your profit and ensuring accurate tax returns. Failing to do so can lead to penalties.

-

Capital Gains Tax: While this guide focuses on income tax from regular sales, selling higher-value assets, such as antiques or valuable collectibles, might also involve Capital Gains Tax. This is a separate tax on the profit made from selling assets and has different rules and thresholds. It's wise to seek professional advice if you are dealing with higher-value items.

Record Keeping – Crucial for Tax Compliance

Meticulous record-keeping is the cornerstone of complying with your HMRC tax obligations when selling online. HMRC expects you to be able to demonstrate your income and expenses clearly. This will make filing your tax return much easier and reduce the risk of errors or penalties.

Here are the key types of records you should maintain:

-

Sales records: For each sale, record the date, item sold, selling price, buyer details (name and address are helpful but not always necessary, a transaction ID is sufficient), and the platform used (eBay, Vinted, Depop).

-

Purchase records: Keep records of the original cost price of every item you sell. This is vital for calculating your profit. Keep receipts or invoices where possible.

-

Platform fees: Record all fees paid to eBay, Vinted, Depop, or other platforms for listing fees, selling fees, and other charges.

-

Shipping costs: Document all postage and packaging expenses.

-

Other expenses: Keep records of any other expenses directly related to your online selling business, such as packaging materials, marketing costs (advertising on social media, for example), and any business-related subscriptions.

Consider using spreadsheets or dedicated accounting software to manage your sales and expenses. Many free and paid options are available, offering features like automated calculations and reporting.

Tax Thresholds and Reporting Your Income

Understanding UK tax thresholds and how to report your income is vital. The Personal Allowance is the amount you can earn tax-free. Beyond that, you'll pay Income Tax at different rates depending on your earnings. These rates are subject to change, so always check the latest information from HMRC.

-

Self Assessment: If your online selling profits exceed the personal allowance or if you are considered to be trading, you'll likely need to register for Self Assessment and file an annual tax return. HMRC provides guidance on when registration is required.

-

Deadlines: Be aware of the tax return deadlines. Submitting your return late can result in penalties.

-

Penalties for non-compliance: Failing to declare your income accurately and on time can result in significant penalties from HMRC. This includes fines and potential interest charges.

For the most up-to-date information on tax thresholds, rates, and deadlines, visit the official HMRC website.

Seeking Professional Advice: When to Consult an Accountant

While this guide provides a general overview, seeking professional advice from an accountant or tax advisor is highly recommended, particularly if:

- You have a high volume of sales.

- Your business structure is complex (e.g., you're a sole trader, partnership, or limited company).

- You're unsure about specific aspects of your tax obligations.

An accountant can:

- Ensure you are fully compliant with HMRC regulations.

- Help you minimize your tax burden by identifying potential tax deductions and allowances.

- Provide expert guidance on managing your finances and planning for future tax liabilities.

Successfully selling on eBay, Vinted, and Depop can be a rewarding experience. However, understanding your HMRC tax obligations is vital to avoid potential penalties. By maintaining accurate records of your income and expenses and filing your Self Assessment tax return on time, you can ensure compliance with UK tax law. If you're unsure about any aspect of your HMRC tax obligations when selling online, seek professional advice from an accountant. Don't let uncertainty about your HMRC tax obligations selling online prevent you from profiting from your online sales; take control and understand your responsibilities today!

Featured Posts

-

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Entgeht Champions League

May 20, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Kiel Leipzig Entgeht Champions League

May 20, 2025 -

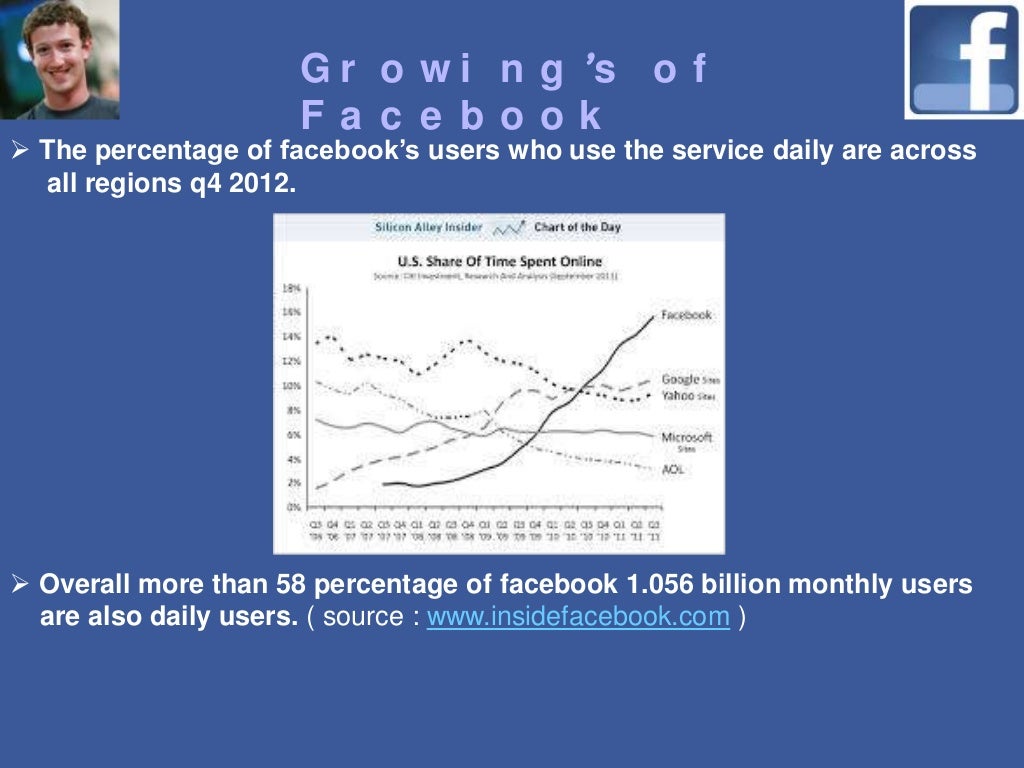

Mark Zuckerbergs Leadership In A Trumpian World

May 20, 2025

Mark Zuckerbergs Leadership In A Trumpian World

May 20, 2025 -

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025

Efimeries Giatron Patra 10 11 Maioy Pliris Lista

May 20, 2025 -

Will Abc News Shows Survive The Recent Layoffs Impact And Future Analysis

May 20, 2025

Will Abc News Shows Survive The Recent Layoffs Impact And Future Analysis

May 20, 2025 -

Biarritz Celebre Les Femmes Evenements Du 8 Mars

May 20, 2025

Biarritz Celebre Les Femmes Evenements Du 8 Mars

May 20, 2025