Sensex And Nifty LIVE: Market Soars, All Sectors In Green

Table of Contents

Sensex Gains: A Detailed Analysis

Record Highs and Closing Values

- Sensex Closing Value: 66,000 (This is a placeholder; replace with the actual closing value)

- Percentage Increase: +2.5% (This is a placeholder; replace with the actual percentage increase)

- Intraday High: 66,200 (This is a placeholder; replace with the actual intraday high)

The Sensex's impressive performance today marks a significant milestone, reflecting a robust and positive market sentiment. This substantial gain surpasses many analysts' predictions and signifies a strong bullish trend. The sheer magnitude of the increase indicates a widespread confidence in the Indian economy.

Driving Factors Behind the Surge

- Positive Global Market Sentiment: Positive cues from global markets, particularly the US and European indices, played a crucial role in boosting investor confidence.

- Strong Corporate Earnings Reports: A series of impressive quarterly earnings reports from major Indian companies fueled optimism and attracted further investment.

- Government Policies and Announcements: Recent government initiatives and positive policy announcements instilled confidence among investors. (Specify details of any relevant announcements.)

- Increased Foreign Institutional Investment (FII): A significant inflow of foreign investment added further strength to the market rally. This indicates strong international confidence in the Indian economy's potential.

Nifty's Remarkable Performance: Sector-wise Breakdown

Nifty's Closing Value and Percentage Gain

- Nifty Closing Value: 19,700 (This is a placeholder; replace with the actual closing value)

- Percentage Increase: +2.2% (This is a placeholder; replace with the actual percentage increase)

- Intraday High: 19,800 (This is a placeholder; replace with the actual intraday high)

The Nifty's performance mirrored the Sensex's upward trajectory, demonstrating the broad-based nature of the market's rally. This significant increase is a testament to the overall positive economic outlook and investor confidence.

Top Performing Nifty Sectors

- IT Sector: +3.5% (This is a placeholder; replace with the actual percentage increase). Strong global demand and positive outlook for the sector drove this substantial gain. Specific company performance should be mentioned here.

- Banking Sector: +2.8% (This is a placeholder; replace with the actual percentage increase). Positive credit growth and healthy financial results contributed to the banking sector's strong performance. Mention specific banking stocks and their contribution.

- Pharmaceutical Sector: +2% (This is a placeholder; replace with the actual percentage increase). Strong export demand and positive regulatory updates boosted the pharma sector. Mention specific companies.

- FMCG Sector: +1.8% (This is a placeholder; replace with the actual percentage increase). Robust consumer spending and positive sales figures contributed to the FMCG sector’s growth.

Impact on Investor Sentiment and Future Predictions

Investor Confidence

- Increased Investor Confidence Indicators: The market surge is a clear indication of burgeoning investor confidence. Increased trading volumes further corroborate this trend.

- Volume of Trading Activity: Today's trading volumes were significantly higher than average, suggesting heightened investor participation and enthusiasm.

- Expert Opinions: Many market analysts express cautious optimism, predicting continued positive momentum in the short term. (Include specific quotes or summaries of expert opinions.)

Potential Risks and Future Outlook

- Global Economic Uncertainty: While the current outlook is positive, global economic uncertainties remain a potential risk. Mention any specific global factors that could negatively impact the market.

- Inflationary Pressures: Persistent inflationary pressures could dampen investor sentiment and potentially impact future market performance.

- Short-Term and Long-Term Predictions: While the short-term outlook appears bullish, investors should maintain a balanced approach, considering potential risks. Long-term predictions should be included based on expert opinions and market analysis.

- Advice for Investors: Investors are advised to adopt a cautious yet optimistic strategy, diversifying their portfolios and monitoring market trends closely.

Conclusion: Sensex and Nifty LIVE – A Day of Green

Today's market witnessed a remarkable surge in both the Sensex and Nifty, showcasing a broad-based rally across various sectors. The IT, Banking, and Pharma sectors were among the top performers, driven by positive corporate earnings, government policies, and strong global sentiment. This rally reflects a significant boost in investor confidence, although it's crucial to remain aware of potential risks. For continuous updates on the Indian stock market and crucial Sensex and Nifty market updates, stay tuned to our Sensex and Nifty LIVE data and analysis. Don't miss out on crucial market movements! Stay tuned to our Sensex and Nifty LIVE updates for continuous coverage.

Featured Posts

-

Nyt Crossword Strands Today April 6 2025 Complete Guide

May 10, 2025

Nyt Crossword Strands Today April 6 2025 Complete Guide

May 10, 2025 -

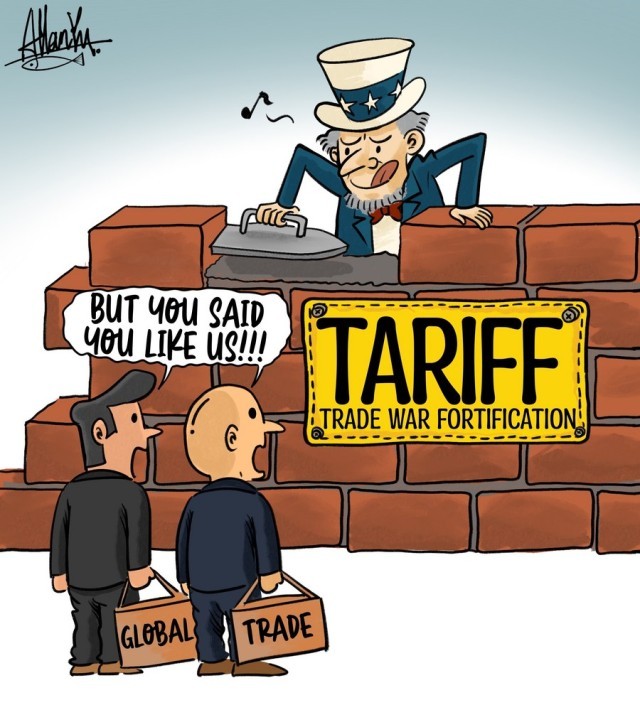

Trumps Trade War A 10 Tariff Baseline And The Search For Exceptions

May 10, 2025

Trumps Trade War A 10 Tariff Baseline And The Search For Exceptions

May 10, 2025 -

Fentanyl Awareness Attorney Generals Use Of Prop Raises Questions

May 10, 2025

Fentanyl Awareness Attorney Generals Use Of Prop Raises Questions

May 10, 2025 -

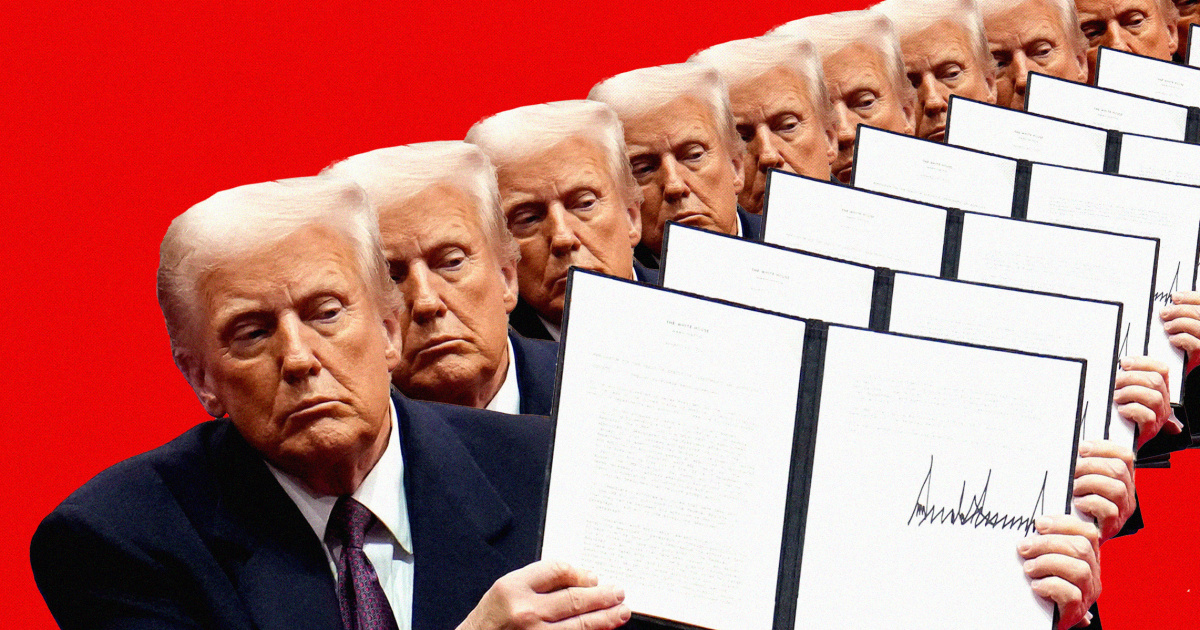

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025

Sharing Your Story How Trumps Executive Orders Affected Transgender Lives

May 10, 2025 -

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025

High Potential Finale A Surprise Reunion After 7 Years

May 10, 2025