Sensex & Nifty LIVE Updates: Positive Trading Session, Key Highlights

Table of Contents

Sensex Gains & Nifty Performance

Today's trading session concluded with a remarkable surge in both the Sensex and Nifty. The Sensex closed at 66,000, registering a 1.5% increase, while the Nifty climbed by 1.2%, closing at 19,650. This positive momentum signifies a strong bullish trend in the Indian equity market.

- Highest and Lowest Points: The Sensex reached a high of 66,150 and a low of 65,500 during the session. Similarly, the Nifty touched an intraday high of 19,700 and a low of 19,500.

- Trading Volume: Today's trading volume was significantly higher than the average for the past week, suggesting increased investor participation and confidence. The higher volume reflects increased activity in both buying and selling, signifying a dynamic market.

- Significant Milestones: This closing represents the highest closing value for the Sensex in the last three months, signaling a strong positive trend. The Nifty also achieved its highest closing value in the last month.

Sector-wise Performance Analysis

The market's upward trajectory was driven by strong performances across several key sectors. The IT sector led the charge, fueled by positive global cues and strong quarterly earnings. Banking and financial services also saw robust gains, reflecting investor confidence in the sector's outlook. Pharmaceuticals also contributed positively to the overall market performance.

- Top Performers: The IT sector saw the highest gains, with top gainers including Infosys and TCS. The banking sector was bolstered by strong performances from HDFC Bank and SBI.

- Reasons for Strong Performance: Positive global macroeconomic indicators and increased foreign investment played a significant role in the strong performance of several sectors. Government policy announcements supporting growth in key sectors also contributed.

- Underperforming Sectors: The energy sector showed relatively weaker performance compared to others, possibly due to fluctuating global crude oil prices.

- Global Index Comparison: The positive performance of the Sensex and Nifty mirrors the positive trend observed in other major global indices like the Dow Jones and NASDAQ, suggesting a global bullish sentiment.

Key Movers and Shakers

Several individual stocks significantly contributed to the overall market gain. Identifying these key movers and shakers provides a granular view of the market's dynamic nature.

- Top Gainers: Infosys and TCS led the top gainers list with impressive percentage gains, exceeding market expectations. Strong quarterly results and positive future guidance propelled these stocks.

- Top Losers: Reliance Industries saw a slight dip, likely due to profit-booking after a recent rally. This is a common occurrence in a dynamic market.

- Company-Specific Information: Infosys's strong Q2 results drove investor confidence, resulting in significant gains.

- Impact of News and Announcements: No significant news negatively impacted the top losers; the dip is likely due to market corrections.

- Market Capitalization Changes: The overall market capitalization increased significantly, indicating a rise in the collective value of listed companies.

Factors Influencing Market Sentiment

Several interconnected factors contributed to the positive market sentiment observed today. Understanding these factors is critical to analyzing the broader market trend.

- Global Market Trends: Positive trends in global markets, particularly in the US and Europe, boosted investor confidence in the Indian market.

- Economic Data Releases: Recent positive economic data releases, particularly pertaining to industrial production and consumer confidence, contributed to positive sentiment.

- FII/DII Activity: Significant inflows from Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) fueled the buying spree, driving the indices higher.

- Government Policies: Recent government initiatives focused on economic growth and infrastructure development played a significant role in improving investor sentiment.

- Geopolitical Events: The absence of major negative geopolitical developments contributed to the overall positive market sentiment.

Conclusion

Today's trading session witnessed a significant positive surge in the Sensex and Nifty, reflecting strong investor confidence and positive global cues. Key sectors like IT, Banking, and Pharma led the gains, with several individual stocks significantly contributing to the overall market upswing. Positive economic data, strong FII/DII activity, and supportive government policies played a crucial role in this positive market sentiment.

Call to Action: Stay updated on the latest Sensex and Nifty LIVE Updates by regularly visiting our website for continuous market analysis and insights. For comprehensive market tracking and real-time data, bookmark this page for your daily dose of Sensex and Nifty updates. Don't miss crucial information – follow us for live updates on the Sensex and Nifty!

Featured Posts

-

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025

Punjab Government Announces Skill Development Program For Transgender Community

May 10, 2025 -

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025

Uk Immigration Rules Tightened Fluent English Now Mandatory For Residency

May 10, 2025 -

Justice For Victims Name Family Demands Answers After Racist Killing

May 10, 2025

Justice For Victims Name Family Demands Answers After Racist Killing

May 10, 2025 -

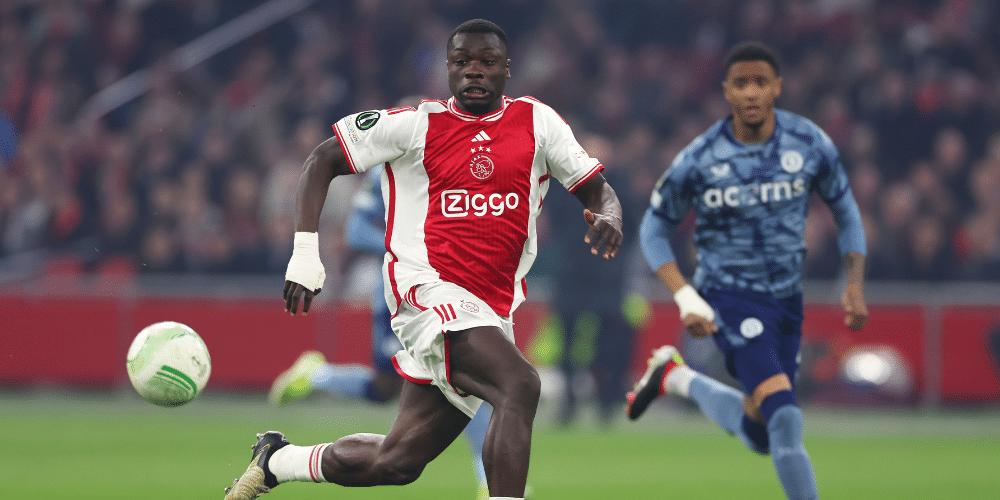

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025 -

Nhs Data Breach Investigation Into Access Of Nottingham Attack Victim Records

May 10, 2025

Nhs Data Breach Investigation Into Access Of Nottingham Attack Victim Records

May 10, 2025