Sensex Gains Momentum: High-Performing Stocks On BSE

Table of Contents

Understanding the Current Sensex Performance and Market Trends

The Sensex has demonstrated impressive positive momentum recently, experiencing a significant percentage increase (e.g., a hypothetical 15% increase in the last quarter – replace with actual data). This upward trend is fueled by a confluence of factors contributing to a positive outlook for the Indian economy.

Contributing factors include strong economic indicators, supportive government policies, and positive global market influences. Specific sectors, such as IT, Pharma, and FMCG, are experiencing particularly robust growth, significantly boosting the Sensex's performance.

- Positive Economic Indicators: Examples include a decline in inflation, rising GDP growth, and increased foreign investment.

- Supportive Government Policies: Initiatives like infrastructure development programs and tax reforms are stimulating economic activity and investor confidence.

- Global Market Influences: Positive global economic trends and easing geopolitical tensions have a positive spillover effect on the Indian stock market.

- Sectoral Growth: The IT sector is booming due to increased global demand for technology services, while the Pharma sector benefits from strong domestic demand and export opportunities. The FMCG sector is consistently performing well due to rising consumer spending.

Top-Performing Stocks on BSE: A Detailed Analysis

Identifying high-performing stocks requires careful analysis of company fundamentals and growth prospects. Below are a few examples of BSE-listed stocks demonstrating strong performance (Note: Replace these examples with actual high-performing stocks and their relevant data. Conduct thorough research before including any specific stock recommendations).

Example 1: Infosys (INFY)

- Sector: Information Technology

- Business Model: Provides IT consulting and services globally.

- Recent Performance: Consistently strong revenue and profit growth, driven by increased demand for digital transformation services.

- Key Financial Metrics: (Insert realistic P/E ratio, EPS growth data)

- Future Growth Prospects: Strong growth potential in the digital space and emerging technologies.

- Key Reasons for Strong Performance: Strong client base, focus on innovation, and efficient operations.

Example 2: Reliance Industries (RELIANCE)

- Sector: Energy, Petrochemicals, Retail

- Business Model: Diversified conglomerate with a strong presence in various sectors.

- Recent Performance: Significant growth in its retail and renewable energy segments.

- Key Financial Metrics: (Insert realistic P/E ratio, EPS growth data)

- Future Growth Prospects: Continued expansion in its retail and new energy businesses.

- Key Reasons for Strong Performance: Diversification, strong brand recognition, and strategic investments.

(Repeat this format for other top-performing stocks.)

Factors to Consider Before Investing in High-Performing BSE Stocks

Investing in the stock market inherently involves risk. Due diligence is paramount before committing capital. Consider these crucial factors:

- Company Fundamentals: Analyze revenue growth, profit margins, debt levels, and cash flow. A strong balance sheet and consistent profitability are positive indicators.

- Industry Analysis: Assess the overall market size, competitive landscape, and future growth potential of the industry the company operates in.

- Valuation: Examine key metrics like the Price-to-Earnings (P/E) ratio and market capitalization to determine if the stock is fairly valued.

- Risk Tolerance and Investment Goals: Align your investment strategy with your individual risk appetite and financial objectives.

- Expert Opinions and Analyst Ratings: Consult with financial advisors and review analyst reports for insights and diverse perspectives.

Practical Tips:

- Diversify your investments across different sectors and asset classes.

- Set realistic investment goals and stick to your strategy.

- Regularly monitor your portfolio and make adjustments as needed.

Diversification and Risk Management Strategies

Diversification is a cornerstone of risk management in investing. Don't put all your eggs in one basket! Spread your investments across various sectors (e.g., IT, Pharma, FMCG), market capitalizations (large-cap, mid-cap, small-cap), and asset classes (equities, bonds, etc.).

Risk management techniques, such as stop-loss orders (to limit potential losses) and portfolio rebalancing (adjusting asset allocation to maintain desired proportions), can further protect your investments.

- Diversification Examples: Invest in a mix of large-cap and mid-cap stocks across different sectors. Consider investing a portion of your portfolio in bonds or other asset classes.

Conclusion: Capitalize on Sensex Gains with High-Performing BSE Stocks

The Sensex's recent positive momentum presents an attractive opportunity for investors. However, success requires careful selection of high-performing stocks and a thorough understanding of the market. This article has highlighted several key factors to consider – from analyzing company fundamentals and industry trends to employing effective diversification and risk management strategies. Remember that thorough research and responsible investment are crucial. Invest wisely in high-performing BSE stocks, maximize your returns with top Sensex performers, and learn more about top BSE stocks today to make informed decisions based on your risk tolerance and financial goals.

Featured Posts

-

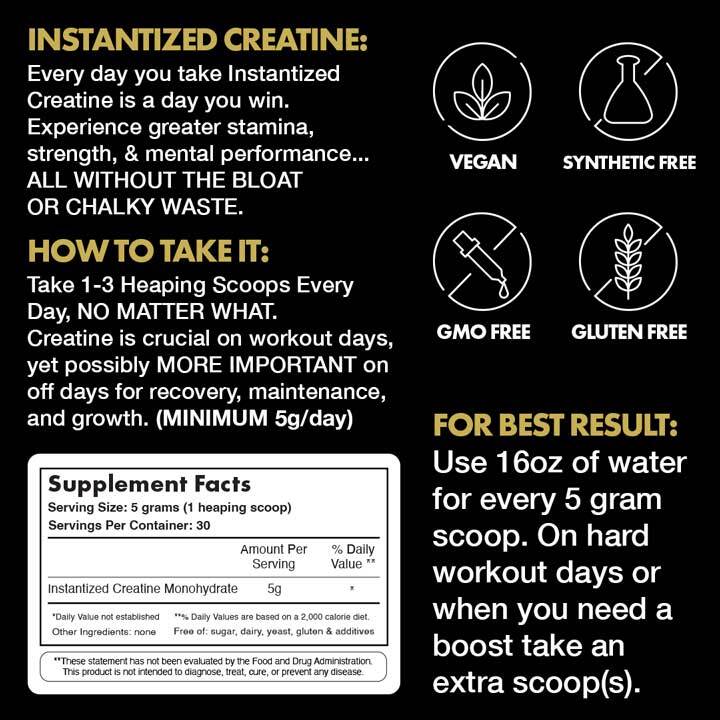

What Is Creatine A Comprehensive Guide To Creatine Use

May 15, 2025

What Is Creatine A Comprehensive Guide To Creatine Use

May 15, 2025 -

Ndukwes Record Breaking Performance Secures Pbc Tournament Mvp Award

May 15, 2025

Ndukwes Record Breaking Performance Secures Pbc Tournament Mvp Award

May 15, 2025 -

San Jose Earthquakes Opposition Scouting Report Key Strengths And Weaknesses

May 15, 2025

San Jose Earthquakes Opposition Scouting Report Key Strengths And Weaknesses

May 15, 2025 -

Burak Mavis In Akkor Davasi Avrupa Insan Haklari Mahkemesi Ve Karma Evlilik Senaryolari

May 15, 2025

Burak Mavis In Akkor Davasi Avrupa Insan Haklari Mahkemesi Ve Karma Evlilik Senaryolari

May 15, 2025 -

Vm Hockey 2024 Analys Av Tre Kronors Lagbygge Kanadas Franvaro Och Tjeckiens Pastrnak Hoppet

May 15, 2025

Vm Hockey 2024 Analys Av Tre Kronors Lagbygge Kanadas Franvaro Och Tjeckiens Pastrnak Hoppet

May 15, 2025