Shopify Stock Jumps Over 14% After Nasdaq 100 Listing

Table of Contents

Analyzing the 14%+ Surge in Shopify Stock Price

The impressive 14%+ surge in Shopify stock price wasn't a spontaneous event; it reflects a confluence of positive factors impacting investor sentiment. Let's break down the key drivers:

-

Strong Q[Insert Quarter] Earnings Report: [Insert details about the strong Q[Insert Quarter] earnings report, including specific figures like revenue growth, earnings per share, and any positive surprises that exceeded analyst expectations. For example: "Shopify's Q3 earnings report significantly exceeded analysts' projections, with revenue growth of X% and earnings per share of Y, showcasing the company's robust financial health."] This fueled immediate optimism among investors.

-

Positive Market Outlook for E-commerce: The ongoing shift towards online shopping continues to propel the growth of e-commerce platforms. Shopify, as a leading player in this sector, directly benefits from this positive trend. Increased consumer adoption of online retail and the expansion of e-commerce into new markets further solidify Shopify's position.

-

Increased Investor Confidence in Shopify's Future Growth: The company's consistent track record of innovation, strategic acquisitions, and expansion into new markets has instilled confidence among investors. This belief in Shopify's long-term growth potential is a major factor driving the stock price higher.

-

Speculation Regarding Future Acquisitions or Partnerships: The market is buzzing with speculation about potential future acquisitions or partnerships that could further accelerate Shopify's growth and expand its market reach. This anticipation contributes to the positive sentiment surrounding the stock.

Data Points: [Insert data points here, for example: "Shopify's stock opened at $XXX and closed at $YYY on [date], with a trading volume of ZZZ shares."]

The Impact of the Nasdaq 100 Listing on Shopify's Valuation

Inclusion in the Nasdaq 100 index is a significant milestone for any company. For Shopify, it translates to several key advantages:

-

Enhanced Credibility and Prestige: Being listed alongside other leading technology companies instantly elevates Shopify's profile and enhances its credibility in the eyes of investors.

-

Access to a Broader Investor Base: The Nasdaq 100 index attracts a wider range of institutional and individual investors, increasing the liquidity and trading volume of Shopify's stock.

-

Potential for Increased Trading Volume and Liquidity: Inclusion in the index leads to increased trading activity, making it easier for investors to buy and sell Shopify shares.

-

Inclusion in Major Stock Indices Often Leads to Higher Valuations: Historically, companies added to major indices like the Nasdaq 100 experience an increase in their market capitalization due to increased investor demand.

Future Outlook and Predictions for Shopify Stock

While the recent stock jump is undeniably positive, it's crucial to consider both the potential for continued growth and the inherent risks involved.

-

Potential for Continued Expansion into New Markets: Shopify's ongoing expansion into international markets presents significant growth opportunities.

-

Technological Advancements and Innovation within the Platform: Shopify's commitment to innovation and technological advancements strengthens its competitive edge and ensures its continued relevance in the evolving e-commerce landscape.

-

Competitive Landscape and Potential Threats from Rivals: The e-commerce market is fiercely competitive, with established players and emerging startups constantly vying for market share. This poses a potential challenge to Shopify's continued dominance.

-

Macroeconomic Factors Influencing the E-commerce Sector: Broader macroeconomic factors, such as economic downturns or shifts in consumer spending, can impact the overall e-commerce sector and, consequently, Shopify's performance.

Shopify's Competitive Advantages in the E-commerce Space

Shopify's success is built on several key competitive advantages:

-

User-Friendly Interface: Its intuitive platform is easy for merchants of all technical skill levels to use, fostering wider adoption.

-

Extensive App Ecosystem: The vast array of apps available on the Shopify platform enhances functionality and customization, catering to diverse business needs.

-

Market Share Dominance: Shopify holds a significant market share in the e-commerce platform sector, solidifying its position as a leader.

Conclusion: Shopify Stock's Bright Future – A Strong Investment Opportunity?

The recent 14%+ surge in Shopify stock, fueled by its inclusion in the Nasdaq 100, reflects strong investor confidence in the company's future. The positive Q[Insert Quarter] earnings, positive e-commerce market outlook, and the prestige of the Nasdaq 100 listing all contribute to a bullish outlook. However, potential risks, including competition and macroeconomic factors, should be carefully considered. Interested investors should conduct thorough research, including a comprehensive Shopify stock analysis and forecast, before making any investment decisions. Consider exploring resources offering in-depth Shopify stock investment advice. Remember, investing in the stock market carries inherent risks. Should you decide to proceed, consider a diversified investment portfolio to mitigate potential losses. Is Shopify stock the right investment for you? Conduct thorough research and consider your risk tolerance before making any decisions related to Shopify stock investment.

Featured Posts

-

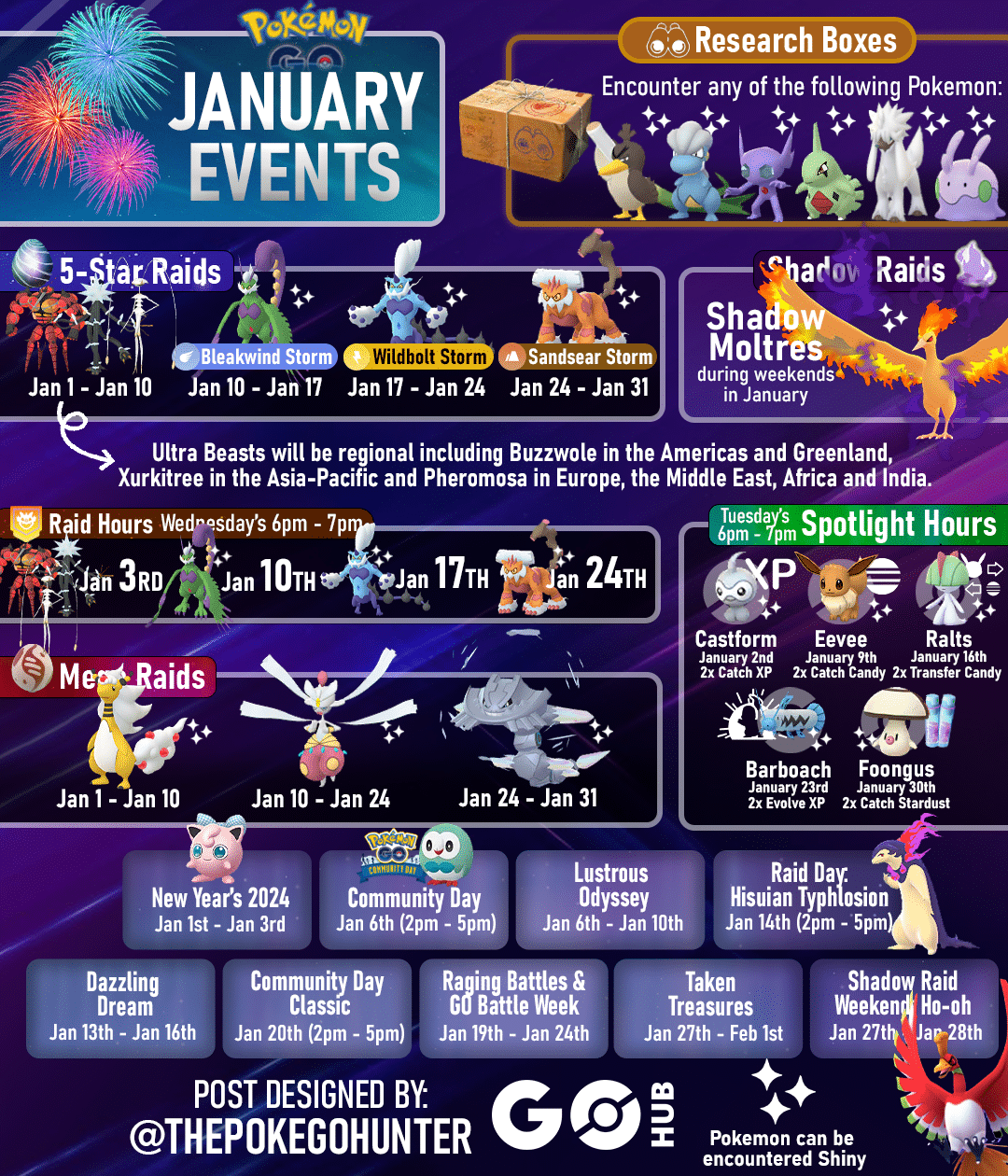

May 2025 Pokemon Go Events A Comprehensive Guide

May 14, 2025

May 2025 Pokemon Go Events A Comprehensive Guide

May 14, 2025 -

9 Explosive Hollyoaks Spoilers Next Weeks Unmissable Events

May 14, 2025

9 Explosive Hollyoaks Spoilers Next Weeks Unmissable Events

May 14, 2025 -

Kasatkina Officially An Australian Player Wta Rankings Reaction

May 14, 2025

Kasatkina Officially An Australian Player Wta Rankings Reaction

May 14, 2025 -

Andi Knoll Kehrt Zurueck Orf Praesentiert Eurovision Song Contest Programm

May 14, 2025

Andi Knoll Kehrt Zurueck Orf Praesentiert Eurovision Song Contest Programm

May 14, 2025 -

Escape To Chocolate Paradise Lindt Opens In Central London

May 14, 2025

Escape To Chocolate Paradise Lindt Opens In Central London

May 14, 2025