Should I Buy Palantir Stock Before Their May 5th Earnings Report?

Table of Contents

Palantir Technologies (PLTR) is set to release its earnings report on May 5th, leaving many investors wondering: should I buy Palantir stock before the announcement? This pivotal moment presents both significant opportunities and considerable risks. This article analyzes key factors to help you make an informed investment decision. We'll examine recent Palantir performance, future projections, and potential market reactions to guide your decision on whether to buy Palantir stock before the earnings report.

Palantir's Recent Performance and Growth Trajectory

Revenue Growth and Profitability

Analyzing Palantir's recent financial performance is crucial before deciding whether to buy Palantir stock. We need to look beyond headline numbers and delve into the details of revenue growth, profitability, and operational efficiency. Examining year-over-year growth provides valuable context.

- Revenue Growth: Palantir has demonstrated consistent revenue growth in recent quarters. However, the rate of growth needs careful scrutiny. A slowing growth rate could negatively impact the stock price. Investors should compare the reported figures to previous years and industry benchmarks to fully assess performance.

- Profitability: While Palantir's revenue is growing, its path to profitability is a key factor to consider before buying Palantir stock. Investors should assess operating margins and net income trends. Consistent improvement in profitability signals a healthier financial position.

- Year-over-Year Growth (YoY): Tracking YoY growth in key metrics like revenue and earnings provides a clearer picture of Palantir's progress and sustainability. Significant deceleration in YoY growth could be a cause for concern for potential investors considering buying Palantir stock.

- Keywords: Palantir revenue, Palantir profitability, PLTR earnings, financial performance, year-over-year growth, operating margin, net income.

Key Contract Wins and Strategic Partnerships

Significant new contracts and strategic partnerships are critical drivers of Palantir's future revenue streams. These achievements signal the company's ability to secure business and expand its market presence.

- Government Contracts: Palantir's reliance on government contracts is a factor to consider. While these contracts provide significant revenue, their renewal and future expansion are subject to various geopolitical and budgetary factors.

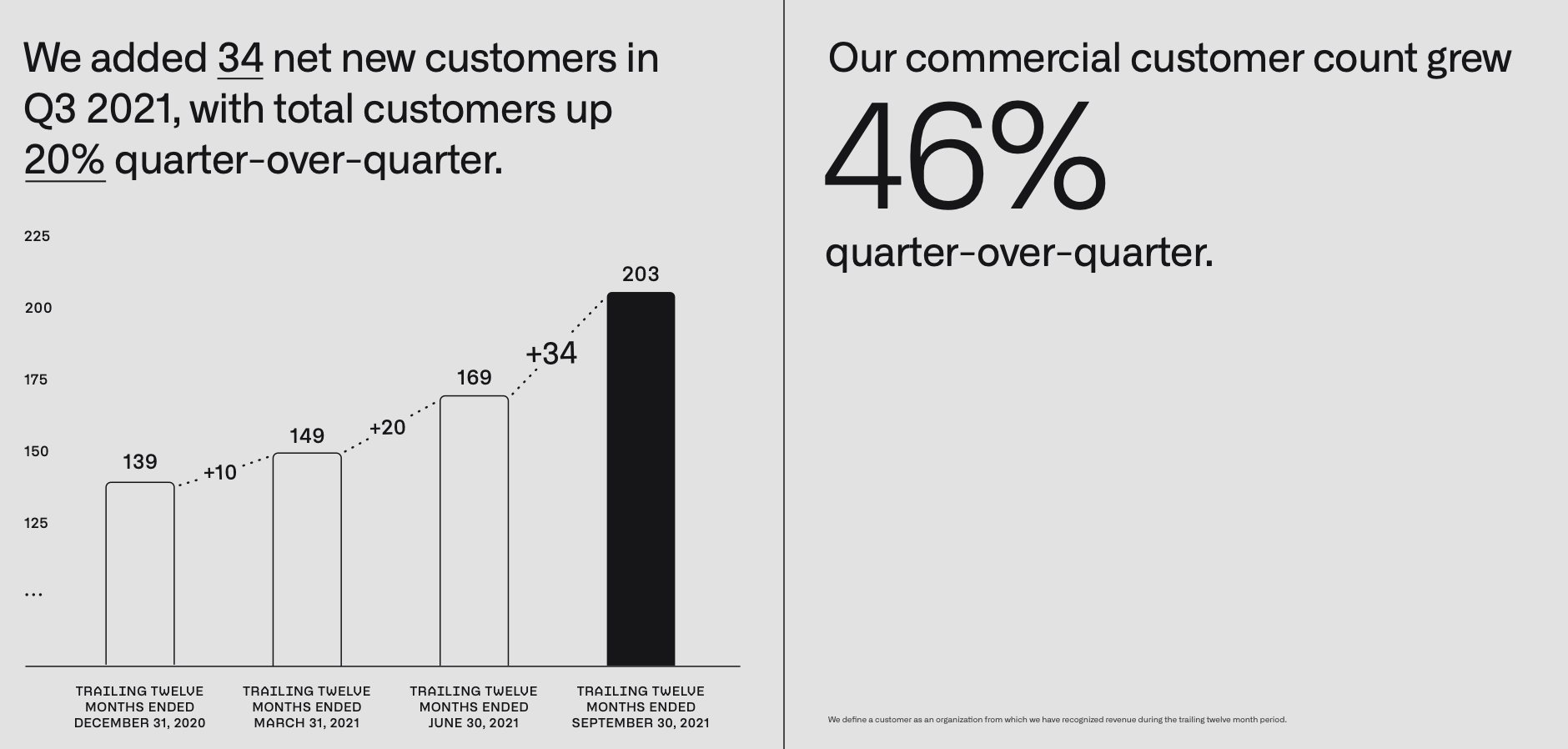

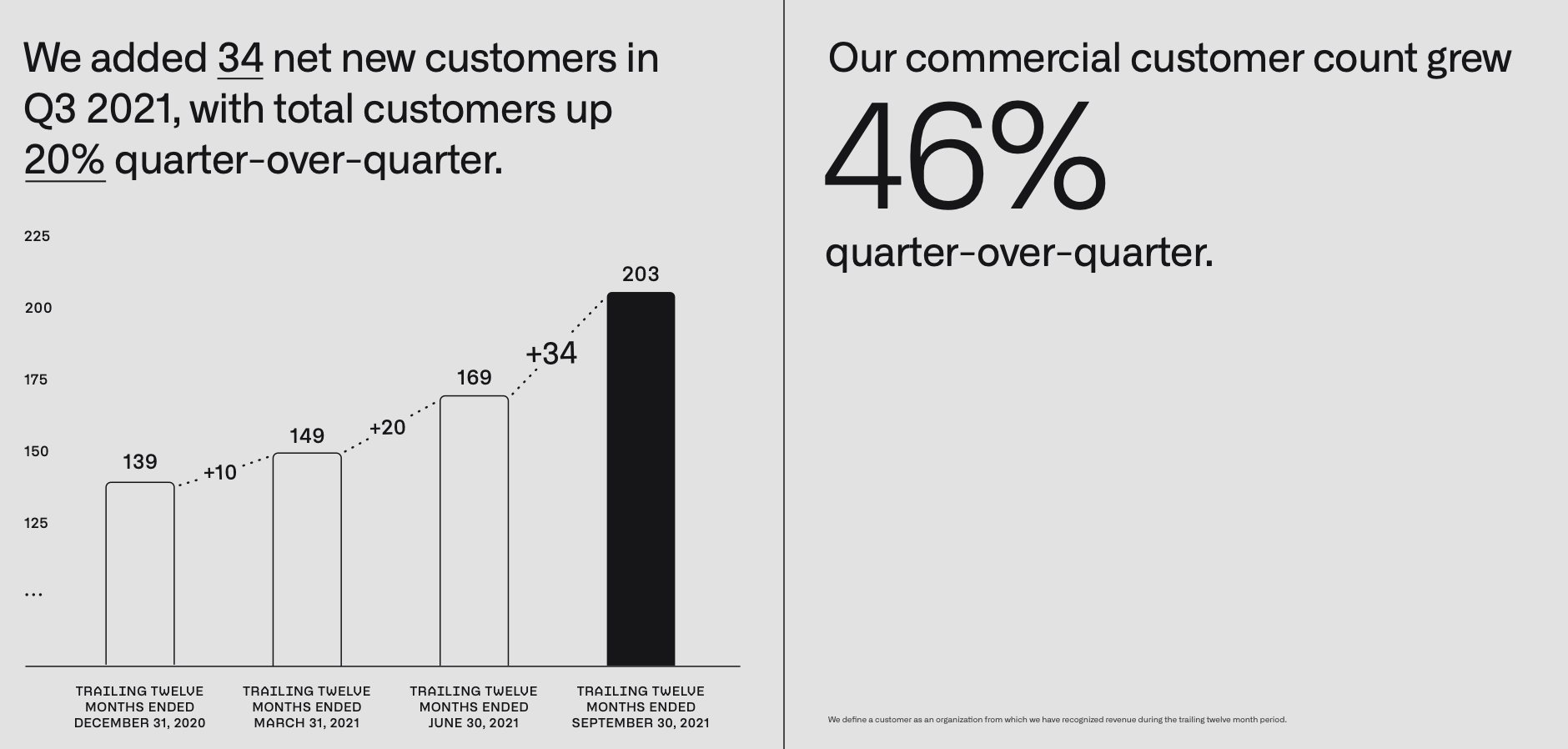

- Commercial Contracts: Growth in commercial contracts diversifies Palantir's revenue streams and reduces its dependence on government funding. The expansion into commercial markets is a positive sign for future growth.

- Strategic Partnerships: Collaborations with other technology companies can significantly enhance Palantir's capabilities and market reach. These alliances should be assessed to determine their potential impact on future growth.

- Keywords: Palantir contracts, strategic partnerships, government contracts, commercial contracts, client acquisition, partnerships.

Analyzing Palantir's Future Outlook and Projections

Market Expectations and Analyst Ratings

Understanding market expectations and analyst sentiment towards Palantir stock is vital before buying. Analyst ratings and price targets provide valuable insights but should not be considered definitive investment advice.

- Analyst Ratings: The consensus among analysts regarding Palantir stock (buy, hold, or sell recommendations) reflects market sentiment and future expectations. Investors should review a range of analyst opinions, not just the average.

- Price Targets: Analyst price targets provide a range of potential future stock prices, giving investors a sense of the upside and downside potential. However, price targets are predictions, not guarantees.

- Market Sentiment: Overall market sentiment towards Palantir stock and the tech sector will impact its price regardless of the earnings report.

- Keywords: Palantir stock price prediction, analyst ratings, Palantir forecast, market sentiment, price target, buy rating, hold rating, sell rating.

Growth Potential in AI and Emerging Technologies

Palantir's investments in artificial intelligence (AI) and other emerging technologies are key drivers of its long-term growth potential. The company's ability to leverage these technologies to enhance its offerings is a significant factor to consider before purchasing Palantir stock.

- AI Applications: Specific examples of Palantir's AI applications in various sectors showcase its technological prowess and potential for market disruption.

- R&D Investments: The company's commitment to research and development is an indicator of its long-term vision and potential to maintain a competitive edge.

- Market Disruption: Palantir's technology has the potential to disrupt various industries, creating new revenue streams and market opportunities.

- Keywords: Palantir AI, artificial intelligence, machine learning, data analytics, emerging technologies, technological innovation.

Risks and Considerations Before Investing in Palantir

Market Volatility and Geopolitical Factors

Investing in Palantir stock involves significant risks. Market volatility and geopolitical events can dramatically affect the stock price.

- Market Fluctuations: The overall stock market's performance significantly influences Palantir's stock price, regardless of its internal performance.

- Geopolitical Risks: Geopolitical instability or changes in government policies can impact Palantir's government contracts and overall market valuation.

- Economic Uncertainty: Economic downturns can reduce demand for Palantir's services and negatively impact its stock price.

- Keywords: market volatility, geopolitical risk, economic uncertainty, stock market fluctuations, investment risk.

Competition and Industry Dynamics

Palantir operates in a competitive market. Understanding the competitive landscape and Palantir's position within it is critical before buying Palantir stock.

- Key Competitors: Identifying Palantir's main competitors and their strengths and weaknesses allows for a comprehensive assessment of its market position.

- Market Share: Palantir's current market share and its growth potential compared to competitors are essential factors to consider.

- Competitive Advantages: Analyzing Palantir's unique selling points and its competitive advantages is key to evaluating its long-term prospects.

- Keywords: Palantir competitors, competitive advantage, market share, industry analysis, competitive landscape.

Conclusion

This article explored key factors to consider before buying Palantir stock before their May 5th earnings report. We analyzed recent performance, future projections, and potential risks. The decision to invest in Palantir should be based on a thorough understanding of these factors and your own risk tolerance. Remember that past performance is not indicative of future results.

Call to Action: Ultimately, the decision of whether or not to buy Palantir stock before May 5th is yours. Carefully weigh the information presented here, conduct your own due diligence, and make an informed investment decision based on your personal financial goals and risk appetite. Remember to always consult with a qualified financial advisor before making any significant investment decisions regarding Palantir stock or any other stock.

Featured Posts

-

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 10, 2025

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 10, 2025 -

Suncors Record Production Sales Slowdown Amidst Inventory Build Up

May 10, 2025

Suncors Record Production Sales Slowdown Amidst Inventory Build Up

May 10, 2025 -

Increased Rent After La Fires A Selling Sunset Star Speaks Out Against Price Gouging

May 10, 2025

Increased Rent After La Fires A Selling Sunset Star Speaks Out Against Price Gouging

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Kilmar Abrego Garcia Case Examining The Complexities Of Asylum And Us Politics

May 10, 2025

The Kilmar Abrego Garcia Case Examining The Complexities Of Asylum And Us Politics

May 10, 2025