Should Investors Buy Palantir Stock Before May 5th? A Wall Street Perspective

Table of Contents

Palantir's Recent Performance and Financial Health

Revenue Growth and Profitability

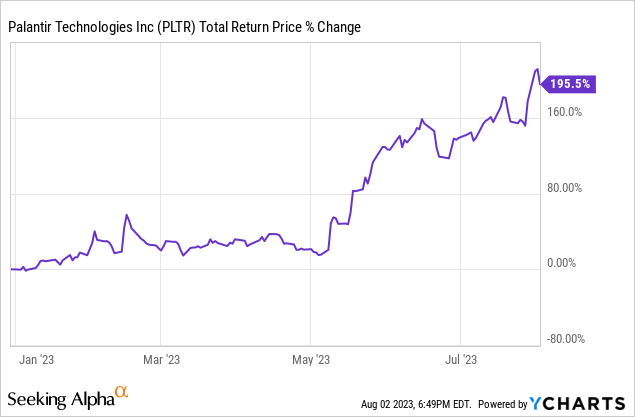

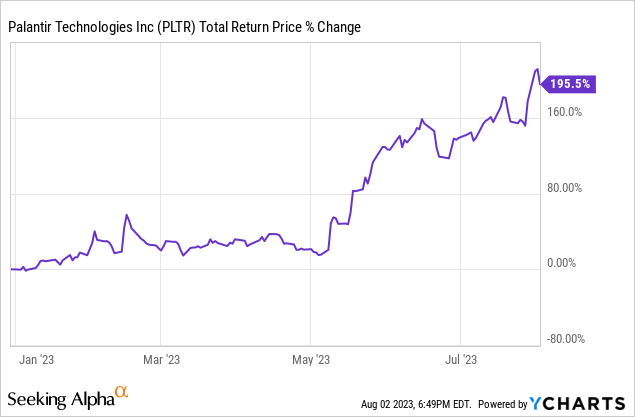

Palantir's recent financial performance provides a crucial lens through which to view the potential of a Palantir stock investment. Analyzing year-over-year (YoY) and quarter-over-quarter (QoQ) revenue growth is essential. While specific numbers will need to be updated closer to May 5th based on the released Q1 2024 earnings, examining past trends can offer insight. Look for consistent revenue growth, especially in key sectors like government contracts and commercial partnerships. Profitability trends, including gross margin and operating margin, are also vital indicators of Palantir's financial health. Improved margins suggest increased operational efficiency and a more sustainable business model. Charts and data visualizing these key metrics will be invaluable in assessing the current state of Palantir's financial health. Any significant contract wins in the recent past leading up to May 5th should be considered as strong positive factors.

- Strong revenue growth in Q4 2023 driven by government contracts. (Note: Update with actual Q1 2024 data)

- Improved profitability indicating increased operational efficiency. (Note: Update with actual Q1 2024 data)

- Positive outlook for future revenue streams based on existing pipeline. (This should be assessed from company statements and analyst reports)

Key Partnerships and Government Contracts

Palantir's reliance on government contracts and key partnerships significantly impacts its stock price. Government contracts often provide long-term stability and predictable revenue streams, which are attractive to investors seeking lower risk. However, over-reliance on government contracts can limit growth potential if the company fails to secure new contracts or expand into the commercial sector. Strategic partnerships, on the other hand, are critical for diversifying revenue streams and penetrating new markets. Analyzing the impact of existing and upcoming contract announcements or renewals is crucial for any Palantir stock forecast.

- Secure long-term government contracts provide stability and predictable revenue.

- Expanding partnerships with commercial clients diversifies income streams.

- New contract wins bolster investor confidence and drive Palantir share price appreciation.

Market Sentiment and Analyst Forecasts

Wall Street's Opinion on Palantir Stock

Before making any Palantir buy decisions, understanding Wall Street's opinion is paramount. Check recent analyst ratings and price targets for Palantir stock. A consensus "Buy" rating with a high average price target suggests positive sentiment and significant upside potential. Conversely, a shift towards "Hold" or "Sell" ratings might indicate growing concerns. It is also crucial to consider the overall market sentiment towards technology stocks and the broader economic context. The tech sector often experiences volatility, and Palantir is no exception.

- Majority of analysts hold a “Buy” or “Hold” rating on PLTR. (Note: This should be verified with up-to-date data)

- Average price target indicates substantial upside potential. (Note: This should be verified with up-to-date data)

- Market volatility impacting the technology sector could influence Palantir's price.

Impact of Macroeconomic Factors

Macroeconomic factors, such as rising interest rates and inflation, can significantly influence investor behavior and impact Palantir's stock price. Rising interest rates increase borrowing costs, potentially hindering growth, while inflation can affect consumer spending and overall economic activity. Geopolitical instability and broader economic uncertainty also create risks for the tech sector. Understanding these factors and their potential influence is crucial for assessing the outlook of a Palantir investment.

- Rising interest rates might increase borrowing costs, affecting growth.

- Geopolitical instability can create uncertainty in the tech sector.

- Strong economic growth could positively impact investor sentiment.

Risks and Potential Downsides of Investing in Palantir

Competition and Market Saturation

The data analytics sector is highly competitive, with established players and emerging startups vying for market share. This intense competition poses a risk to Palantir's future growth. Market saturation is another potential threat, as the market might reach a point where demand cannot support further expansion. New entrants with innovative technologies also pose a challenge, potentially disrupting Palantir’s dominance in certain niches.

- Intense competition from established players and new tech startups.

- Risk of declining market share due to technological advancements.

- Difficulty in penetrating new markets could limit revenue growth.

Regulatory Risks and Data Privacy Concerns

Palantir operates in a sector subject to stringent data privacy regulations. Data breaches and security vulnerabilities can severely damage the company's reputation and stock price. Furthermore, legal challenges or regulatory scrutiny could significantly impact operations and profitability. Understanding the regulatory landscape and potential legal risks is crucial for a comprehensive Palantir stock assessment.

- Stricter data privacy regulations could increase compliance costs.

- Data breaches and security vulnerabilities can damage reputation and stock price.

- Legal challenges and regulatory scrutiny could negatively impact operations.

Conclusion

The decision of whether to buy Palantir stock before May 5th requires careful consideration of its recent performance, market sentiment, and inherent risks. While strong revenue growth and key partnerships offer potential upside, investors must also be aware of the competitive landscape and regulatory challenges. Analyzing the upcoming earnings report and considering the macroeconomic climate will be crucial in forming a well-informed investment strategy. Ultimately, the answer to "Should you buy Palantir stock before May 5th?" depends on your individual risk tolerance and investment goals. Conduct thorough research and consider seeking advice from a financial professional before making any investment decisions regarding Palantir stock. Remember to stay updated on Palantir's financial reports and market trends after May 5th to make further informed decisions about your Palantir investment.

Featured Posts

-

El Bolso Favorito De Dakota Johnson Descubre La Marca Catalana Hereu

May 09, 2025

El Bolso Favorito De Dakota Johnson Descubre La Marca Catalana Hereu

May 09, 2025 -

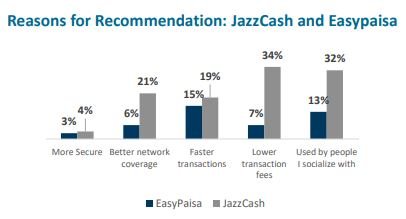

Accessible Stock Investment Thanks To Jazz Cash And K Trade

May 09, 2025

Accessible Stock Investment Thanks To Jazz Cash And K Trade

May 09, 2025 -

Investing In Palantir Analyzing The 40 Growth Projection For 2025

May 09, 2025

Investing In Palantir Analyzing The 40 Growth Projection For 2025

May 09, 2025 -

Proposed Uk Restrictions On Student Visas From High Risk Asylum Countries

May 09, 2025

Proposed Uk Restrictions On Student Visas From High Risk Asylum Countries

May 09, 2025 -

Netflix Predstoyasch Rimeyk Na Kniga Ot Stivn King

May 09, 2025

Netflix Predstoyasch Rimeyk Na Kniga Ot Stivn King

May 09, 2025

Latest Posts

-

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025

News From The Bangkok Post The Push For Better Transgender Rights

May 10, 2025 -

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025

The Bangkok Post And The Ongoing Struggle For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025

Examining Transgender Equality Issues Highlighted By The Bangkok Post

May 10, 2025 -

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025

The Bangkok Post And The Fight For Transgender Equality In Thailand

May 10, 2025