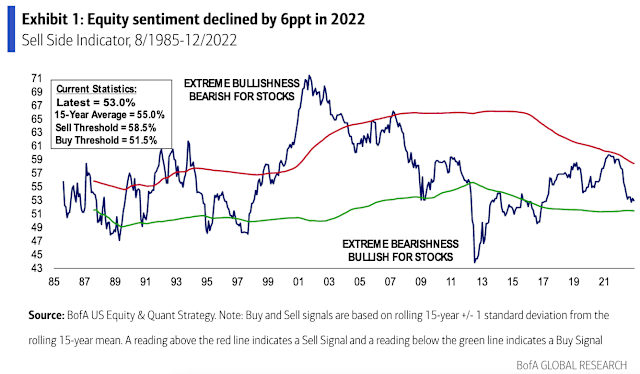

Should Investors Worry About Elevated Stock Market Valuations? BofA's Analysis

Table of Contents

BofA's Key Findings on Elevated Stock Market Valuations

BofA's recent analysis on stock market valuations paints a nuanced picture. While acknowledging the significant price increases, their assessment isn't purely bearish. They acknowledge the strong corporate earnings growth as a supporting factor, but also express caution about the sustainability of these elevated levels given various economic headwinds. Their analysis isn't a simple "buy" or "sell" recommendation, but rather a call for careful consideration and strategic portfolio management.

-

Specific valuation metrics used by BofA: BofA employs a range of valuation metrics, including the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation ratios. These metrics provide a multifaceted view of market valuation, considering both short-term and long-term performance.

-

BofA's assessment of the current market environment: BofA's overall assessment leans toward cautious optimism. They recognize the potential for continued growth but emphasize the inherent risks associated with currently elevated valuations. Their stance can be best described as "neutral to slightly bearish," with a strong emphasis on risk management.

-

Specific sectors identified as overvalued or undervalued: BofA's analysis often highlights specific sectors that appear overvalued or undervalued relative to their historical performance and future growth prospects. These insights can help investors make informed decisions about sector allocation within their portfolios. For instance, certain technology sectors might be flagged as overvalued, while others, like energy or infrastructure, might be viewed as relatively undervalued.

-

Specific risks highlighted by BofA: BofA consistently highlights several key risks, including potential interest rate hikes by central banks aiming to combat inflation, the persistent threat of inflation impacting corporate profitability, and geopolitical instability. These factors all contribute to the uncertainty surrounding current stock market valuations.

Factors Contributing to Elevated Valuations

Several intertwined factors contribute to the current elevated stock market valuations. Understanding these factors is essential for comprehending the market's dynamics and predicting its future trajectory.

-

Low interest rates and their impact on investment choices: Historically low interest rates have made bonds and other fixed-income investments less attractive, encouraging investors to seek higher returns in the stock market, thereby pushing up valuations.

-

Strong corporate earnings growth and its sustainability: Strong corporate earnings growth, particularly in certain sectors, has supported higher stock prices. However, the sustainability of this growth remains a key question, especially given the macroeconomic uncertainties.

-

The role of quantitative easing and monetary policy: The massive injection of liquidity into the financial system through quantitative easing (QE) programs has played a significant role in fueling asset price inflation, including stock prices.

-

Increased investor confidence and speculation: Periods of sustained growth often breed investor optimism and speculation, leading to higher valuations and increased market volatility. This sentiment can amplify the effects of other factors.

-

Impact of technological advancements and disruptive innovation: Technological advancements and disruptive innovations have driven significant growth in certain sectors, boosting valuations and creating new investment opportunities. This positive influence, however, comes with its own set of risks and uncertainties.

Assessing the Risks: Should Investors Be Concerned?

While the market's upward trajectory is tempting, investors must carefully assess the risks associated with these elevated valuations.

-

Potential for a market correction or crash: High valuations inherently increase the potential for a market correction or even a more significant crash. This risk should not be ignored.

-

The impact of inflation on stock prices: Persistent inflation erodes purchasing power and can negatively impact corporate profits, potentially leading to a decline in stock prices. The Federal Reserve's actions to combat inflation are a critical factor here.

-

Increased interest rate risk and its effect on valuations: Rising interest rates increase borrowing costs for businesses and can make stocks less attractive compared to fixed-income investments, putting downward pressure on valuations.

-

Geopolitical uncertainty and its influence on market sentiment: Geopolitical events, such as wars or trade disputes, can significantly impact market sentiment and lead to volatility, affecting stock prices.

-

The possibility of a recession and its effect on corporate earnings: A recession could significantly reduce corporate earnings, negatively impacting stock prices. The possibility of a recession should be a major consideration in any investment strategy.

Strategies for Navigating Elevated Stock Market Valuations

Given the potential risks, investors need a proactive strategy to navigate this market environment. BofA's analysis indirectly suggests a cautious, diversified approach.

-

Diversification strategies to mitigate risk: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk and reduce the impact of any market downturn.

-

Sector-specific investment opportunities: While some sectors might be overvalued, others may present attractive opportunities. Careful analysis of individual companies and sectors is essential.

-

Importance of a long-term investment horizon: A long-term investment horizon helps to weather short-term market fluctuations and allows for greater potential for growth over time.

-

Rebalancing your portfolio: Regularly rebalancing your portfolio helps to maintain your desired asset allocation and capitalize on market opportunities while mitigating risk.

-

Considering defensive investment options: In times of uncertainty, considering defensive investment options, such as high-quality bonds or dividend-paying stocks, can help to protect your portfolio from significant losses.

Conclusion

BofA's analysis on elevated stock market valuations highlights a complex picture. While robust corporate earnings have supported growth, the high valuations, coupled with potential risks like interest rate hikes and inflation, necessitate a cautious approach. Investors shouldn't necessarily panic, but they should be aware of the potential for corrections and adjust their investment strategies accordingly. A diversified portfolio, a long-term perspective, and careful consideration of sector-specific opportunities are vital for navigating the challenges and opportunities presented by elevated stock market valuations. Conduct thorough research and consult with a financial advisor before making any investment decisions. Understanding and proactively managing the risks associated with elevated stock market valuations is key to successful long-term investing.

Featured Posts

-

Grayscale Xrp Etf Filing And Sec Action Xrps Market Dominance Over Bitcoin

May 08, 2025

Grayscale Xrp Etf Filing And Sec Action Xrps Market Dominance Over Bitcoin

May 08, 2025 -

Brasileirao Dupla De Arrascaeta Da Vitoria Ao Flamengo Contra O Gremio

May 08, 2025

Brasileirao Dupla De Arrascaeta Da Vitoria Ao Flamengo Contra O Gremio

May 08, 2025 -

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025

Kripto Lider Kripto Para Yatirimlarinda Yeni Bir Perspektif

May 08, 2025 -

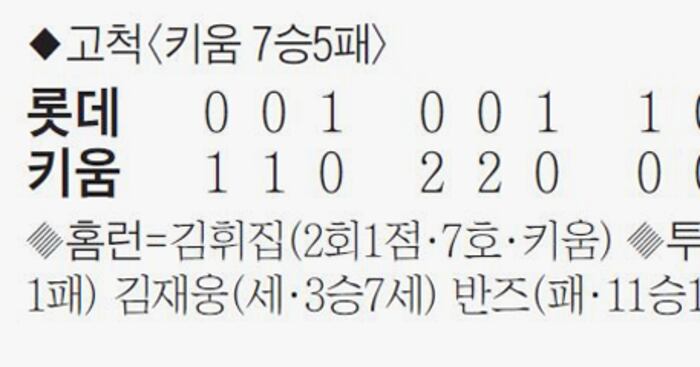

5 0 355 Nl 3

May 08, 2025

5 0 355 Nl 3

May 08, 2025 -

Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly Py Ays Ayl 2024 Ka Nwtyfkyshn

May 08, 2025

Lahwr Ke Askwlwn Ke Awqat Kar Myn Tbdyly Py Ays Ayl 2024 Ka Nwtyfkyshn

May 08, 2025

Latest Posts

-

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025

Mans 3 K Babysitting Bill Leads To 3 6 K Daycare Cost A Costly Lesson

May 09, 2025 -

The Emotional Toll Of Daycare Support For Working Parents

May 09, 2025

The Emotional Toll Of Daycare Support For Working Parents

May 09, 2025 -

From 3 K Babysitter To 3 6 K Daycare A Cautionary Tale Of Childcare Costs

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare A Cautionary Tale Of Childcare Costs

May 09, 2025 -

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025

Handhaving Van De Relatie Brekelmans India Kansen En Bedreigingen

May 09, 2025 -

From 3 000 Babysitter To 3 600 Daycare A Dads Financial Struggle

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Dads Financial Struggle

May 09, 2025