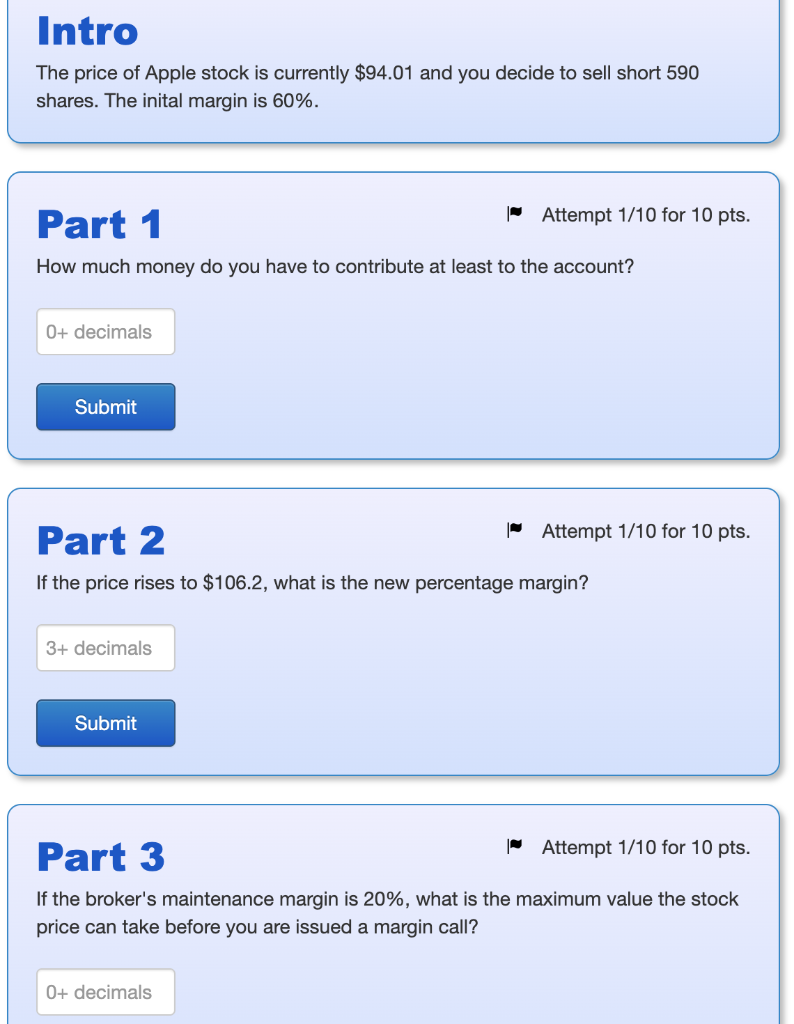

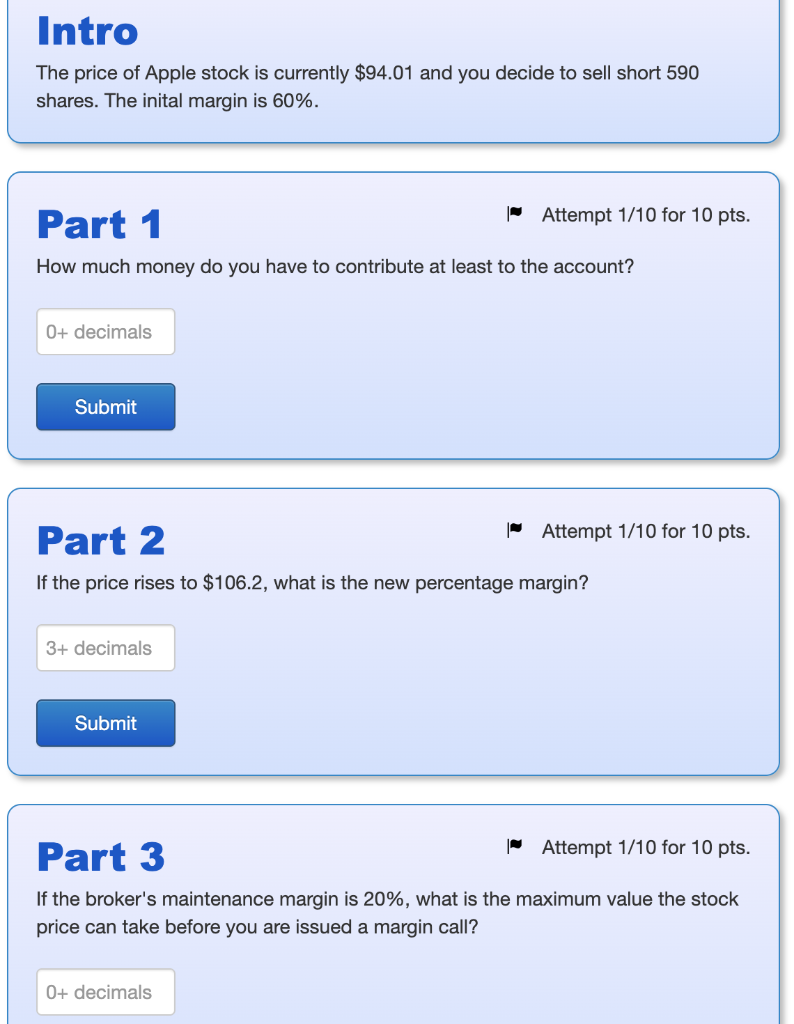

Should You Buy Apple Stock At $200? Analyst's $254 Price Target Explained

Table of Contents

The Analyst's $254 Price Target: What's Behind It?

The $254 Apple stock price target isn't plucked from thin air. Several key factors underpin this optimistic projection.

Strong iPhone Sales and Services Growth

Despite economic headwinds, iPhone sales remain robust. This sustained strength, coupled with explosive growth in Apple's Services segment (Apple Music, iCloud, App Store, etc.), forms a strong foundation for the projected price increase. Apple's ecosystem continues to lock in customers, leading to recurring revenue streams.

- Increasing iPhone upgrade cycle: The longevity of iPhones encourages longer upgrade cycles, resulting in steady revenue streams.

- Expansion into emerging markets: Apple continues to penetrate developing economies, tapping into vast new customer bases.

- Growth in subscription services: The Services segment is a high-margin, recurring revenue powerhouse, showing exceptional growth and bolstering overall profitability. This is a key driver of the increased Apple stock price target.

This combination of consistent hardware sales and explosive service revenue growth paints a positive picture for the future of AAPL stock.

Innovation and Future Product Launches

Apple's reputation for innovation is a cornerstone of its success. Anticipated product launches, such as new iPhone models, highly anticipated AR/VR headsets, and potential advancements in other areas like electric vehicles or healthcare, could significantly impact the Apple stock price. Their continuous investment in R&D fuels this expectation.

- Potential for disruptive technologies: Apple's history demonstrates its capacity to introduce game-changing technologies.

- Strong brand loyalty and customer base: A fiercely loyal customer base ensures a captive audience for new products.

- Expansion into new markets: Apple's exploration of new sectors like electric vehicles and healthcare represents significant growth opportunities. These potential avenues of expansion directly influence the projected $254 Apple stock price.

These innovative endeavors add to the bullish sentiment surrounding the Apple stock price and support the analyst's $254 target.

Macroeconomic Factors and Market Sentiment

While positive internal factors drive the forecast, the broader macroeconomic environment and overall market sentiment play a crucial role.

- Interest rate hikes and inflation: Rising interest rates and inflation could negatively impact consumer spending and influence Apple stock performance.

- Global economic outlook: A global recession could dampen demand for Apple products, affecting the Apple stock price negatively.

- Competition in the tech market: Intense competition from Samsung, Google, and other tech giants poses a constant challenge.

Risks and Potential Downsides of Investing in Apple Stock at $200

While the $254 Apple stock price target is alluring, it's crucial to acknowledge potential risks.

Valuation Concerns

The $254 price target's justification depends on Apple's current valuation. Analyzing the price-to-earnings ratio (P/E) and other key financial metrics is essential to determine if this target is realistic.

- Comparison to competitors' valuations: Comparing Apple's valuation to its competitors helps determine if it's fairly priced or overvalued.

- Potential for overvaluation: The current price might already reflect future growth, leaving little room for further appreciation.

- Market corrections and volatility: Unexpected market downturns can significantly impact even the most robust stocks like Apple.

A thorough valuation analysis is crucial before investing in Apple stock at this price point.

Geopolitical Risks and Supply Chain Issues

Geopolitical instability and supply chain disruptions pose significant threats to Apple's profitability.

- Manufacturing disruptions: Disruptions to manufacturing facilities due to geopolitical events can affect production and sales.

- International trade policies: Changes in international trade policies can impact Apple's costs and profitability.

- Geopolitical instability: Uncertainties in global politics can create volatility in the Apple stock price.

Competition in the Tech Industry

The intense competition in the tech industry is an ongoing concern.

- Increased competition in smartphones: Samsung, Google, and other manufacturers fiercely compete for market share in the smartphone sector.

- Competition in other sectors (wearables, services): Competition extends beyond smartphones, encompassing wearables and services.

- Potential for market share erosion: Apple's dominance isn't guaranteed, and market share erosion could impact its growth trajectory.

Should You Buy Apple Stock at $200? A Balanced Perspective

Deciding whether to buy Apple stock at $200 requires considering both the potential upside and downside. The $254 price target is enticing, but the risks need careful evaluation.

- Consider your investment timeline: A long-term investment horizon allows you to weather short-term market fluctuations.

- Diversify your portfolio: Don't put all your eggs in one basket. Diversification minimizes risk.

- Consult a financial advisor: Seek professional advice tailored to your specific financial situation and risk tolerance.

Conclusion

The decision of whether to buy Apple stock at $200 is multifaceted, involving factors like iPhone sales, future product releases, macroeconomic conditions, and competitive pressures. While a $254 price target presents an attractive possibility, investors must weigh the potential rewards against the inherent risks. Conduct thorough research, analyze this information, and consider your individual investment strategy and risk tolerance before investing in Apple stock. Remember to consult a financial advisor before making any significant investment decisions related to Apple stock (AAPL stock) or any other investment.

Featured Posts

-

Test Na Znanie Filmov S Olegom Basilashvili

May 24, 2025

Test Na Znanie Filmov S Olegom Basilashvili

May 24, 2025 -

Sheinelle Jones Health Update Return To The Today Show

May 24, 2025

Sheinelle Jones Health Update Return To The Today Show

May 24, 2025 -

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025

Dr Beachs 2025 Best Beaches In The Us Top 10 List

May 24, 2025 -

Alnmw Alqwy Ldaks 30 Tfwqh Ela Almwshrat Alawrwbyt Alakhra

May 24, 2025

Alnmw Alqwy Ldaks 30 Tfwqh Ela Almwshrat Alawrwbyt Alakhra

May 24, 2025 -

French Ex Pm Speaks Out Against Macrons Leadership

May 24, 2025

French Ex Pm Speaks Out Against Macrons Leadership

May 24, 2025