Should You Buy Palantir Stock Before May 5th? A Pre-Earnings Analysis

Table of Contents

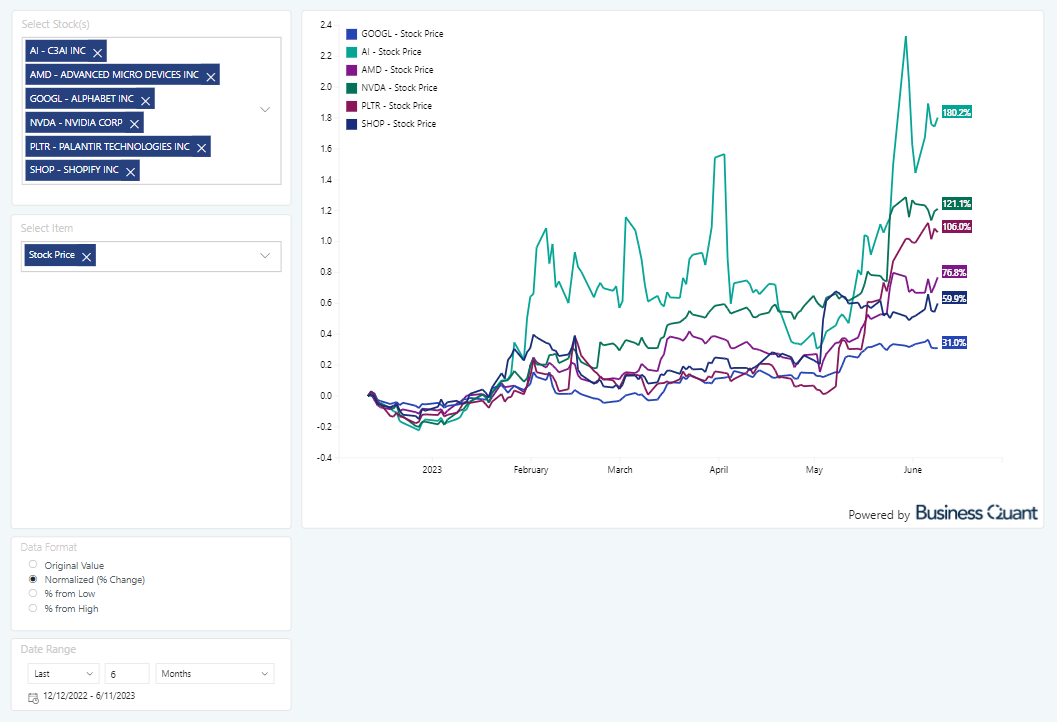

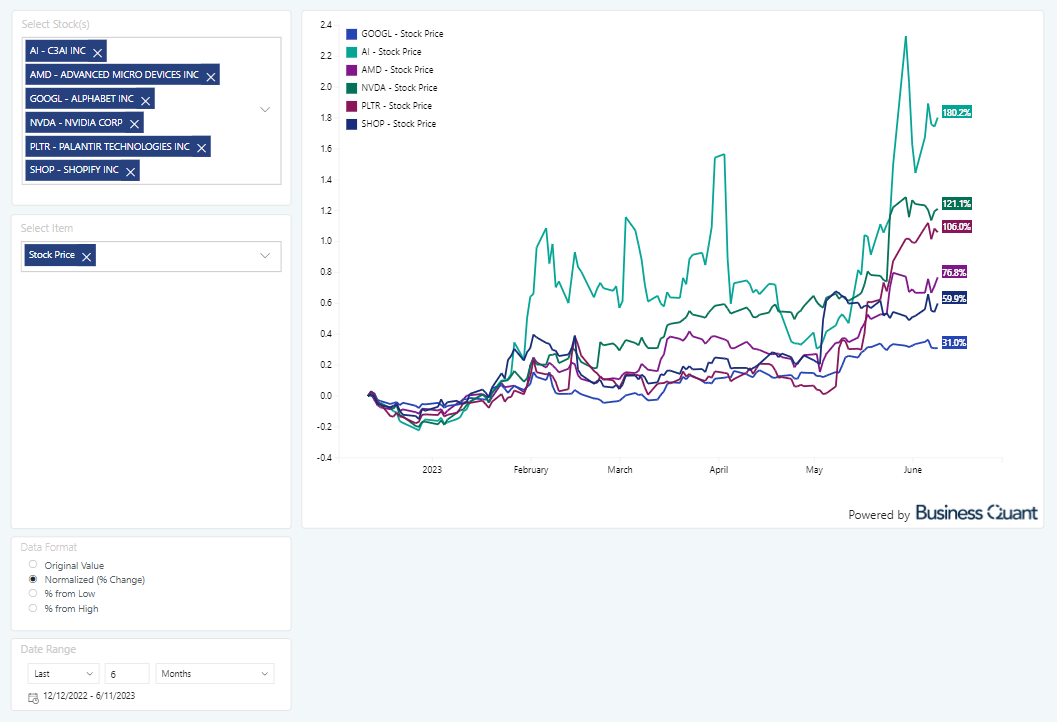

Palantir's Recent Performance and Market Sentiment

Recent market sentiment towards Palantir has been mixed. The PLTR stock price has experienced volatility in recent months, influenced by a variety of factors. Understanding these fluctuations is critical before deciding whether to invest.

- Recent News Impacting PLTR Stock Price: Recent news, including new contract wins, strategic partnerships, and regulatory developments, has significantly influenced investor sentiment. Positive announcements tend to boost the stock price, while negative news can lead to declines. Keep an eye on press releases and financial news sources for the latest updates.

- Analyst Ratings and Price Targets: Analyst ratings and price targets offer valuable insights into market expectations for Palantir. While these predictions shouldn't be taken as gospel, they reflect the overall consensus view among professionals. Examining the range of price targets can help gauge the potential upside and downside for PLTR stock.

- Investor Confidence in Palantir's Future Growth: Investor confidence is a key driver of Palantir's stock price. Factors like the company's ability to secure new contracts, expand into new markets, and demonstrate consistent revenue growth significantly impact this confidence. Monitoring investor sentiment through news articles, social media discussions, and financial forums can provide a useful pulse on the market. Search for keywords like "Palantir investor sentiment" to uncover these perspectives.

Key Factors to Consider Before May 5th Earnings

Several key factors will likely influence Palantir's stock price after the May 5th earnings release. Carefully analyzing these factors is crucial for informed investment decisions.

- Revenue Growth: Palantir's revenue growth is a major indicator of its financial health and future potential. Analyzing projected revenue growth for the quarter and comparing it to previous quarters will help assess the company's trajectory. Look for official press releases and financial reports for accurate figures. Searching for "Palantir revenue" or "PLTR revenue growth" will help you find this data.

- Profitability: Palantir's progress towards profitability is another critical factor. Achieving profitability would significantly boost investor confidence and potentially drive the stock price higher. Examining the company's profit margin and its projected path to profitability is crucial. The keywords "Palantir profitability" and "PLTR profit margin" are useful for this research.

- Government Contracts: Palantir relies heavily on government contracts for a significant portion of its revenue. The securing of new contracts or the potential loss of existing ones can significantly impact the company's performance and its stock price. Understanding the pipeline of potential government contracts and the associated risks is vital. Use keywords like "Palantir government contracts" and "PLTR defense contracts" to stay informed.

- New Product Launches/Partnerships: New product launches and strategic partnerships can create significant growth opportunities for Palantir. Analyzing the potential impact of any recent developments in these areas is important to assess their potential influence on future earnings. Use keywords such as "Palantir new products" and "PLTR partnerships" to find relevant information.

Risk Assessment: Potential Downsides of Investing in Palantir Stock

While Palantir presents significant growth potential, it's crucial to acknowledge the associated risks before investing.

- Volatility of the Stock Price: PLTR stock is known for its volatility. This means the price can fluctuate significantly in short periods, creating both opportunities and risks for investors. Be prepared for potentially significant price swings, both positive and negative. Search for "PLTR stock volatility" to understand this risk better.

- Dependence on Large Government Contracts: Palantir's reliance on large government contracts exposes it to potential risks, including delays in contract awards, budget cuts, and changes in government priorities. This dependence necessitates a thorough understanding of the political and economic landscape impacting government spending.

- Competition in the Big Data and Analytics Market: The big data and analytics market is highly competitive. Palantir faces competition from established players and emerging startups, potentially impacting its market share and revenue growth. Researching the competitive landscape will help you assess Palantir's competitive advantages.

- Potential for Disappointing Earnings Results: Even with positive projections, there's always a risk that Palantir's actual earnings could fall short of expectations. This could trigger a sell-off, leading to a significant decline in the stock price.

Alternative Investment Strategies

Investors hesitant about buying Palantir stock before earnings have several alternatives.

- Waiting for the Earnings Report: A cautious approach involves waiting for the May 5th earnings report before making an investment decision. This allows you to assess the company's actual performance and adjust your strategy accordingly.

- Diversifying Investments: Diversifying your portfolio across various sectors and asset classes reduces risk. Instead of heavily investing in Palantir, consider spreading your investments across different companies and sectors to mitigate potential losses.

- Considering Options Trading Strategies: Options trading can offer a more nuanced approach to managing risk and potential gains. Call options, for instance, allow you to profit from an upward movement in the stock price without the significant capital commitment of outright stock ownership, while limiting potential losses to the premium paid for the option. However, options trading involves significant risk and requires a deep understanding of the market.

Conclusion

The decision of whether to buy Palantir stock before May 5th requires a careful consideration of several factors. While Palantir's potential for future growth is considerable, its volatile stock price and dependence on government contracts introduce significant risks. Projected revenue growth, profitability, government contracts, and new product launches/partnerships will all play pivotal roles in shaping the post-earnings reaction. Remember that thorough due diligence is paramount before investing in any stock. Whether you decide to buy Palantir stock before May 5th or adopt a wait-and-see approach, remember to thoroughly research and understand the risks involved. Continue your own analysis of Palantir stock and its potential for future growth. Make an informed decision about your Palantir stock investment strategy.

Featured Posts

-

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025

Hart Trophy Finalists Announced Draisaitl Hellebuyck And Kucherov

May 10, 2025 -

Surgeon General Nomination Withdrawn A Social Media Influencers Unexpected Rise

May 10, 2025

Surgeon General Nomination Withdrawn A Social Media Influencers Unexpected Rise

May 10, 2025 -

Draisaitls Return Key For Oilers Playoff Success

May 10, 2025

Draisaitls Return Key For Oilers Playoff Success

May 10, 2025 -

Renaissance Et Modem Vers Une Fusion Pour Renforcer La Majorite Presidentielle

May 10, 2025

Renaissance Et Modem Vers Une Fusion Pour Renforcer La Majorite Presidentielle

May 10, 2025 -

Snls Impression Of Harry Styles His Disappointed Response

May 10, 2025

Snls Impression Of Harry Styles His Disappointed Response

May 10, 2025