Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Palantir's Recent Performance and Financial Health

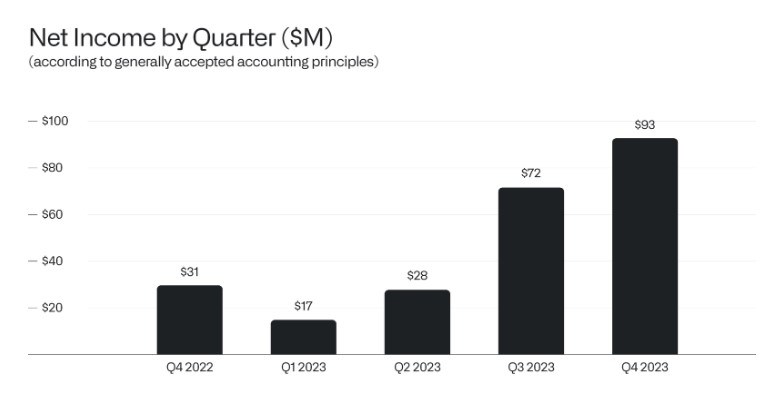

Understanding Palantir's recent financial health is crucial for assessing its stock's potential. Analyzing recent quarterly earnings reports reveals a mixed bag. While Palantir has shown consistent revenue growth, its profitability remains a key area of focus for investors. Key performance indicators (KPIs) like revenue growth (both year-over-year and quarter-over-quarter), profit margins, customer acquisition and retention rates, and debt levels all play a significant role in influencing the PLTR stock price.

- Revenue Growth Trends (YoY and QoQ): Palantir has demonstrated consistent, albeit sometimes uneven, revenue growth. Investors should analyze the trends to identify growth acceleration or deceleration.

- Profit Margins and Profitability Improvements: Improving profit margins are vital for long-term sustainability. Tracking this metric helps gauge the effectiveness of Palantir's cost-cutting measures and operational efficiency.

- Customer Acquisition and Retention Rates: High customer acquisition and strong retention are essential for sustainable revenue streams. A decline in these metrics could signal potential challenges.

- Debt Levels and Cash Flow: Palantir's debt levels and cash flow generation capabilities directly impact its financial stability and its ability to invest in future growth.

Analyzing these Palantir earnings reports and understanding the underlying drivers of Palantir revenue growth and Palantir financial health is paramount before making any investment decisions. Understanding the relationship between these factors and PLTR stock performance is key.

Wall Street Analyst Ratings and Price Targets

Wall Street analysts' opinions on Palantir stock offer valuable insights. Leading up to May 5th, the consensus rating from major investment banks shows a surprising degree of optimism for some, while others remain cautious. This divergence in opinions highlights the complexity of evaluating Palantir's future prospects. Analyzing the rationale behind these recommendations is crucial.

- Average Price Target for Palantir Stock: The average price target reflects the collective expectations of analysts regarding the future price of PLTR stock.

- Number of Buy, Hold, and Sell Ratings: The distribution of buy, hold, and sell ratings gives a broader picture of analyst sentiment. A high number of buy ratings suggests strong bullish sentiment.

- Key Factors Influencing Analyst Ratings: Factors such as the growth of Palantir's government contracts, progress in its commercial sector, and overall market conditions significantly influence analyst ratings and Palantir stock forecast.

Examining the Wall Street analyst rating Palantir data, including the Palantir stock price target and the number of PLTR buy ratings, provides a crucial perspective on the current market sentiment surrounding Palantir stock.

Upcoming Catalysts and Events Before May 5th

Several upcoming events before May 5th could significantly impact Palantir's stock price. These catalysts include potential earnings calls, product launches, contract announcements, and industry conferences. Understanding the potential impact of these events is vital for informed investment decisions.

- Specific Upcoming Events and Their Dates: A detailed calendar of upcoming events and their dates allows for anticipation of potential market reactions.

- Potential Positive and Negative Impacts on Stock Price: Analyzing the potential impact of each event – both positive and negative – helps prepare for market volatility.

- Importance of Each Event to Palantir's Long-Term Strategy: Understanding how these events contribute to Palantir's overall strategic goals provides context for evaluating their impact on the stock price.

Monitoring the Palantir events calendar and understanding the potential impact of PLTR upcoming news on the Palantir stock outlook is crucial. These Palantir catalysts can significantly influence the short-term and long-term trajectory of the stock price.

Risks and Considerations Before Investing in Palantir Stock

Investing in Palantir stock carries inherent risks. Potential downsides and challenges include market volatility, competition, and dependence on government contracts. Careful consideration of these risks is crucial before making an investment decision.

- Competition from Other Data Analytics Companies: The data analytics market is competitive, and Palantir faces pressure from established players and emerging competitors.

- Regulatory Risks and Compliance Issues: Operating in the data analytics space exposes Palantir to regulatory scrutiny and potential compliance issues.

- Dependence on Large Government Contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and procurement policies.

- Market Volatility and Economic Uncertainty: The overall market environment and broader economic conditions can significantly impact Palantir's stock price.

Understanding these Palantir risk factors, especially PLTR stock risks and Palantir investment risks, and acknowledging Palantir stock volatility are critical for mitigating potential losses.

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

The decision of whether to buy Palantir stock before May 5th requires careful consideration of its recent financial performance, Wall Street's mixed consensus, upcoming catalysts, and the inherent risks. While Palantir shows potential for long-term growth, the inherent volatility and dependence on government contracts present significant risks. The upcoming events could sway the market either way.

Make an informed decision on whether to buy Palantir stock before May 5th by carefully considering the factors discussed in this article. Remember to conduct your own thorough research before making any investment decisions related to Palantir stock. Consider your risk tolerance and investment goals before investing in this potentially volatile stock.

Featured Posts

-

Is Benson Boone Copying Harry Styles The Singer Responds

May 09, 2025

Is Benson Boone Copying Harry Styles The Singer Responds

May 09, 2025 -

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025

Nottingham Attack Survivor Speaks Out I Wish He D Taken Me Instead

May 09, 2025 -

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Gouvernementale

May 09, 2025

Fusion Renaissance Modem Elisabeth Borne Clarifie La Ligne Gouvernementale

May 09, 2025 -

Edmonton Unlimiteds New Strategy Scaling Tech Innovation For Global Impact

May 09, 2025

Edmonton Unlimiteds New Strategy Scaling Tech Innovation For Global Impact

May 09, 2025 -

Tat Tre Toi Tap Bao Mau Tien Giang Khai Gi

May 09, 2025

Tat Tre Toi Tap Bao Mau Tien Giang Khai Gi

May 09, 2025

Latest Posts

-

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025 -

Olly Murs Concert Massive Music Festival At A Beautiful Castle Near Manchester

May 09, 2025

Olly Murs Concert Massive Music Festival At A Beautiful Castle Near Manchester

May 09, 2025 -

Once Rejected Now A Key Player For Europes Best Team

May 09, 2025

Once Rejected Now A Key Player For Europes Best Team

May 09, 2025 -

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025

Rhlt Barys San Jyrman Nhw Alfwz Bdwry Abtal Awrwba

May 09, 2025 -

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025

Manchesters Stunning Castle To Host Major Music Festival With Olly Murs

May 09, 2025