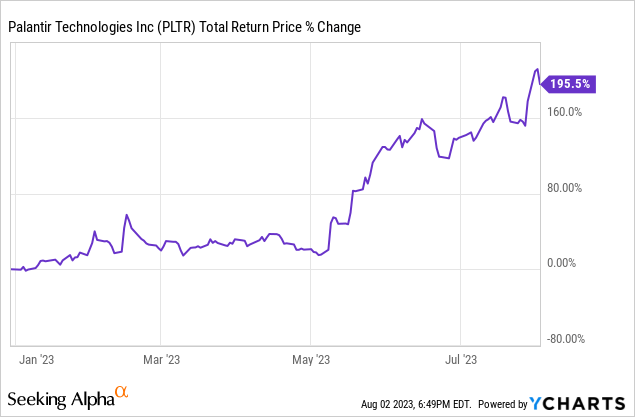

Should You Invest In Palantir Stock Before May 5th? A Detailed Look

Table of Contents

Palantir's Recent Performance and Financial Health

Analyzing Palantir's recent financial performance is crucial for assessing its current valuation and future potential. We need to examine key metrics from recent quarterly earnings reports to understand the company's financial health and its implications for the stock price.

-

Revenue Growth: Year-over-year revenue growth provides insight into Palantir's ability to expand its customer base and increase sales. A consistent upward trend suggests a healthy and growing business, while stagnation or decline indicates potential challenges. Examining the breakdown of revenue between government and commercial sectors is also crucial for understanding growth drivers.

-

Profitability Margins: Analyzing gross and operating profit margins reveals Palantir's efficiency in managing costs and generating profits from its operations. Improving margins suggest enhanced operational efficiency and cost-cutting measures, while declining margins may indicate escalating expenses or pricing pressures.

-

Cash Flow and Debt Levels: A strong cash flow position is essential for a company's financial stability and growth. Positive cash flow allows Palantir to invest in research and development, acquire competitors, and handle unexpected expenses. High debt levels, on the other hand, can hinder growth and increase financial risk.

-

Key Performance Indicators (KPIs): Specific KPIs relevant to Palantir's business model, such as customer acquisition cost, customer churn rate, and average revenue per user (ARPU), offer valuable insights into the operational effectiveness of its data analytics platforms. Tracking these KPIs over time provides a clear picture of Palantir's progress and future prospects.

The overall financial health of Palantir, as revealed by these metrics, will significantly influence the future stock price movement. Any recent announcements, such as new contracts, partnerships, or regulatory changes, should also be carefully considered.

Analyzing Palantir's Business Model and Growth Prospects

Palantir's core business revolves around providing advanced data analytics and software platforms to government and commercial clients. Understanding the dynamics of both these sectors is essential for evaluating its growth prospects.

-

Government Contracts: Government contracts are a significant revenue stream for Palantir, providing stable income but also potentially limiting growth if dependence becomes too high. Analyzing the pipeline of future government contracts and their potential value is essential.

-

Commercial Market Expansion: Palantir's success in expanding into the commercial market is crucial for long-term growth. The adoption rate of its platforms by commercial clients and their satisfaction levels will directly impact revenue growth.

-

Competition: The data analytics sector is fiercely competitive, with established players and emerging startups vying for market share. Assessing Palantir's competitive advantages, such as its technology, expertise, and customer relationships, is vital.

-

Innovation Pipeline: Palantir's investment in research and development and its ability to introduce innovative products and services are key to maintaining its competitive edge and fueling future growth. Analyzing its innovation pipeline provides a glimpse into its future potential.

Assessing the long-term growth potential requires considering market trends, technological advancements, and Palantir's ability to adapt and innovate within a highly competitive landscape.

Evaluating the Risks Associated with Investing in Palantir Stock

Investing in Palantir stock involves inherent risks that potential investors must carefully consider before making any investment decision.

-

Market Volatility: The technology sector is known for its volatility, and Palantir's stock price is susceptible to market fluctuations and broader economic conditions. Economic downturns can significantly impact demand for Palantir's services, particularly in the commercial sector.

-

Government Contract Dependence: Reliance on government contracts exposes Palantir to the risk of losing contracts due to budget cuts, changes in government priorities, or competitive bidding.

-

Competition: Intense competition from established players and emerging startups in the data analytics market poses a significant risk to Palantir's market share and profitability.

-

Regulatory Risks: Palantir operates in a regulated environment, particularly in the government sector, and changes in regulations could impact its business operations and revenue streams.

A balanced assessment of these potential downsides is crucial for making an informed investment decision regarding Palantir before May 5th.

Considering Alternative Investment Options

Before committing to Palantir, it's wise to explore alternative investment options within the technology sector or other asset classes.

-

Comparable Companies: Comparing Palantir's performance and valuation with similar companies in the data analytics space can provide valuable context and perspective. Analyzing their growth trajectories, financial health, and risk profiles offers a broader comparison.

-

Diversification: Diversifying your investment portfolio reduces risk by spreading investments across different asset classes and sectors. This strategy mitigates potential losses should Palantir's stock price decline.

-

Alternative Strategies: Consider other investment strategies, such as index funds or ETFs, which offer broader market exposure and diversification benefits.

This comparative analysis helps ensure your investment decisions are well-informed and align with your overall risk tolerance and financial goals.

Conclusion

Investing in Palantir stock before May 5th requires a thorough assessment of its recent performance, future growth prospects, and associated risks. We have analyzed Palantir's financial health, business model, competitive landscape, and potential risks, along with considering alternative investment options. The decision to buy, sell, or hold ultimately rests on your individual risk tolerance and investment objectives. Remember that this analysis is for informational purposes only and shouldn't be considered financial advice. Before making any decisions regarding your Palantir investment strategy, conduct thorough research and consult a qualified financial advisor. Make informed decisions about your Palantir stock investment.

Featured Posts

-

Us Militarys Arctic Ambitions Examining The Proposed Transfer Of Greenland To Northern Command

May 10, 2025

Us Militarys Arctic Ambitions Examining The Proposed Transfer Of Greenland To Northern Command

May 10, 2025 -

Oilers Draisaitl Out Winnipeg Jets Matchup In Jeopardy

May 10, 2025

Oilers Draisaitl Out Winnipeg Jets Matchup In Jeopardy

May 10, 2025 -

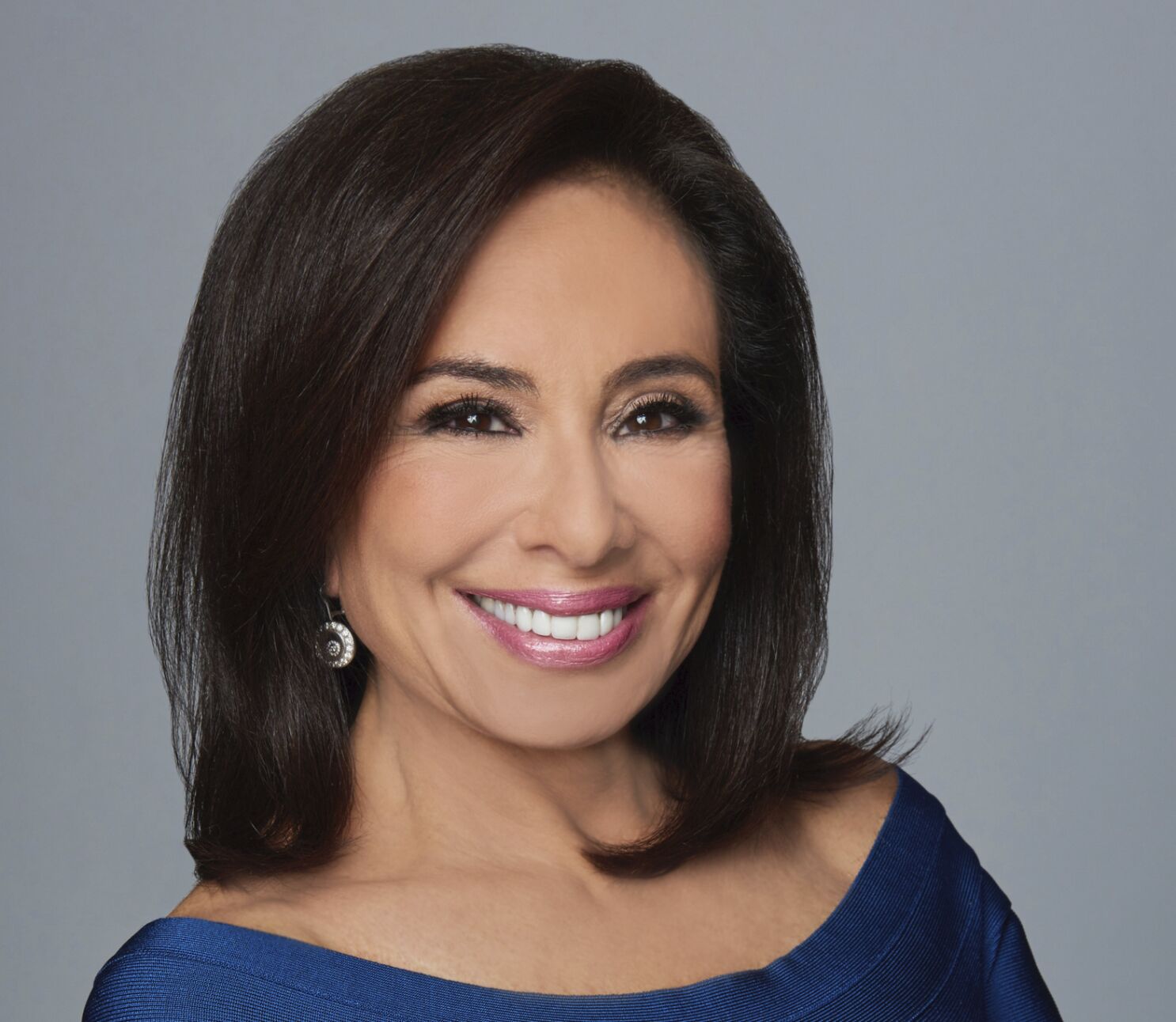

Jeanine Pirros North Idaho Visit What To Expect

May 10, 2025

Jeanine Pirros North Idaho Visit What To Expect

May 10, 2025 -

100 Days Of Trump Analyzing The Effects On Elon Musks Fortune

May 10, 2025

100 Days Of Trump Analyzing The Effects On Elon Musks Fortune

May 10, 2025 -

Elizabeth City Road Fatal Pedestrian Accident Claims Two Lives

May 10, 2025

Elizabeth City Road Fatal Pedestrian Accident Claims Two Lives

May 10, 2025