Should You Invest In This SPAC Stock Rivaling MicroStrategy? A Detailed Look

Table of Contents

Understanding the SPAC Landscape and its Risks

What is a SPAC?

Special Purpose Acquisition Companies (SPACs) are shell companies formed with the sole purpose of merging with a private company and taking it public. This avoids the traditional IPO process, offering a quicker route to market for private businesses. A SPAC raises capital through an initial public offering (IPO), then searches for a suitable acquisition target within a specified timeframe (usually 18-24 months). Once a target is identified and a merger agreement is reached, the SPAC shareholders vote on the deal. If approved, the private company becomes a publicly traded entity.

- Highlighted risks of SPAC investments:

- Lack of historical data on the target company before the merger, making valuation challenging.

- Heavy reliance on the SPAC management team's ability to identify and successfully integrate a suitable acquisition target.

- Potential for significant dilution of existing shareholder value if the merger terms are unfavorable.

- Benefits of SPAC investments:

- Access to pre-IPO opportunities in potentially high-growth companies.

- Potential for high returns if the SPAC successfully identifies and merges with a valuable company.

- Often, a quicker path to market for private companies compared to traditional IPOs.

Due Diligence on the SPAC “Rivaling MicroStrategy”

Before investing in any SPAC, particularly one with a Bitcoin-focused strategy like the rumored MicroStrategy rival, thorough due diligence is paramount. This involves scrutinizing various aspects of the target company:

- Analyze the target company's Bitcoin holdings (if any) and its stated strategy: Understand how much Bitcoin they intend to hold, their acquisition strategy, and their risk management plan concerning Bitcoin's volatility. Compare this to MicroStrategy’s publicly available information.

- Compare the SPAC’s projected financials against MicroStrategy's performance: A realistic comparison is crucial. Consider factors such as revenue projections, expense management, and potential profit margins. Are the projections ambitious or grounded in reality?

- Investigate any red flags or potential conflicts of interest: Examine the backgrounds of the SPAC’s management team and any potential conflicts of interest. Look for any legal issues or controversies. Transparency is key.

Comparing the SPAC to MicroStrategy's Bitcoin Strategy

MicroStrategy's Success (and Challenges)

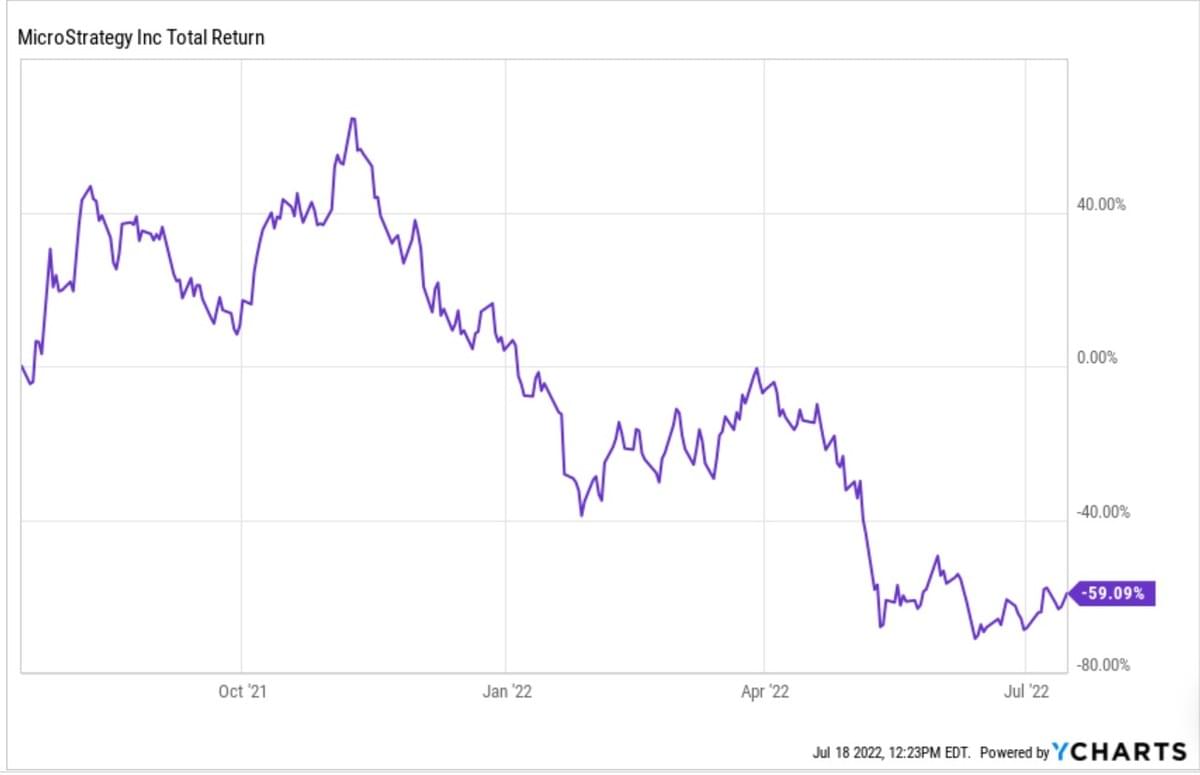

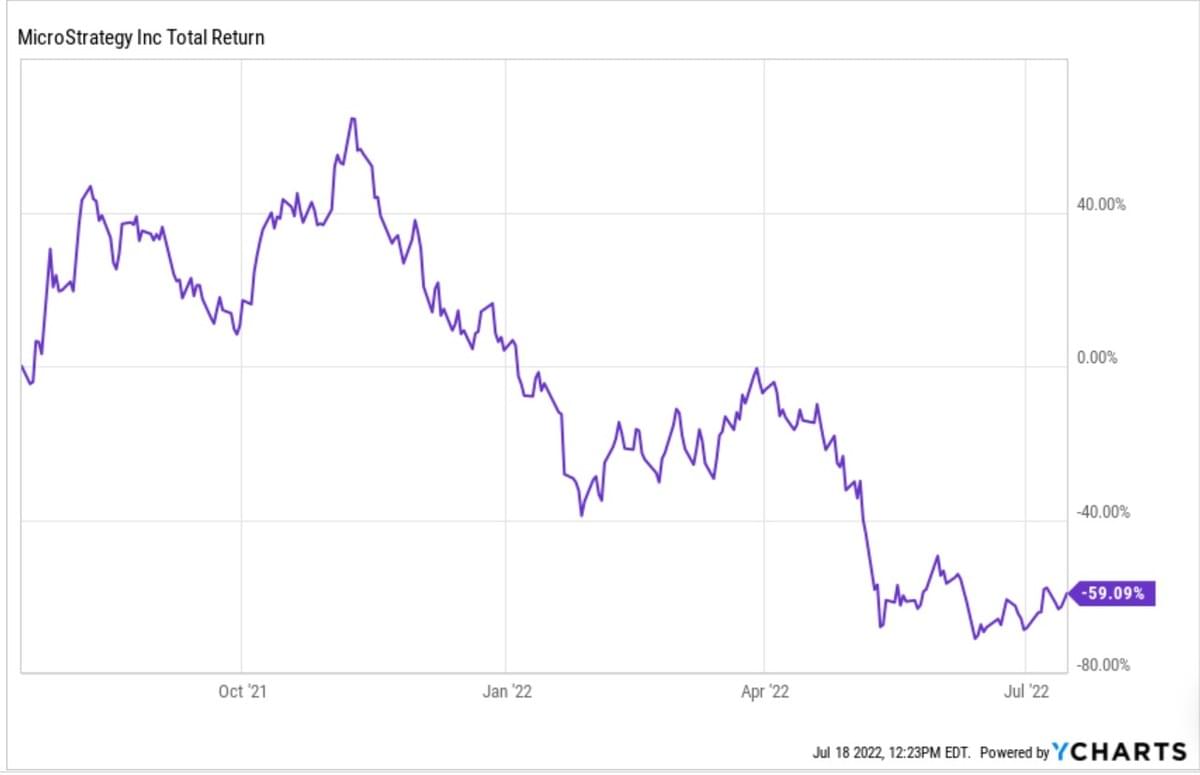

MicroStrategy's bold move to amass a significant Bitcoin reserve has been both praised and criticized. While it has positioned the company as a Bitcoin advocate, it's also exposed them to the inherent volatility of the cryptocurrency market.

- Analyze MicroStrategy's stock performance since initiating its Bitcoin strategy: This will give you a clearer picture of the potential risks and rewards associated with a Bitcoin-heavy investment strategy.

- Discuss the regulatory and financial risks associated with holding significant Bitcoin reserves: This includes potential tax implications, accounting complexities, and the risk of regulatory changes impacting Bitcoin's value or legality.

The SPAC's Potential for Similar Success (or Failure)

The success of the SPAC hinges on its ability to effectively replicate (or improve upon) MicroStrategy's strategy while mitigating the risks.

- Assess the SPAC's management team’s experience in cryptocurrency and financial markets: A strong and experienced team is crucial for navigating the complexities of the cryptocurrency market and managing risks.

- Evaluate the SPAC’s projected timeline for Bitcoin acquisition (if applicable) and its overall financial projections: Are the timelines realistic? Are the projections based on sound financial models and market analysis?

The Bitcoin Market and its Influence on SPAC Stock Performance

Bitcoin Volatility and its Impact on Investments

Bitcoin's price is notoriously volatile, subject to rapid and significant fluctuations. This inherent volatility directly impacts companies with substantial Bitcoin holdings.

- Discuss the impact of regulatory changes and market sentiment on Bitcoin's price: Government regulations and public opinion can significantly sway Bitcoin's value.

- Explore alternative cryptocurrencies and their potential to diversify risk: Diversification within the crypto market might offer some protection against extreme volatility.

Long-Term Outlook for Bitcoin and its Influence on the SPAC

The long-term prospects of Bitcoin are crucial for assessing the SPAC's potential.

- Discuss factors that could positively or negatively impact Bitcoin's long-term value: Consider factors such as mass adoption, regulatory clarity, technological advancements, and competition from other cryptocurrencies.

- Analyze the potential for other cryptocurrencies to compete with Bitcoin: The crypto market is constantly evolving, and new players could challenge Bitcoin's dominance.

Conclusion

Investing in a SPAC “rivaling MicroStrategy” presents both exciting opportunities and considerable risks. While mirroring MicroStrategy's successful Bitcoin strategy could yield high returns, the volatility of Bitcoin and the inherent uncertainties of SPAC investments must be carefully considered. Thorough due diligence, a deep understanding of the Bitcoin market, and a realistic assessment of the SPAC's potential are crucial before making any investment decisions. Before committing your capital, conduct comprehensive research into this SPAC stock rivaling MicroStrategy and consult with a qualified financial advisor. Remember, investing in any SPAC, especially those focused on cryptocurrencies, should be approached with caution and a diversified investment strategy.

Featured Posts

-

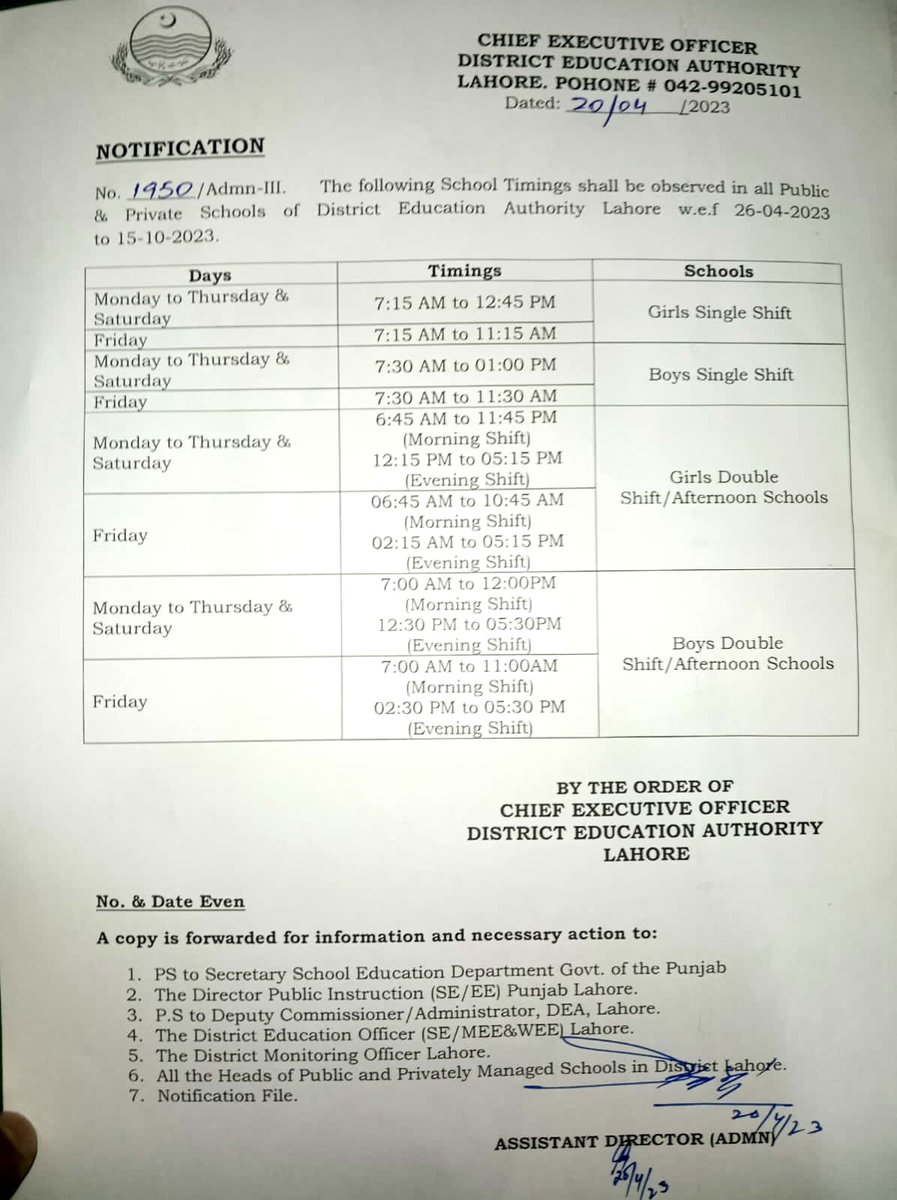

Lahwr Py Ays Ayl Ky Wjh Se Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025

Lahwr Py Ays Ayl Ky Wjh Se Askwlwn Ke Awqat Kar Tbdyl Srkary Nwtyfkyshn

May 08, 2025 -

Fias Latest Human Smuggling Bust Four More Arrested

May 08, 2025

Fias Latest Human Smuggling Bust Four More Arrested

May 08, 2025 -

The Long Walk Trailer Released A Dark Thriller Even Stephen King Found Disturbing

May 08, 2025

The Long Walk Trailer Released A Dark Thriller Even Stephen King Found Disturbing

May 08, 2025 -

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025

Dwp Update Important Information Regarding Your Bank Account And 12 Benefits

May 08, 2025 -

Uber Pet Delhi And Mumbai Get New Pet Transportation Option

May 08, 2025

Uber Pet Delhi And Mumbai Get New Pet Transportation Option

May 08, 2025

Latest Posts

-

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025

Match Dijon Concarneau Score Final Et Resume De La 28e Journee De National 2 2024 2025

May 09, 2025 -

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025

Defaite De Dijon Face A Concarneau 0 1 En National 2 04 04 2025

May 09, 2025 -

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025

National 2 Dijon Concede La Defaite Face A Concarneau 0 1

May 09, 2025 -

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025

Resultat Dijon Concarneau 0 1 National 2 2024 2025 Journee 28

May 09, 2025 -

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025

Uk Immigration Policy Update Restrictions On Visa Applications

May 09, 2025