Should You Invest In This SPAC Taking On MicroStrategy? A Detailed Analysis

Table of Contents

Keywords: SPAC, MicroStrategy, Bitcoin, investment, analysis, risk, reward, due diligence, Phoenix Acquisition Corp., PHNX

Understanding the SPAC and its Target Market

A SPAC, or Special Purpose Acquisition Company, is a publicly traded company with no operational business. Its sole purpose is to raise capital through an Initial Public Offering (IPO) to acquire a private company. Phoenix Acquisition Corp. (PHNX) has explicitly stated its intention to merge with a company operating within the blockchain technology and cryptocurrency space, aiming to directly compete with MicroStrategy's significant Bitcoin holdings and business model.

- SPAC's management team experience and track record: PHNX boasts a team with extensive experience in finance and technology, suggesting a strong foundation for navigating the complexities of the cryptocurrency market. Their previous successes in identifying and developing high-growth companies will be crucial for the SPAC's success.

- SPAC's proposed business model and its potential for disruption: PHNX’s strategy involves acquiring a company poised to leverage innovative blockchain technology for a significant market advantage. This could involve anything from mining operations to developing new financial products based on blockchain. Success hinges on identifying a target company with a truly disruptive technology.

- Comparison of SPAC's proposed strategy to MicroStrategy's existing operations: Unlike MicroStrategy's largely passive approach of holding Bitcoin, PHNX aims to engage in more active participation in the ecosystem, potentially involving mining, developing applications, or creating novel financial products.

- Market analysis of the target industry and its growth potential: The cryptocurrency market remains volatile, but the underlying blockchain technology shows significant long-term growth potential across various sectors. PHNX aims to capitalize on this growth by strategically entering the market with a well-chosen acquisition.

- Specific keywords: SPAC merger, de-SPAC, target company, competitive advantage, market share

MicroStrategy's Position and Potential Vulnerabilities

MicroStrategy has established itself as a major player in the Bitcoin market, holding a substantial amount of Bitcoin on its balance sheet. This strategy, however, presents inherent risks.

- MicroStrategy's financial performance and its reliance on Bitcoin: MicroStrategy's financial performance is intrinsically linked to the price of Bitcoin. A significant downturn in Bitcoin's price could severely impact its financial stability.

- Risks associated with Bitcoin's price volatility: The cryptocurrency market is notoriously volatile, making MicroStrategy's Bitcoin holdings a significant source of both potential profit and significant loss.

- Potential regulatory challenges facing MicroStrategy's Bitcoin holdings: The regulatory landscape surrounding cryptocurrencies is constantly evolving, and changes in regulations could negatively affect MicroStrategy's holdings.

- Competitive landscape and potential emerging threats: While MicroStrategy holds a prominent position, the cryptocurrency market is dynamic, with new players and technologies constantly emerging that could challenge its dominance.

- Specific keywords: Bitcoin price, regulatory risk, financial stability, market capitalization, competitive landscape

Evaluating the Risks and Rewards of Investing in the SPAC

Investing in a SPAC like PHNX offers the potential for high rewards but also carries substantial risk. The success of PHNX is entirely dependent on successfully identifying and acquiring a target company that can deliver on its promises.

- Risk assessment of the SPAC's business model and market entry strategy: The success of the SPAC hinges on the chosen acquisition target’s ability to compete effectively. Thorough due diligence is crucial in assessing this risk.

- Potential for high returns versus the possibility of significant losses: The SPAC model inherently involves high risk and potential for significant losses if the chosen acquisition fails to meet expectations.

- Liquidity considerations and the potential for illiquidity: SPACs can be illiquid, especially before a merger is finalized. Investors should be prepared for the possibility of limited trading opportunities.

- Comparison of the SPAC's risk profile to other investment options: Compared to traditional investments, PHNX presents a higher-risk, higher-reward profile. Investors should consider their risk tolerance carefully.

- Specific keywords: Investment risk, return on investment (ROI), due diligence, risk management, diversification

Due Diligence and Investor Considerations

Before investing in PHNX, thorough due diligence is paramount. This includes:

- Reviewing the SPAC's offering documents and financial statements: Carefully examine all publicly available information, including the prospectus and financial statements.

- Assessing the management team's credibility and experience: Research the background and track record of the management team to assess their competence and ability to execute their strategy.

- Understanding the risks and uncertainties associated with the investment: Be fully aware of the inherent risks involved in investing in a SPAC, particularly in the volatile cryptocurrency market.

- Diversifying investments to mitigate risk: Never put all your eggs in one basket. Diversify your investment portfolio to reduce overall risk.

- Seeking advice from financial professionals: Consult with a qualified financial advisor to discuss the suitability of this investment for your personal circumstances.

- Specific keywords: Investment strategy, financial advisor, due diligence checklist, risk mitigation, investment portfolio

Conclusion

This analysis has examined the key factors to consider when deciding whether to invest in Phoenix Acquisition Corp. (PHNX), the SPAC challenging MicroStrategy's dominance. While the potential for high rewards exists, the inherent risks associated with SPACs and the volatility of the cryptocurrency market cannot be ignored. The success of PHNX is entirely contingent on the successful identification and integration of a strong target company.

Call to Action: Before making any investment decisions regarding PHNX or similar ventures targeting the market held by MicroStrategy, conducting thorough due diligence and seeking professional financial advice is crucial. Remember, careful research is essential before investing in any SPAC, especially one competing with established players like MicroStrategy.

Featured Posts

-

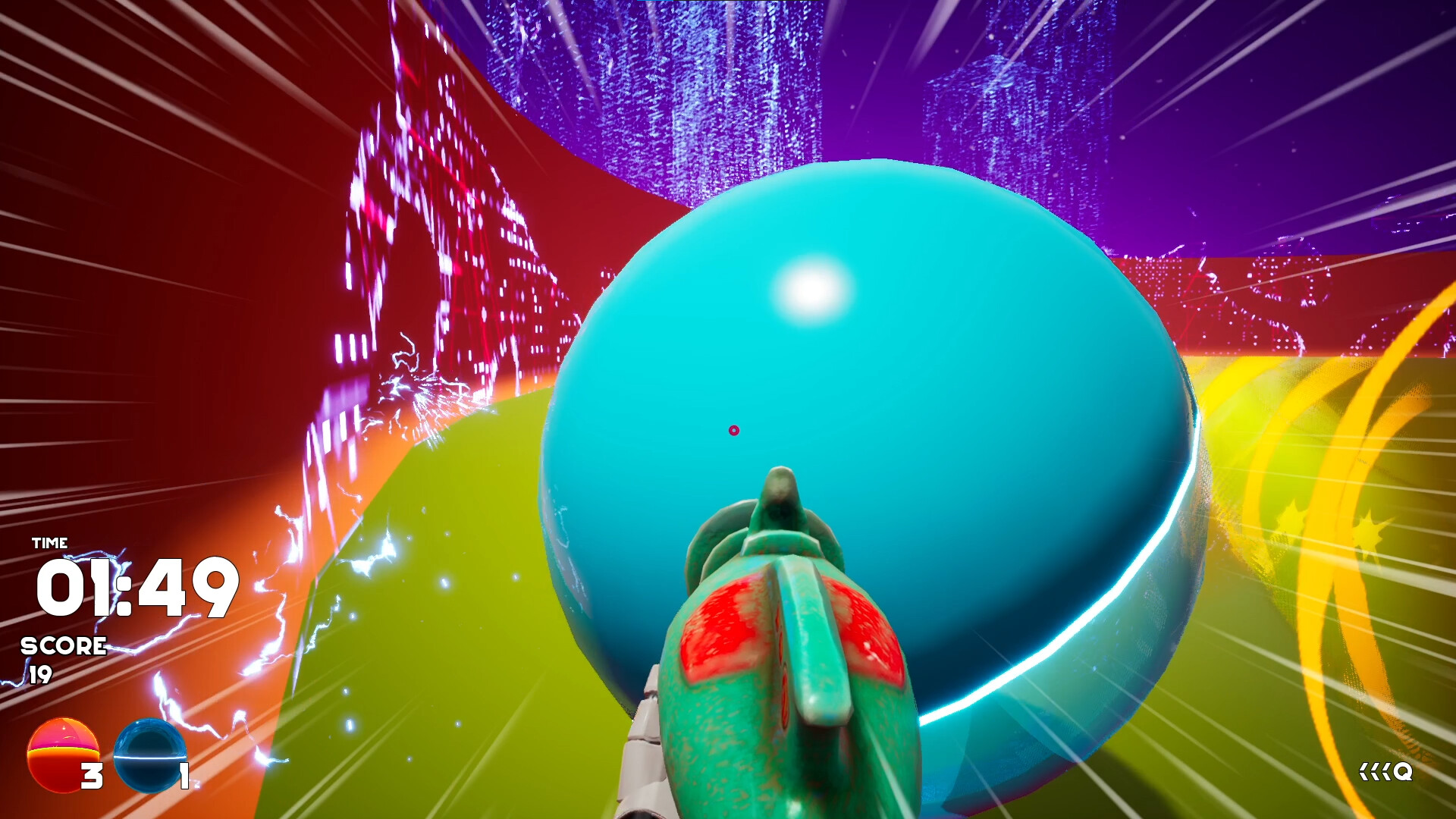

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 09, 2025

The Bubble Blasters And Other Chinese Goods Trade Chaos And Its Impact

May 09, 2025 -

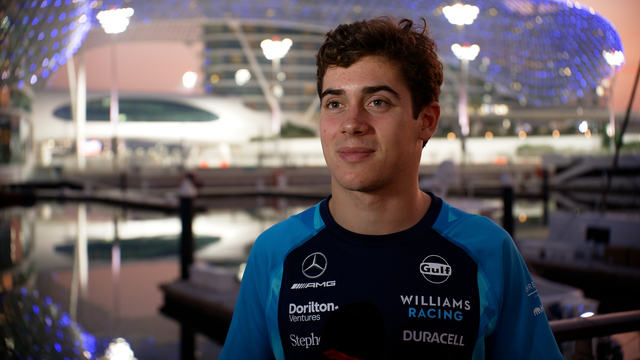

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025

Formula 1s Next Star Colapinto Emerges As Strong Contender

May 09, 2025 -

Who Is Casey Means Trumps Nominee For Surgeon General Explained

May 09, 2025

Who Is Casey Means Trumps Nominee For Surgeon General Explained

May 09, 2025 -

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025

Public Access To Jeffrey Epstein Files Evaluating Ag Pam Bondis Choice

May 09, 2025 -

Trumps Ag Delivers Chilling Message To Political Foes

May 09, 2025

Trumps Ag Delivers Chilling Message To Political Foes

May 09, 2025

Latest Posts

-

Wynne Evans Health Battle Recovery Progress And Future Plans

May 09, 2025

Wynne Evans Health Battle Recovery Progress And Future Plans

May 09, 2025 -

Show Of Support For Wynne Evans As He Addresses Allegations

May 09, 2025

Show Of Support For Wynne Evans As He Addresses Allegations

May 09, 2025 -

Wynne Evans Illness Recovery Update And Speculation On Showbiz Return

May 09, 2025

Wynne Evans Illness Recovery Update And Speculation On Showbiz Return

May 09, 2025 -

Singer Wynne Evans Shares Health Update Following Serious Illness

May 09, 2025

Singer Wynne Evans Shares Health Update Following Serious Illness

May 09, 2025 -

Go Compare Advert Star Wynne Evans And The Strictly Fallout

May 09, 2025

Go Compare Advert Star Wynne Evans And The Strictly Fallout

May 09, 2025