Should You Invest In XRP (Ripple) While It's Trading Below $3?

Table of Contents

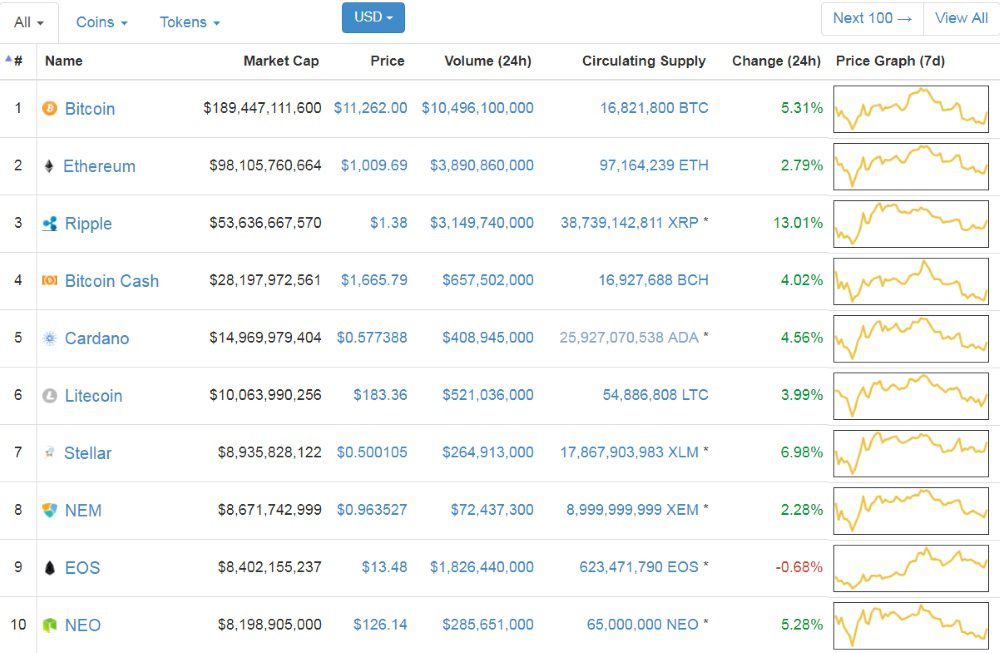

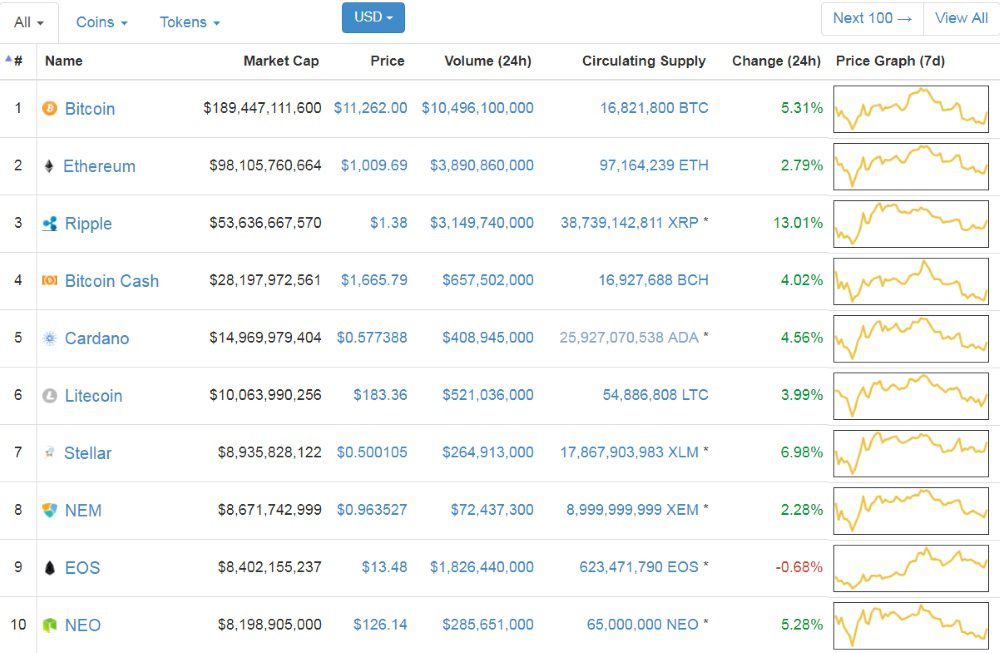

XRP's Current Market Position and Price Analysis

Understanding XRP's current market position requires a comprehensive look at both technical and fundamental factors.

Technical Analysis: XRP Price Prediction and Indicators

Analyzing XRP's price charts reveals several key indicators. Currently, the price seems to be consolidating within a specific range, with support levels around [Insert current support level] and resistance at [Insert current resistance level]. Trading volume is [Describe trading volume - high, low, increasing, decreasing etc.], suggesting [Interpret the meaning of the trading volume]. The Relative Strength Index (RSI) is currently at [Insert RSI value], indicating [Overbought, oversold, neutral - and its implications]. Other technical indicators like the Moving Average Convergence Divergence (MACD) should also be considered for a more complete picture. Accurate XRP price prediction requires careful observation of these trends over time.

Fundamental Analysis: RippleNet, ODL, and Institutional Adoption of XRP

Beyond technical charts, Ripple's fundamental strength significantly influences XRP's value. RippleNet, Ripple's global payment network, continues to gain traction, facilitating cross-border transactions for numerous financial institutions. The On-Demand Liquidity (ODL) solution, using XRP for faster and cheaper payments, is a key driver of adoption. Several major financial institutions have partnered with Ripple, showcasing the growing acceptance of XRP within the traditional financial sector. Analyzing the growth of RippleNet and ODL adoption provides valuable insights into XRP's long-term potential.

- Key Technical Indicators: RSI, MACD, support and resistance levels, trading volume.

- Significant Partnerships: List notable partnerships between Ripple and financial institutions.

- Recent News: Summarize any recent positive or negative news impacting XRP's price.

The SEC Lawsuit and its Impact on XRP's Price

The ongoing SEC lawsuit against Ripple significantly impacts XRP's price and investment outlook.

Understanding the SEC Case: SEC vs Ripple and XRP Lawsuit Update

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal laws. Ripple counters that XRP is a currency and not a security. The outcome of this case holds significant weight for the future of XRP. Staying abreast of "XRP lawsuit updates" is crucial for any investor.

Potential Outcomes and Their Impact on Price: XRP Price After Lawsuit

Several scenarios could unfold:

-

Ripple Wins: A Ripple victory could potentially send XRP's price soaring, as regulatory uncertainty would be significantly reduced.

-

Settlement: A settlement could result in a mixed reaction, depending on the terms of the agreement.

-

SEC Wins: An SEC victory could severely impact XRP's price, potentially leading to delisting from major exchanges and a significant loss of value.

-

Key Arguments: Summarize the main points from both the SEC and Ripple's arguments.

-

Price Impact: Detail the potential price fluctuations associated with each outcome.

-

Expert Opinions: Mention analysis from financial experts regarding the likelihood of each outcome.

Risk Assessment and Diversification

Investing in XRP involves considerable risk.

Risks of Investing in XRP: XRP Risk and Cryptocurrency Risk

XRP, like other cryptocurrencies, is highly volatile. The ongoing legal uncertainty surrounding XRP adds another layer of risk. The cryptocurrency market is notoriously unpredictable, and there's always the potential for a complete loss of investment. Considering "investing in XRP risks" is paramount.

Diversification Strategies: Portfolio Diversification and Risk Management

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket. A well-diversified portfolio should include a variety of asset classes, such as stocks, bonds, and other cryptocurrencies, to balance out the volatility of XRP.

- Key Risks: Volatility, regulatory uncertainty, potential for complete loss.

- Diversification Strategies: Asset allocation across different asset classes.

- Alternative Investments: Suggest lower-risk investment options.

Conclusion: Should You Invest in XRP (Ripple) While It's Trading Below $3?

In conclusion, whether or not you should invest in XRP while it's trading below $3 is a complex question with no easy answer. The potential for growth is there, fueled by RippleNet's expansion and the utility of XRP within its ecosystem. However, the significant risks associated with the ongoing SEC lawsuit and the inherent volatility of the cryptocurrency market cannot be ignored. While XRP's price presents an attractive entry point for some, careful consideration of the "investing in XRP risks" is essential.

While XRP presents potential for growth, it's crucial to carefully weigh the risks before investing. Ultimately, the decision of whether or not to invest in XRP while it's trading below $3 remains entirely yours. Conduct thorough research and seek professional financial advice before making any investment decisions.

Featured Posts

-

Roden Loos Alarm Na Melding Gaslucht

May 01, 2025

Roden Loos Alarm Na Melding Gaslucht

May 01, 2025 -

Six Nations 2025 Can France Continue Its Success

May 01, 2025

Six Nations 2025 Can France Continue Its Success

May 01, 2025 -

9 Distinguishing Features Target Starbucks Vs Independent Locations

May 01, 2025

9 Distinguishing Features Target Starbucks Vs Independent Locations

May 01, 2025 -

Lich Thi Dau Va Kenh Phat Song Vong Chung Ket Thaco Cup 2025

May 01, 2025

Lich Thi Dau Va Kenh Phat Song Vong Chung Ket Thaco Cup 2025

May 01, 2025 -

Million Pound Giveaway Scandal Investigation Into Michael Sheen And Channel 4s Role

May 01, 2025

Million Pound Giveaway Scandal Investigation Into Michael Sheen And Channel 4s Role

May 01, 2025