Significant Development: Ivanhoe Withdraws Production Outlook For Congo Copper Mine

Table of Contents

Reasons Behind the Withdrawal

Ivanhoe Mines' decision to withdraw its production forecast for its Congolese copper mine stems from a confluence of factors, underscoring the complex challenges inherent in large-scale mining projects in emerging markets. The company hasn't explicitly detailed every factor, but several key issues have been hinted at in recent statements and industry analyses.

- Delays in Obtaining Necessary Permits: Securing the required permits and licenses for mining operations in the DRC is often a protracted and complex process, subject to bureaucratic hurdles and potential delays. These delays can significantly impact project timelines and costs.

- Unexpected Geological Challenges: Unforeseen geological complexities, such as variations in ore grade or unexpected geological formations, can disrupt mining operations and affect the overall production forecast. This could involve higher than anticipated extraction costs and lower yields.

- Infrastructure Limitations: Inadequate infrastructure, including limited access roads, unreliable power supply, and insufficient water resources, can significantly constrain production capacity and add to operational costs. Upgrading this infrastructure is often a substantial and lengthy undertaking.

- Uncertainties Related to the Congolese Mining Sector's Regulatory Environment: The regulatory environment in the DRC's mining sector has historically been characterized by uncertainty, with potential changes in mining laws and regulations impacting project feasibility and profitability. This unpredictability creates significant risks for investors.

- Impact of Global Economic Conditions: Fluctuations in global commodity prices, particularly copper prices, coupled with macroeconomic instability, can impact the economic viability of a mining project. Changes in global demand can affect investment decisions and future projections.

Impact on Investors and the Market

The withdrawal of the Ivanhoe Congo Copper Mine Production Outlook has had a palpable effect on investor sentiment and market dynamics. The immediate reaction was largely negative, resulting in considerable volatility in Ivanhoe Mines' stock price.

- Stock Price Fluctuations Following the Announcement: The news caused immediate and significant drops in Ivanhoe's share price, reflecting investor uncertainty and concerns about the project's future.

- Investor Sentiment and Potential Sell-offs: Many investors reacted by selling their shares, leading to a decrease in investor confidence in the company's short-term prospects.

- Impact on the Overall Copper Market Supply and Price: While not a dominant player, the potential reduction in copper supply from Ivanhoe's Congolese mine could contribute to upward pressure on copper prices in the long term, depending on the duration of the production halt.

- Alternative Investment Options for Investors: Investors seeking exposure to the copper market may seek alternative investments in companies with less volatile production outlooks or greater operational stability.

- Credit Rating Agencies' Perspectives: Credit rating agencies are likely to review Ivanhoe's credit rating, potentially downgrading it depending on the assessment of the project's risks and the company's response.

Future Outlook and Potential Solutions

While the immediate outlook is uncertain, Ivanhoe Mines has indicated its commitment to the project. The company's success hinges on effective mitigation of the challenges identified.

- Ivanhoe's Communication Strategy Regarding Future Updates: Transparency and regular communication with investors are crucial to maintaining confidence. Timely updates on the progress of addressing the challenges are essential.

- Potential Solutions to Address Operational Challenges: Addressing infrastructure limitations, expediting permit applications, and implementing improved geological surveying techniques are crucial steps. Strategic partnerships with local businesses and government collaboration are also vital.

- Timeline for Resuming Production or Providing a Revised Forecast: A clear and realistic timeline for addressing these challenges and providing a revised production forecast is necessary to reassure investors.

- Exploration of Strategic Partnerships or Investments: Collaboration with experienced mining companies or securing additional investment might be necessary to overcome financial and operational hurdles.

- Contingency Plans to Mitigate Future Risks: Developing robust contingency plans to address potential future disruptions is key to ensuring long-term project viability.

Comparison with other Congolese Mining Projects

It's important to contextualize Ivanhoe's situation within the broader landscape of Congolese copper mining. Many projects face similar challenges, although the extent and severity may vary.

- Performance of Other Major Copper Mining Operations in the DRC: Analyzing the operational performance and challenges faced by other major mining companies operating in the DRC provides valuable insights and benchmarks.

- Comparative Analysis of Operational Challenges and Risks: Comparing the specific challenges faced by Ivanhoe with those experienced by other operators helps to identify industry-wide trends and best practices.

- Industry Trends and Best Practices for Mitigating Risks in the DRC: Learning from the successes and failures of other projects can inform strategies for risk mitigation and operational efficiency.

- Government Policies and Their Impact on Mining Projects: Understanding the impact of government policies, regulations, and political stability on mining projects is crucial for assessing long-term viability.

Conclusion

The withdrawal of the Ivanhoe Congo Copper Mine Production Outlook represents a significant development with far-reaching implications for Ivanhoe Mines, its investors, and the broader copper market. The challenges highlighted underscore the complexities inherent in large-scale mining projects in the DRC, emphasizing the need for robust risk management strategies, effective government collaboration, and transparent communication. While the short-term outlook remains uncertain, the company's long-term success hinges on effectively addressing the identified challenges. To stay informed about further developments concerning the Ivanhoe Congo Copper Mine Production Outlook, follow Ivanhoe Mines' official announcements and reputable news sources covering the mining industry. For the latest updates, visit the Ivanhoe Mines investor relations page [Insert Link Here].

Featured Posts

-

Planning Your Trip To Wrexham What To See And Do

May 28, 2025

Planning Your Trip To Wrexham What To See And Do

May 28, 2025 -

Abd Ekonomisi Mart Ayinda Tueketici Kredilerindeki Yuekselis

May 28, 2025

Abd Ekonomisi Mart Ayinda Tueketici Kredilerindeki Yuekselis

May 28, 2025 -

Romes Champion Pushing Boundaries Maintaining Momentum

May 28, 2025

Romes Champion Pushing Boundaries Maintaining Momentum

May 28, 2025 -

2025 Mlb Padres Host Braves In Wild Card Rematch

May 28, 2025

2025 Mlb Padres Host Braves In Wild Card Rematch

May 28, 2025 -

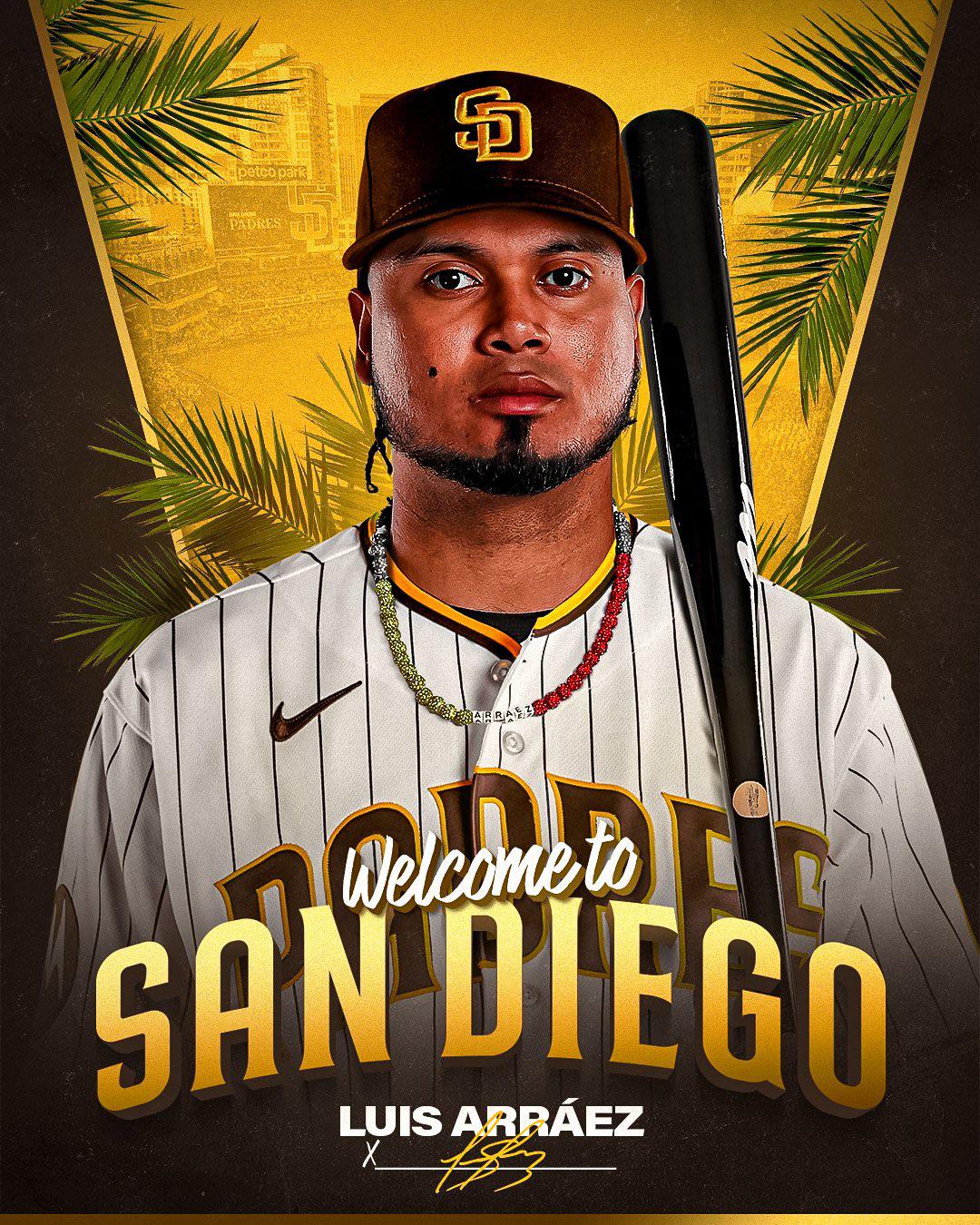

San Diego Padres Welcome Back Luis Arraez And Jason Heyward

May 28, 2025

San Diego Padres Welcome Back Luis Arraez And Jason Heyward

May 28, 2025