Simplified Dividend Investing: High Returns Made Easy

Table of Contents

Understanding Dividend Investing Basics

What are Dividends?

Dividends are payments made by a company to its shareholders, representing a share of the company's profits. This regular income stream is a key attraction for many investors. Unlike relying solely on capital appreciation (the increase in a stock's price), dividends provide a consistent cash flow.

- Regular income stream: Dividends offer a predictable source of income, supplementing other income streams.

- Potential for capital appreciation: While dividends are a key benefit, the value of your stock holdings can also increase over time, leading to capital gains.

- Reinvestment options: Many companies offer Dividend Reinvestment Plans (DRIPs), allowing you to automatically reinvest your dividends to buy more shares, accelerating your wealth-building.

Keywords: Dividend yield, dividend payout ratio, dividend growth stocks

Types of Dividend Stocks

Different types of dividend stocks cater to diverse investment goals and risk tolerances.

- High-yield dividend stocks: These stocks offer a high dividend yield, meaning a larger percentage of the stock price is paid out as dividends. However, higher yields often come with higher risk.

- Growth dividend stocks: These companies prioritize both dividend growth and overall business growth. They may have lower initial yields but offer the potential for significant long-term dividend increases.

- Blue-chip dividend stocks: These are established, large-cap companies with a long history of paying consistent dividends. They are often considered less risky than other dividend stocks.

Examples: High-yield sectors might include real estate investment trusts (REITs), while consumer staples often represent stable blue-chip options. Growth dividend stocks are more spread out across various sectors. Consider researching specific examples like Johnson & Johnson (JNJ) or Coca-Cola (KO) as examples of established dividend payers.

Keywords: High-yield dividend stocks, blue-chip stocks, dividend aristocrats, growth stocks

The Power of Dividend Reinvestment

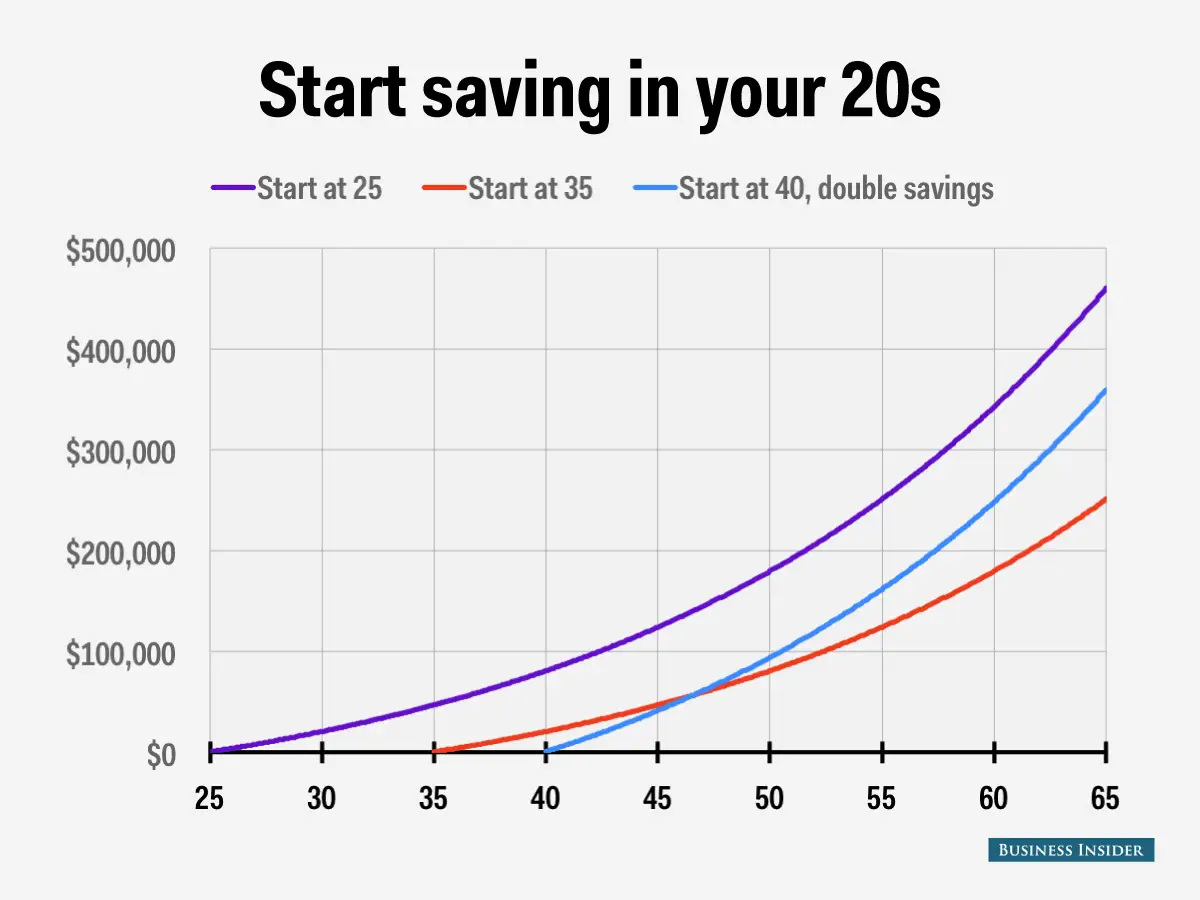

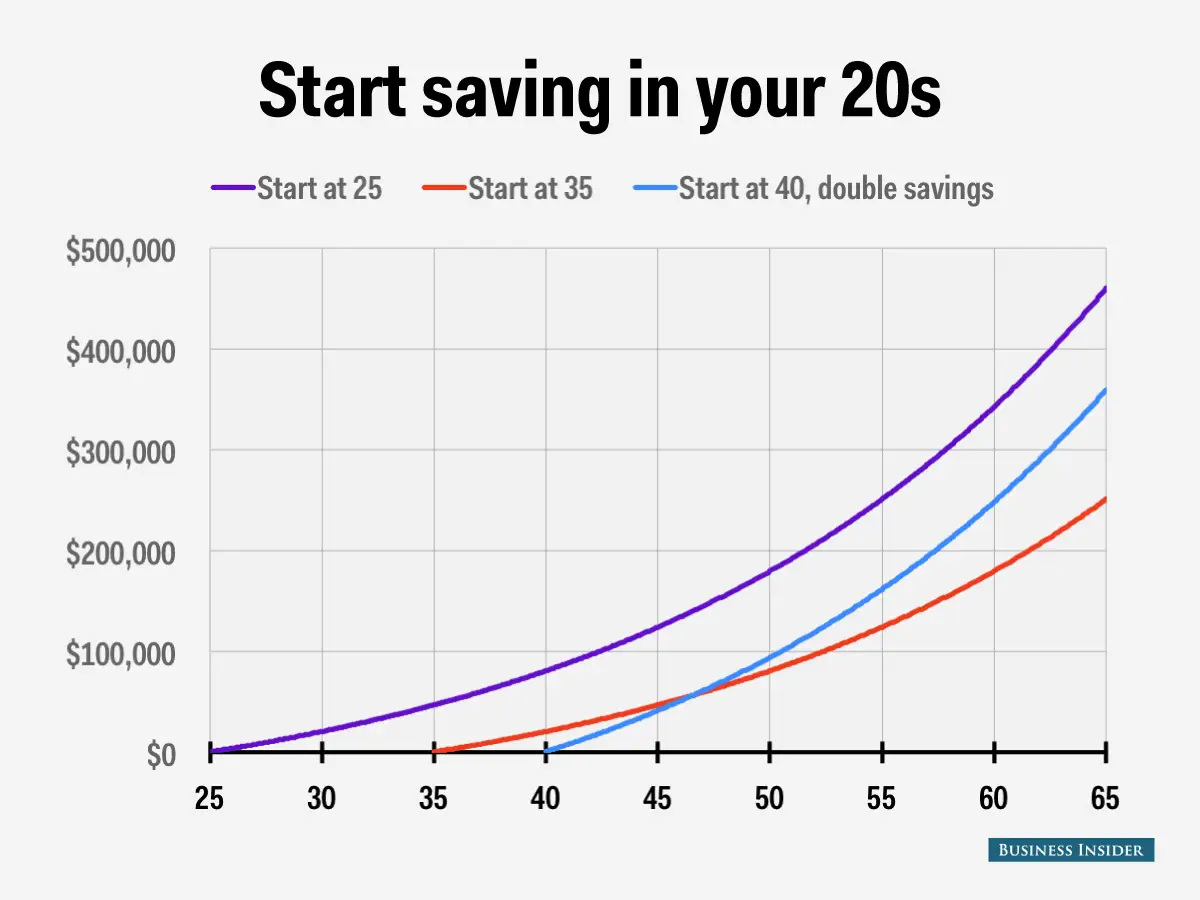

Reinvesting your dividends is a powerful strategy for wealth creation. This technique allows you to take advantage of the magic of compounding.

- Compounding returns: Reinvesting dividends allows you to buy more shares, generating even more dividends in the future. This effect snowballs over time, significantly increasing your overall returns.

- Long-term wealth building: Consistent reinvestment, even with small amounts, contributes significantly to your portfolio's growth over the long term.

- Minimizing transaction fees: DRIPs often eliminate or reduce brokerage fees associated with buying additional shares.

Keywords: Dividend reinvestment plans (DRIPs), compounding interest, long-term investment strategy

Finding High-Yield Dividend Stocks

Screening for Quality Dividend Stocks

Identifying strong dividend-paying companies requires careful analysis. Don't just chase the highest yield. Focus on quality.

- Analyzing financial statements: Review key financial metrics like the dividend payout ratio (the percentage of earnings paid out as dividends), debt levels, and profitability. A sustainable payout ratio is crucial.

- Assessing dividend history: Examine the company's history of dividend payments. Consistency is key. Look for companies with a long track record of increasing dividends, indicating financial strength.

- Considering company fundamentals: Analyze the company's business model, competitive landscape, and overall financial health. A strong and growing business is more likely to sustain its dividend payments.

Keywords: Fundamental analysis, dividend payout ratio, dividend growth rate, financial statements

Utilizing Online Resources

Several valuable tools and resources can assist your research.

- Stock screeners: Many financial websites offer stock screeners that allow you to filter stocks based on specific criteria, such as dividend yield, payout ratio, and market capitalization.

- Financial news websites: Stay informed about company news and financial performance through reputable financial news sources.

- SEC EDGAR database: Access company filings directly through the Securities and Exchange Commission's EDGAR database for in-depth financial information.

- Dividend tracking tools: Dedicated dividend tracking websites and software can help monitor your dividend income and analyze your portfolio performance.

Keywords: Stock screeners, financial websites, SEC EDGAR database, dividend tracking tools

Diversifying Your Portfolio

Diversification is essential for managing risk. Don't put all your eggs in one basket!

- Investing across sectors: Spread your investments across different industries to reduce the impact of sector-specific downturns.

- Avoiding over-concentration: Don't invest heavily in a single stock, even if it seems promising. Diversification protects your portfolio from significant losses if one investment performs poorly.

- Benefits of index funds and ETFs: Consider index funds or ETFs that track a broad market index like the S&P 500, providing instant diversification across many companies.

Keywords: Portfolio diversification, risk management, index funds, ETFs, sector diversification

Building a Simplified Dividend Investing Strategy

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a simple yet effective strategy.

- Regular investments: Invest a fixed amount of money at regular intervals (e.g., monthly or quarterly), regardless of market fluctuations.

- Averaging the purchase price: DCA helps mitigate the risk of investing a large sum of money at a market peak. By averaging your purchase price over time, you reduce the impact of market volatility.

Keywords: Dollar-cost averaging, investment strategy, risk mitigation

Setting Realistic Goals and Expectations

Success in dividend investing requires a long-term perspective.

- Long-term perspective: Dividend investing is a marathon, not a sprint. Focus on building wealth steadily over time.

- Managing expectations: Market volatility is inevitable. Don't expect consistent high returns every year.

- Understanding market volatility: Be prepared for fluctuations in both stock prices and dividend payments.

Keywords: Financial goals, investment timeline, risk tolerance

Seeking Professional Advice (When Necessary)

While dividend investing can be relatively straightforward, seeking professional guidance can be beneficial in certain situations.

- Complex financial situations: If you have complex financial needs or a high-net-worth portfolio, consulting a financial advisor can provide personalized strategies and guidance.

- Need for personalized investment strategies: A financial advisor can help tailor an investment plan to your specific financial goals, risk tolerance, and time horizon.

Keywords: Financial advisor, investment planning, personalized investment strategies

Conclusion

Simplified dividend investing offers a compelling path to building long-term wealth and generating passive income. By understanding dividend basics, identifying quality stocks, diversifying your portfolio, and employing strategies like dollar-cost averaging, you can create a robust and potentially high-yielding investment strategy. Remember to always research and understand the risks involved before investing.

Call to Action: Start your journey towards financial freedom with simplified dividend investing today! Explore high-yield dividend stocks and build a passive income stream. Learn more about dividend investing strategies and start building your portfolio now.

Featured Posts

-

L Avis De Gerard Hernandez Sur Chantal Ladesou Sa Partenaire Dans Scenes De Menages

May 11, 2025

L Avis De Gerard Hernandez Sur Chantal Ladesou Sa Partenaire Dans Scenes De Menages

May 11, 2025 -

Sylvester Stallones Armor A Free Action Thriller Streaming Now

May 11, 2025

Sylvester Stallones Armor A Free Action Thriller Streaming Now

May 11, 2025 -

Shevchenkos Ufc 315 Fight Fiorots Tough Retirement Test

May 11, 2025

Shevchenkos Ufc 315 Fight Fiorots Tough Retirement Test

May 11, 2025 -

Thomas Mueller Quitte Le Bayern Munich Apres 25 Ans La Fin D Une Ere

May 11, 2025

Thomas Mueller Quitte Le Bayern Munich Apres 25 Ans La Fin D Une Ere

May 11, 2025 -

Manon Fiorot A Deep Dive Into The French Fighters Career

May 11, 2025

Manon Fiorot A Deep Dive Into The French Fighters Career

May 11, 2025