SMFG In Talks To Acquire Yes Bank Stake: Sources

Table of Contents

The Potential Acquisition: Details and Speculation

Sources suggest SMFG is exploring a substantial stake acquisition in Yes Bank. While the exact percentage remains undisclosed, speculation points towards a significant shareholding that could reshape the Indian banking landscape. The deal's valuation is equally shrouded in secrecy, with analysts speculating figures in the range of several billion dollars. This uncertainty underscores the complexity of the negotiations and the significant financial weight involved.

-

Acquisition Details: Sources suggest the acquisition could involve a combination of primary and secondary share purchases, potentially diluting existing shareholder stakes. The intricacies of this structure remain unclear, adding another layer of complexity to the deal.

-

Negotiation Stages: Negotiations are reportedly in the advanced stages, with due diligence processes likely underway. This intensive process will involve a thorough examination of Yes Bank's financial health, assets, and liabilities to determine the true value and risks associated with the investment.

-

Regulatory Hurdles: Securing regulatory approvals from both the Reserve Bank of India (RBI) and relevant Japanese authorities presents a significant hurdle. This approval process can be lengthy and demanding, potentially delaying or even derailing the acquisition.

Why SMFG Might Be Interested in Yes Bank

SMFG's interest in Yes Bank stems from a strategic rationale involving multiple factors. The acquisition presents a compelling opportunity for the Japanese financial giant to expand its global reach and tap into the burgeoning Indian market.

-

Strategic Rationale: SMFG seeks to expand its international footprint, particularly in rapidly growing emerging markets like India. This move aligns with the broader trend of global financial institutions seeking diversification and access to new growth avenues.

-

Market Entry: Acquiring a stake in Yes Bank offers a strategic entry point into India's sizeable banking sector, bypassing the challenges of establishing a new entity from scratch. Yes Bank's existing infrastructure and customer base provides a ready-made platform for expansion.

-

Growth Opportunities & Potential Returns: Yes Bank's existing infrastructure and large customer base represent significant growth opportunities for SMFG. The potential for high returns on investment in a recovering Indian economy is a major incentive. Moreover, Yes Bank's existing technological infrastructure and expertise could be leveraged by SMFG.

Potential Challenges and Risks for SMFG

Despite the potential rewards, SMFG faces considerable challenges and risks in pursuing this acquisition. These challenges extend beyond the mere financial aspects, encompassing regulatory hurdles and the inherent complexities of integrating a struggling institution.

-

Regulatory Hurdles: Securing regulatory approvals in India can be a complex and time-consuming process, subject to stringent scrutiny. Meeting the RBI's requirements for foreign investment in the Indian banking sector is paramount.

-

Yes Bank's Financial Health: Yes Bank's past financial troubles pose significant risks related to asset quality and potential liabilities. A thorough assessment of these risks is essential before proceeding with the acquisition.

-

Political Risks & Integration Challenges: Navigating the political and economic landscape in India requires careful consideration. Successfully integrating Yes Bank into SMFG's existing operations will present considerable logistical and cultural challenges.

Implications for Yes Bank and the Indian Banking Sector

The potential acquisition carries significant implications for both Yes Bank and the broader Indian banking sector. The outcome of these negotiations could significantly influence the stability and future direction of the Indian financial landscape.

-

Yes Bank's Future: A successful acquisition by SMFG could inject much-needed capital into Yes Bank, potentially facilitating its recovery and long-term viability. This capital infusion could stabilize its operations and attract further investment.

-

Market Stability & Foreign Investment: The deal might enhance Yes Bank's financial stability and improve its credit rating, boosting investor confidence in both the bank and the Indian banking sector as a whole. Foreign investment from a reputable institution like SMFG could signal a renewed confidence in India's financial health.

-

Indian Banking Landscape: The acquisition could lead to increased competition and innovation within the Indian banking landscape, potentially stimulating growth and modernization across the sector.

Conclusion

The potential acquisition of a significant stake in Yes Bank by SMFG represents a major development in the Indian banking sector. While the deal presents significant opportunities for both SMFG and Yes Bank, navigating regulatory hurdles and addressing inherent financial risks are crucial for a successful outcome. The implications for the broader Indian banking sector are substantial, potentially influencing investor sentiment and competition. The SMFG investment in Yes Bank, if successful, could signal a new era of foreign investment and strategic partnerships in Indian banking.

Call to Action: Stay updated on the evolving situation surrounding the potential SMFG-Yes Bank acquisition. Further developments and analyses on this significant SMFG investment and the future of Yes Bank will be crucial to watch. Continue following this story for the latest updates on the SMFG and Yes Bank deal.

Featured Posts

-

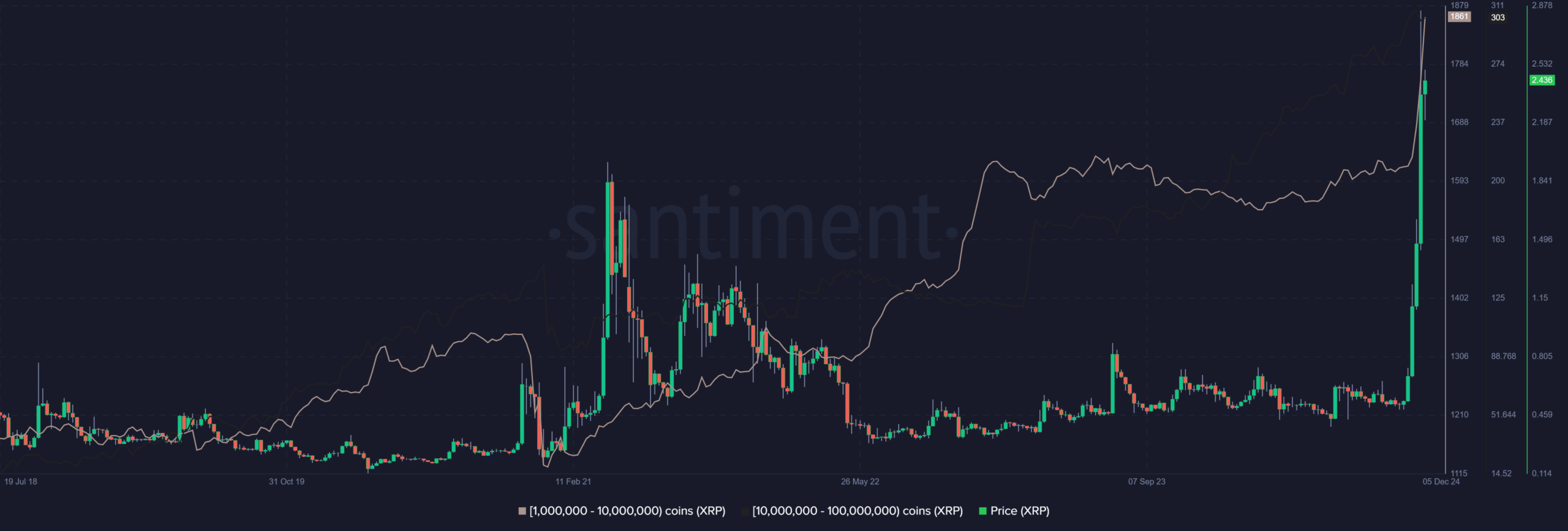

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 07, 2025

Significant Xrp Purchase Whale Transaction Sparks Market Speculation

May 07, 2025 -

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025

Timberwolves Randle Revelation What The Knicks Missed

May 07, 2025 -

Twsye Shbkt Alkhtwt Almlkyt Almghrbyt Almzyd Mn Alrhlat Byn Saw Bawlw Waldar Albydae

May 07, 2025

Twsye Shbkt Alkhtwt Almlkyt Almghrbyt Almzyd Mn Alrhlat Byn Saw Bawlw Waldar Albydae

May 07, 2025 -

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 07, 2025

Los Angeles Wildfires A Reflection Of Our Times Through The Lens Of Betting Markets

May 07, 2025 -

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025

V Kocanih In Drugod Pokop Zrtev Pozara V Nocnem Klubu

May 07, 2025