Solana's Trading Volume Lags Behind XRP As ETF Anticipation Builds

Table of Contents

XRP's Trading Volume Surge: Factors Driving the Growth

XRP's recent surge in trading volume can be attributed to several key factors, particularly the growing anticipation surrounding crypto ETF approvals.

Increased Institutional Interest

Institutional investors are increasingly showing interest in XRP, potentially fueled by the prospect of ETF approval. This increased institutional investment is a crucial driver of XRP's trading volume.

- Grayscale's XRP Trust: The existence of a Grayscale XRP Trust, although currently not trading on major exchanges, signifies institutional interest.

- Partnerships and Integrations: XRP's integration into various payment platforms and its partnerships with financial institutions are contributing to broader adoption and increased trading activity.

- Regulatory Developments: While still evolving, any positive regulatory developments concerning XRP could further fuel institutional confidence and investment.

- Data Point: Reports suggest a significant percentage increase (hypothetical example: 30%) in institutional holdings of XRP over the past quarter.

ETF Approval Expectations

The anticipation of XRP ETF approval is undeniably a major catalyst for the increased trading volume. The potential benefits are substantial:

- Increased Liquidity: ETF approval would dramatically increase the liquidity of XRP, making it easier to buy and sell.

- Price Appreciation: Market sentiment suggests a strong likelihood of XRP's price appreciating following ETF approval.

- Expert Opinion: Many market analysts predict a significant jump in XRP trading volume upon ETF approval, citing increased accessibility and investor confidence.

Growing Use Cases for XRP

XRP's practical applications contribute to its sustained trading volume. Its utility in real-world scenarios boosts confidence and demand.

- Remittances: XRP's speed and low transaction fees make it attractive for cross-border payments and remittances.

- Cross-border Payments: Several financial institutions are utilizing XRP for faster and cheaper international transactions.

- Other Applications: XRP is finding use cases in various other financial sectors, solidifying its utility and driving demand.

Solana's Trading Volume: Challenges and Opportunities

Despite its potential, Solana's trading volume currently lags behind XRP. Several factors contribute to this:

Network Congestion and Scalability Issues

Solana has experienced periods of network congestion and scalability issues in the past. These issues negatively impacted user experience and deterred potential investors.

- Past Outages: Specific instances of network outages or significant slowdowns have been documented and publicized.

- Impact on User Experience: These issues have led to frustrated users and a perception of unreliability, impacting trading activity.

Competition within the Ecosystem

Solana faces intense competition from other layer-1 blockchains vying for market share.

- Competing Blockchains: Ethereum, Cardano, Avalanche, and others all compete for developer attention and user adoption.

- Market Share: Solana's current market share compared to competitors directly impacts its overall trading volume.

Lack of Institutional Adoption (Compared to XRP)

Solana's institutional adoption lags significantly compared to XRP, potentially hindering its trading volume growth.

- Regulatory Uncertainty: Uncertainty surrounding the regulatory landscape for Solana may deter institutional investors.

- Lack of Established Infrastructure: The lack of established infrastructure for institutional-grade trading in Solana could be a deterrent.

The Impact of ETF Approvals on Solana and XRP

The approval of crypto ETFs will likely have a significant impact on both Solana and XRP, but the magnitude and direction of the impact will differ.

- XRP: A positive impact on XRP's trading volume and price is highly anticipated due to increased accessibility and institutional involvement.

- Solana: The impact on Solana is less certain and depends on its ability to overcome its existing challenges and attract institutional investment. Increased market volatility is expected regardless.

Increased market volatility is anticipated for both cryptocurrencies following ETF approval, regardless of their individual responses.

Conclusion: Solana's Path Forward Amidst XRP's ETF-Fueled Growth

This analysis reveals a clear disparity between XRP's and Solana's current trading volumes, significantly influenced by the anticipation of crypto ETF approvals. XRP benefits from increased institutional interest, growing real-world use cases, and the positive market sentiment surrounding ETF approval. In contrast, Solana faces challenges related to network scalability, competition, and comparatively lower institutional adoption.

The approval of crypto ETFs will likely further exacerbate this gap, at least in the short term. However, Solana still possesses significant potential. Overcoming its network challenges, attracting institutional investment, and focusing on clear use cases will be crucial for driving up Solana trading volume and competing effectively in the evolving cryptocurrency landscape. Stay informed about developments concerning Solana trading volume, XRP trading volume, and crypto ETF approvals by subscribing to our newsletter or following us on social media for further in-depth analysis.

Featured Posts

-

Bitcoin Rally Analyst Predicts Start Of Upward Trend May 6th Chart Analysis

May 08, 2025

Bitcoin Rally Analyst Predicts Start Of Upward Trend May 6th Chart Analysis

May 08, 2025 -

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025

Este Betis Historico Analisis De Una Temporada Epica

May 08, 2025 -

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025 -

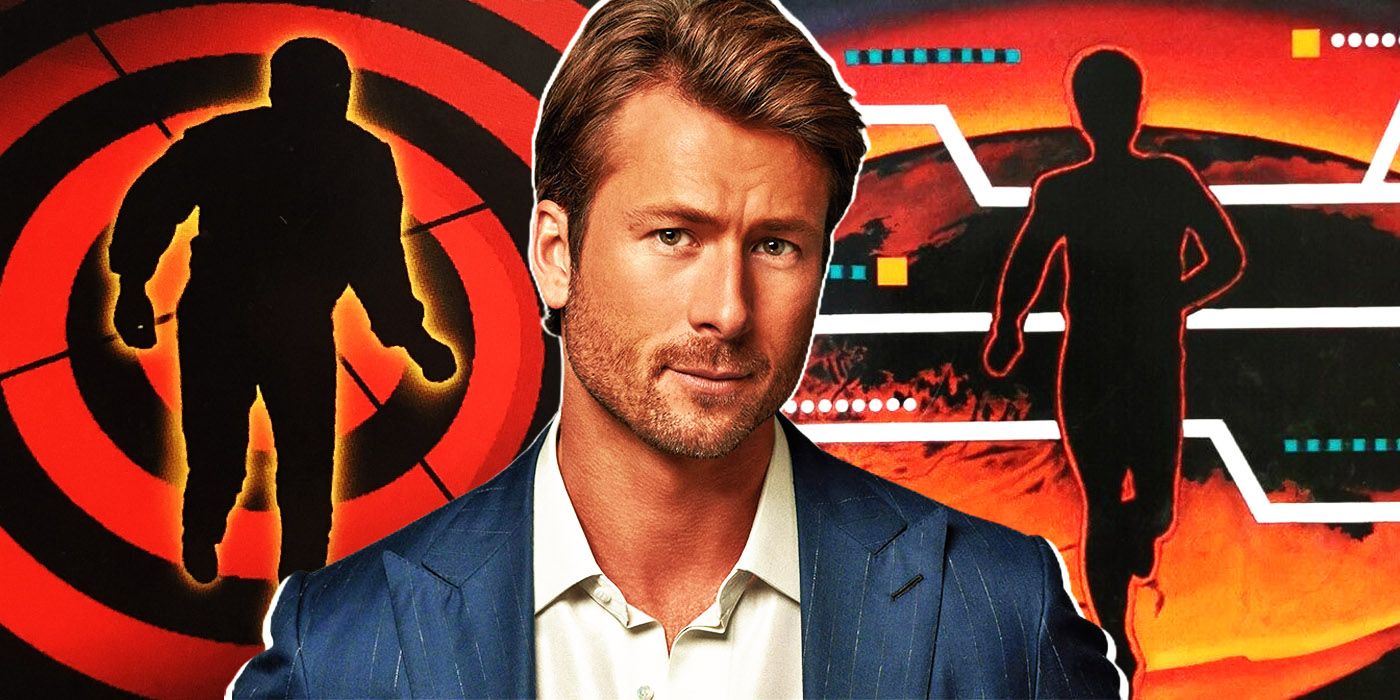

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025

Glen Powells Fitness Regime And Character Development In The Running Man

May 08, 2025 -

222 Milione Euro Historia E Plote E Transferimit Te Neymar Te Psg

May 08, 2025

222 Milione Euro Historia E Plote E Transferimit Te Neymar Te Psg

May 08, 2025

Latest Posts

-

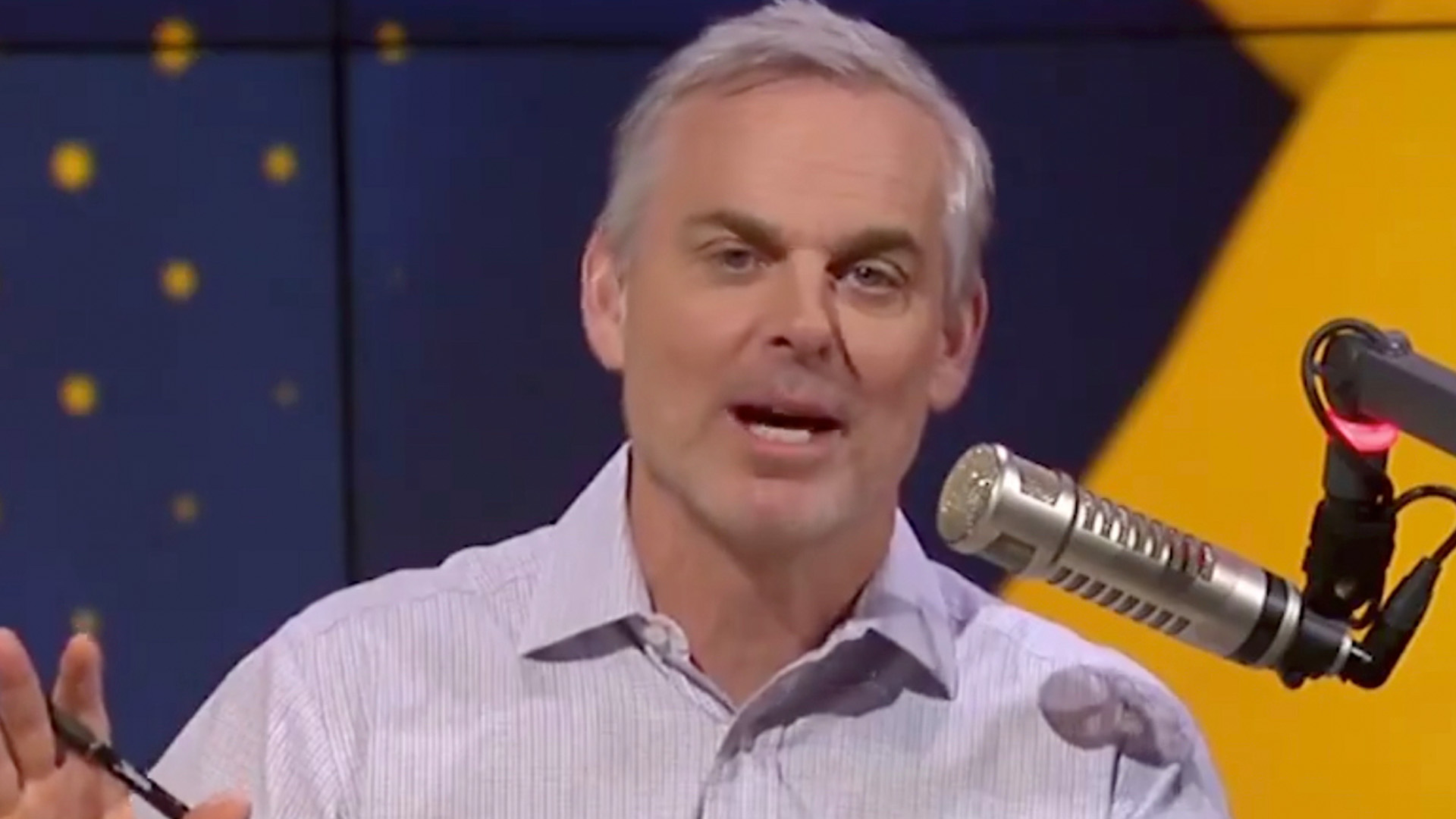

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025 -

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025

Cowherds Persistent Attacks On Jayson Tatum An Analysis

May 08, 2025 -

Colin Cowherd Remains Critical Of Jayson Tatums Performance

May 08, 2025

Colin Cowherd Remains Critical Of Jayson Tatums Performance

May 08, 2025 -

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025

Colin Cowherds Continued Criticism Of Jayson Tatum

May 08, 2025 -

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025

Universal Credit Understanding And Reclaiming Hardship Payment Overpayments

May 08, 2025