Solid Corporate Earnings: A Temporary Trend?

Table of Contents

Factors Contributing to Current Solid Corporate Earnings

Several interconnected factors have contributed to the recent surge in solid corporate earnings. Understanding these factors is crucial to predicting the future trajectory of corporate profitability.

Inflationary Pricing Power

Many companies have successfully passed increased costs onto consumers, boosting profit margins despite rising input prices. This "inflationary pricing power" has been a key driver of strong earnings.

- Examples: Industries like packaged foods, pharmaceuticals, and energy have demonstrated significant pricing power, successfully raising prices without drastically impacting demand.

- Limitations: This strategy is not sustainable indefinitely. Excessive price increases can lead to consumer backlash, reduced demand, and ultimately, damage brand loyalty. The elasticity of demand varies greatly across industries and products.

- Risks: A sharp decline in consumer spending or the emergence of cheaper alternatives could severely impact companies relying heavily on pricing power to maintain profitability. This strategy also exposes companies to accusations of price gouging and potential government intervention.

Supply Chain Improvements

Easing supply chain disruptions have significantly improved corporate profitability for many businesses. Reduced lead times, lower transportation costs, and increased availability of raw materials have all contributed to higher production efficiency and lower costs.

- Examples: The automotive industry, which faced significant chip shortages earlier, has seen notable improvements in production thanks to easing supply chain pressures. Similarly, the electronics and manufacturing sectors have benefited from smoother logistics.

- Lingering Vulnerabilities: While supply chains have improved, vulnerabilities remain. Geopolitical instability, natural disasters, and potential future pandemics could still disrupt global trade and production.

- Potential for Future Disruptions: It's important to remember that supply chains are complex and interconnected. A disruption in one part of the world can have ripple effects across the globe, potentially impacting corporate earnings once again.

Strong Consumer Demand (Despite Inflation)

Despite high inflation eroding purchasing power, consumer spending remains relatively robust in many sectors. This resilience has supported strong sales and revenue growth for numerous companies.

- Government Stimulus (Past Impact): In some regions, government stimulus packages provided a temporary boost to consumer spending, though this effect is waning in many economies.

- Pent-Up Demand: After periods of lockdown and restricted activity, some consumers are still working through pent-up demand for goods and services.

- Shifting Consumer Priorities: Consumer spending patterns have shifted, with some categories seeing increased demand while others experience declines. Understanding these shifts is crucial for businesses to adapt their strategies.

- Potential for a Slowdown: The current level of consumer spending is unsustainable in the long term if inflation persists. A significant economic slowdown or recession could dramatically reduce consumer spending, impacting corporate earnings.

Potential Threats to Sustained Solid Corporate Earnings

While current corporate earnings are strong, several factors could jeopardize their sustainability.

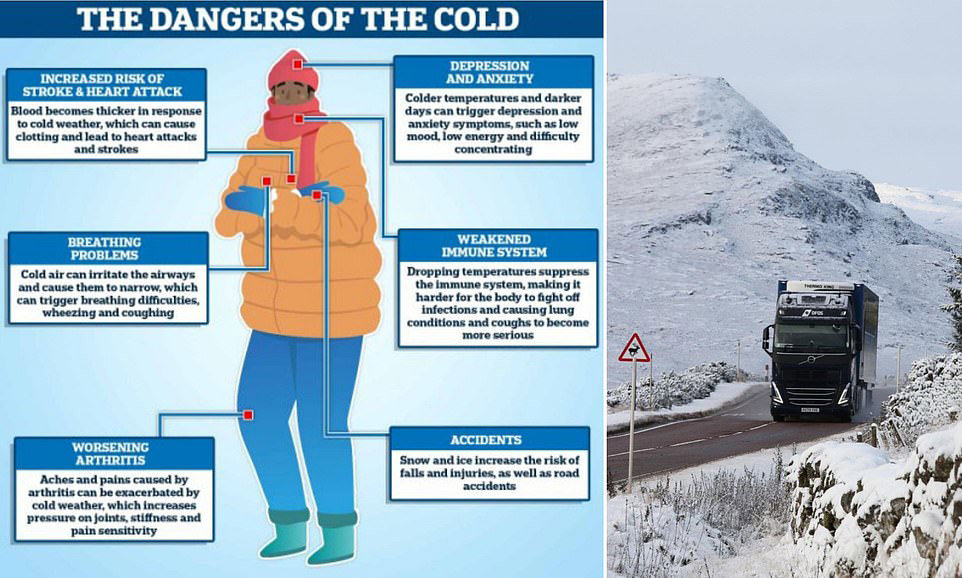

Recessionary Fears

The looming threat of a global recession represents a significant risk to corporate earnings. A downturn would likely lead to reduced consumer spending, decreased business investment, and higher unemployment.

- Leading Economic Indicators: Indicators like falling consumer confidence, rising unemployment claims, and inverted yield curves all point towards an increased likelihood of a recession.

- Potential Triggers: High interest rates, geopolitical instability, and persistent inflation are all potential triggers for a significant economic slowdown.

- Industry-Specific Vulnerabilities: Certain industries, like those heavily reliant on discretionary spending, are particularly vulnerable to a recession.

Geopolitical Instability

Geopolitical events, such as the ongoing war in Ukraine and rising tensions between major global powers, create significant uncertainty and risks for businesses.

- Specific Geopolitical Risks: Trade wars, sanctions, and disruptions to global supply chains due to conflict can negatively impact corporate profitability.

- Impact on Various Sectors: Industries dependent on global trade or those with significant operations in affected regions are particularly vulnerable.

- Potential Mitigation Strategies: Businesses can mitigate geopolitical risks by diversifying their supply chains, hedging against currency fluctuations, and developing contingency plans for various scenarios.

Rising Interest Rates

Central banks around the world are raising interest rates to combat inflation. This increase in borrowing costs impacts corporate investment decisions and profitability.

- Impact on Capital Expenditures: Higher interest rates make it more expensive for companies to borrow money for capital expenditures, potentially slowing down investment in new equipment and expansion.

- Effect on Debt Servicing: Companies with high levels of debt face increased interest payments, squeezing profit margins.

- Implications for Future Profitability: Reduced investment and increased debt servicing costs can negatively impact future profitability and growth.

Conclusion: Solid Corporate Earnings – A Temporary Trend or Lasting Strength?

In summary, several factors have contributed to the current period of solid corporate earnings, including inflationary pricing power, supply chain improvements, and surprisingly resilient consumer demand. However, significant threats remain, including recessionary fears, geopolitical instability, and rising interest rates. While the current strength in corporate earnings is undeniable, its sustainability is far from guaranteed. Whether this is a temporary trend or a sign of lasting strength depends heavily on the interplay of these positive and negative forces. The economic landscape remains highly uncertain.

Stay informed on the evolving economic landscape to better understand the future trajectory of solid corporate earnings. Continue your research by exploring resources from reputable economic forecasting organizations.

Featured Posts

-

Did Elon Musk Father Amber Heards Twins Exploring The Claims

May 30, 2025

Did Elon Musk Father Amber Heards Twins Exploring The Claims

May 30, 2025 -

Measles Virus Detected In Sacramento County Wastewater Public Health Officials Issue Warning

May 30, 2025

Measles Virus Detected In Sacramento County Wastewater Public Health Officials Issue Warning

May 30, 2025 -

Anderlecht En De Realiteit Van Een Aantrekkelijk Transferbod

May 30, 2025

Anderlecht En De Realiteit Van Een Aantrekkelijk Transferbod

May 30, 2025 -

Stavba Roku Vitezove Souteze A Nejlepsi Ceske Stavby

May 30, 2025

Stavba Roku Vitezove Souteze A Nejlepsi Ceske Stavby

May 30, 2025 -

Grab R45 000 Off Your New Kawasaki Ninja

May 30, 2025

Grab R45 000 Off Your New Kawasaki Ninja

May 30, 2025