SPAC Stock Frenzy: Is This MicroStrategy Competitor Worth The Hype?

Table of Contents

Understanding the MicroStrategy Business Model and its Competitors

MicroStrategy's Core Business

MicroStrategy is a prominent player in the business intelligence and analytics market. Its core offerings include enterprise analytics platforms, mobile software, cloud services, and related consulting services. MicroStrategy boasts a substantial market share, built on a foundation of robust technology and a long-standing reputation for providing powerful data visualization and analytical tools. Its established client base, spanning various industries, provides a strong revenue stream and brand recognition.

- Established Client Base: A diverse portfolio of Fortune 500 companies and government agencies.

- Technological Expertise: Continuous innovation in big data analytics, cloud computing, and AI integration.

- Market Share: Significant presence in the enterprise analytics sector, competing effectively with other large players.

Identifying Key SPAC-Listed MicroStrategy Competitors

Several companies competing with MicroStrategy have recently gone public through SPAC mergers. Identifying and analyzing these competitors is crucial for understanding the evolving competitive landscape. While specific examples require up-to-date market research (as SPAC mergers are dynamic), some hypothetical examples for illustrative purposes include:

- Hypothetical Competitor A (Ticker: HYPA): Specializes in cloud-based analytics, targeting smaller businesses. Its unique selling proposition (USP) centers around user-friendly interfaces and affordable pricing.

- Hypothetical Competitor B (Ticker: HYPB): Focuses on advanced AI-powered analytics, targeting large enterprises. Its strength lies in its sophisticated algorithms and predictive modeling capabilities.

- Hypothetical Competitor C (Ticker: HYPC): Offers a comprehensive suite of business intelligence tools with a strong emphasis on data security and compliance, aiming for regulated industries.

Evaluating the Hype: Are These SPAC-Backed Competitors a Real Threat?

Financial Performance Analysis

A thorough financial performance analysis is critical. We need to compare key financial metrics – revenue growth, profitability (net income margins, EBITDA), and debt levels – of these SPAC-listed competitors against MicroStrategy. This comparison should also consider factors like cash flow, return on equity, and valuation multiples (P/E ratio, EV/Revenue).

- Revenue Growth: Compare the year-over-year revenue growth rates to determine the trajectory of each company.

- Profitability: Analyze profit margins to gauge efficiency and financial health.

- Debt Levels: High debt can indicate significant financial risk.

(Note: This section would ideally include charts and graphs visually comparing these metrics across MicroStrategy and the SPAC-listed competitors. However, that is beyond the scope of this text-based response.)

Competitive Advantages and Disadvantages

A comparative analysis of competitive advantages and disadvantages is essential. This includes assessing the technological capabilities, market reach, management expertise, and go-to-market strategies of each competitor against MicroStrategy's established position.

| Feature | MicroStrategy | Hypothetical Competitor A | Hypothetical Competitor B | Hypothetical Competitor C |

|---|---|---|---|---|

| Technology | Mature, robust platform | Cloud-focused, user-friendly | AI-powered, sophisticated | Secure, compliant platform |

| Market Reach | Broad, established enterprise focus | Smaller businesses | Large enterprises | Regulated industries |

| Management | Experienced leadership team | Emerging leadership team | Experienced leadership team | Emerging leadership team |

Investment Risks and Potential Rewards of SPAC-Listed MicroStrategy Competitors

Risks Associated with SPAC Investments

Investing in SPACs inherently carries significant risks. Understanding these risks is crucial before committing capital.

- Uncertainty Regarding the Target Company: SPACs often lack specific targets initially, leaving investors with uncertainty about the final acquisition.

- Dilution of Shares: SPAC mergers can lead to significant dilution of existing shares, potentially reducing investor returns.

- Poor Management: The SPAC's management team may lack the expertise or experience to successfully identify and integrate a target company.

- Lack of Transparency: Information about the target company may be limited until a deal is finalized.

Potential for High Returns (and Losses)

While SPACs offer the potential for substantial returns if the chosen target company performs well, significant losses are also possible. It's essential to balance the potential upside with the considerable downside.

- Example of Successful SPAC: (Insert example of a successful SPAC and its performance).

- Example of Unsuccessful SPAC: (Insert example of an unsuccessful SPAC and its performance).

Conclusion: Is the SPAC Stock Frenzy Justified for MicroStrategy Competitors?

The "SPAC stock frenzy" surrounding MicroStrategy competitors presents a complex investment landscape. While some competitors may offer innovative solutions and disruptive technologies, the inherent risks associated with SPAC investments cannot be ignored. Our analysis highlights the need for thorough due diligence, comparing financial performance, competitive advantages, and evaluating the management teams. The hype surrounding these competitors needs to be critically assessed against the backdrop of MicroStrategy's established market position and financial strength. Before investing in any SPAC-listed MicroStrategy competitor, conduct extensive research and carefully weigh the potential rewards against the substantial risks involved in this current SPAC stock frenzy. Remember, a well-informed investment decision is crucial for success in this volatile market.

Featured Posts

-

New Canola Sources For China A Look At The Post Canada Landscape

May 09, 2025

New Canola Sources For China A Look At The Post Canada Landscape

May 09, 2025 -

Champions League Inter Milans Impressive Win Against Bayern Munich

May 09, 2025

Champions League Inter Milans Impressive Win Against Bayern Munich

May 09, 2025 -

Farages Reform Will It Succeed Where Others Have Failed

May 09, 2025

Farages Reform Will It Succeed Where Others Have Failed

May 09, 2025 -

Madeleine Mc Cann Case Update 23 Year Old Presents New Dna Evidence

May 09, 2025

Madeleine Mc Cann Case Update 23 Year Old Presents New Dna Evidence

May 09, 2025 -

Vozmuschenie Kinga Pisatel Atakoval Trampa I Maska

May 09, 2025

Vozmuschenie Kinga Pisatel Atakoval Trampa I Maska

May 09, 2025

Latest Posts

-

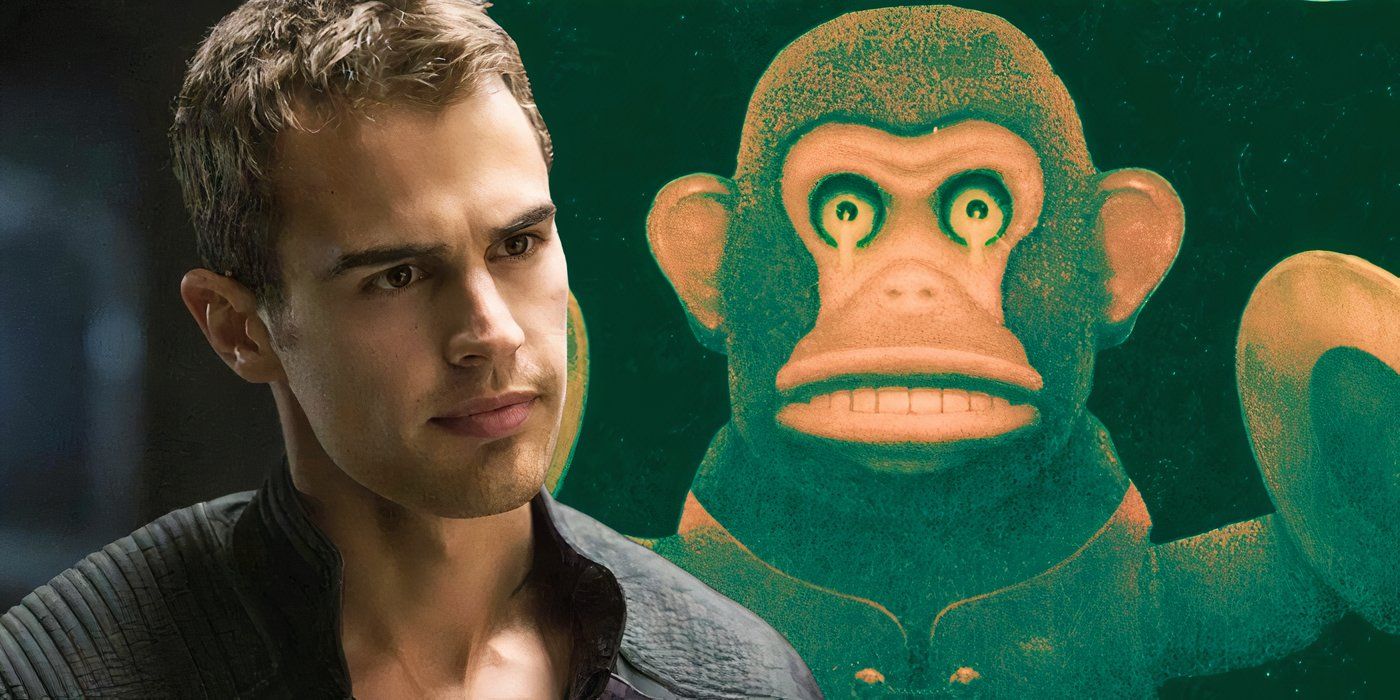

The Impact Of The Monkey Assessing Stephen Kings 2025 Film Adaptations

May 09, 2025

The Impact Of The Monkey Assessing Stephen Kings 2025 Film Adaptations

May 09, 2025 -

Ochakvan Rimeyk Na Stivn King Ot Netflix

May 09, 2025

Ochakvan Rimeyk Na Stivn King Ot Netflix

May 09, 2025 -

Tomas Hertls Dominant Performance Golden Knights Beat Red Wings

May 09, 2025

Tomas Hertls Dominant Performance Golden Knights Beat Red Wings

May 09, 2025 -

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025

The Ultimate Stephen King Reading List 5 Books You Cant Miss

May 09, 2025 -

A Critical Look At The Monkey Will 2025 Be A Good Year For Stephen King Adaptations Regardless

May 09, 2025

A Critical Look At The Monkey Will 2025 Be A Good Year For Stephen King Adaptations Regardless

May 09, 2025