SSE's £3 Billion Spending Cut: A Detailed Analysis

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

The decision to slash £3 billion from its capital expenditure plan stems from a confluence of challenging economic and regulatory factors. SSE, like many energy companies, is facing significant financial pressures.

-

Soaring Inflation and Interest Rates: The sharp rise in inflation and interest rates has dramatically increased the cost of financing large-scale energy projects. Securing loans for renewable energy initiatives, for example, has become considerably more expensive, impacting project viability.

-

Heightened Regulatory Uncertainty: Changes in government policy and regulatory frameworks create uncertainty for long-term investment planning. This uncertainty makes it difficult for SSE to accurately assess the long-term profitability of its projects and increases the perceived risk.

-

Focus on Return on Investment (ROI): SSE is prioritizing projects with a higher return on investment. This means that projects deemed less profitable or carrying higher risks are being reassessed or potentially shelved.

-

Shareholder Value Pressure: In the current challenging economic climate, SSE faces pressure to enhance shareholder value. Cutting capital expenditure is one way to improve short-term financial performance and boost investor confidence.

-

Reassessment of Project Viability: The changing energy market landscape requires a constant reassessment of project viability. Factors such as fluctuating energy prices, technological advancements, and evolving consumer demand are all considered when prioritizing investments.

The impact of macroeconomic conditions on the feasibility of large-scale energy projects is undeniable. The significant increase in inflation and interest rates makes securing funding more challenging, while regulatory uncertainty adds further complexity to the decision-making process. News reports and financial analyses suggest that these factors played a crucial role in SSE's decision to implement this substantial spending cut.

Impact on SSE's Renewable Energy Portfolio

The £3 billion reduction in capital expenditure will undoubtedly impact SSE's renewable energy portfolio, a cornerstone of its strategy and the UK's energy transition goals.

-

Potential Delays and Cancellations: Several planned renewable energy projects, including wind farms and potentially solar power initiatives, could face delays or even outright cancellation.

-

Re-evaluation of Existing Projects: SSE will likely re-evaluate the viability of existing renewable energy projects in its pipeline, potentially prioritizing those with the strongest financial prospects.

-

Shift Towards Less Capital-Intensive Projects: The company may shift its focus towards smaller, less capital-intensive renewable energy ventures that offer faster returns and reduced financial risk.

-

Impact on UK Renewable Energy Targets: The spending cut could impede the UK's ambitious renewable energy targets and its overall decarbonization strategy, potentially slowing the transition to a cleaner energy system.

The impact on the UK's commitment to net-zero emissions is a significant concern. Delays or cancellations of renewable energy projects could affect the country's ability to meet its climate change commitments. This section will continue to monitor the specific projects impacted by the spending cut and assess the overall effects on the UK's renewable energy landscape.

Implications for the UK Energy Market

SSE's decision extends beyond the company itself, influencing the wider UK energy market in several crucial ways.

-

Energy Security Concerns: Reduced investment in new energy infrastructure could impact UK energy security and the resilience of its energy supply chain.

-

Potential Price Hikes: Decreased competition in the energy sector, potentially resulting from fewer new entrants due to reduced investment, could lead to higher energy prices for consumers.

-

Slower Energy Transition: The slowdown in the deployment of renewable energy infrastructure will inevitably hinder the UK's energy transition towards a cleaner, more sustainable energy system.

-

Impact on Investor Confidence: SSE's spending cut could negatively impact investor confidence in the UK energy sector, making it more challenging to attract future investment in crucial energy projects.

The long-term consequences for UK energy security and the energy transition remain to be seen. Further analysis is needed to fully understand the ripple effects of SSE's decision on the overall health and competitiveness of the UK energy market.

Alternative Strategies and Future Outlook for SSE

To mitigate the impact of the £3 billion spending cut, SSE will likely explore various alternative strategies.

-

Asset Sales and Divestments: The company might consider selling non-core assets to free up capital for its prioritized projects.

-

Cost Optimization Measures: Implementing rigorous cost-cutting measures across the business will be crucial to improve efficiency and profitability.

-

Operational Efficiency Improvements: SSE will likely focus on streamlining operations and improving efficiency to maximize the return from its existing assets.

-

Alternative Financing Options: Exploring alternative financing options, such as green bonds or project finance initiatives, could help secure funding for strategically important projects.

SSE's strategic review and subsequent actions will be key to navigating this challenging period and continuing to contribute to the UK's energy future.

Conclusion

SSE's £3 billion spending cut is a watershed moment for the UK energy sector, carrying significant implications for the company's future trajectory, the nation's energy transition goals, and the wider energy market. This drastic measure, driven by economic headwinds and regulatory uncertainty, underscores the difficulties inherent in developing large-scale energy projects. While potential delays in renewable energy deployment and impacts on UK energy security are concerns, the move also compels SSE to prioritize cost optimization and efficient capital allocation. Closely monitoring SSE's strategic responses and the evolving energy market is crucial for all stakeholders. Stay informed about the latest developments concerning the SSE spending cut and its ongoing impact on the UK's energy landscape. Understanding the ramifications of this significant decision is vital for investors, policymakers, and consumers alike.

Featured Posts

-

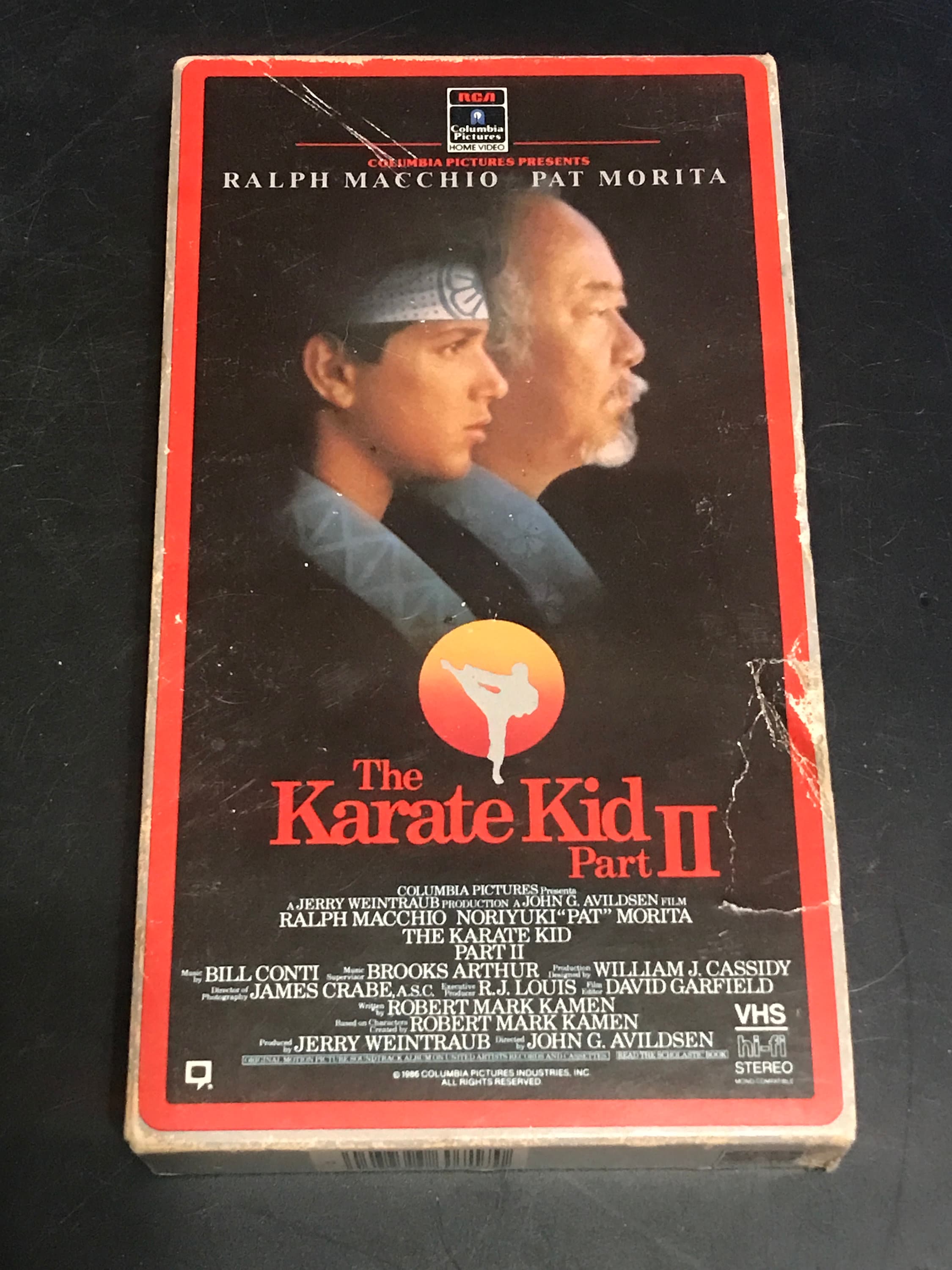

The Karate Kid Part Ii A Deeper Dive Into Miyagi Do

May 23, 2025

The Karate Kid Part Ii A Deeper Dive Into Miyagi Do

May 23, 2025 -

A Real Pain Kieran Culkins Optreden In Theater Het Kruispunt

May 23, 2025

A Real Pain Kieran Culkins Optreden In Theater Het Kruispunt

May 23, 2025 -

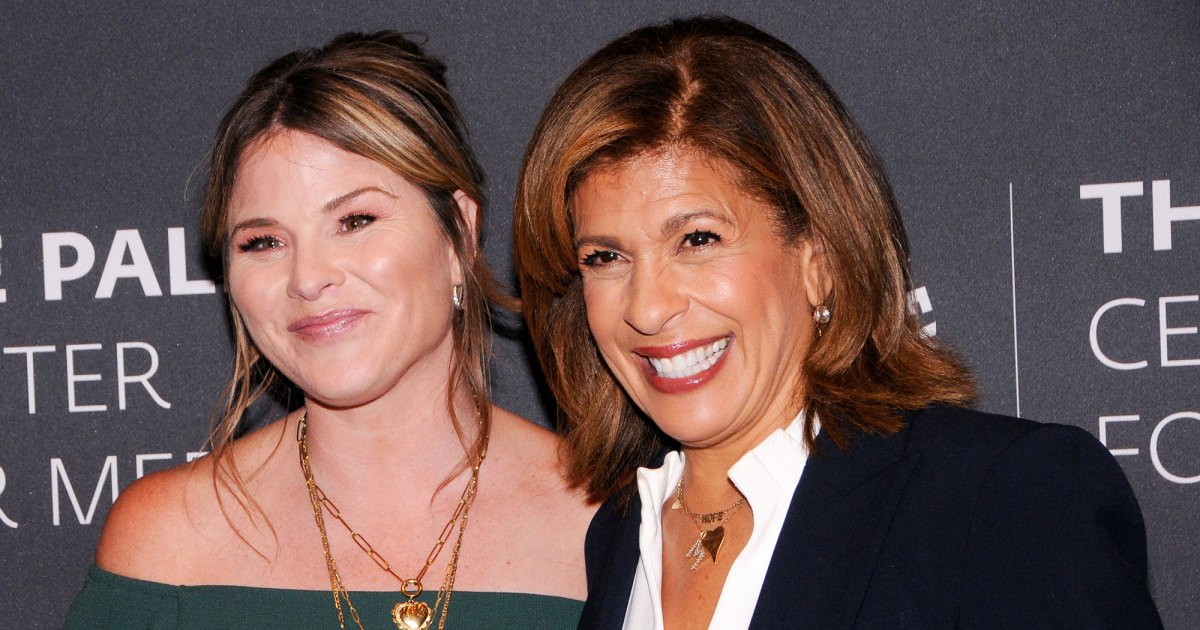

Update On Today Show Anchors Absence Co Hosts Share Their Concerns

May 23, 2025

Update On Today Show Anchors Absence Co Hosts Share Their Concerns

May 23, 2025 -

This Morning Cat Deeleys Pre Show Wardrobe Issue

May 23, 2025

This Morning Cat Deeleys Pre Show Wardrobe Issue

May 23, 2025 -

New Karate Kid Legends Trailer Showcases Family Honor And Tradition

May 23, 2025

New Karate Kid Legends Trailer Showcases Family Honor And Tradition

May 23, 2025