Stock Market Analysis: Deciphering Today's Moves In Bonds, Bitcoin, And Dow Futures

Table of Contents

Analyzing Bond Market Trends

The bond market, often seen as a safe haven, is significantly impacted by interest rate fluctuations. Effective stock market analysis necessitates understanding this dynamic.

Interest Rate Sensitivity

Bond prices and interest rates share an inverse relationship. When interest rates rise, the value of existing bonds falls, and vice-versa. Recent Federal Reserve actions, aimed at curbing inflation, have directly affected bond yields.

- Impact of inflation on bond yields: High inflation erodes the purchasing power of fixed-income investments like bonds, leading to higher yields to compensate investors for the inflation risk. Investors demand higher returns to offset the diminishing value of their investment.

- Flight to safety: During periods of market uncertainty, investors often flock to bonds, considered a safer asset compared to stocks. This increased demand pushes bond prices up and yields down. This is a key factor in stock market analysis, indicating investor sentiment.

- Different types of bonds (government, corporate) and their relative risk: Government bonds are generally considered less risky than corporate bonds due to the backing of the government. However, corporate bonds often offer higher yields to compensate for the added risk of default. Understanding this risk profile is crucial for diversified portfolio construction.

Yield Curve Analysis

The yield curve, a graphical representation of the relationship between bond yields and their maturities, offers valuable insights into future economic growth.

- Interpretation of various yield curve shapes: A normal yield curve (upward sloping) indicates healthy economic growth. An inverted yield curve (downward sloping), where short-term yields exceed long-term yields, is often seen as a recessionary predictor. A flat yield curve suggests economic uncertainty.

- Correlation between yield curve and recessionary periods: Historically, an inverted yield curve has preceded economic recessions. This is a powerful tool in stock market analysis, offering a potential leading indicator of economic downturns.

- Using yield curve analysis for investment strategy: Investors can adjust their portfolio allocation based on the shape of the yield curve. A flattening or inverted curve might suggest a shift towards safer assets like government bonds.

Decoding Bitcoin's Price Volatility

Bitcoin, the leading cryptocurrency, exhibits significant price volatility, making it a complex element in any stock market analysis.

Cryptocurrency Market Sentiment

Bitcoin's price is influenced by a confluence of factors, including regulatory developments, adoption rates, and overall macroeconomic conditions.

- Impact of Elon Musk's tweets or other major influencers: Statements from prominent figures can significantly impact Bitcoin's price, showcasing the role of market sentiment in cryptocurrency valuation. This highlights the importance of monitoring social media and news for impactful stock market analysis.

- Effect of institutional investment on Bitcoin price: Increased institutional adoption of Bitcoin leads to higher demand and, consequently, price appreciation. This demonstrates the increasing integration of cryptocurrencies into traditional financial markets.

- Influence of global regulatory frameworks on cryptocurrency markets: Government regulations play a crucial role in shaping the future of cryptocurrencies. Clear and favorable regulations can boost investor confidence and drive price increases.

Bitcoin's Correlation with Traditional Markets

The correlation between Bitcoin and traditional asset classes like stocks and bonds is evolving, becoming increasingly relevant for comprehensive stock market analysis.

- Bitcoin as a hedge against inflation: Some investors view Bitcoin as a hedge against inflation due to its limited supply. This perspective is a critical component in understanding its price movements within a broader macroeconomic context.

- Bitcoin’s role in a diversified investment portfolio: Including Bitcoin in a diversified portfolio might help reduce overall risk, but this requires careful consideration of its volatility.

- Analyzing Bitcoin price movements in relation to Dow fluctuations: Examining the relationship between Bitcoin and traditional market indices like the Dow helps to understand potential correlations and diversification benefits.

Interpreting Dow Futures and their Implications

Dow futures contracts provide insights into investor sentiment and predict the direction of the Dow Jones Industrial Average at the market open. This is a valuable tool in short-term stock market analysis.

Pre-Market Indicators

Dow futures contracts serve as pre-market indicators, reflecting investor expectations before the official market opening.

- Understanding the relationship between futures and spot prices: Futures prices often anticipate spot prices (actual market prices). Analyzing the divergence or convergence between futures and spot prices provides insights into market expectations.

- Using futures contracts for hedging and speculation: Investors use futures contracts to hedge against potential losses or speculate on price movements. Understanding this dynamic is crucial for both risk management and profit generation.

- Factors affecting pre-market trading activity: News events, economic data releases, and corporate announcements can all influence pre-market trading activity and the price of Dow futures.

Impact of Global Events

Global events significantly impact Dow futures and overall market sentiment, requiring careful attention in comprehensive stock market analysis.

- Impact of major news events (e.g., war, political instability): Geopolitical events can cause significant market volatility, influencing both Dow futures and the broader market. This underscores the need to consider geopolitical risk in investment strategies.

- Influence of economic indicators (e.g., GDP, unemployment): Economic data releases, such as GDP growth or unemployment figures, can significantly impact market sentiment and Dow futures prices.

- Company-specific news and its effect on Dow futures: Positive or negative news about individual companies in the Dow Jones Industrial Average can influence the price of Dow futures contracts.

Conclusion

This stock market analysis highlights the intricate connections between bonds, Bitcoin, and Dow futures. Understanding the interplay of these assets is crucial for navigating today's complex investment landscape. Effective stock market analysis requires a multifaceted approach, considering various economic indicators, market sentiment, and global events. By regularly monitoring these factors and utilizing tools like yield curve analysis, investors can make more informed decisions. To stay ahead in this dynamic market, continue to monitor our insightful stock market analysis updates and refine your investment strategy accordingly.

Featured Posts

-

Essener Wirtschaftswunder Golz Und Brumme Im Portraet

May 24, 2025

Essener Wirtschaftswunder Golz Und Brumme Im Portraet

May 24, 2025 -

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025

Best Of Bangladesh In Europe 2nd Edition Focuses On Collaboration And Growth

May 24, 2025 -

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025

Glastonbury 2025 Lineup Announcement A Controversial Choice

May 24, 2025 -

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025

Rising Living Costs Lead To Compromised Vehicle Security In Canada

May 24, 2025 -

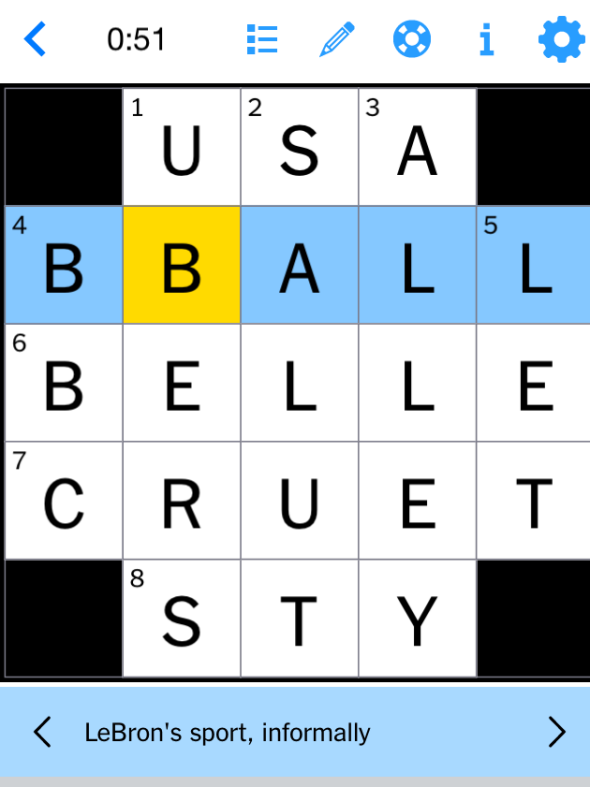

Find Nyt Mini Crossword Answers March 16 2025

May 24, 2025

Find Nyt Mini Crossword Answers March 16 2025

May 24, 2025