Stock Market News: Dow Futures, Earnings Season, And Current Market Conditions

Table of Contents

Dow Futures: A Window into Market Sentiment

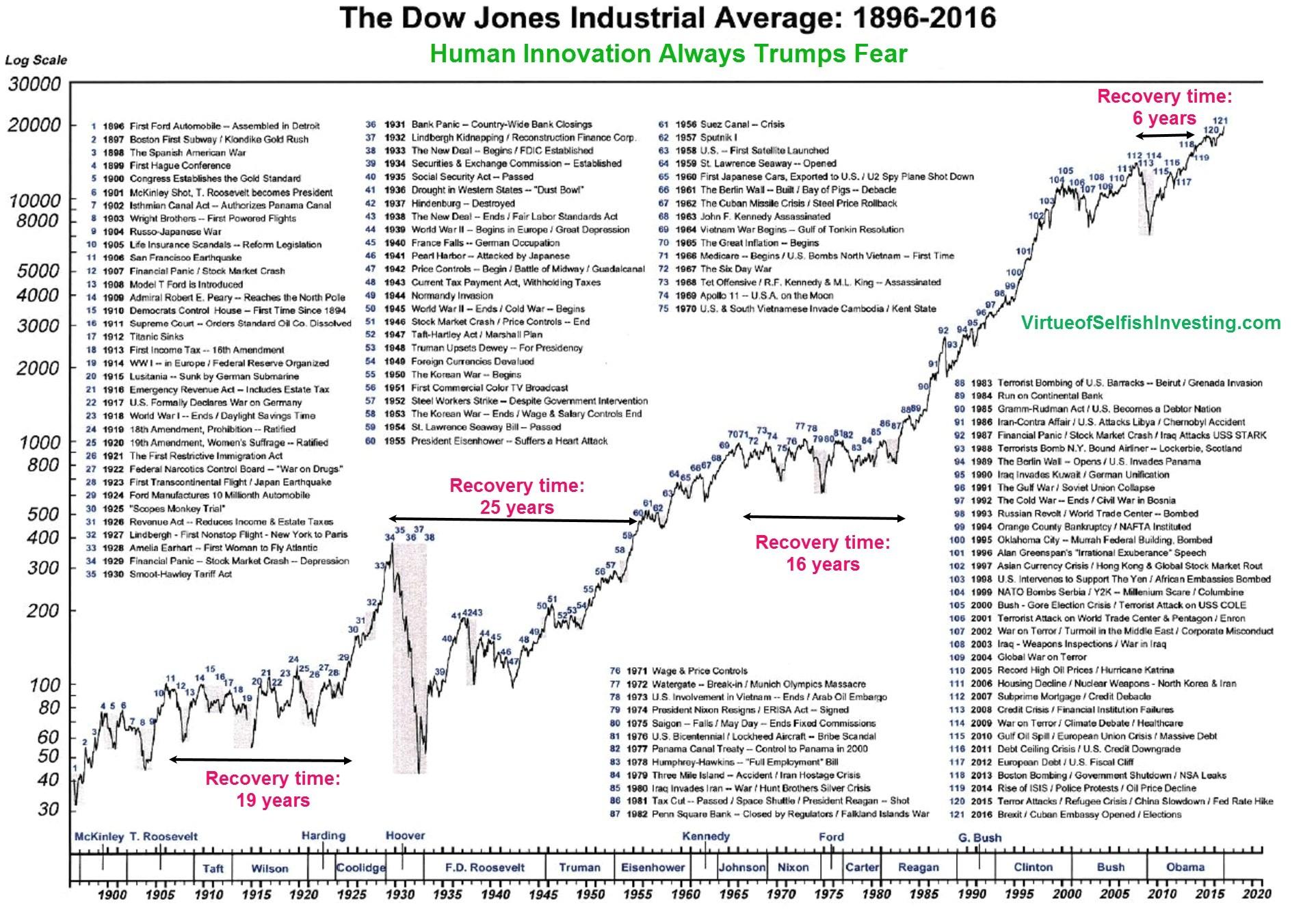

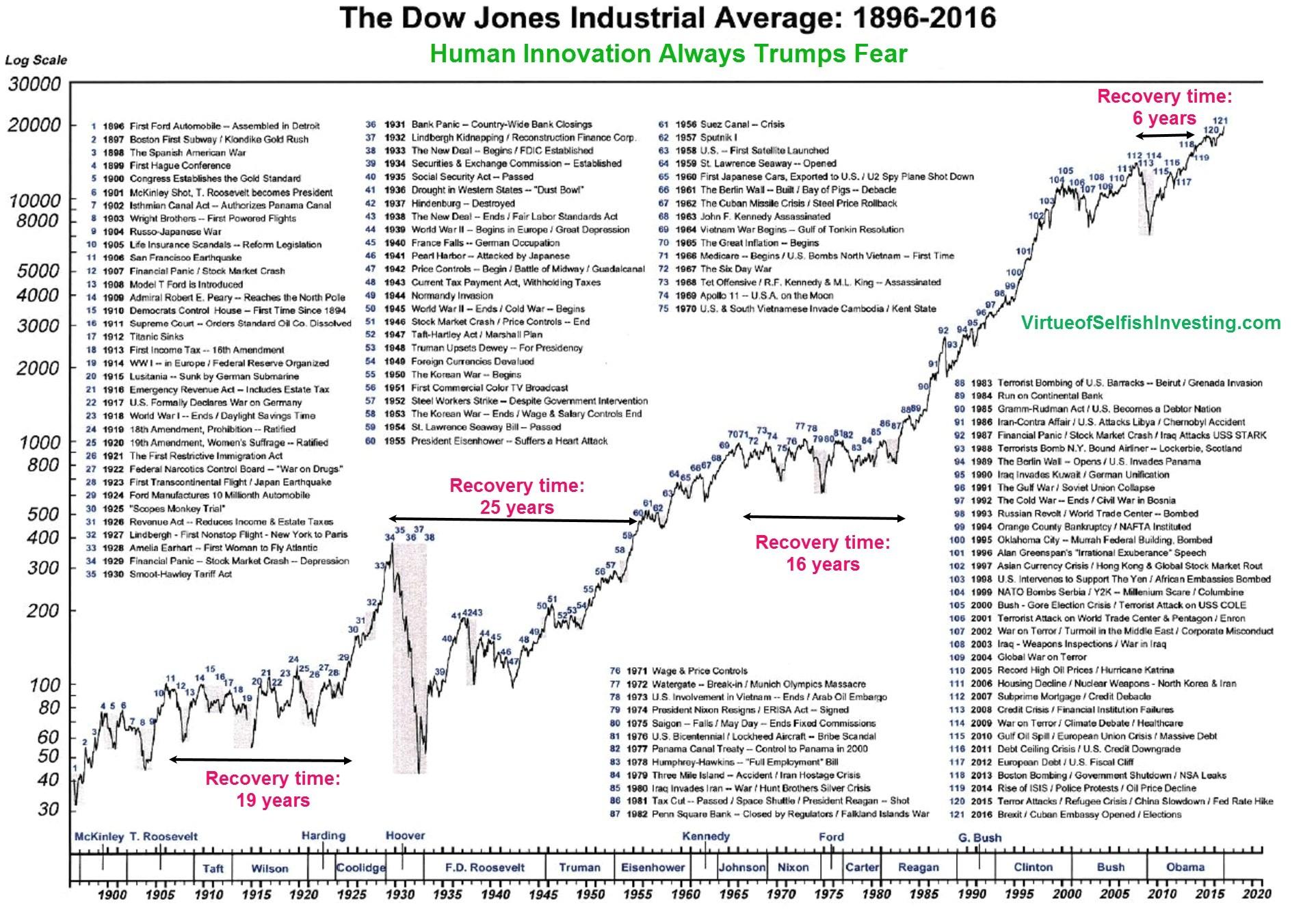

Dow Futures contracts are agreements to buy or sell the Dow Jones Industrial Average (DJIA) at a predetermined price on a future date. They act as a powerful indicator of market expectations and investor sentiment towards the overall market.

Understanding Dow Futures Contracts

- Reflecting Investor Sentiment: Dow Futures prices reflect the collective wisdom of the market regarding the future direction of the DJIA. Rising futures prices often suggest optimism and bullish sentiment, while falling prices can signal pessimism and bearish expectations.

- Relationship to Dow Performance: While not perfectly correlated, Dow Futures prices tend to move in tandem with the actual performance of the Dow Jones Industrial Average. Significant discrepancies can indicate potential market shifts or corrections.

- Signaling Market Movements: Sharp changes in Dow Futures, especially overnight or pre-market movements, can offer valuable insights into potential market direction before the regular trading session begins. For example, a significant drop in Dow Jones Industrial Average Futures overnight might suggest a negative opening for the stock market.

Analyzing Dow Futures for Trading Strategies

- Chart Interpretation: Analyzing Dow Futures charts, using technical indicators like moving averages and relative strength index (RSI), can help identify potential trading opportunities. Identifying support and resistance levels is crucial for setting stop-loss and profit targets.

- Risk Management: Trading Dow Futures involves inherent risk. Implementing effective risk management strategies, such as using stop-loss orders and diversifying your portfolio, is critical to mitigate potential losses.

- Contract Types: Different Dow Futures contracts exist with varying expiration dates. Understanding these maturities and choosing contracts that align with your investment horizon is essential. This includes understanding the implications of Index Futures trading.

- Market Prediction: Using Dow Jones Industrial Average Futures data effectively can contribute to more accurate market predictions. Combining this information with other market indicators is ideal for creating well-informed trading strategies.

Earnings Season: Impact on Stock Prices and Market Volatility

Earnings season, the period when publicly traded companies release their quarterly or annual financial results, is a crucial driver of stock prices and market volatility.

The Significance of Earnings Reports

- Driving Stock Prices: Earnings reports significantly impact individual stock prices. Positive earnings surprises (better-than-expected results) generally lead to price increases, while negative surprises often cause declines.

- Shaping Investor Confidence: The collective performance of companies during earnings season shapes overall investor confidence and market sentiment. Strong earnings across various sectors can fuel market rallies, while widespread disappointments can trigger sell-offs.

- Historical Influence: Historically, significant earnings announcements have profoundly influenced the market. For instance, unexpected losses from major companies can trigger widespread market corrections.

Analyzing Earnings Reports for Investment Decisions

- Key Performance Indicators (KPIs): Analyze earnings reports focusing on key metrics such as earnings per share (EPS), revenue growth, profit margins, and cash flow. Comparing these KPIs against expectations and prior year results offers valuable insights into a company's performance.

- Expectations vs. Reality: The difference between actual earnings and analyst expectations (the "earnings surprise") is crucial. Positive surprises usually lead to positive market reactions.

- Growth Potential: Identify companies showing consistent earnings growth, indicating strong future prospects and potentially higher returns. This requires careful evaluation of a company's financial health and industry outlook.

Current Market Conditions: Macroeconomic Factors and Their Influence

Macroeconomic factors significantly impact stock market performance. Understanding these factors is vital for making sound investment decisions.

Identifying Key Macroeconomic Indicators

- Inflation: High inflation erodes purchasing power and can lead to interest rate hikes, impacting corporate profitability and stock valuations.

- Interest Rates: Interest rate changes influence borrowing costs for companies and investors. Higher rates generally make borrowing more expensive, potentially slowing economic growth.

- Unemployment: Low unemployment indicates a strong economy, generally positive for the stock market. High unemployment can signal economic weakness and potentially lead to market declines.

Assessing Market Risk and Volatility

- Current Risk Level: The current market environment’s risk level must be assessed based on the current economic indicators, geopolitical events, and investor sentiment.

- Risk Tolerance: Investors should carefully assess their own risk tolerance before making investment decisions. Risk tolerance influences appropriate investment strategies for managing volatility.

- Risk Management Strategies: Diversification, stop-loss orders, and hedging techniques are critical for managing market volatility and protecting your portfolio. A well-defined investment strategy is paramount for navigating volatile periods.

Conclusion: Staying Informed on Stock Market News

Successfully navigating the stock market requires a deep understanding of Dow Futures, earnings season dynamics, and broader macroeconomic conditions. Regularly monitoring stock market news, paying close attention to Dow Futures movements, analyzing earnings reports, and assessing overall market conditions are essential for making well-informed investment decisions. To stay ahead, consistently monitor reputable financial news sources and consider subscribing to a financial newsletter to receive regular updates on these crucial market drivers. By staying informed and adapting your strategies accordingly, you can significantly improve your chances of achieving your investment goals.

Featured Posts

-

Why Doesnt Beyonce Include Sir Carter In Her Tour Performances With Rumi And Blue Ivy

Apr 30, 2025

Why Doesnt Beyonce Include Sir Carter In Her Tour Performances With Rumi And Blue Ivy

Apr 30, 2025 -

Louisville Community Under Shelter In Place Honoring The Victims

Apr 30, 2025

Louisville Community Under Shelter In Place Honoring The Victims

Apr 30, 2025 -

Beyonces Family On Tour The Absence Of Sir Carter Explained

Apr 30, 2025

Beyonces Family On Tour The Absence Of Sir Carter Explained

Apr 30, 2025 -

Breaking Chilean Migrants Indicted In Series Of High Profile Nfl Heists

Apr 30, 2025

Breaking Chilean Migrants Indicted In Series Of High Profile Nfl Heists

Apr 30, 2025 -

Ru Pauls Drag Race Season 17 What To Expect In Episode 11 Unleashing The Ducks

Apr 30, 2025

Ru Pauls Drag Race Season 17 What To Expect In Episode 11 Unleashing The Ducks

Apr 30, 2025