Stock Market Overview: Dow Futures And The Implications Of US-China Trade Relations

Table of Contents

Understanding Dow Futures and Their Sensitivity to Geopolitical Events

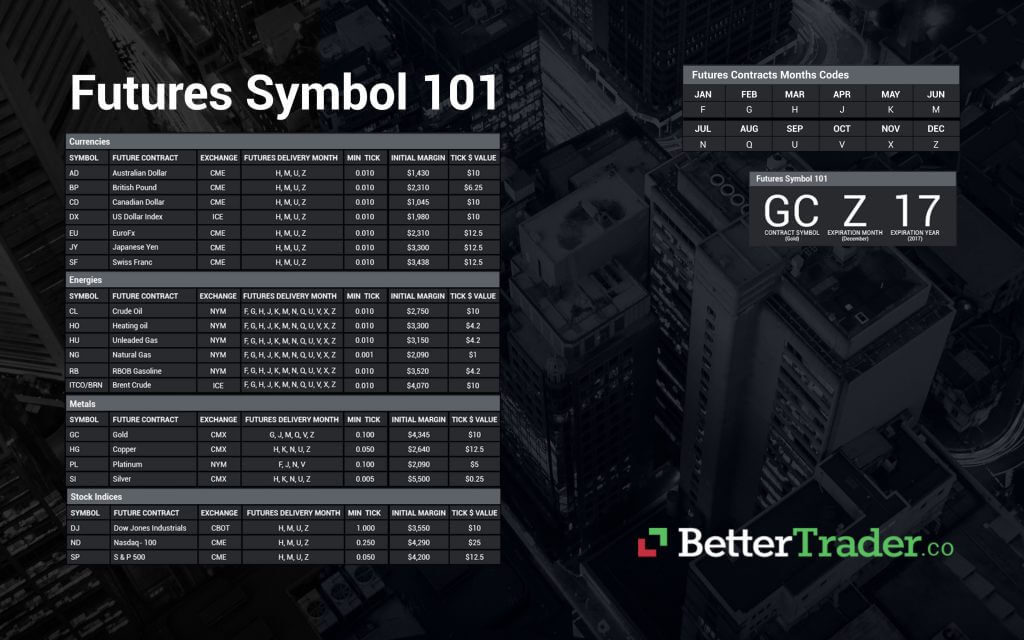

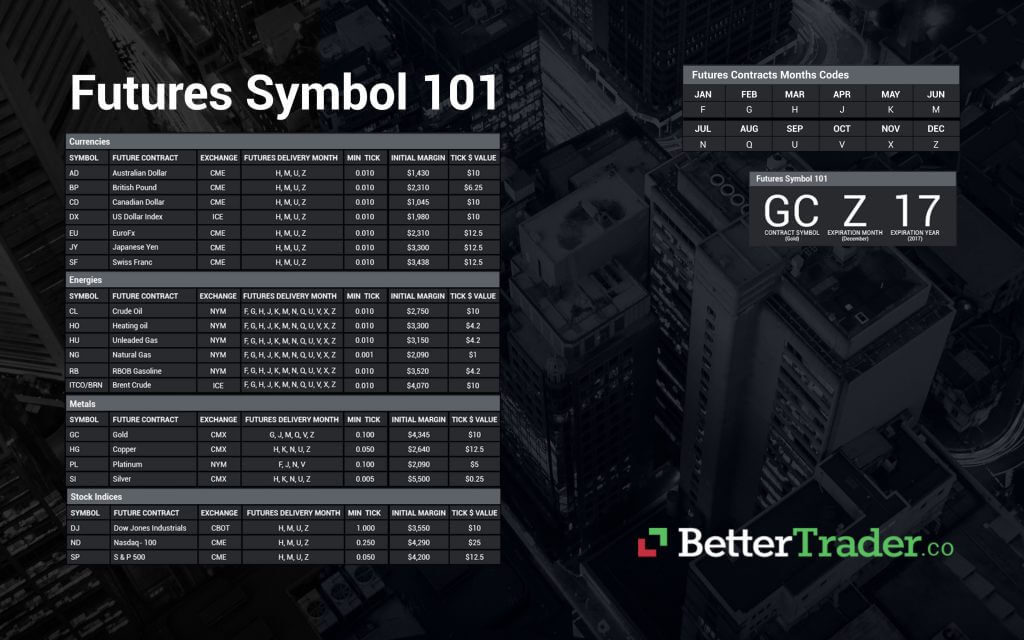

Dow futures contracts are derivative instruments that track the expected future value of the Dow Jones Industrial Average (DJIA). They allow investors to speculate on the direction of the market or hedge against potential losses. Because the DJIA is a broad index reflecting the performance of 30 large, publicly-owned companies in the US, Dow futures serve as a barometer for the overall US economy. As such, they are highly sensitive to major news events, particularly those with global implications, including international trade disputes.

For example, the announcement of new tariffs or trade restrictions between the US and China often leads to immediate and significant reactions in Dow futures, reflecting investor anxieties about potential economic consequences. Past instances clearly demonstrate this correlation. The escalating trade war of 2018-2020 saw considerable volatility in Dow futures, often mirroring the ebb and flow of trade negotiations.

- Mechanism of Dow futures trading: Investors buy or sell contracts based on their prediction of future DJIA movement.

- Factors influencing Dow futures price movements: Interest rate changes, economic data releases (like GDP and inflation reports), geopolitical events, and overall investor sentiment significantly impact Dow futures prices.

- Importance of monitoring Dow futures for market sentiment: Dow futures provide real-time insights into how investors perceive current events and their likely impact on the broader market.

The Impact of US-China Trade Relations on Global Markets

The relationship between the US and China is pivotal to global economic stability. Historically, increasing trade between the two nations fueled significant global economic growth. However, the rise of trade tensions, including tariffs and trade wars, has disrupted this dynamic, creating significant ripples throughout global markets.

Trade wars and tariffs directly impact specific sectors. For instance, the technology sector has felt the brunt of restrictions on technology exports and intellectual property, while the agricultural sector has been significantly affected by retaliatory tariffs on agricultural products. This leads to a ripple effect, disrupting global supply chains and ultimately impacting consumer prices.

- Key events in the US-China trade war timeline: The imposition of tariffs in 2018, the "phase one" trade deal in 2020, and ongoing disputes over technology and intellectual property.

- Specific industries most affected by trade tensions: Technology, agriculture, manufacturing, and retail.

- Potential long-term consequences of trade disputes: Slower economic growth, increased inflation, and potential shifts in global supply chains.

Analyzing the Correlation Between Dow Futures and US-China Trade Developments

A strong correlation exists between changes in US-China trade policies and the performance of Dow futures. Data analysis consistently reveals a negative correlation: the escalation of trade tensions often leads to a decrease in Dow futures prices, signaling investor pessimism. Conversely, de-escalation and positive developments in trade relations tend to boost Dow futures. Charts depicting the movement of Dow futures alongside key US-China trade events clearly demonstrate this relationship.

Different scenarios regarding US-China trade relations can significantly impact Dow futures. An escalation of trade tensions, for instance, could trigger further market declines, while a significant de-escalation or a comprehensive trade agreement could lead to a rally.

- Statistical analysis showcasing the correlation: Regression analysis can quantify the strength of the relationship between specific trade policy changes and Dow futures movements.

- Examples of specific policy changes and their effect on Dow futures: The announcement of new tariffs often results in an immediate drop in Dow futures, while positive news regarding trade negotiations can lead to a surge.

- Risk management strategies for investors: Understanding this correlation allows investors to develop strategies to mitigate risks associated with trade tensions.

Investment Strategies in a Volatile Market: Dow Futures and Risk Mitigation

Navigating the volatility induced by US-China trade uncertainties requires a well-defined investment strategy. Diversification is key. Spreading investments across different asset classes (stocks, bonds, real estate, etc.) can help reduce the overall impact of any single market downturn. Hedging strategies, using instruments like Dow futures, can help protect against potential losses.

Staying informed is paramount. Regularly monitor news related to US-China trade developments from reliable sources, including government publications, financial news outlets, and economic analysis reports.

- Diversification across different asset classes: Reduce reliance on any single sector or market.

- Hedging strategies using derivatives like Dow futures: Utilize futures contracts to offset potential losses in the stock market.

- Importance of thorough research and due diligence: Make informed decisions based on comprehensive analysis and understanding of market dynamics.

Dow Futures, US-China Trade, and Your Investment Decisions

The relationship between Dow futures and US-China trade relations is undeniable. Understanding this complex interplay is crucial for making informed investment decisions. Consistent monitoring of market trends and geopolitical developments, particularly concerning US-China trade, is vital. Stay ahead of the curve by consistently monitoring Dow futures and US-China trade developments. Learn more about effective investment strategies in the face of global uncertainty by consulting reputable financial advisors and research resources. Don't underestimate the power of informed decisions when it comes to your investment portfolio.

Featured Posts

-

Closure Of Anchor Brewing Company After 127 Years

Apr 26, 2025

Closure Of Anchor Brewing Company After 127 Years

Apr 26, 2025 -

Green Bay Welcomes Nfl Draft First Round Preview

Apr 26, 2025

Green Bay Welcomes Nfl Draft First Round Preview

Apr 26, 2025 -

The American Battleground Taking On The Worlds Richest

Apr 26, 2025

The American Battleground Taking On The Worlds Richest

Apr 26, 2025 -

A Cnn Anchor Reveals His Beloved Florida Location

Apr 26, 2025

A Cnn Anchor Reveals His Beloved Florida Location

Apr 26, 2025 -

Nfl Draft Day 1 Green Bays First Round Coverage

Apr 26, 2025

Nfl Draft Day 1 Green Bays First Round Coverage

Apr 26, 2025