Stock Market Prediction: 2 Companies To Outpace Palantir Within 3 Years

Table of Contents

Company 1: Dataminr – A Deep Dive into Disruptive Real-Time Information

Keywords: Dataminr, Real-time Information, Disruptive Technology, Market Share, Competitive Advantage, Revenue Growth, Stock Performance

Unparalleled Technological Advancement:

Dataminr's core strength lies in its proprietary AI-powered platform that analyzes vast amounts of public data in real-time, extracting actionable insights from social media, news feeds, and other online sources. This gives its clients – including major news organizations, financial institutions, and government agencies – a significant first-mover advantage in accessing critical information.

- Proprietary AI algorithms for early threat detection: Dataminr's AI excels at identifying emerging trends and potential crises before they become widely known.

- Patent-pending technology in real-time data analysis: Their unique technology allows for rapid processing and interpretation of massive datasets, providing actionable intelligence with unparalleled speed.

- First-mover advantage in real-time information delivery: Dataminr has established itself as a leader in this rapidly growing market, solidifying its position against competitors.

Strong Financial Performance and Projections:

While Dataminr is a privately held company, its impressive client roster and consistent growth suggest significant financial strength. Industry analysts predict substantial revenue growth in the coming years, fueled by increasing demand for its real-time information services.

- Projected 30% year-over-year revenue growth (Industry estimates): This reflects the strong market demand and the company’s ability to expand its client base.

- Positive EBITDA within the next 2 years (Industry estimates): This indicates the company's path towards profitability and financial sustainability.

- Increasing market share in real-time data analytics: Dataminr is actively expanding into new sectors, further solidifying its position as a market leader.

Robust Management Team and Strategic Partnerships:

Dataminr boasts a highly experienced management team with a proven track record in technology and data analytics. Its strategic partnerships with key players in various industries further enhance its market reach and influence.

- Experienced CEO with a proven track record in scaling technology companies: This ensures effective leadership and strategic vision.

- Strategic alliances with major news organizations and financial institutions: These partnerships validate Dataminr's technology and ensure its continued success.

- Strong investor confidence evidenced by substantial funding rounds: This demonstrates the belief in the company's potential for significant future growth.

Company 2: Upstart Holdings, Inc. – Capitalizing on the AI-Driven Lending Boom

Keywords: Upstart Holdings, Inc., AI-Driven Lending, Market Opportunity, Scalability, Growth Potential, Investment Strategy, Return on Investment

Addressing a Critical Market Need:

Upstart Holdings is revolutionizing the lending industry through its AI-powered platform. By analyzing a broader range of data points than traditional credit scoring models, Upstart provides more accurate assessments of creditworthiness, leading to increased loan approvals for borrowers who may be underserved by traditional lenders.

- Solution to the growing problem of underbanked borrowers: Upstart addresses the critical issue of access to credit for a significant segment of the population.

- Addressing underserved market segment of borrowers with limited credit history: Upstart's AI-based approach allows for a more inclusive and fair lending process.

- High demand for its AI-powered lending platform: The increasing adoption of AI in finance further strengthens Upstart's market position.

Scalable Business Model and Rapid Expansion:

Upstart's business model is inherently scalable, allowing for rapid expansion into new markets and partnerships with financial institutions. Its cloud-based platform enables efficient operation and low overhead.

- Efficient operational structure allowing for rapid growth: Upstart's technology is designed to scale effectively with increasing loan volumes.

- Plans for international expansion into key markets: Upstart is actively exploring opportunities to expand its services globally.

- Strong potential for strategic acquisitions: The acquisition of complementary businesses will further enhance Upstart’s capabilities and market reach.

Attractive Valuation and Future Growth Prospects:

Despite its recent growth, Upstart Holdings still presents a compelling valuation for investors seeking exposure to the burgeoning AI-driven lending market. Analysts predict significant growth in the company's revenue and market share over the coming years.

- Current market capitalization and projected growth: Upstart’s strong growth potential makes it an attractive option for long-term investors.

- Analyst ratings and price targets: Many analysts have positive outlooks for Upstart, citing its strong growth trajectory.

- Potential for significant return on investment for early investors: Upstart represents a potentially lucrative opportunity for investors willing to accept some risk.

Conclusion:

This analysis suggests that Dataminr and Upstart Holdings, Inc., leveraging their innovative technologies and strategic positioning, are well-positioned to significantly outperform Palantir in the next three years. Their strong growth potential, robust management teams, and promising market opportunities present compelling reasons for investors to consider these stocks. Remember to always conduct your own thorough research before making any investment decisions.

Call to Action: Are you ready to explore high-growth opportunities in the stock market? Start your research into Dataminr and Upstart Holdings, Inc. today and consider adding these potentially lucrative stocks to your portfolio. Learn more about stock market prediction and identify other promising growth stocks by [link to relevant resource/further reading].

Featured Posts

-

Emplois Disponibles Restaurants Et Rooftop A Dijon

May 09, 2025

Emplois Disponibles Restaurants Et Rooftop A Dijon

May 09, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025 -

Elon Musks Net Worth Under President Trump A 100 Day Overview

May 09, 2025

Elon Musks Net Worth Under President Trump A 100 Day Overview

May 09, 2025 -

Daycare Costs Skyrocket After Man Pays 3 000 For Babysitting Services

May 09, 2025

Daycare Costs Skyrocket After Man Pays 3 000 For Babysitting Services

May 09, 2025 -

Polish Woman Charged With Stalking After Madeleine Mc Cann Claim At Bristol Airport

May 09, 2025

Polish Woman Charged With Stalking After Madeleine Mc Cann Claim At Bristol Airport

May 09, 2025

Latest Posts

-

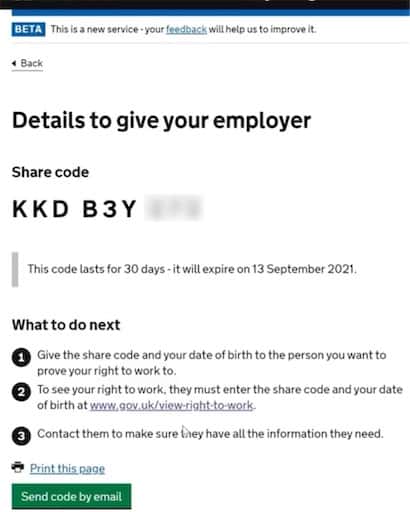

Changes To Uk Visa System Aimed At Reducing Visa Misuse

May 10, 2025

Changes To Uk Visa System Aimed At Reducing Visa Misuse

May 10, 2025 -

Report Uk To Restrict Visa Applications From Specific Countries

May 10, 2025

Report Uk To Restrict Visa Applications From Specific Countries

May 10, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 10, 2025 -

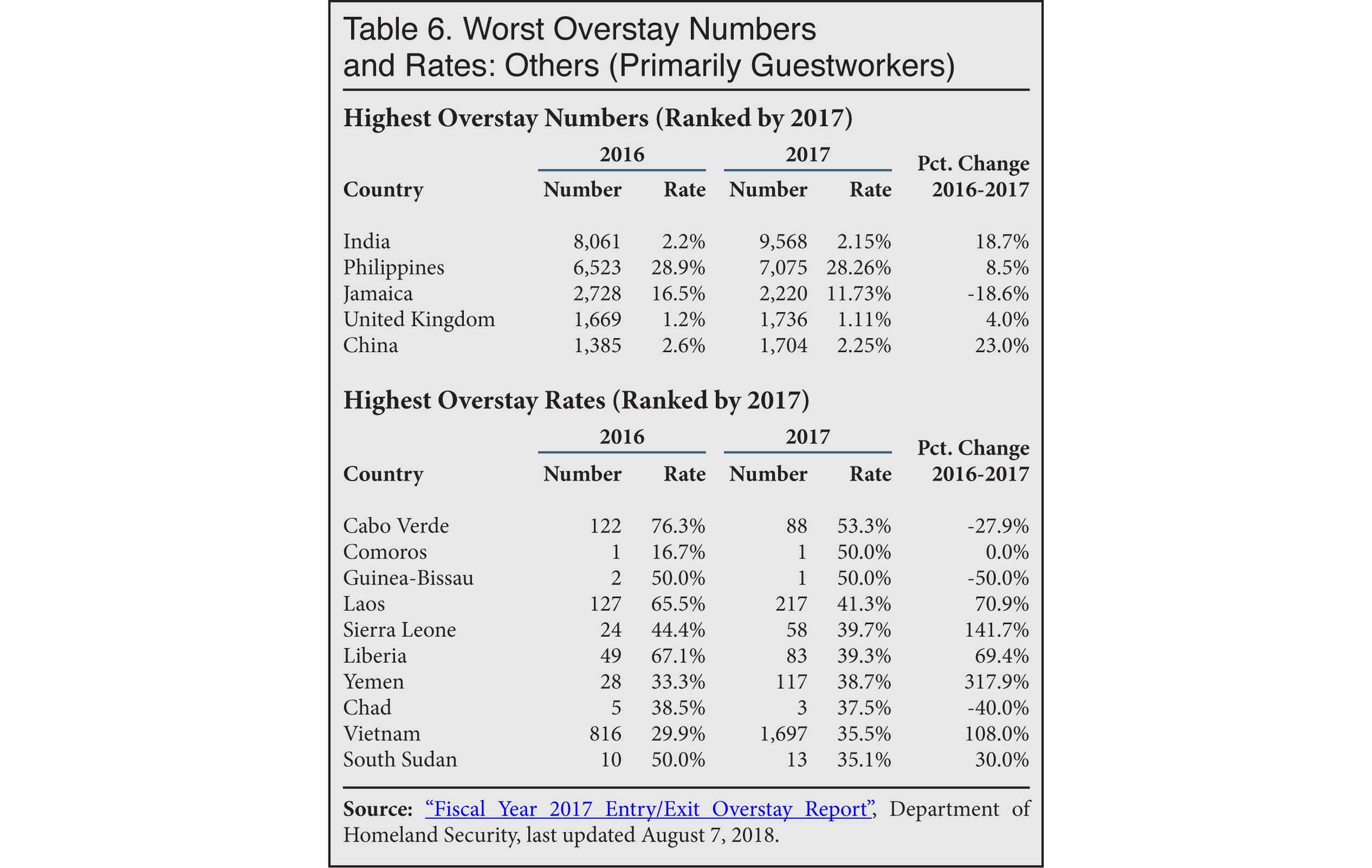

Uk Immigration New Visa Policies Target Overstay Rates From Nigeria And Elsewhere

May 10, 2025

Uk Immigration New Visa Policies Target Overstay Rates From Nigeria And Elsewhere

May 10, 2025 -

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 10, 2025

Uk Visa Crackdown Stricter Rules For Work And Student Visas

May 10, 2025