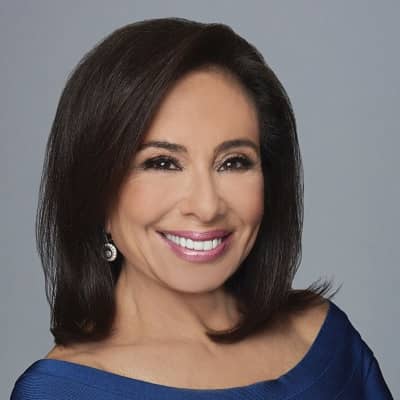

Stock Market Prediction: Jeanine Pirro's Advice To Investors

Table of Contents

Understanding Jeanine Pirro's Investment Philosophy

Jeanine Pirro is a prominent public figure known for her legal career and television appearances. While her specific investment strategies aren't publicly detailed, we can speculate on a potential approach based on her known personality and professional background. Her career demands a high level of risk assessment and decision-making under pressure, traits likely transferable to investing.

- Investment Timeline: Given her demanding career, it's plausible she favors long-term investments requiring less frequent monitoring and adjustments. Short-term trading demands considerable time and attention.

- Asset Allocation: A diversified portfolio, including a mix of stocks, bonds, and potentially real estate, aligns with a measured approach to risk. The exact allocation would depend on her personal risk tolerance and financial goals.

- Risk Tolerance: Her public persona suggests a relatively high risk tolerance, willing to take calculated risks for potentially higher rewards. However, this is purely speculative.

- Sector Preferences: Without specific information, we cannot determine her sector preferences. However, a balanced approach might favor established, blue-chip companies alongside investments in potentially higher-growth sectors.

Analyzing Market Trends for Stock Market Prediction

Accurately predicting the stock market requires a robust understanding of market trends. A hypothetical approach Jeanine Pirro might employ would involve a combination of fundamental and technical analysis, coupled with an awareness of broader economic and geopolitical factors.

- Fundamental Analysis: This involves scrutinizing a company's financial health – reviewing balance sheets, income statements, cash flow statements, and earnings reports. Strong financials suggest a company's ability to withstand market downturns and deliver long-term growth.

- Technical Analysis: Studying chart patterns, trading volume, and other market indicators can help identify potential trends and predict price movements. This approach focuses on market sentiment and historical price action.

- Economic Indicators: Monitoring key economic indicators such as inflation rates, interest rates, GDP growth, and unemployment figures provides context for market performance. These indicators can influence investor sentiment and affect stock valuations.

- Geopolitical Events: Significant global events like wars, political instability, or major policy changes can dramatically impact stock markets. Staying informed about geopolitical developments is crucial for effective stock market prediction.

- Reliable Sources: Relying on reputable financial news outlets, data providers, and economic research institutions is crucial for informed decision-making.

Risk Management in Stock Market Prediction

Effective risk management is paramount for successful stock market prediction. Even with careful analysis, market volatility is inevitable. A disciplined approach to risk mitigation can protect your investments and enhance long-term growth.

- Diversification: Spreading investments across different sectors, asset classes (stocks, bonds, real estate, etc.), and geographies reduces the impact of losses in any single area.

- Stop-Loss Orders: Setting stop-loss orders automatically sells your investments if the price drops below a predetermined level, limiting potential losses.

- Risk Tolerance: Understanding your personal risk tolerance – your comfort level with potential losses – is essential for making informed investment choices. Conservative investors may opt for lower-risk assets, while more aggressive investors might tolerate higher volatility.

- Emotional Discipline: Avoid emotional decision-making. Panic selling during market downturns can lead to significant losses. Sticking to a well-defined investment plan is critical.

- Portfolio Review: Regularly reviewing and rebalancing your portfolio to maintain your desired asset allocation is essential for managing risk and ensuring your investments align with your goals.

Jeanine Pirro's Hypothetical Advice on Risk Management (Speculative)

Given her assertive personality and experience navigating high-pressure situations, it's plausible she might advise investors to: (1) have a clearly defined risk tolerance, (2) not be afraid to make bold decisions after careful analysis and (3) regularly re-evaluate their portfolio to adjust to changing circumstances. This is purely speculative.

Long-Term Investment Strategies for Successful Stock Market Prediction

A long-term perspective is crucial for weathering market fluctuations and achieving substantial returns. Focusing on long-term growth rather than short-term gains can significantly improve investment outcomes.

- Dollar-Cost Averaging: Regularly investing a fixed amount regardless of market conditions helps mitigate the risk of investing a lump sum at a market peak.

- Fundamental Investing: Choosing companies with strong fundamentals, consistent earnings growth, and a sustainable competitive advantage is key to long-term success.

- Patience and Discipline: Successful investing requires patience and the discipline to stick to your investment plan, even during market downturns.

- Dividend Reinvestment: Reinvesting dividends earned from your investments can accelerate wealth accumulation through compounding returns.

- Regular Review and Adjustment: Periodically review your investment strategy to ensure it continues to align with your goals and adjust as needed based on changes in the market or your personal circumstances.

Conclusion

Successfully predicting the stock market requires a blend of knowledge, analysis, and risk management. While Jeanine Pirro’s specific investment strategies may not be publicly known, understanding market trends, employing sound risk management techniques, and adopting a long-term perspective remain crucial for successful stock market prediction. By utilizing fundamental and technical analysis, staying informed, and making disciplined investment decisions, you can improve your chances of achieving your financial goals. Start researching and building your understanding of stock market prediction today!

Featured Posts

-

Uk Government Tightens Visa Rules For Specific Nationalits

May 10, 2025

Uk Government Tightens Visa Rules For Specific Nationalits

May 10, 2025 -

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 10, 2025

Uk Student Visa Restrictions Impact On Pakistani Students And Asylum Seekers

May 10, 2025 -

Dakota Johnsons Shifting Career Trajectory Analyzing The Potential Impact Of Chris Martin

May 10, 2025

Dakota Johnsons Shifting Career Trajectory Analyzing The Potential Impact Of Chris Martin

May 10, 2025 -

Transgender Experiences Under Trumps Executive Orders We Want To Hear From You

May 10, 2025

Transgender Experiences Under Trumps Executive Orders We Want To Hear From You

May 10, 2025 -

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025

Europa League Preview Brobbeys Strength A Key Factor

May 10, 2025