Stock Market Reaction To Growing US Fiscal Worries

Table of Contents

The Impact of Rising US Debt on Investor Sentiment

The relationship between increasing national debt and investor sentiment is undeniably intertwined. As the US national debt continues to climb, anxieties about potential debt defaults or credit downgrades grow. This uncertainty directly impacts market stability, leading to increased volatility and potentially triggering sell-offs. Investors become hesitant to commit capital in an environment perceived as fiscally unstable.

- Increased borrowing costs for businesses: Higher government borrowing can push up interest rates, making it more expensive for businesses to secure loans and hindering investment and expansion.

- Reduced consumer spending due to economic uncertainty: Fiscal worries often translate to decreased consumer confidence, leading to reduced spending and potentially slowing economic growth.

- Potential inflation driven by government spending: Excessive government spending can fuel inflation, eroding the purchasing power of consumers and impacting corporate profitability.

- Foreign investor reactions to US fiscal instability: Concerns about US fiscal solvency can lead to foreign investors withdrawing capital, further impacting the dollar's value and market stability.

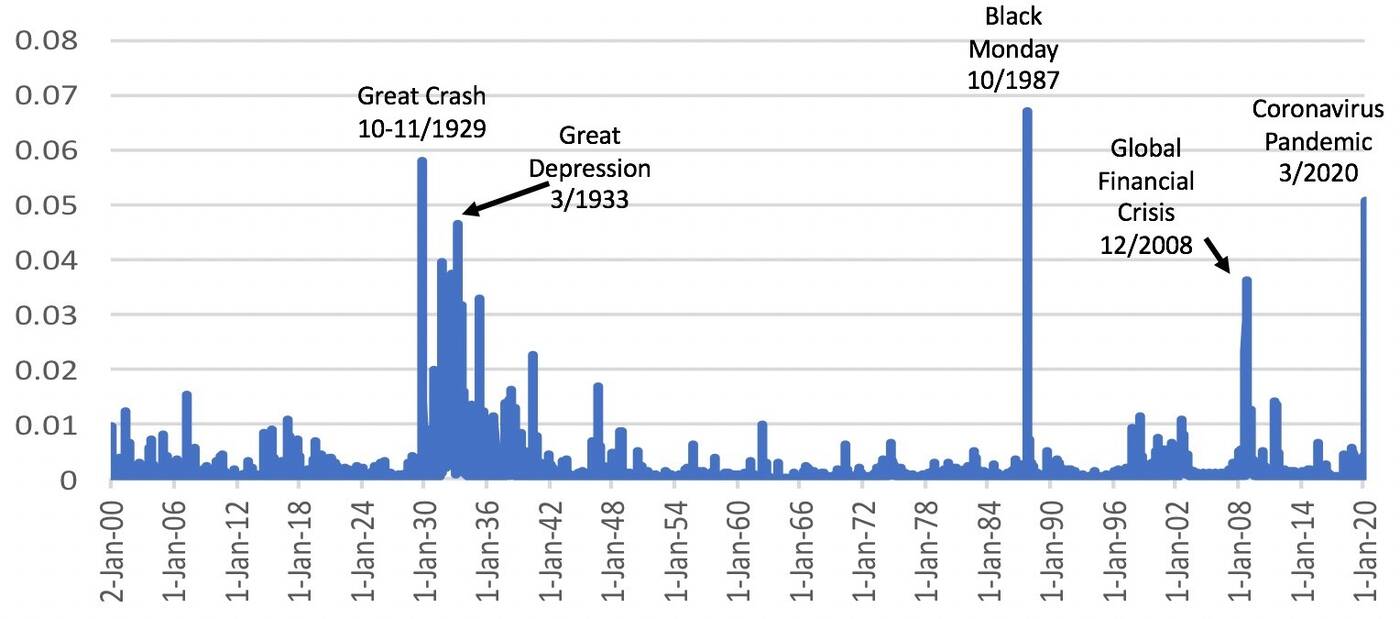

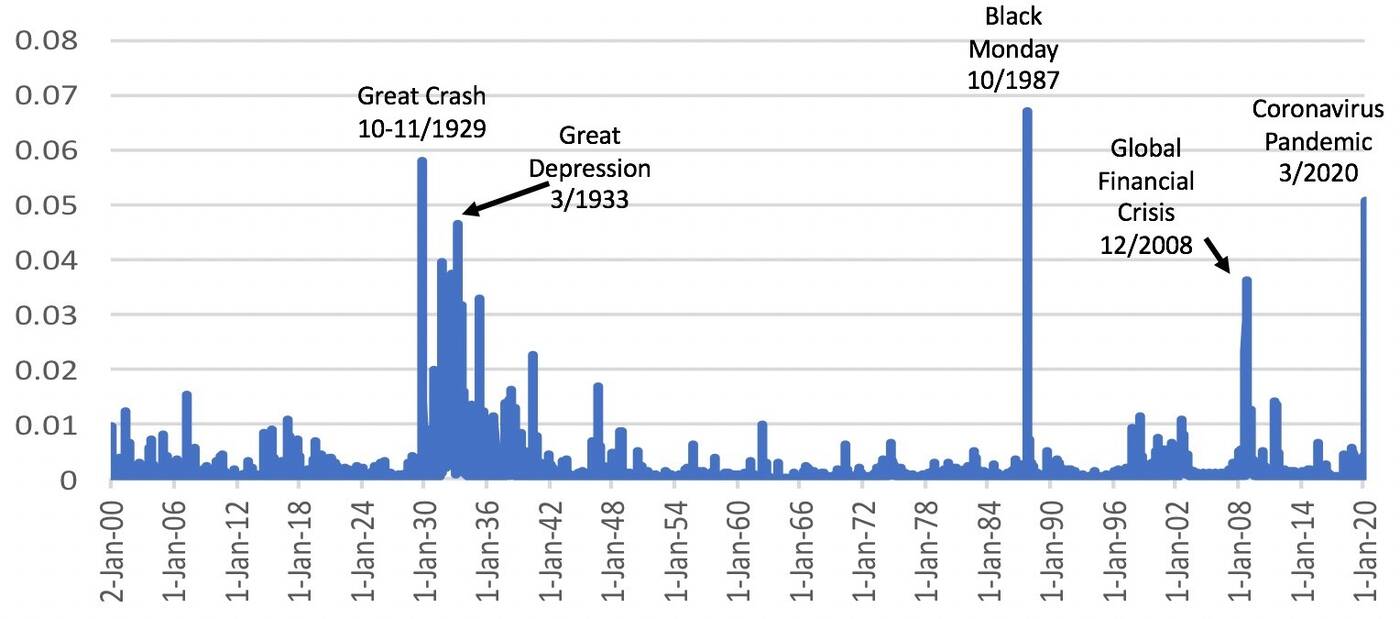

Analyzing the Stock Market's Response to Fiscal Policy Changes

Fiscal policy decisions – such as tax cuts, spending increases, or attempts at austerity – significantly influence market performance. Analyzing historical data reveals distinct market reactions to different policy choices. For instance, periods of substantial tax cuts have sometimes been followed by short-term market rallies, while significant spending increases can trigger inflation concerns and subsequent market corrections.

- Short-term vs. long-term market effects: The immediate impact of fiscal policy changes on the stock market can differ substantially from the long-term consequences. Short-term market reactions are often driven by speculation and investor sentiment, while long-term effects depend on the policy's overall economic impact.

- Sector-specific impacts (e.g., financials, technology): Different sectors react differently to fiscal policy changes. For example, the financial sector might be particularly sensitive to changes in interest rates, while the technology sector could be affected by changes in government spending on research and development.

- Role of the Federal Reserve's response: The Federal Reserve's actions in response to fiscal policy – such as adjusting interest rates or implementing quantitative easing – significantly impact the market's reaction.

Predicting Future Market Movements Based on Fiscal Worries

Accurately predicting the stock market's response to fiscal uncertainty is a complex challenge. Numerous factors intertwine to shape market behavior, and forecasting involves a high degree of uncertainty. However, careful monitoring of key indicators and the application of economic models can provide valuable insights.

- Importance of monitoring economic data releases (GDP, inflation, etc.): Tracking key economic indicators like GDP growth, inflation rates, and unemployment figures is essential for understanding the overall health of the economy and its potential sensitivity to fiscal pressures.

- Analyzing credit rating agency reports and government debt projections: Credit rating agency assessments and government debt projections offer valuable perspectives on the long-term fiscal outlook and potential risks.

- Considering political factors influencing fiscal policy decisions: Political gridlock and partisan debates can significantly impact fiscal policy decisions and introduce uncertainty into market forecasts.

- Using technical analysis to identify potential market trends: Technical analysis, focusing on chart patterns and trading volume, can provide insights into potential short-term market trends related to fiscal uncertainty.

Strategies for Investors Amidst US Fiscal Uncertainty

Navigating the current fiscal climate requires a cautious and strategic approach. Investors should prioritize risk management and portfolio diversification to mitigate potential losses and maximize returns.

- Diversifying investments across asset classes: Diversification across various asset classes (stocks, bonds, real estate, etc.) reduces exposure to any single market segment.

- Investing in defensive stocks less sensitive to economic downturns: Defensive stocks, such as consumer staples and utilities, often demonstrate greater resilience during economic uncertainty.

- Utilizing hedging strategies to mitigate potential losses: Hedging strategies, such as options trading, can help protect portfolios against potential market downturns.

- Seeking professional financial advice: Consulting a financial advisor can provide personalized guidance on managing investments and navigating the complex dynamics of the current fiscal landscape.

Conclusion

The stock market reaction to growing US fiscal worries is a multifaceted issue that demands close attention from investors. Understanding the impact of rising national debt on investor sentiment, analyzing the market's response to policy changes, and employing appropriate risk management strategies are crucial for successful navigation of this challenging environment. The challenges in predicting future movements emphasize the need for vigilance and informed decision-making.

To stay ahead of the curve and protect your investments, stay informed about US fiscal developments and their potential impact on your portfolio. Subscribe to our newsletter for regular updates on the Stock Market Reaction to Growing US Fiscal Worries, and follow us on social media for timely analysis and expert commentary. Don't let fiscal uncertainty derail your financial goals; arm yourself with knowledge and navigate the market with confidence.

Featured Posts

-

Edinburgh To Host Tour De France Grand Depart In 2027

May 23, 2025

Edinburgh To Host Tour De France Grand Depart In 2027

May 23, 2025 -

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025

Tour De France 2027 Grand Depart From Edinburgh Scotland

May 23, 2025 -

Goroskopy I Predskazaniya Dlya Vsekh Znakov Zodiaka

May 23, 2025

Goroskopy I Predskazaniya Dlya Vsekh Znakov Zodiaka

May 23, 2025 -

Grand Ole Oprys Historic London Concert Royal Albert Hall Broadcast Details

May 23, 2025

Grand Ole Oprys Historic London Concert Royal Albert Hall Broadcast Details

May 23, 2025 -

The Cost Of Anonymity An Analysis Of Trumps Memecoin Gathering

May 23, 2025

The Cost Of Anonymity An Analysis Of Trumps Memecoin Gathering

May 23, 2025