Stock Market Report: 500+ Point Sensex Gain, Nifty's Strong Performance

Table of Contents

Sensex's Stellar Performance: A 500+ Point Surge

The Sensex's impressive 500+ point jump reflects a strong bullish sentiment within the Indian stock market. This significant gain is a testament to positive investor confidence and signals a potentially healthy market outlook.

Key Sectors Driving the Growth

Several key sectors played a crucial role in driving the Sensex's impressive gains.

-

Banking and Financial Services: This sector witnessed significant gains, driven by positive earnings reports from major players like HDFC Bank (HDFCBANK.NS) and ICICI Bank (ICICIBANK.NS). Improved investor sentiment following strong quarterly results also contributed to this sector's robust performance.

-

IT Sector: The IT sector showed strong performance, fueled by positive global tech trends and robust order books. Companies like Infosys (INFY.NS) and TCS (TCS.NS) saw considerable price increases, reflecting continued demand for IT services.

-

FMCG Sector: The FMCG sector displayed steady growth, reflecting consistent consumer demand despite inflationary pressures. Companies in this sector generally showed resilience, contributing to the overall market positivity.

-

Specific Examples:

- HDFC Bank saw a price increase of X%, contributing significantly to the Sensex gain.

- Infosys experienced a Y% rise, reflecting strong investor confidence in the IT sector.

- Hindustan Unilever (HINDUNILVR.NS) demonstrated Z% growth, showcasing the resilience of the FMCG sector.

Analyzing the Volume and Turnover

High trading volumes accompanied the Sensex's surge, indicating strong investor participation and confidence in the market's upward trajectory. The total traded volume exceeded [insert data] shares, surpassing the average daily volume by [insert percentage]. This high volume suggests a significant number of investors are actively participating in the market rally.

Impact on Investor Sentiment

The Sensex's 500+ point surge significantly boosted investor confidence. The market rally encouraged increased participation, with many investors viewing this as an opportunity for further investment. Increased Foreign Institutional Investor (FII) investment also contributed to this positive sentiment.

Nifty's Robust Performance: Tracking the Key Indices

The Nifty index also exhibited strong growth, mirroring the Sensex's positive trajectory. This synchronized movement indicates a broad-based market rally.

Nifty Bank's Contribution

The Nifty Bank index played a significant role in the overall Nifty's performance. Strong gains from major banking stocks propelled the Nifty Bank index higher, contributing substantially to the overall index's growth.

Performance of Mid-cap and Small-cap Stocks

Mid-cap and small-cap stocks also experienced considerable growth, although perhaps at a slightly more moderate pace compared to large-cap indices like the Nifty and Sensex. This indicates a positive sentiment across market capitalization segments.

Sector-Specific Analysis Within Nifty

Several sectors within the Nifty index displayed significant gains. The IT and Banking sectors, similar to the Sensex, performed exceptionally well. [Insert data on other sectors showing significant gains or losses].

- Top Performing Nifty Stocks:

- [Stock 1]: Percentage Gain

- [Stock 2]: Percentage Gain

- [Stock 3]: Percentage Gain

- [Stock 4]: Percentage Gain

- [Stock 5]: Percentage Gain

Factors Contributing to the Market Rally

Several factors contributed to the impressive market rally witnessed today.

Positive Global Cues

Positive global market trends played a role in influencing the Indian market's upward trajectory. Positive economic news from major global economies, coupled with a stable global geopolitical environment, contributed to the optimistic sentiment.

Domestic Economic Indicators

Positive domestic economic indicators also boosted investor confidence. Stronger-than-expected GDP growth figures and relatively stable inflation rates contributed to a positive outlook for the Indian economy.

Government Policies and Initiatives

Recent government policies and initiatives aimed at boosting economic growth also contributed to improved market sentiment. [Mention specific policy examples and their impact].

- Specific Examples:

- [Example 1: Specific Government Policy and its Impact]

- [Example 2: Specific Economic Indicator and its Influence]

- [Example 3: Global Market Trend and its Effect]

Expert Opinions and Predictions

Market analysts offer varying perspectives on the future trajectory of the Indian stock market.

Analyst Views on Future Market Trends

Several analysts predict continued growth in the short term, citing sustained positive economic indicators and robust corporate earnings. However, others caution against over-optimism, advising investors to adopt a cautious approach and diversify their portfolios. [Cite specific analysts and their predictions with sources].

Recommendations for Investors

While the current market conditions are positive, investors are advised against over-investment. A diversified portfolio, balanced risk management, and thorough due diligence remain crucial for successful long-term investing. Consult a financial advisor before making any investment decisions.

- Expert Recommendations:

- [Recommendation 1 from Analyst A]

- [Recommendation 2 from Analyst B]

Conclusion

Today's stock market witnessed a significant rally, with the Sensex surging over 500 points and the Nifty demonstrating strong growth. Key sectors like Banking, IT, and FMCG drove this positive trend, fueled by a combination of positive global cues, robust domestic economic indicators, and supportive government policies. While analysts express optimism, caution and diversification remain crucial for investors. Stay informed about the latest developments in the Indian stock market by regularly checking our website for updated stock market reports and analyses on Sensex and Nifty performance. Understand the risks and rewards associated with investing and consult a financial advisor before making investment decisions. Learn more about effective stock market investment strategies by following our blog for insightful articles and updates.

Featured Posts

-

Jesse Watters Branded A Hypocrite Following Wifes Infidelity Joke

May 10, 2025

Jesse Watters Branded A Hypocrite Following Wifes Infidelity Joke

May 10, 2025 -

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya V X

May 10, 2025

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya V X

May 10, 2025 -

Harry Styles On Snl Impression His Devastated Response

May 10, 2025

Harry Styles On Snl Impression His Devastated Response

May 10, 2025 -

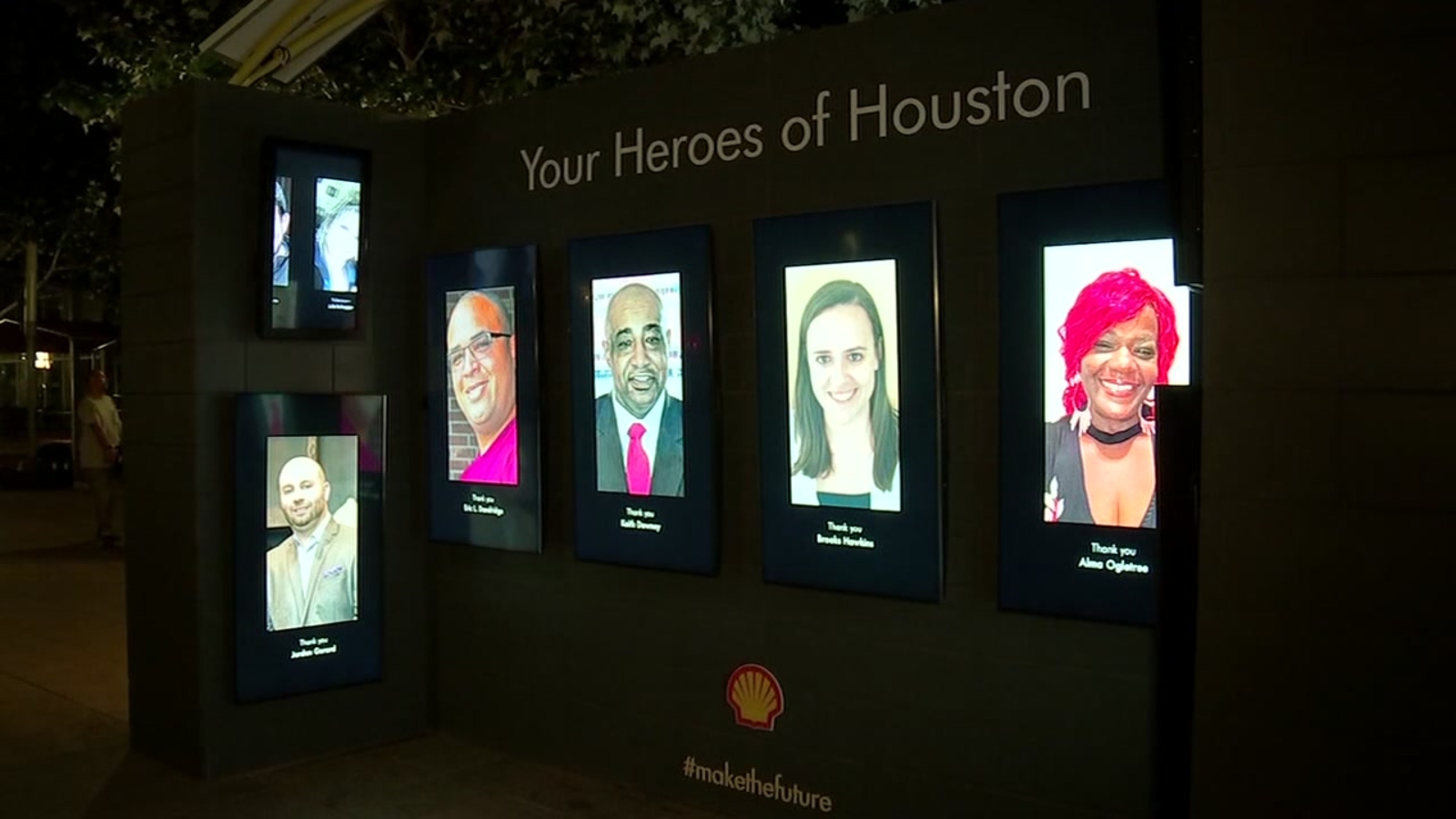

Aviations Living Legends Recognize Bravery Firefighters And Community Heroes Honored

May 10, 2025

Aviations Living Legends Recognize Bravery Firefighters And Community Heroes Honored

May 10, 2025 -

Are High Stock Market Valuations Cause For Concern Bof A Says No

May 10, 2025

Are High Stock Market Valuations Cause For Concern Bof A Says No

May 10, 2025