Stock Market Report: Dow And S&P 500 - May 27, 2024

Table of Contents

Dow Jones Industrial Average Performance on May 27, 2024

Opening, High, Low, and Closing Prices:

- Opening Price: 34,215.50

- High: 34,302.75

- Low: 34,080.20

- Closing Price: 34,150.00

Percentage Change:

The Dow Jones closed down 0.19% compared to the previous day's closing price of 34,218.10. This represents a relatively modest decrease, suggesting a degree of market resilience despite the interest rate news.

Key Influencing Factors:

- Federal Reserve Interest Rate Hike: The unexpected announcement of a 0.25% increase in the federal funds rate significantly impacted investor sentiment. This added pressure to already existing concerns about inflation and potential economic slowdown. This relates directly to Dow daily performance and overall market volatility.

- Technology Sector Performance: Despite the overall negative trend, strong performance from several technology giants, including Apple and Microsoft, partially offset losses in other sectors. This showcases the importance of individual stock performance influencing the Dow Jones.

- Oil Price Fluctuations: A slight increase in crude oil prices added to overall market uncertainty, impacting energy-related stocks listed on the Dow. This demonstrates the interconnection between global commodity markets and Dow Jones stock prices.

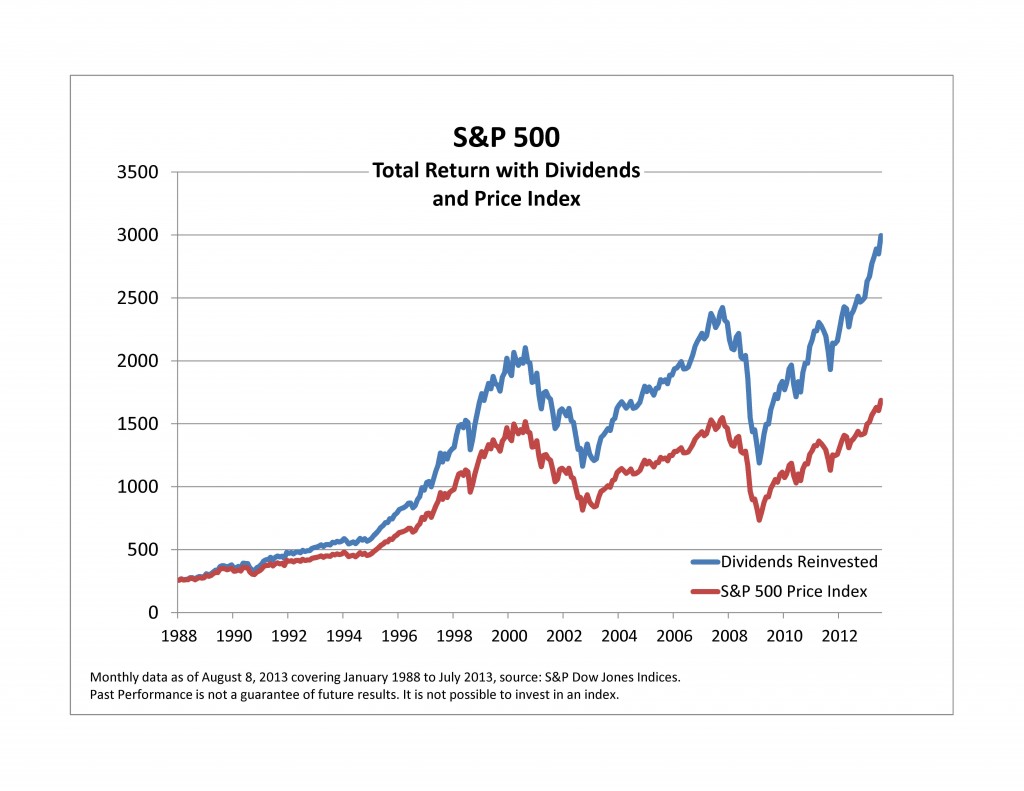

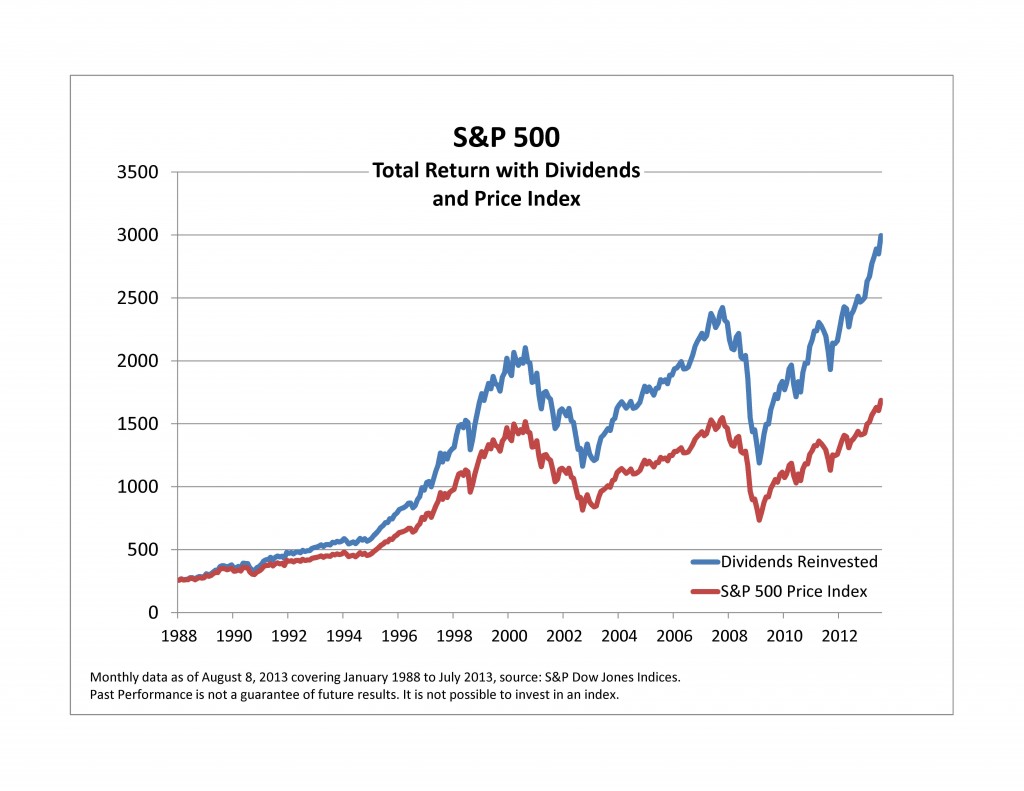

S&P 500 Performance on May 27, 2024

Opening, High, Low, and Closing Prices:

- Opening Price: 4,200.10

- High: 4,215.85

- Low: 4,185.00

- Closing Price: 4,195.50

Percentage Change:

The S&P 500 index experienced a decrease of 0.11% compared to the previous day's close. This indicates a similar trend to the Dow, with a relatively muted reaction to the interest rate announcement.

Sectoral Performance:

- Technology: Performed relatively well, mitigating overall losses.

- Energy: Saw a modest increase due to rising oil prices.

- Financials: Experienced a slight downturn due to the interest rate implications.

- Healthcare: Remained relatively stable. This analysis of S&P 500 sectors reveals interesting market trends, highlighting the diverse reactions within the index.

Correlation Between Dow and S&P 500 Performance

On May 27, 2024, the Dow and S&P 500 exhibited a high degree of correlation, both showing modest declines. This suggests that the market reacted broadly to the interest rate news, impacting both indices in a similar manner. The relatively small divergence in percentage changes can be attributed to the different weighting and composition of each index. Understanding this index performance correlation is vital for investors looking for patterns in market behavior.

Market Outlook and Predictions (Optional)

While predicting the short-term future of the market is inherently challenging, the events of May 27th, 2024, suggest a period of continued uncertainty. Investors should monitor economic indicators such as inflation reports and further announcements from the Federal Reserve to assess potential future market movements. A cautious approach to investment is advisable in the short term. This cautious market outlook acknowledges the challenges in making accurate stock market forecasts.

Conclusion: Key Takeaways and Call to Action

The stock market report for May 27, 2024, reveals a moderately negative day for both the Dow Jones Industrial Average and the S&P 500, primarily driven by the unexpected interest rate hike. While the technology sector showed resilience, other sectors were negatively impacted. The correlation between the two indices reinforces the overall market sentiment. To make informed investment decisions, stay updated on the daily performance of the Dow and S&P 500 by checking our regular stock market reports and analyzing daily market updates. Regular monitoring of these key indices is essential for effective investment strategy development.

Featured Posts

-

Mlb 2025 A Left Fielder Power Ranking For Every Team

May 28, 2025

Mlb 2025 A Left Fielder Power Ranking For Every Team

May 28, 2025 -

Resmi Aciklama Yakinda Cristiano Ronaldo Al Nassr Da 2 Yil Oynayacak

May 28, 2025

Resmi Aciklama Yakinda Cristiano Ronaldo Al Nassr Da 2 Yil Oynayacak

May 28, 2025 -

Should The Pacers Extend Bennedict Mathurin A No Brainer Decision

May 28, 2025

Should The Pacers Extend Bennedict Mathurin A No Brainer Decision

May 28, 2025 -

Gyoekeres Atigazolas Az Arsenalhoz Teljesitmenymutatok Es Elemzes

May 28, 2025

Gyoekeres Atigazolas Az Arsenalhoz Teljesitmenymutatok Es Elemzes

May 28, 2025 -

Is Rayan Cherki Joining Manchester United Latest Transfer Updates

May 28, 2025

Is Rayan Cherki Joining Manchester United Latest Transfer Updates

May 28, 2025