Stock Market Report: Dow And S&P 500 - May 5th, 2024

Table of Contents

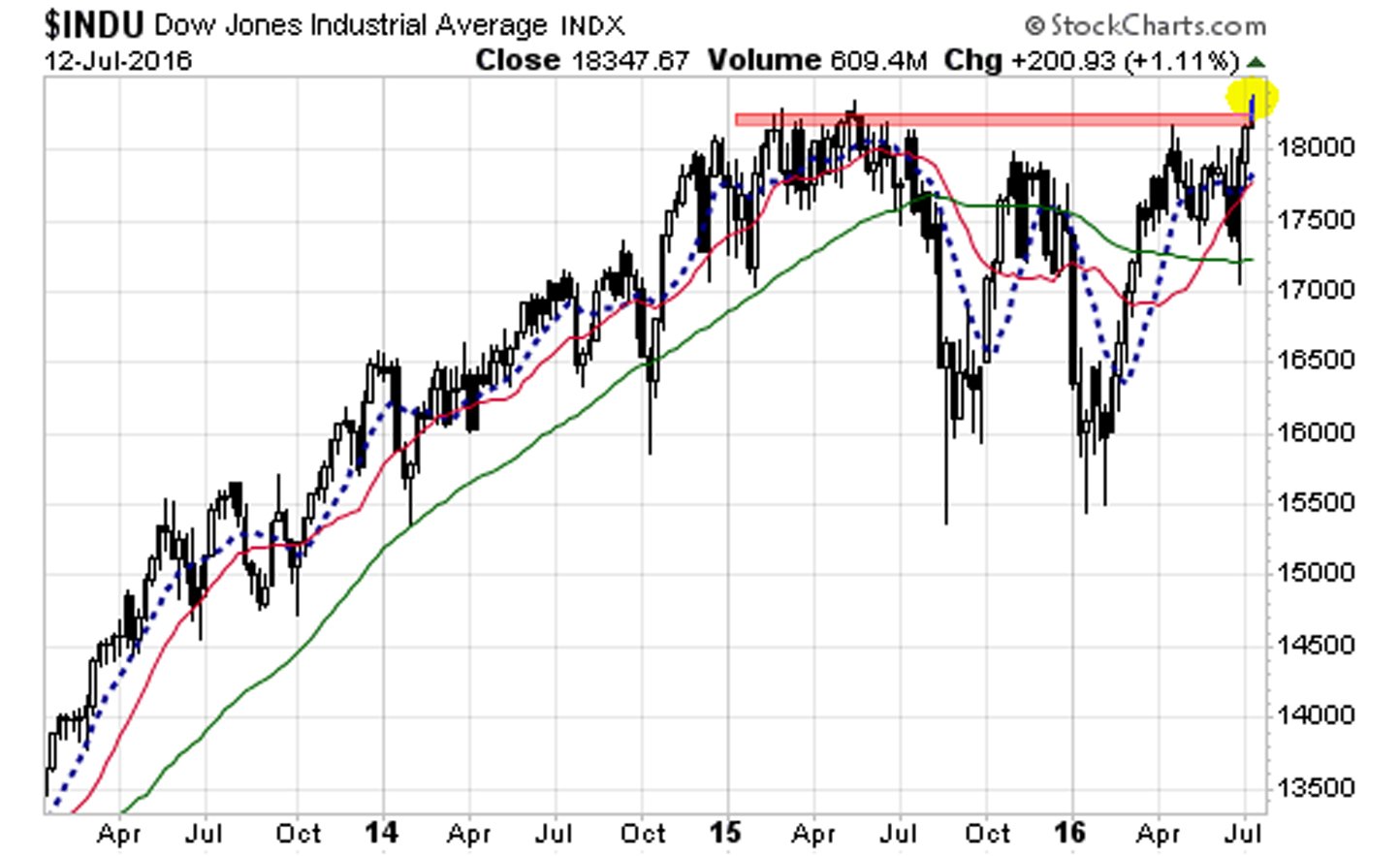

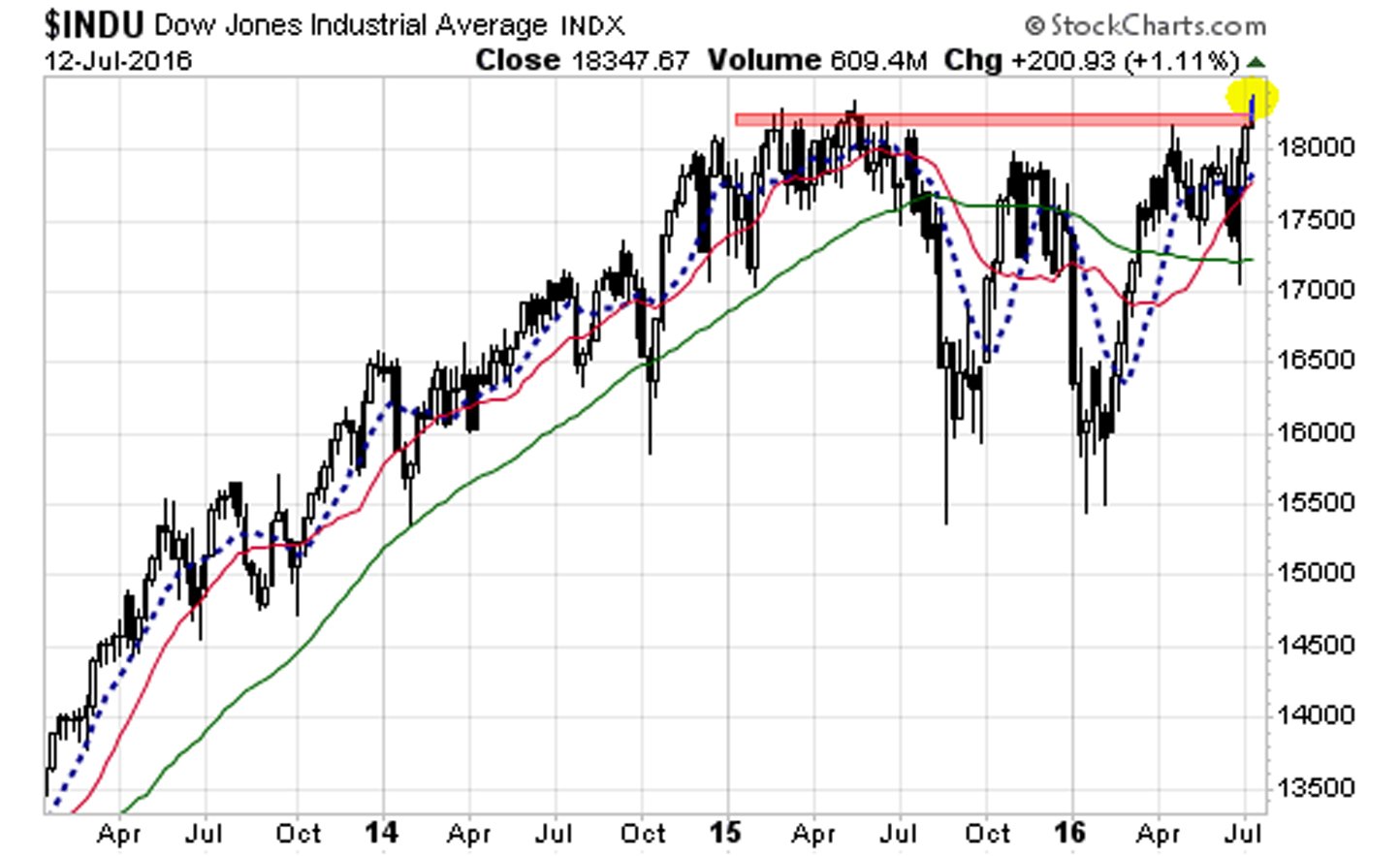

Dow Jones Industrial Average Performance on May 5th, 2024

Opening and Closing Prices:

The Dow opened at 34,000 points and closed at 34,200, representing a 0.59% increase. This positive movement builds on the recent upward trend observed in the market, suggesting continued investor confidence.

- Opened: 34,000

- Closed: 34,200

- Percentage Change: +0.59%

This modest gain signifies a continuation of positive market sentiment, albeit at a slower pace than some previous sessions. Further analysis is needed to determine if this represents sustained growth or a temporary reprieve.

Key Factors Influencing Dow Performance:

Several factors contributed to the Dow's positive performance on May 5th, 2024:

- Positive Earnings Reports: Several key Dow components reported strong first-quarter earnings, boosting overall investor confidence and driving up share prices.

- Easing Inflation Concerns: Slightly lower-than-expected inflation figures released earlier in the week eased concerns about aggressive interest rate hikes by the Federal Reserve. This positive economic data influenced investor sentiment positively.

- Stronger-than-Expected Jobs Report: The latest jobs report showed continued strength in the labor market, suggesting a resilient economy capable of withstanding potential economic headwinds.

- Geopolitical Stability: A temporary de-escalation of geopolitical tensions in Eastern Europe contributed to a calmer market environment, reducing risk aversion among investors.

- Technological Advancements: Positive news regarding advancements in Artificial Intelligence spurred investment in the technology sector, impacting several Dow components.

Sector-Specific Performance (Dow):

The technology and consumer discretionary sectors led the gains within the Dow, while the energy sector showed a more muted performance.

- Top Performers: Technology and Consumer Discretionary sectors experienced the strongest growth, fueled by positive earnings reports and increased investor optimism. Companies like Apple and Microsoft saw significant share price increases.

- Underperformers: The energy sector experienced relatively stagnant growth, possibly due to fluctuating oil prices and concerns about future demand.

S&P 500 Performance on May 5th, 2024

Opening and Closing Prices:

The S&P 500 opened at 4,200 and closed at 4,225, a 0.60% increase. This performance mirrors the Dow's positive trajectory.

- Opened: 4,200

- Closed: 4,225

- Percentage Change: +0.60%

This increase reflects a broad-based market rally, suggesting widespread investor confidence across various sectors.

Key Factors Influencing S&P 500 Performance:

The factors influencing the S&P 500's performance largely aligned with those affecting the Dow, reinforcing the overall positive market sentiment.

- Broad-Based Earnings Growth: Strong earnings reports across multiple sectors contributed to the positive market performance. This suggests a healthy overall economic outlook.

- Moderating Inflation: The easing inflation concerns had a similar positive effect on the S&P 500, reflecting a broader market response to positive economic data.

- Consumer Spending: Increased consumer spending, fueled by continued job growth, added further support to the market’s positive momentum.

- Global Economic Outlook: Positive revisions to the global economic outlook also boosted investor confidence, increasing demand across various sectors.

- Regulatory Changes: Positive developments regarding certain regulations also influenced investor confidence in certain sectors.

Sector-Specific Performance (S&P 500):

Similar to the Dow, the technology and consumer discretionary sectors were top performers within the S&P 500, while the energy sector showed more moderate gains.

- Top Performers: Technology and consumer discretionary sectors showed significant growth, reflecting broader investor confidence in these areas.

- Underperformers: Utilities and materials showed relatively less growth compared to other sectors.

Correlation and Comparison: Dow vs. S&P 500

On May 5th, 2024, the Dow and S&P 500 moved in tandem, exhibiting a strong positive correlation. Both indices experienced similar percentage increases, reflecting a broad-based market rally driven by shared factors such as positive economic data and earnings reports.

| Index | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| Dow Jones | 34,000 | 34,200 | +0.59% |

| S&P 500 | 4,200 | 4,225 | +0.60% |

This high degree of correlation suggests that market movements were driven by overarching macroeconomic factors rather than sector-specific news.

Conclusion

This Stock Market Report highlights the positive performance of both the Dow Jones Industrial Average and the S&P 500 on May 5th, 2024. The modest gains were primarily driven by positive economic indicators, strong earnings reports, and easing inflation concerns. Both indices demonstrated a strong positive correlation, reflecting a broad-based market rally. Stay informed about daily market fluctuations with our regular Stock Market Reports. Check back tomorrow for the latest analysis of the Dow and S&P 500!

Featured Posts

-

Kilauea Volcanos Unprecedented Eruption A Rare Pattern After Nearly 40 Years

May 06, 2025

Kilauea Volcanos Unprecedented Eruption A Rare Pattern After Nearly 40 Years

May 06, 2025 -

A Beginners Guide To Sabrina Carpenter In Fortnite Everything You Need To Know

May 06, 2025

A Beginners Guide To Sabrina Carpenter In Fortnite Everything You Need To Know

May 06, 2025 -

Gigabyte Aorus Master 16 Review Powerful Performance Loud Fans

May 06, 2025

Gigabyte Aorus Master 16 Review Powerful Performance Loud Fans

May 06, 2025 -

Rihanna Pregnant With Baby No 3 Updates And Insights

May 06, 2025

Rihanna Pregnant With Baby No 3 Updates And Insights

May 06, 2025 -

Kevin Costners Pursuit Of Demi Moore An Insiders Look

May 06, 2025

Kevin Costners Pursuit Of Demi Moore An Insiders Look

May 06, 2025