Stock Market Update: Dow Jones & S&P 500 Live Data (May 27)

Table of Contents

Dow Jones Industrial Average Performance (May 27)

Opening Prices & Intraday Volatility

The Dow Jones Industrial Average (DJIA) opened at 33,826.69 on May 27th. Throughout the day, the index experienced considerable volatility, reflecting the uncertainty in the broader market.

- Opening Price: 33,826.69

- Intraday High: 34,012.55

- Intraday Low: 33,750.82

- Closing Price: 33,926.71

This volatility can be attributed to several factors, including concerns about rising interest rates and mixed economic data released earlier in the week. The market reacted to these conflicting signals, leading to significant intraday fluctuations.

Sector-Specific Performance

Performance varied significantly across different sectors within the Dow Jones.

- Strong Performers: Technology stocks, buoyed by positive earnings reports from several major companies, saw significant gains. For example, Apple experienced a positive surge. Similarly, the energy sector benefited from rising oil prices.

- Underperformers: Consumer discretionary and financial stocks experienced relatively weaker performance, likely due to concerns about potential economic slowdowns. Companies in these sectors faced pressure from investor uncertainty.

Analyzing sector-specific performance is crucial for understanding the nuanced dynamics within the broader market.

Key Influencing Factors

Several factors influenced the Dow Jones's performance on May 27th.

- Inflation Concerns: Persistent inflation remained a key concern for investors, impacting market sentiment and driving volatility.

- Interest Rate Hike Expectations: The anticipation of further interest rate hikes by the Federal Reserve added to the uncertainty, putting downward pressure on certain sectors.

- Geopolitical Events: Ongoing geopolitical instability continued to contribute to market uncertainty, prompting investors to adopt a cautious approach.

S&P 500 Index Performance (May 27)

Opening Prices & Intraday Movement

The S&P 500 opened at 4,131.74 on May 27th. Its movement largely mirrored that of the Dow Jones, exhibiting similar volatility.

- Opening Price: 4,131.74

- Intraday High: 4,152.33

- Intraday Low: 4,120.11

- Closing Price: 4,141.56

The overall trend was slightly upward, suggesting a degree of resilience in the face of ongoing economic challenges.

Comparison to Dow Jones Performance

Both the S&P 500 and the Dow Jones displayed similar patterns on May 27th, with both indices experiencing periods of significant volatility. However, the S&P 500 demonstrated slightly stronger overall performance compared to the Dow Jones. This divergence could be attributed to the differing composition of the two indices, with the S&P 500 encompassing a broader range of companies.

Market Breadth Analysis

The market breadth on May 27th reflected a mixed sentiment. While the major indices showed some gains, the number of advancing and declining stocks was relatively balanced, suggesting underlying uncertainty. A closer look at the individual stock movements provides a more granular view of market sentiment.

Technical Analysis & Chart Patterns (May 27)

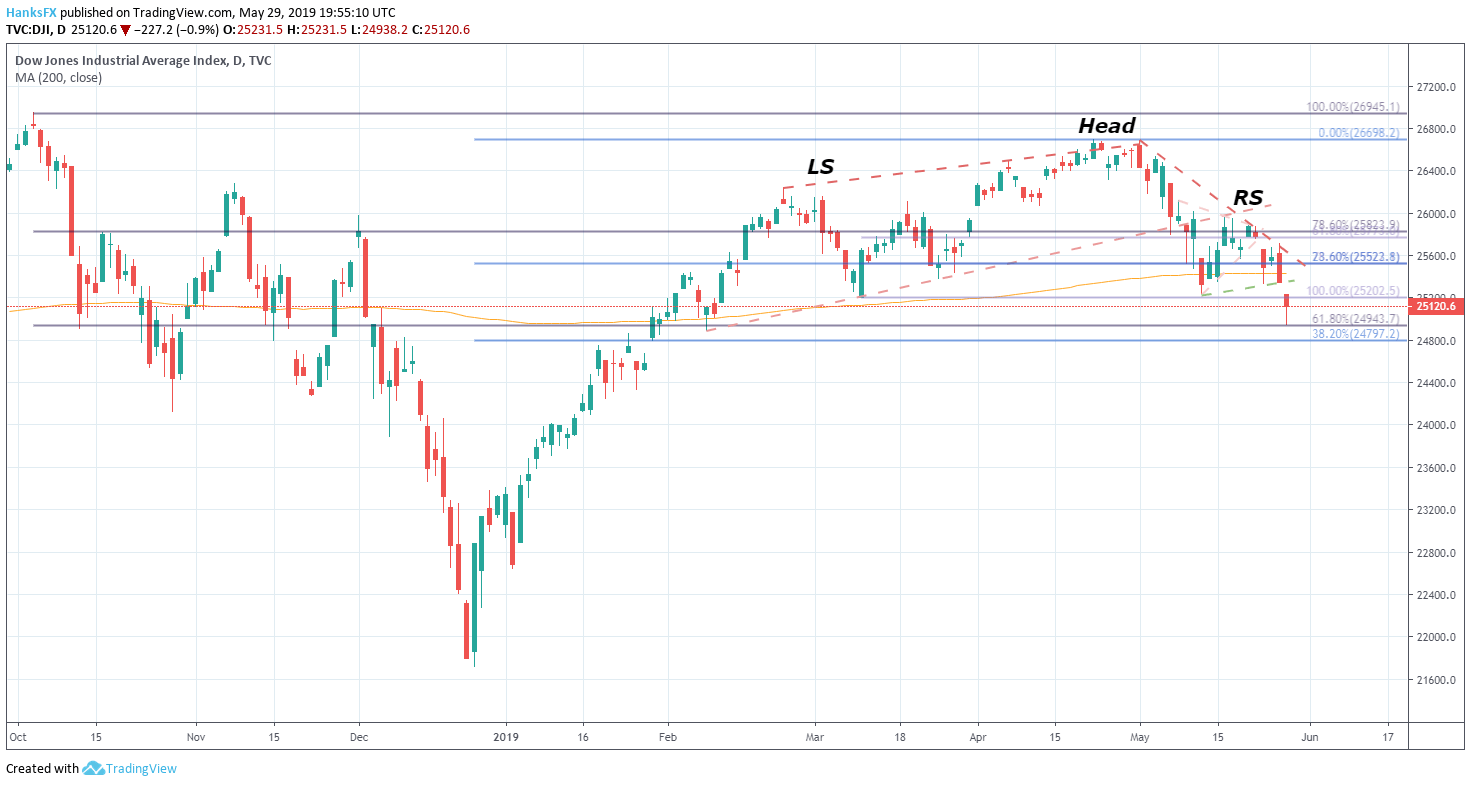

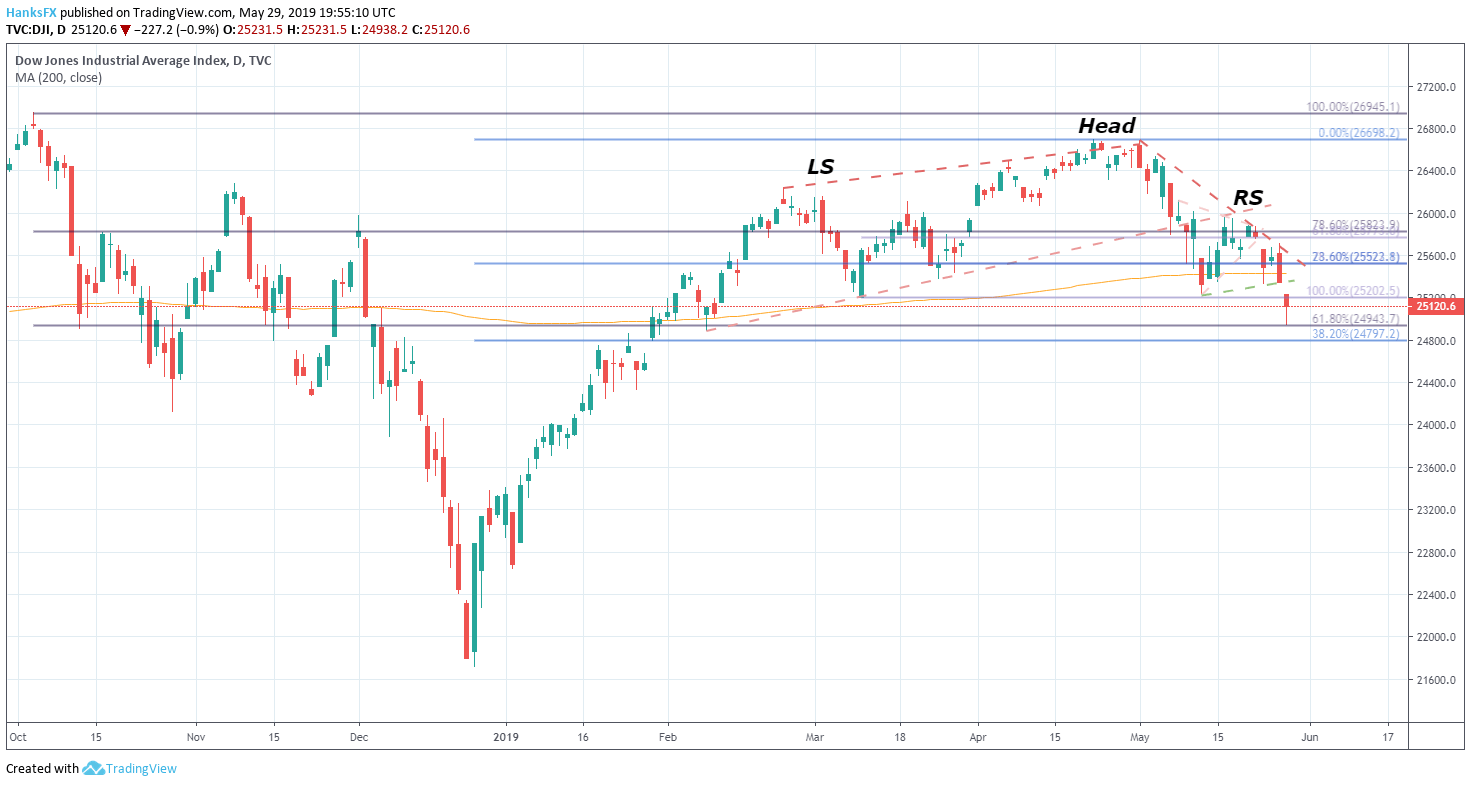

Dow Jones Chart Analysis

The Dow Jones chart on May 27th showed some signs of consolidation after a recent period of upward momentum. Support levels around 33,700 were tested, indicating potential buying pressure at lower price points.

S&P 500 Chart Analysis

Similarly, the S&P 500 chart displayed consolidation, with potential resistance levels around 4,160. The moving averages suggested a continuation of the sideways trend. (Note: Visual aids, such as charts and graphs, would be included here in a published article.)

Implications for Future Market Movement

Based on the technical analysis, the market appears to be entering a period of consolidation, awaiting further clarity on economic indicators and geopolitical developments. The direction of future market movement remains uncertain.

Conclusion

May 27th saw the Dow Jones and S&P 500 experience notable intraday volatility, influenced by inflation concerns, interest rate hike expectations, and geopolitical uncertainty. Both indices showed resilience, closing with modest gains, but sector-specific performance varied considerably. To make informed investment decisions, staying updated on live stock market data is essential. Stay updated with our daily Dow Jones and S&P 500 live data for continuous insights into market trends. [Link to daily updates/newsletter signup]

Featured Posts

-

Can Jacob Wilsons Breakout Season Be Believed A Poll And Analysis

May 28, 2025

Can Jacob Wilsons Breakout Season Be Believed A Poll And Analysis

May 28, 2025 -

Al Nassr Ve Cristiano Ronaldo 2 Yillik Bir Ortaklik Mi

May 28, 2025

Al Nassr Ve Cristiano Ronaldo 2 Yillik Bir Ortaklik Mi

May 28, 2025 -

Nhayt Almwsm Ayndhwfn Yhtfl Blqb Aldwry Alhwlndy

May 28, 2025

Nhayt Almwsm Ayndhwfn Yhtfl Blqb Aldwry Alhwlndy

May 28, 2025 -

Ramalan Cuaca Jawa Timur 6 Mei 2024 Hujan Di Beberapa Daerah

May 28, 2025

Ramalan Cuaca Jawa Timur 6 Mei 2024 Hujan Di Beberapa Daerah

May 28, 2025 -

Man United In Race For Rayan Cherki Transfer Battle Heats Up

May 28, 2025

Man United In Race For Rayan Cherki Transfer Battle Heats Up

May 28, 2025