Stock Market Valuation Concerns? BofA Offers A Counterargument

Table of Contents

BofA's Bullish Stance: Why They Believe the Market Isn't Overvalued

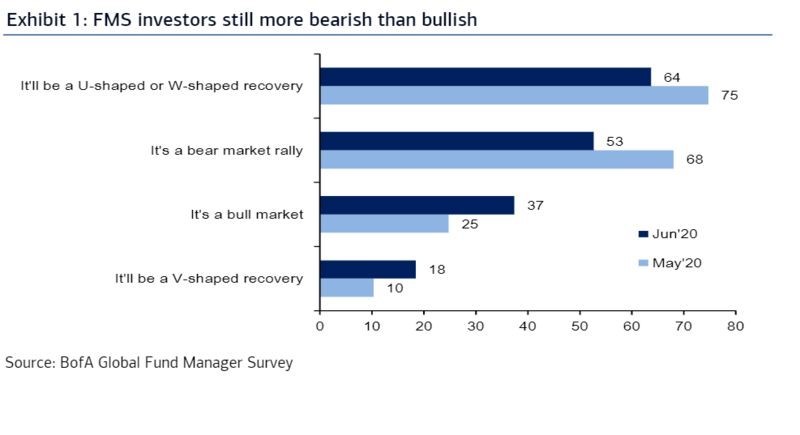

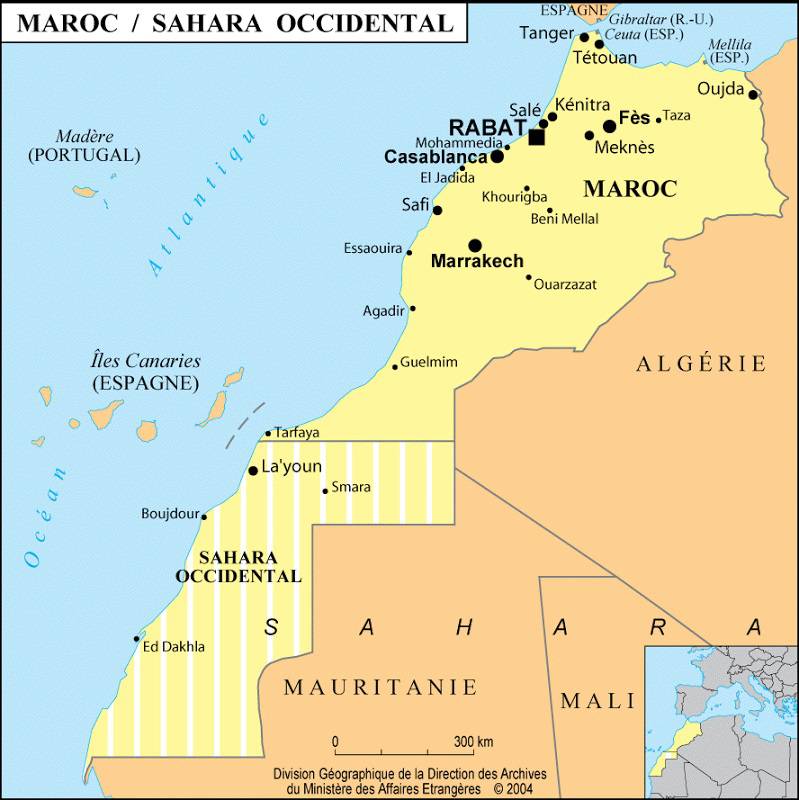

BofA's core argument against market overvaluation rests on several key pillars. They contend that current valuations, while seemingly high compared to historical averages, are justified by strong corporate earnings growth and a positive outlook for the economy. Their analysis incorporates a range of metrics, including price-to-earnings ratios (P/E), discounted cash flow (DCF) analysis, and sector-specific performance indicators.

- BofA's Key Economic Forecasts: BofA's assessment is heavily influenced by their forecast of continued, albeit moderate, economic growth, supported by factors such as strong consumer spending and robust corporate investment. They anticipate inflation to gradually decrease, further supporting their positive market outlook.

- Undervalued Sectors: BofA identifies specific sectors, such as technology and certain segments of the healthcare industry, as potentially undervalued, offering attractive investment opportunities. They point to strong future growth potential and robust balance sheets within these sectors.

- Quantitative Data: BofA supports their claims with data showing that while P/E ratios are elevated, they are in line with historical precedents when considering the current low interest rate environment and projected earnings growth. They also highlight the strong balance sheets of many publicly traded companies.

Addressing Common Valuation Concerns: Debunking the Myths

Several arguments fuel concerns about stock market overvaluation. Let's examine them through BofA's lens:

- High P/E Ratios: Critics point to high P/E ratios compared to historical averages. BofA counters this by emphasizing that these elevated ratios are partially justified by the historically low interest rate environment, which reduces the discount rate used in valuation models, leading to higher present values. They also highlight the expectation of robust future earnings growth.

- Rising Interest Rates: The impact of rising interest rates on stock valuations is a major concern. BofA acknowledges the potential for higher rates to dampen growth, but argues that the current level of rate increases is already factored into their models and is not expected to significantly derail market performance. They emphasize the strength of corporate balance sheets to withstand moderate interest rate hikes.

- Market Correction Potential: The possibility of a market correction is undeniable. BofA acknowledges this risk but suggests that a sharp correction is less likely given their positive economic forecasts and the overall strength of corporate fundamentals. They view any potential downturn as a buying opportunity for long-term investors.

BofA's Investment Recommendations Based on Their Valuation Analysis

Based on their valuation analysis, BofA recommends a moderately bullish investment strategy. They advise maintaining a diversified portfolio, with a focus on equities, particularly in the sectors identified as potentially undervalued. The following points summarize their suggestions:

- Investment Recommendations: While specific stock recommendations should be sought from a financial advisor, BofA's publicly available research generally points toward sectors with strong growth potential. However, always perform your own due diligence.

- Risk Mitigation: BofA emphasizes the importance of diversification across sectors and asset classes to manage risk. They suggest allocating a portion of the portfolio to defensive assets to reduce volatility.

- Investment Horizon: Their recommendations lean towards a long-term investment horizon, recognizing that market fluctuations are normal and that a long-term perspective is crucial for successful investing.

Alternative Perspectives and Critical Analysis

It's crucial to acknowledge that BofA's viewpoint isn't universally shared. Many analysts hold more cautious perspectives, citing factors such as geopolitical uncertainty and persistent inflation as potential headwinds.

- Differing Viewpoints: Other financial institutions have expressed concerns about overvaluation, citing potentially unsustainable valuations in certain sectors and the potential for a more significant market correction than BofA anticipates.

- Limitations of BofA's Analysis: BofA's analysis, like any other, has limitations. Their economic forecasts are subject to uncertainty, and unforeseen events could significantly impact their conclusions. Their analysis focuses on quantitative data and might not fully capture qualitative factors affecting market sentiment and investor behavior.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Insights

BofA's counterargument to prevailing stock market valuation concerns rests on a positive economic outlook, strong corporate earnings, and the belief that current valuations, while high, are justified by future growth prospects. While acknowledging the potential for market corrections and considering alternative perspectives is vital, BofA's analysis offers a valuable perspective for investors. Remember to always conduct your own thorough due diligence before making any investment decisions. To further explore BofA's research and understand their methodology for assessing stock valuations, consult their publicly available reports and resources. By considering various perspectives and understanding the nuances of stock market valuation, you can develop a more informed and robust investment strategy for managing stock market valuation risks.

Featured Posts

-

Where To Stream Green Bones And The Breadwinner Post Mmff 2024 A Netflix Guide

May 27, 2025

Where To Stream Green Bones And The Breadwinner Post Mmff 2024 A Netflix Guide

May 27, 2025 -

How To Watch 1923 Season 2 Episode 7 Finale Streaming And Release Details

May 27, 2025

How To Watch 1923 Season 2 Episode 7 Finale Streaming And Release Details

May 27, 2025 -

The Sheridan Verse Unraveling The Links Between Landman And Yellowstone

May 27, 2025

The Sheridan Verse Unraveling The Links Between Landman And Yellowstone

May 27, 2025 -

Le Sahara Occidental Et La Caf Une Decision Historique

May 27, 2025

Le Sahara Occidental Et La Caf Une Decision Historique

May 27, 2025 -

Put Ukrainy V Nato Germaniya Podtverzhdaet Svoyu Podderzhku

May 27, 2025

Put Ukrainy V Nato Germaniya Podtverzhdaet Svoyu Podderzhku

May 27, 2025