Stock Market Valuation Concerns? BofA Offers A Different Perspective

Table of Contents

BofA's Arguments Against Overvaluation

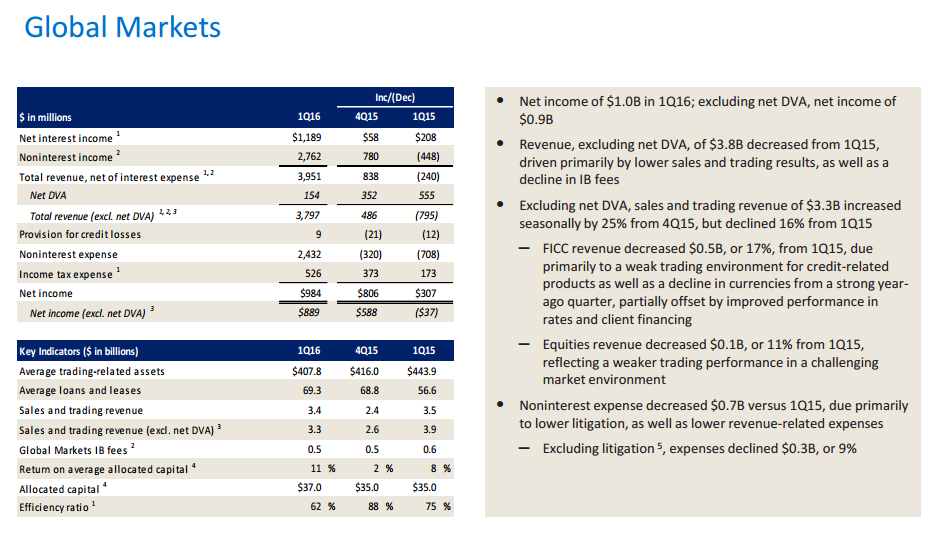

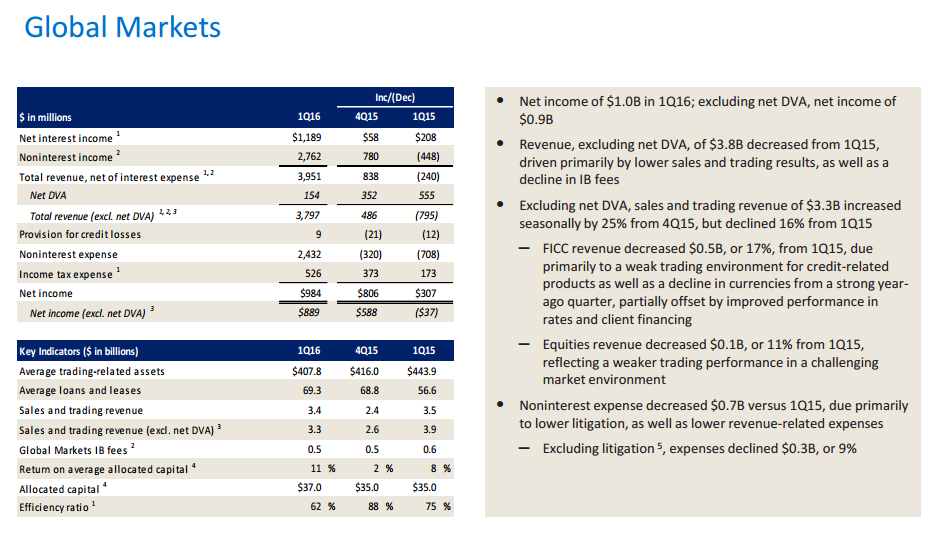

BofA's analysis of stock market valuation challenges the common narrative of an overvalued market. Their perspective incorporates several key factors, moving beyond simplistic interpretations of traditional metrics.

Focus on Earnings Growth

BofA emphasizes the critical importance of considering earnings growth alongside traditional valuation metrics like the price-to-earnings (P/E) ratio. Simply looking at a high P/E ratio without considering the underlying growth trajectory can be misleading.

- Strong corporate earnings growth can justify higher valuations. A company with consistently high earnings growth can support a higher P/E ratio than a company with stagnant or declining earnings. BofA's analysts delve deep into individual company performance to assess sustainable growth potential.

- BofA analysts highlight specific sectors demonstrating robust earnings growth. They identify sectors poised for expansion, pointing to underlying trends and market forces driving profitability. This granular approach helps investors understand the nuanced picture beyond broad market indices.

- They suggest looking beyond headline P/E ratios to consider forward P/E ratios and other growth-adjusted metrics. Forward P/E ratios, which project future earnings, provide a more dynamic view of valuation than trailing P/E ratios. BofA uses a comprehensive approach, integrating multiple valuation methodologies for a holistic assessment.

The Role of Interest Rates

BofA acknowledges the impact of rising interest rates on stock market valuation. Higher interest rates generally increase the cost of borrowing, potentially impacting corporate investment and slowing economic growth, and consequently, company earnings. However, BofA argues that current rates are still relatively low in a historical context.

- While higher rates can impact valuations, they are not necessarily a death knell for the market. BofA's research examines the historical relationship between interest rate increases and market performance, showing that markets can adapt and still deliver positive returns.

- BofA's analysis considers the relationship between interest rates and long-term economic growth. Their assessment weighs the potential dampening effect of higher rates against the underlying strength of the economy and the potential for continued expansion.

- They may highlight specific scenarios where higher rates are manageable for the market. The analysis might explore various interest rate scenarios and their potential impact on different sectors and asset classes, providing investors with a more nuanced understanding of the risk.

Technological Innovation and Long-Term Growth

BofA points to technological advancements and sustained innovation as key drivers of future earnings growth, significantly influencing their stock market valuation perspective. This long-term perspective is crucial for understanding the potential for sustained market expansion.

- Emerging technologies are identified as key catalysts for long-term market expansion. This includes sectors like artificial intelligence (AI), renewable energy, biotechnology, and others with high growth potential.

- BofA might discuss the potential of sectors like AI, renewable energy, or biotechnology. Specific examples and detailed analysis of growth potential in these sectors add depth and credibility to their overall assessment.

- This section would emphasize the long-term investment horizon and potential for sustained returns. BofA's perspective stresses the importance of considering a long-term investment strategy to capture the potential benefits of technological disruption and innovation.

Counterarguments and Considerations

While BofA presents a relatively optimistic view of stock market valuation, it's crucial to acknowledge potential counterarguments and risks.

Inflationary Pressures

Persistent inflation poses a significant risk to corporate profits and therefore stock market valuation.

- Discuss the potential for inflation to erode corporate profits. Rising input costs can squeeze profit margins, impacting earnings growth and potentially justifying lower valuations.

- Mention the impact of inflation on consumer spending and its effect on demand. High inflation can reduce consumer purchasing power, leading to lower demand for goods and services and negatively affecting corporate revenue.

- Examine how BofA's analysis accounts for inflationary risks. Their assessment likely includes models and scenarios that account for different levels of inflation and their impact on earnings and market performance.

Geopolitical Uncertainty

Global political instability and unforeseen events can significantly impact market confidence and valuations.

- Analyze how geopolitical risks are incorporated into BofA's valuation models. Their assessment likely uses scenario planning to incorporate the potential impact of various geopolitical events.

- Discuss the potential for unforeseen events to disrupt market stability. Unforeseeable global crises can introduce significant volatility and uncertainty.

- Highlight any mitigating factors considered by BofA. Their analysis might include factors such as diversification strategies and the resilience of certain sectors to geopolitical shocks.

Alternative Valuation Metrics

Beyond P/E ratios, other valuation methods can offer a more comprehensive picture.

- Discuss Price-to-Sales (P/S) ratios, Price-to-Book (P/B) ratios, or other relevant metrics. Using a range of metrics helps to provide a more robust and balanced assessment of valuation.

- Explain how these alternative metrics might paint a different picture of market valuation. Comparing results from different metrics helps investors avoid reliance on a single, potentially misleading indicator.

- Highlight the limitations and strengths of using multiple valuation approaches. A holistic approach acknowledges the strengths and weaknesses of each metric, creating a more nuanced understanding.

Conclusion

BofA's perspective on stock market valuation challenges the prevailing narrative of overvaluation. By focusing on earnings growth, considering the context of interest rates, and acknowledging the potential of technological innovation, BofA presents a more nuanced and potentially optimistic outlook. While acknowledging risks such as inflation and geopolitical uncertainty, their analysis suggests a more measured approach to current market concerns. Understanding stock market valuation is crucial for informed investment decisions. To delve deeper into BofA's comprehensive analysis and develop your own perspective on current market conditions, explore their research reports and insights on stock market valuation. Don't let generalized concerns about stock market valuation deter you from exploring the opportunities the market presents.

Featured Posts

-

The Art Of Cricket Bat Making Honoring Tradition Shaping The Future

May 23, 2025

The Art Of Cricket Bat Making Honoring Tradition Shaping The Future

May 23, 2025 -

The Jonas Brothers Couples Fight And Joes Reaction

May 23, 2025

The Jonas Brothers Couples Fight And Joes Reaction

May 23, 2025 -

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 23, 2025

A Que Hora Juega Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 23, 2025 -

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 23, 2025

Pandemic Fraud Lab Owner Admits To Falsifying Covid Test Results

May 23, 2025 -

Memorial Day 2025 Find The Best Appliance Sales Forbes Vetted

May 23, 2025

Memorial Day 2025 Find The Best Appliance Sales Forbes Vetted

May 23, 2025