Stock Market Valuation Concerns? BofA Offers Reassurance

Table of Contents

BofA's Key Arguments for a Less-Pessimistic Outlook

BofA's analysts, while acknowledging the inherent uncertainties in the market, generally believe that current valuations, while high in some sectors, are not excessively alarming across the board. They argue that the market is not in a bubble poised to burst. Their assessment incorporates a range of economic indicators and valuation metrics to paint a more nuanced picture than a simple "overvalued" or "undervalued" label allows.

-

Valuation Metrics: BofA employs several key metrics to gauge market valuation. These include the widely used Price-to-Earnings (P/E) ratio, examining both forward and trailing P/E, and the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE ratio), which accounts for inflation and economic cycles. They also consider other relevant factors like dividend yields.

-

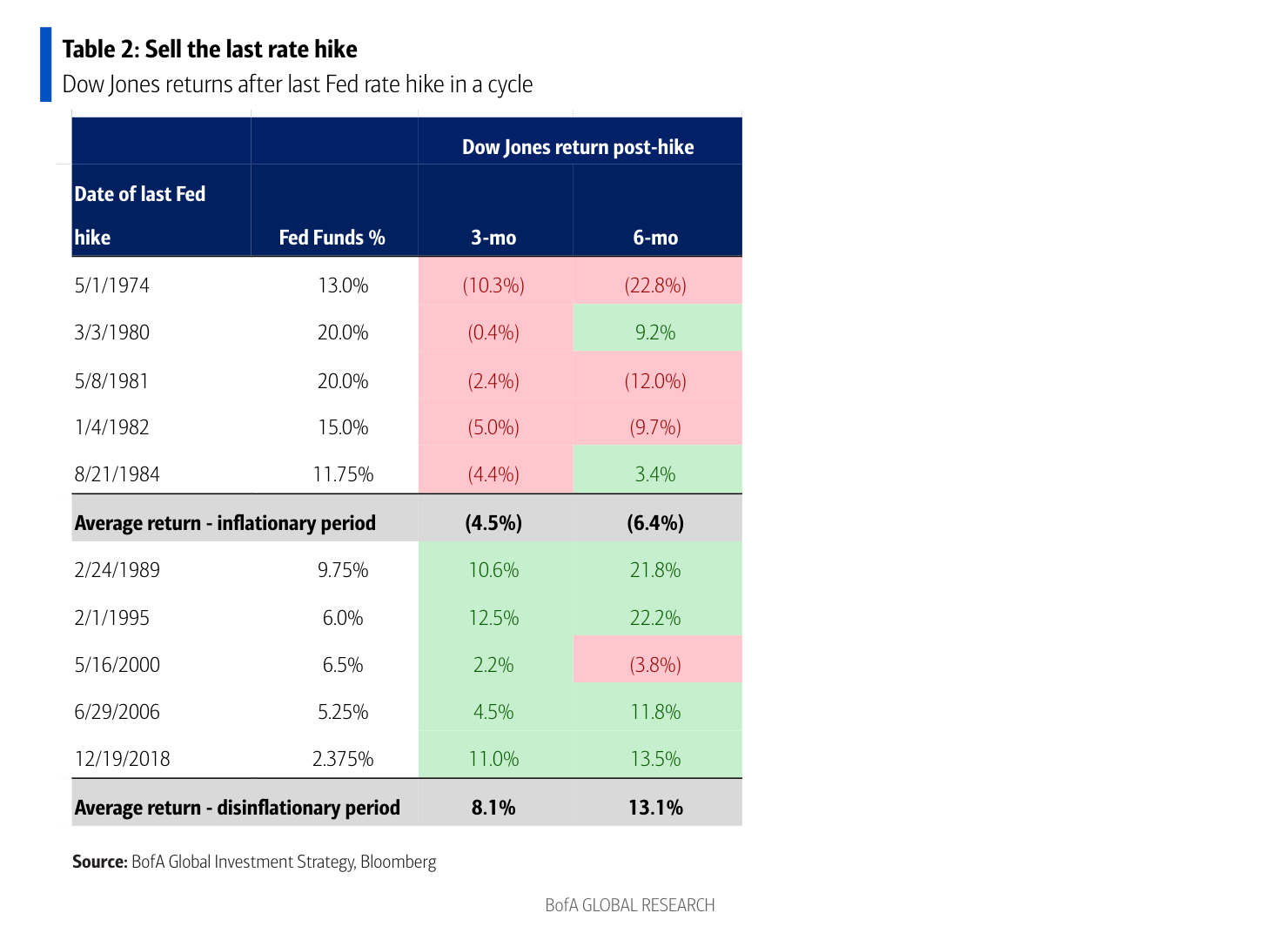

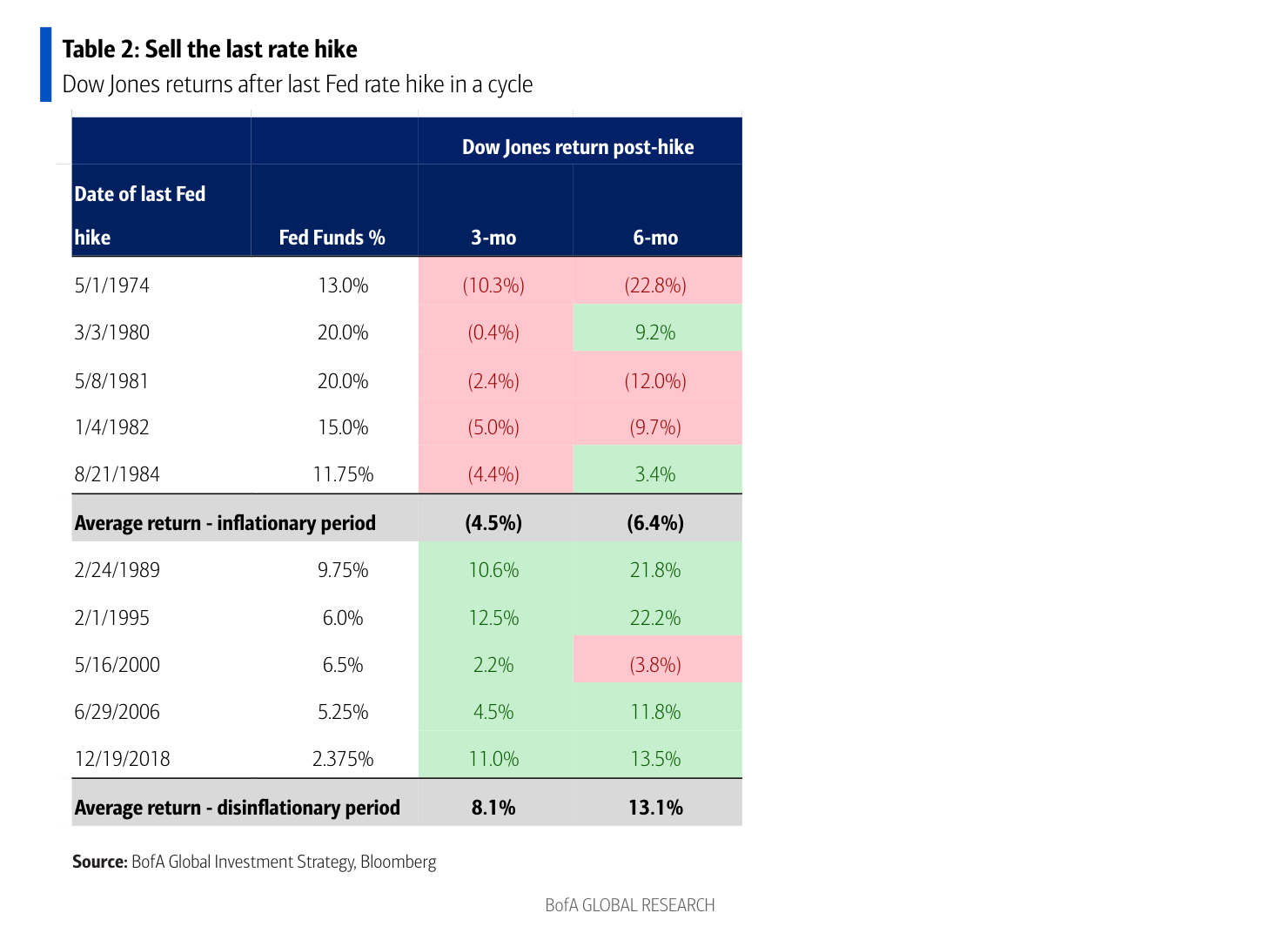

Economic Indicators: Their analysis takes into account crucial economic indicators, including interest rate trends, inflation rates, and GDP growth projections. BofA considers the impact of these factors on corporate earnings and future market performance. Current interest rate increases, for example, are factored into their models as potentially tempering future growth, but not necessarily causing a catastrophic market downturn.

-

Rationale: BofA's positive outlook is largely based on their projections of continued corporate earnings growth, even with anticipated economic slowdowns. They highlight specific sectors poised for growth despite potential headwinds. Their analysis emphasizes a long-term perspective, acknowledging short-term volatility as a normal part of the market cycle.

Addressing Specific Valuation Concerns Raised by Investors

Investors understandably have concerns. High inflation, rising interest rates, and persistent geopolitical risks all contribute to a sense of uncertainty. Let's examine these anxieties and BofA's response:

-

High Inflation: BofA acknowledges that persistent inflation eats into corporate profits. However, their analysis suggests that many companies are successfully managing rising costs through price increases and efficiency improvements. They also predict that inflation will gradually moderate over time.

-

Rising Interest Rates: While higher interest rates increase borrowing costs for companies and can slow economic growth, BofA argues that the current rate hikes are necessary to control inflation and promote long-term economic stability. They believe the market has largely priced in these rate increases.

-

Geopolitical Risks: Geopolitical instability is undeniably a risk factor. BofA acknowledges this, but suggests that markets tend to be resilient and often recover from geopolitical shocks faster than many anticipate. They encourage investors to maintain a diversified portfolio to mitigate these risks.

BofA's Investment Recommendations and Strategies

Based on their valuation assessment and economic forecasts, BofA offers several strategic investment recommendations:

-

Sector Focus: BofA suggests focusing on sectors that are less sensitive to interest rate changes and possess strong long-term growth potential. They point towards specific sectors showing resilience and future growth, often in technology and healthcare.

-

Portfolio Adjustments: They advise investors to review and rebalance their portfolios to align with their risk tolerance and long-term investment goals. This includes considering adjustments to sector allocations and diversification strategies.

-

Rationale: BofA's recommendations are underpinned by their belief that a diversified, long-term investment strategy is the most effective approach to navigate market volatility and achieve investment objectives, even with stock market valuation concerns. They suggest focusing on fundamentally sound companies with solid earnings growth potential.

Understanding the Limitations and Risks

It's crucial to remember that BofA's assessment is just one perspective among many. The stock market is inherently unpredictable, and unforeseen events can significantly impact market performance.

-

Potential Downsides: Recessions, unexpected geopolitical events, or a more aggressive-than-anticipated tightening of monetary policy could negatively impact market valuations.

-

Risk Management: Diversification, rigorous due diligence, and a well-defined risk management strategy remain paramount. No investment is risk-free.

-

Due Diligence: Investors should conduct their own research and consult with financial advisors before making any investment decisions based on any single analysis, including BofA's.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Guidance

BofA's analysis offers a relatively optimistic outlook on current stock market valuation concerns, emphasizing the importance of considering multiple economic indicators and long-term growth potential. While acknowledging inherent market risks, they suggest that the market is not necessarily overvalued to a dangerous degree. However, investors should always remember to conduct their own thorough research, diversify their portfolios, and consider their own risk tolerance. Don't let stock market valuation concerns keep you from making informed investment decisions. Learn more about BofA's insights and strategies today! [Link to BofA's market analysis resources]

Featured Posts

-

Ere Zilveren Nipkowschijf Toegekend Aan Jiskefet

May 15, 2025

Ere Zilveren Nipkowschijf Toegekend Aan Jiskefet

May 15, 2025 -

10 Gains On Bse Sensex Rally Lifts These Stocks

May 15, 2025

10 Gains On Bse Sensex Rally Lifts These Stocks

May 15, 2025 -

Bmw I X 2026 Examining The All Electric Future

May 15, 2025

Bmw I X 2026 Examining The All Electric Future

May 15, 2025 -

Get Ready Nhl 25 Arcade Mode Returns

May 15, 2025

Get Ready Nhl 25 Arcade Mode Returns

May 15, 2025 -

New Nhl Draft Lottery System A Source Of Fan Frustration

May 15, 2025

New Nhl Draft Lottery System A Source Of Fan Frustration

May 15, 2025