Stock Market Valuation Concerns: BofA Offers Reassurance To Investors

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's positive market outlook rests on three key pillars: moderate valuation levels, strong corporate earnings growth projections, and resilient economic fundamentals. Let's examine each in detail.

Moderate Valuation Levels

Despite recent market gains, BofA argues that stock valuations are not excessively high compared to historical averages. Their analysis considers several factors:

- Price-to-Earnings (P/E) ratios: BofA's analysis of P/E ratios across various sectors reveals relatively moderate valuations. While certain sectors might show higher multiples, the overall picture suggests valuations are not drastically inflated compared to historical benchmarks. This indicates that the market isn't experiencing a speculative bubble, at least not to the extent of previous periods like the dot-com era.

- Comparison with previous market cycles: Comparing current valuation multiples with those preceding periods of sustained growth reveals similarities. This historical context suggests that the current valuation levels are not necessarily indicative of an impending market crash. Instead, they are potentially consistent with a healthy market poised for continued, albeit potentially slower, growth.

- Impact of interest rate hikes: The recent increase in interest rates has undeniably influenced valuation multiples. BofA acknowledges this impact but suggests that the effect is already largely priced into current market values. Higher interest rates typically lead to lower present values of future earnings, impacting stock prices. However, BofA's analysis suggests this effect is already factored in.

Strong Corporate Earnings Growth Projections

BofA highlights robust earnings projections for many companies, underpinning their belief that current valuations are justified by future earnings potential.

- Sectors with strong earnings growth: Specific sectors, such as technology and healthcare, are projected to show particularly strong earnings growth. These projections are based on factors like technological innovation, expanding market share, and increasing demand.

- Revenue growth forecasts: BofA's analysis incorporates revenue growth forecasts, which directly influence future earnings and ultimately stock prices. Strong revenue growth projections indicate that companies are well-positioned to generate substantial profits in the coming years.

- Factors driving earnings growth: Several factors contribute to these positive earnings projections. Technological advancements, increasing consumer spending (particularly in certain resilient sectors), and global economic recovery (albeit uneven) all play a significant role.

Resilient Economic Fundamentals

Underlying economic strength, according to BofA, is another key factor supporting current market valuations.

- Key economic indicators: BofA's assessment considers key economic indicators like employment data, consumer confidence, and manufacturing activity. While acknowledging some headwinds, their analysis suggests that the overall economic environment remains relatively strong, providing support for continued corporate earnings growth.

- Impact of global economic events: The analysis also accounts for the impact of global economic events, such as geopolitical instability and supply chain disruptions. BofA appears to suggest these factors are largely manageable, and their impact on the broader market is not catastrophic.

- Predictions for future economic growth: BofA's predictions for future economic growth, albeit cautious, remain positive, further bolstering their optimistic market outlook. This positive outlook is a key factor in their reassurance to investors regarding stock market valuations.

Addressing Investor Concerns About High Inflation and Interest Rates

High inflation and rising interest rates are legitimate concerns for investors. BofA acknowledges these challenges, but offers a nuanced perspective.

Inflation's Impact on Valuation

BofA acknowledges that inflation directly impacts stock valuations. However, they suggest that much of its impact is already reflected in current prices.

- Inflation's effect on discount rates: Higher inflation generally leads to higher discount rates used in valuation models. This reduces the present value of future earnings, potentially leading to lower stock prices. BofA's analysis suggests this impact is already largely priced in.

- Relationship between inflation and earnings growth: While inflation increases costs, it can also stimulate earnings growth in certain sectors if companies can effectively pass on increased costs to consumers. BofA's analysis likely considers this complex relationship.

- Federal Reserve's monetary policy: The Federal Reserve's monetary policy, aimed at controlling inflation, plays a crucial role. BofA's analysis likely incorporates the expected trajectory of interest rate hikes and their potential impact on both inflation and the market.

Interest Rate Hikes and Their Effect on Stock Prices

BofA analyzes the effects of interest rate increases on stock valuations, suggesting the impact is less severe than initially feared.

- Historical relationship between interest rates and stock market performance: BofA likely studied historical data to understand the correlation between interest rate changes and stock market performance. This historical analysis provides context for their current assessment.

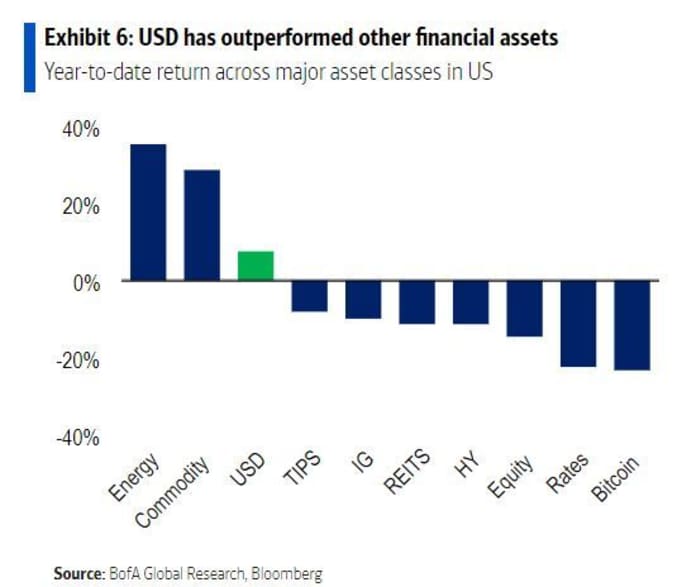

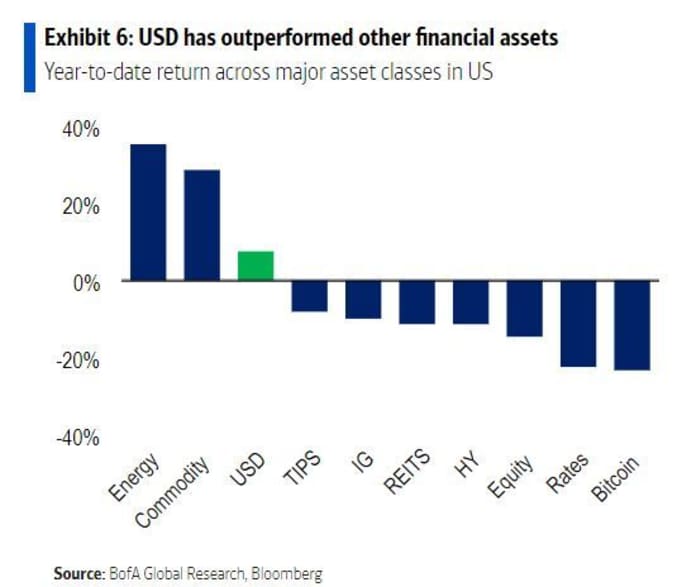

- Impact on different sectors and asset classes: Different sectors and asset classes react differently to interest rate hikes. BofA's analysis likely differentiates the impact across various segments of the market.

- Strategies for mitigating risk: BofA probably offers advice on strategies for mitigating risks in a rising interest rate environment, such as diversification and selecting stocks less sensitive to interest rate changes.

BofA's Investment Strategy Recommendations

Based on their analysis, BofA likely provides recommendations for investors. These recommendations might include:

- Specific investment strategies: Suggestions for investing in sectors expected to outperform in the current market environment.

- Portfolio diversification: Advice on diversifying investment portfolios to mitigate risk and achieve a balanced exposure across different asset classes.

- Risk management techniques: Strategies for managing risk effectively, given the current market conditions and economic outlook.

Conclusion

Bank of America's analysis offers a degree of reassurance regarding current stock market valuation concerns. While acknowledging the challenges posed by inflation and rising interest rates, BofA highlights moderate valuations, robust earnings projections, and resilient economic fundamentals as reasons for optimism. Investors should consider BofA's insights when formulating their investment strategies, but remember to conduct thorough due diligence and potentially consult with a financial advisor before making any investment decisions. Understanding the nuances of stock market valuation and staying informed about expert opinions like those from BofA is crucial for navigating the complexities of the market and making informed decisions about your investments. Don't hesitate to explore further research on stock market valuation to solidify your understanding and refine your investment approach.

Featured Posts

-

Turki Al Sheikh And The Canelo Paul Fight A Costly Miscalculation Of Viewership

May 04, 2025

Turki Al Sheikh And The Canelo Paul Fight A Costly Miscalculation Of Viewership

May 04, 2025 -

Kevin Hollands Ufc Decline A Timeline Of Irrelevance

May 04, 2025

Kevin Hollands Ufc Decline A Timeline Of Irrelevance

May 04, 2025 -

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Betting Preview And Odds

May 04, 2025

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Betting Preview And Odds

May 04, 2025 -

Sarajevo Book Fair Gibonni Ce Predstaviti Inspirativnu Knjigu

May 04, 2025

Sarajevo Book Fair Gibonni Ce Predstaviti Inspirativnu Knjigu

May 04, 2025 -

The Count Of Monte Cristo A Detailed Review And Analysis

May 04, 2025

The Count Of Monte Cristo A Detailed Review And Analysis

May 04, 2025